Private firms, not-for-profits reckon with CECL

CFO Dive

MARCH 18, 2024

Many not-for-profits and private companies are just beginning to grapple with the new rules for current expected credit loss accounting.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

CFO Dive

MARCH 18, 2024

Many not-for-profits and private companies are just beginning to grapple with the new rules for current expected credit loss accounting.

Jedox Finance

OCTOBER 6, 2022

The profit and loss statement is one of the main parts of the annual statement that companies must prepare at the end of a financial year, along with the cash flow statement and accounting balance sheet. This article discusses influential factors, advantages, and common problems considering the profit and loss statement.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Musings on Markets

JANUARY 31, 2024

Since businesses invest that capital in their operations, generally, and in individual projects (or assets), specifically, the big question is whether they generate enough in profits to meet these hurdle rate requirements. While private businesses are often described as profit maximizers, the truth is that if they should be value maximizers.

CFO News

MAY 6, 2024

Several top executives of the three companies and auditors associated with some of them now face criminal charges due to the irregularities. Additionally, both auditors and their firms are undergoing disciplinary procedures.

The Charity CFO

APRIL 26, 2024

The right accountant can be the difference between an efficient accounting process and a total mess. That’s why it’s so important to know what to look for in a nonprofit accountant. The next step is to ask your potential nonprofit accountant a few questions to see if they’d be a good fit for your organization.

The Charity CFO

DECEMBER 27, 2023

Does your nonprofit have ownership of a for-profit entity? Whether your organization owns a for-profit company outright or has limited ownership, a for-profit subsidiary can have serious tax implications for your nonprofit. Nonprofits with excess holdings may face an excise tax on the value of shares over the limit.

Capital CFO LLC

APRIL 4, 2023

As a business owner, you may have heard various accounting terms thrown around, such as balance sheet, cash flow, and profit and loss statement. However, it is essential to have […] The post Accounting Terms 101: A Beginners Guide for Business Owners appeared first on Capital CFO+.

CFO Share

NOVEMBER 18, 2023

To most small business owners, accounting best practices feel like an annoyance and distraction. However, common mistakes can create an accounting mess and impede growth. Solution : Accounting best practices require financials to close by the 15 th each month. If you do not know what that means, you are likely a culprit.

PYMNTS

AUGUST 11, 2020

With its losses mounting, the London-based digital bank may need to tap into its corporate reserves to keep up with its expansion plans. The company posted a total loss of $139.6 Revolut attributed the losses to its expansion into new markets and the introduction of new products. million (£106.5 million) in 2019 — up from £32.9

The Charity CFO

JANUARY 17, 2022

If you’re like most nonprofit leaders, you’re not researching nonprofit accounting basics to satisfy your curiosity. with this overview of nonprofit accounting basics. . What is nonprofit accounting? Investopedia defines accounting as “the process of recording financial transactions pertaining to a business.” .

CFO Simplified

FEBRUARY 17, 2022

But understanding your company’s profitability is critical to making the right decisions. The business’ part-time CFO was providing financials that didn’t match the reports they received from their accountant. Some months had huge profits, which alternated with other months containing huge losses. Initial contact –.

PYMNTS

FEBRUARY 17, 2020

Losses widened this past year for OYO Homes & Hotels , as the SoftBank -backed company tried to expand into China, according to Reuters. The losses the company reported were increased sixfold since March 2019. The quarterly profit for SoftBank was almost decimated by its Vision Fund losses, worth $100 billion.

CFO News Room

NOVEMBER 16, 2022

Thanks above all to the pioneering and in-depth work of Eileen Appelbaum and Rosemary Batt, the press, Congresscritters, and the victimized general public have gotten an idea of how private equity’s exploitation of the many chokepoints in health care has enabled them to profit greatly to our collective detriment.

The Charity CFO

OCTOBER 9, 2023

However, that’s not the case with an organization’s accounting systems. Let’s take a closer look at nonprofit accounting systems, the most frequent mistakes, and how to avoid trouble down the road. It’s vital to get these right from the beginning or risk serious consequences in the future.

Creative CFP

OCTOBER 12, 2020

The profit and loss statement (or P&L in accounting jargon) is arguably the central management statement for most SMEs, recording the majority of operational activities over any period of time, usually monthly. From the profit and loss statement a revenue-to-salaries ratio can be determined.

CFO News Room

DECEMBER 10, 2022

What Types of Accounts are Best for Compounding? Banks Savings Accounts. Most savings accounts, money market accounts, and certificates of deposit earn compound interest. Taxable vs. tax-deferred vs. tax-free accounts. It’s also possible to take advantage of tax-free accounts. 3) Money Market Accounts.

PYMNTS

AUGUST 6, 2020

Adidas AG , the global sneaker maker, revealed losses of nearly $400 million in the second quarter (Q2) amid store closures to prevent the spread of the coronavirus. At the same time, Adidas suffered an operating loss of 333 million euros ($394 million). billion euros ($4.3 billion) in the quarter.

The Charity CFO

AUGUST 15, 2023

Myths of Nonprofit Accounting and Why They Matter to Job Seekers Unfortunately, many job seekers fall victim to the stereotypes and believe the myths surrounding nonprofit accounting. In this section, we will debunk the three most common nonprofit accounting myths. Ready to dive deep into this exciting realm?

The Charity CFO

JANUARY 19, 2023

Accounting standards for nonprofits are probably not the first thing you think about, but are crucial for your organization to succeed. Nonprofit organizations distinguish themselves from for-profit entities through their purpose and mission.

PYMNTS

JULY 28, 2020

bank profits are at double the risk for loan losses than their European counterparts, according to the Financial Times on Tuesday (July 28). According to consultants with Accenture , European banks are already preparing to follow American ones in massive second-quarter loan loss reporting related to the pandemic. Swiss and E.U.

The Charity CFO

FEBRUARY 25, 2022

If you’re brand new to nonprofit accounting, the Chart of Accounts might be the best place to start. Because even if you only have one bank account, bill, investment, or expense, you’ll need one. What is a Chart of Accounts? How to Organize a Nonprofit Chart of Accounts . Account Description.

PYMNTS

DECEMBER 9, 2020

That would come on the heels of revenue growth in its most recently reported results, through August of this year, where revenues were up 180 percent but losses tripled. million pounds, but losses were 106.5 Starling said in its recent accounts update that it has 1.8 million pounds.

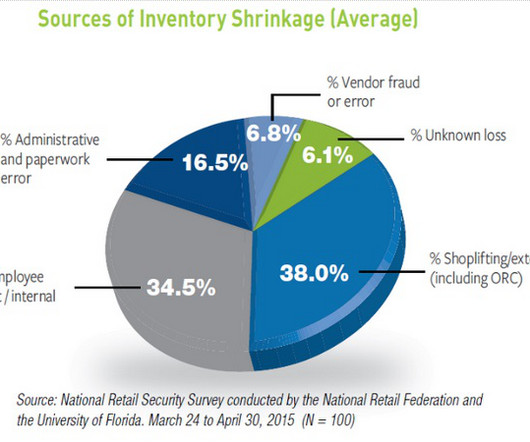

Barry Ritholtz

DECEMBER 11, 2023

billion in retail inventory losses in 2021 was not “attributable to organized retail crime.” retailers retracted its claim that “organized retail crime” accounted for nearly half of all inventory losses in 2021 after finding that incorrect data was used for its analysis.” No, “ nearly half ” of $94.5

https://trustedcfosolutions.com/feed/

SEPTEMBER 15, 2022

As your business grows, your accounting solution should scale and grow with you, but this isn’t the case with older, outdated software. Expansion contributes to a profitable business, but if you don’t prepare to handle rapid growth, you will ultimately hurt your bottom line and prevent your business from reaping the benefits.

CFO Share

JULY 20, 2021

What does a Forensic Accountant Do? Is your small business not making as much profit as you expect? Are you earning profits but always falling short on cash? Since internal accountants are the most likely employee to be stealing from the company, businesses rely on forensic accounting consultants to investigate potential fraud.

The Charity CFO

JANUARY 13, 2022

But accounting for in-kind donations presents its own unique challenges. In this article, we’ll dig into how to account for in-kind donations on your nonprofit’s books. Why accounting for in-kind donations matters. Accounting for in-kind donations isn’t just important; it’s required for many nonprofit organizations. .

PYMNTS

DECEMBER 10, 2020

Nor is the ability to easily transfer money inside of accounts as well as to others, even though these technologies have been around for some 10 years. All the while, “stuck banks” have been mired in the profits and losses (P&L) issues and internal fiefdoms fighting with each other over limited resources, he said.

PYMNTS

FEBRUARY 26, 2018

billion | Number of adults in the world who do not have bank accounts and may not have government-issued IDs but do have mobile phones. That data will be used to instantly verify those mobile device users around the globe with the aim of reducing fraud tied to account openings. billion loss. Here are the numbers: 1.8

CFO News Room

NOVEMBER 7, 2022

billion to account for the deal. Berkshire Hathaway — Shares of Warren Buffett’s conglomerate rose more than 1% after the company posted a 20% increase in operating profits during the third quarter. billion loss on its investments during the third quarter’s market turmoil, however. health-care business to $14.5

Future CFO

FEBRUARY 3, 2022

In a survey conducted by the Institute of Singapore Chartered Accountants (ISCA) , 89% of accountancy professionals indicated they have adapted to new ways of working and doing business — such as remote working, videoconferencing, and virtual collaboration — amid the pandemic, the accountancy body said recently.

PYMNTS

MAY 22, 2020

A large share of the banking sectors of nine advanced economies, by assets, may not be able to bring in profits higher than their cost of equity in 2025, according to a simulation exercise cited in the “Global Financial Stability Report” by the International Monetary Fund (IMF).

PYMNTS

APRIL 28, 2020

stores stay shuttered during the coronavirus pandemic could protect the California technology giant from record losses, Reuters reported. China accounts for 15 percent of Apple’s sales. Analysts say the reopening Apple’s stores in China while its U.S. In January, Apple reported record revenues in the first quarter that ended on Dec.

The SaaS CFO

APRIL 5, 2022

I talk about the SaaS P&L (profit and loss statement) almost every week with SaaS founders, finance, and accounting teams. The SaaS P&L is critical to the management of your SaaS business. At this point, I’ve reviewed hundreds of SaaS P&Ls (also called an income statement).

CFO Share

MAY 22, 2024

This guide will provide you with financial reporting help and actionable steps to get accounting back in order and working for you. Check out our blog for other accounting tips that help you avoid losses and missed opportunities. Like compound interest on a loan, accounting errors grow and become more complex over time.

PYMNTS

OCTOBER 23, 2019

23) after the bank reported a net loss of £4.9 Earlier this year, Metro Bank revealed an accounting error that kicked off a rocky year, and led some of its top clients to leave the bank. The company’s third-quarter loss rose from £1.2 Metro Bank Co-founder and Chairman Vernon Hill stepped down as chairman on Wednesday (Oct.

Future CFO

OCTOBER 28, 2019

HSBC’s CFO Ewen Stevenson said the bank plans to restructure its loss-making businesses after announcing an 18% year-on-year drop in pre-tax profit in Q3 on Monday. The Hong Kong-listed bank reported pre-tax profit of US$4.8 The post HSBC CFO: Bank to restructure after Q3 profit drop appeared first on FutureCFO.

CFO Simplified

JANUARY 10, 2022

Look at these scenarios, and see if any sound familiar to you: An internet sales company showed financial reports with huge profits for three straight months, and then suddenly, huge losses during the next few. In spite of growing sales, they showed increasing losses as the year progressed. It’s that simple.

PYMNTS

JUNE 17, 2016

Get ready for some sinking bank profits. The Wall Street Journal reported on Thursday (June 16) that accounting rules are taking effect that would ensure that banks would have to report loans going south much earlier than had been done before, which may push reserves higher, eating into profits.

Centage

DECEMBER 12, 2023

When it comes to analyzing a company’s financial health, one of the most important documents to look at is the consolidated profit and loss statement (often called a P&L, P and L, or P&L statement). What is a consolidated P&L statement? A consolidated income statement is essentially a consolidated P&L.

PYMNTS

FEBRUARY 18, 2019

However, Uber’s revenue increased only 2 percent between Q3 and Q4, reaching $3 billion, a 24 percent increase over the previous year — leading some investors to question the ridesharing firm’s future prospects for profitability. Losses came in at $1.8 billion in losses reported at the same time in 2017. Scooter Battles.

CFO News Room

NOVEMBER 23, 2022

This provided great grounding, he says, particularly in financial accounting. He joined oil and gas company BG Group in their budgeting and forecasting team to broaden his management accounting and reporting experience. This meant everyone felt empowered to make the appropriate decisions to drive the company’s profitability”. “By

PYMNTS

FEBRUARY 15, 2019

But revenue growth clocked in at only 2 percent between Q3 and Q4 — leading some investors to question the ridesharing firm’s future prospects for profitability in the future. Losses came in at $1.8 billion in losses reported at the same time in 2017. By the numbers, Uber brought in $11.3

Spreadym

JULY 19, 2023

The three main types of financial statements are: Income Statement (Profit and Loss Statement) Balance Sheet (Statement of Financial Position) Cash Flow Statement Income Statement (Profit and Loss Statement) The income statement summarizes a company's revenues, expenses, and profits or losses over a specific period, typically quarterly or annually.

CFO Simplified

SEPTEMBER 11, 2022

There are two different ways of performing accounting functions in your business: One is on a cash basis, and the other is on an accrual basis. More often than not, your tax accountant is doing your taxes on a cash basis. Why should you use accrual basis accounting for your business? Cash Basis Accounting. Let’s dive in.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content