Financial Reports to Share with Nonprofit Board

The Charity CFO

MAY 31, 2024

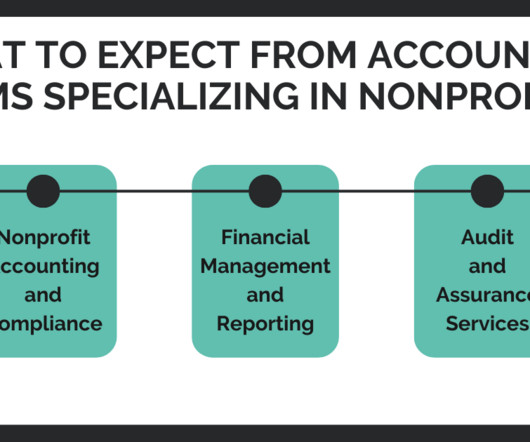

Being transparent in your nonprofit accounting helps build trust in your organization. But what financial reports are most important to build that trust through transparency with your board of directors? Actual Report Fundraising and Development Report 1.

Let's personalize your content