By David Enna, Tipswatch.com

The Treasury’s auction of $23 billion in a new 5-year Treasury Inflation-Protected Security — CUSIP 91282CKL4 — resulted a real yield to maturity of 2.242%, the 2nd highest result for this term since October 2008.

The coupon rate was set at 2.125%, the 2nd highest for this term since April 2006.

Earlier in the day, the most recent 5-year TIPS was trading on the secondary market with a real yield to maturity of 2.18%. This auction got a result 6 basis points higher, but it came in below the “when-issued” prediction of 2.27%, so demand was strong. The bid-to-cover ratio was 2.58, also indicating decent demand.

The April 5-year TIPS auction tends to get a real yield higher than the market established by the October version from the year earlier. That is because of the typical swoon in end-of-year non-seasonal inflation, which will hit right before this TIPS matures in 2029. More on that for nerds.

All those details aside, this is a good result for investors in today’s auction, with the real yield holding well above 2.0%. Here is the trend in the 5-year real yield over the last 3 years, showing the dramatic increase since spring 2022:

Pricing

Because the coupon rate for this new TIPS was set slightly below the real yield to maturity, investors got it at a discount.

Here is how the pricing would work out for an investor purchasing $10,000 par value of this TIPS:

- Par value: $10,000

- Inflation index on settlement date of April 30: 1.00309

- Total principal purchased: $10,000 x 1.00309 = $10,030.90

- Unadjusted price: 99.452867

- Cost of investment: $10,030.90 x 0.99452867 = $9,976.02

- + accrued interest of about $8.74

In summary, the investor paid $9,976.02 for $10,030.90 of principal and will receive inflation accruals through the maturity date of April 15, 2029, plus twice-a-year coupon payments totaling 2.125%.

Inflation breakeven rate

With the nominal 5-year Treasury note yielding 4.68% at the auction’s close, this TIPS gets an inflation breakeven rate of 2.44%, about in the midrange of recent auctions of this term. This means it will outperform the nominal Treasury if inflation averages more than 2.44% over the next five years.

This chart shows the inflation breakeven trend over the last five years. Even though 2.44% is a high breakeven rate by historical standards, it is on the low end of more-recent trends as inflation has ramped higher.

Reaction to the auction

This one appears to have gone off as expected, with CUSIP 91282CKL4 getting the expected “April boost” in yield. Demand appears to have been solid. I was a buyer, adding to my 2029 holdings. This is from the Reuters report:

The results of the U.S. Treasury’s $23 billion auction of U.S. five-year Treasury Inflation-Protected Securities on Thursday were stronger-than-expected across almost all metrics. The note’s high yield stopped at 2.242%, lower than the expected rate at the bid deadline, which suggested that investors were willing to settle for a lower yield to take the security.

The bid-to-cover ratio, another measure of demand, was 2.58, slightly above the 2.55 seen in December, but much higher than October’s 2.38. The note’s bid-to-cover ratio was the highest since June 2022.

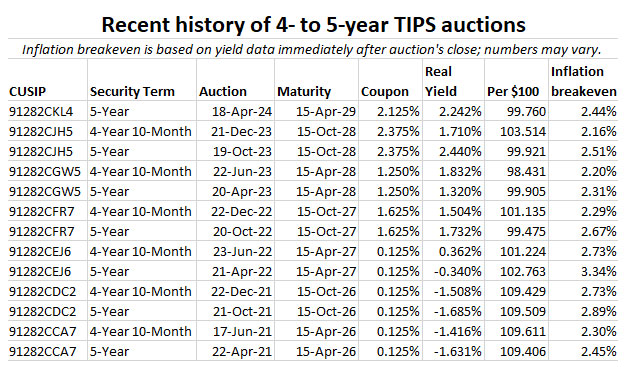

Here is a history of recent auctions of this term:

• Now is an ideal time to build a TIPS ladder

• Confused by TIPS? Read my Q&A on TIPS

• TIPS in depth: Understand the language

• TIPS on the secondary market: Things to consider

• Upcoming schedule of TIPS auctions

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

David, given the good auction results on 5-year, is now a good time to buy longer term tips, like 30 year tips on 2ndary market? Any watch out & advice? Thank You so much!

Where can I find the “when-issued” prediction?

I think it is released very close to the auction’s close. I have never seen it before the close. (I am sure some people do, however.) The way I get it is to look for a posting on X just after the auction close, where it is reported here: https://twitter.com/LiveSquawk

How is it useful if it is released post-auction?

The people who pay to see it probably get it before the close, early enough for it to matter. Some of them may be dealers who will be buying, no matter what. It is useful to me after the fact to judge how the auction was received.

Thank you very much for your insightful TIPS guidance! We have one question: does it make sense to replace an existing TIPS purchase with a new one with a higher yield? For instance we purchased a 5 yr TIPS with a yield of 1.84% at the beginning of the year. A similar TIPS has now a yield of 2.24%. Would it make sense to sell and buy a similar TIPS at the same day?

Look up your current 5 year TIPS among offerings on the secondary market today. Expect to find that it is priced lower to compensate prospective buyers for the lower coupon. That will give you a sense of whether it would be of benefit for you – probably pretty much a wash.

I am checking this out. Thank you very much for this guidance!

The TIPS you purchased with a yield of 1.84% (assuming it matures in Oct 2028) now has a market yield of about 2.16%, very close to today’s value. The coupon rate is 2.375%, higher than today’s market value. So you paid a premium cost to get that TIPS. It doesn’t make sense to flip it, the current yields are very close. The one factor I can’t judge is if you could take a capital loss on the sale. I’m no tax expert.

I bought the recent 5 year TIPS (thanks for all your great info). It got me thinking about my 10 yr TIPS from 1/23. (Many of your readers may be in similar situation below). I believe the BE is 2.2% but the 10 yr treasury on 1/23 was 3.55%. I am OK holding my 10 TIPS to maturity but was wondering if the 10 yr Nominal Treasury gets closer to 5% would it be worth selling the 10 yr TIPS and buying the guaranteed 5% for a 1.4% uplift? Thanks

I would be interested in getting a nominal 10-year Treasury note at 5%+, but I would not sell a TIPS to do it. But that is up to you. The 10-year note closed yesterday at 4.64% and your TIPS has a coupon rate of 1.125%. The principal has increased about 3.9%, but if you sell it, you will be taking a loss.

I was thinking of buying but I will do nominal 5yr T bills tomorrow.

With 5 year bills I worry that inflation will be 10% next year.

Hi David,

Your recent articles previewing this TIPS auction were very helpful reminders for me after being so busy and not keeping up with the auction schedule, and so I logged onto my Vanguard account yesterday and placed an order. Very happy with these results, so many thanks for your persistent notices. Keep up the great work!

Any guesses on the next 10 year TIP auction in May? Or when might you post about that? Thank you Master Yoda in TIPs.

I’d say the current rising trend (very late in the cycle) might be pointing to a fixed rate of 1.3%, since the factors were right between 1.2% and 1.3% a week ago. Again, this is a guess based on observations. The Treasury will do what it does.

Hello David,

Can you please explain to me why my 5 year TIPS I bought at the October 2023 auction for $5000 was adjusted upward for inflation by only $49? I thought with inflation running higher that it would be more than that like $130 or $140. Thanks

The half month inflation accrual for October was 0.22%, based on August’s non-seasonally adjusted inflation. And then:

In November (based on September): 0.25%

In December (based on October): -0.04%

In January (based on November): -0.20%

In February (based on December): -0.10$

In March (based on January): 0.54%

Add these up and you get to only 0.42% through the end of March. April is getting a boost of 0.62% and May will get an increase of 0.65%.

This is the typical trend as end-of-year non-seasonal inflation often drops to near zero.

I see, thank you for the analysis. I didn’t know that Dec, Jan, and Feb were negative.

Thanks, David, for bringing this to my attention last week. After doing a fair amount of reading and research, I made my first ever TIPS purchase today.

How does this affect the May Ibond fixed rate?

Probably puts 1.3% in the lead as of the moment.

Thank you for the continuing education and hand holding, David. I am yet another grateful recipient.

How would I now calculate the Real Yield of a TIPS I bought on the secondary market in May 2023? (I was too unsophisticated at the time to note it.)

Thanks, as always.

Bob

This is hard to do after the fact. When I buy a TIPS on the secondary market, I try to take a screenshot of all the particulars or keep notes so I will be able to record the real yield, actual price and accrued inflation. If you can remember the exact date, you can get a decent idea by looking at the Treasury’s Real Yields Curve page for 2023: https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_real_yield_curve&field_tdr_date_value=2023 … It is also possible that your brokerage had the details on the confirmation it issued after the sale. Vanguard’s confirmations do list this.

It worked (of course). Thank you once again!

Hello David: I purchased 1000 in a tax advantaged account and 700 through Tresury. I recall you mentioned that in some cases you had purchased via non-tax advantaged account. Could you please go over the advantages or disavantages of doing this? One advantage of course is that you can buy in Multiples of $100 instead of $1000.

Yes, the small lot size is the advantage at TreasuryDirect. Otherwise, the auction results are the same. At the brokerage you will now see a constantly fluctuating market value (which I tend to ignore since I am holding to maturity.) TreasuryDirect will show you only the accrued principal and it doesn’t even update that too often. Here is the article I wrote in 2021 on this topic: https://tipswatch.com/2021/04/02/frightened-by-a-phantom-tips-are-fine-in-a-taxable-account-until/

And of course another advantage depending on your residency is that they are free of state and local taxes when held in a non-tax advantaged account. I live in Maryland, and this is a significant savings.

Ann; Can you please explain me that like to an 8 year old? how is it. that I find myself paying state taxes if i keep it on a Roth iRA account

Rodolfo, you wouldn’t pay any taxes in that Roth account, but most times people are buying TIPS in tax-deferred traditional accounts, which could face state taxes on withdrawals.

I am confused by your response. Why would TIPS interest be taxable in a tax deferred account? Isn’t it a federal obligation and therefore free from state taxes? Are you referring to capital gains tax?

In a regular IRA, withdrawals are taxed as ordinary income, and in Maryland, for example, one would pay about 9% state and local tax on the withdrawal. When held in a regular brokerage account, they will be free of these taxes. (As David pointed out above, this is not true for a Roth IRA.)

The point David made for Roth IRA is obvious. My confusion was with respect to tax-deferred account withdrawal. My understanding is that part of the withdrawal is treated as a return of principal and another part is treated as earnings. Assuming that some or all of the earnings came from investment in TIPS, wouldn’t your State allow exemption for a portion or all of your earnings from state taxes? That’s why brokerages supply what % of your mutual funds earnings is from investment in treasuries.

Any redemption is a traditional IRA is considered INCOME. Thus if you sell your tips The whole product of the sale is used as income to calculate your AGI for the year. So when you do that you end up paying state taxes.

All investments in an 401k or IRA lose their original character for tax purposes in the account and are treated as ordinary income when withdrawn.

Thanks for that clarification. I had no idea! In that case, why would anyone want to own any treasury securities, muni bonds etc. in a tax deferred account? You’re better off in a taxable account!

Not necessarily. The funds are already going to be in the IRA or 401k. Treasuries and TIPS are just other investment choices. A TIPS could have better returns than picking the wrong stocks. Everything coming out of the non Roth IRA is going to be taxed as regular income whether treasuries or equities.

pvsfox: the Trad IRA is not the tax advantage account you would use. the After taxes (Roth) IRA is the one.

Thanks David! I was very slightly disappointed, but after reading your post, it sounds like this was a good one after all. This was my 3rd TIPS auction purchase, with the other two coming in below market, so I’m glad for the good result. I was glad the total cost came in under PAR. You just can’t lose after that!

My first ever TIPS purchase during this auction. I could never have done it without the information that you provided to allow me to learn how TIPS work and what information to look at. Thank you!