By David Enna, Tipswatch.com

Last week I was being interviewed by CNBC’s Kate Dore about I Bond investment strategies, and I found myself asking her a question: “Do you think the Federal Reserve has learned a lesson?”

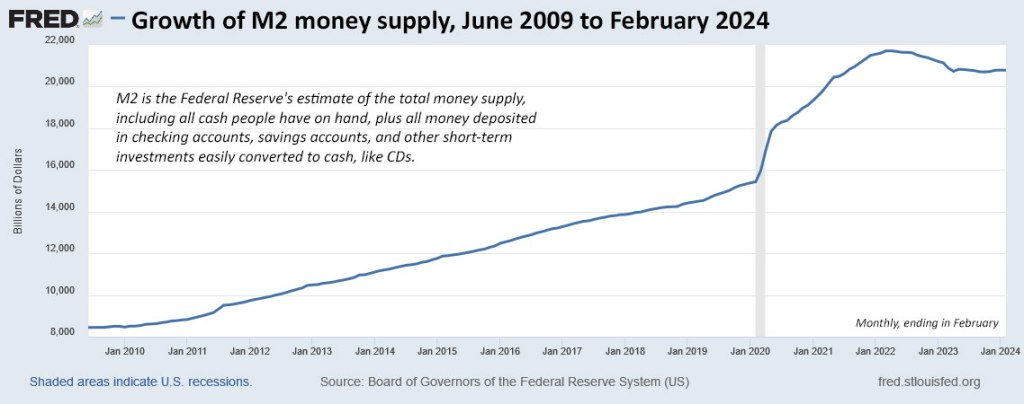

In other words, after a decade of manipulating the U.S. Treasury market and money supply, has the Fed really learned its actions can have dire consequences? We got a 40-year-high surge in inflation. Is the Fed done with all that?

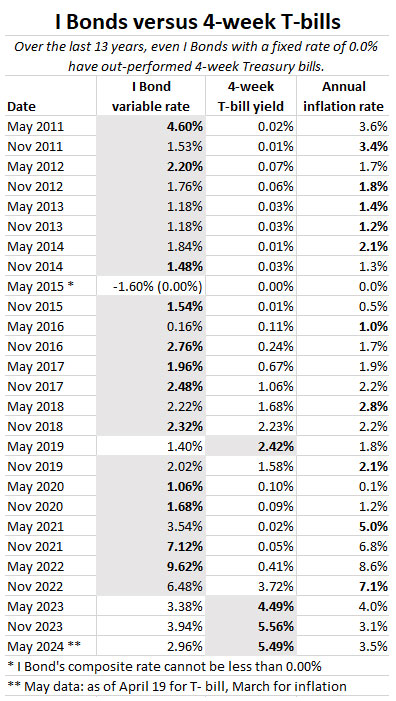

We can’t know, of course. I asked this question because I have been getting a lot of feedback from readers and seeing heated discussions on the Bogleheads forum about this issue: Should I dump I Bonds to buy T-bills? It is a reasonable question because I Bonds with a 0.0% fixed rate will soon be earning 2.96% for six months. Even for new I Bonds, the May-to-October composite rate will fall to about 4.27% at a time when 4-week T-bills are paying 5.49%.

T-bills are going to have a 100-basis-point advantage over new I Bonds, and that is hard to ignore. For example, here are two perfectly logical comments from readers:

When interest rates were still very low, there was a 7.12%, 9.62% and then a 6.48% APR staring you right in the face. You’d be ignorant to not pounce on it. Add on the compounding interest and the money being safe, and you’re all set. However, the tide has turned and now I-bonds are still “okay” at 5.27% and 4.27% APR (average of 4.77%), but I can get a 4-week bond for 5.33% APR with no penalty and my money is available within 4 weeks.

And this:

Hard pass. This only makes sense if (1) fixed rate doesn’t go higher and (2) very long term. My savings accounts pay 5%+ and easy to lock 1-2 year CDs at 5-6%. Combine the 3 month penalty plus subpar 4.27% for 6 months and this is a loser.

These readers are thinking logically, because they are committed to investing for the short term, and as I noted in my recent article on the I Bond buying equation, I Bonds are no longer the most attractive investment for the short term.

But for the long term?

Over the last 13 years, even I Bonds with 0.0% fixed rates have greatly out-performed 4-week T-bills. Why? Because the Fed controls short-term interest rates, but has no actual direct control over U.S. inflation, which sets the I Bond’s variable rate. The results:

This gets back to my question: Has the Fed truly learned its lesson about manipulating the U.S. bond market? Will it now be unwilling to force nominal yields to close to zero and real yields below zero? I think it has, for the time being, and we won’t see ultra-low interest rates in the near future.

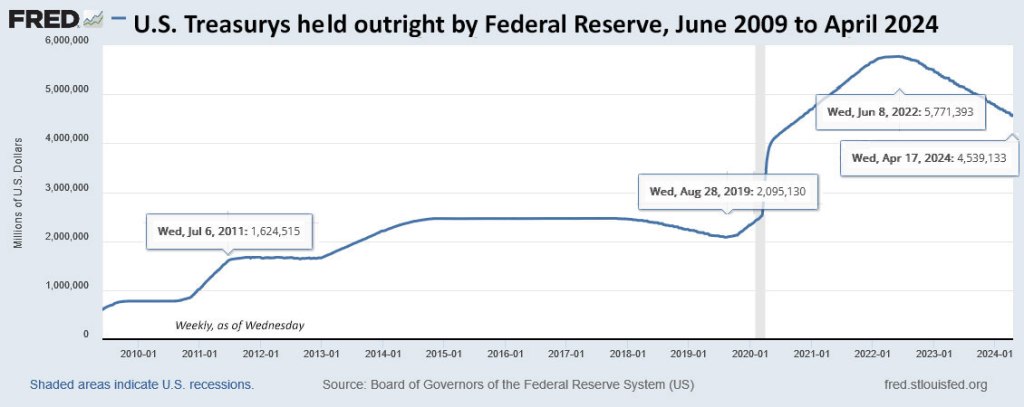

But what happens if the economy begins spiraling downward, or the banking system faces another crisis? Can the Fed resist the temptation to send interest rates tumbling and begin another phase of quantitative easing? Take a look at the Federal Reserve’s balance sheet of U.S. Treasurys since 2009:

From August 2019 to June 2022, the Federal Reserve’s balance sheet of Treasury holdings increased 175%. And this was the effect on the U.S. money supply, combined with very generous direct payments to U.S. taxpayers during the Covid crisis:

And finally, the effect of the Fed’s actions on U.S. inflation over the same period:

These charts are relevant because the Federal Reserve is now considering paring back quantitative tightening, meaning it will slow down reduction of its balance sheet, even though it remains double the size of the 2020 level. This is from a recent Reuters report:

The Fed is currently allowing up to $60 billion per month in Treasury bonds and up to $35 billion per month in mortgage bonds to mature and not be replaced as part of a process called quantitative tightening, or QT.

“Participants generally favored reducing the monthly pace of runoff by roughly half from the recent overall pace,” the minutes said.

Most Americans will have no idea of this change, which eventually should help bring longer-term interest rates a bit lower. And in due course, the Fed will begin gradually lowering short-term interest rates, which will get noticed. The process should be slow and careful, as long as the U.S. economy remains healthy.

For the near-term, T-bills are going to offer better yields than I Bonds. Short-term investors should favor T-bills if their investing horizon is 2 years or less.

Some readers have suggested: “Well, if the T-bill yield falls I will just jump back into I Bonds.” The problem, though, is the $10,000 per person limit on purchases. It takes a long time to build a sizable holding in I Bonds, unless you use complicated strategies like tax-refund paper I Bonds and purchases through gift-box, trusts, or business-owner strategies.

And to be clear, I love T-bills and have been using staggered rollovers of 13- and 26-week T-bills as an emergency cash holding for nearly two years.

But for the longer-term, I Bond still make sense. They protect against unexpected future inflation and unexpected future Federal Reserve manipulation. If we see ultra-low interest rates again, even 0.0% fixed-rate I Bonds are going to offer a return matching inflation and well above T-bills. Today, I Bonds are selling with a permanent fixed rate of 1.3%, the highest in more than 16 years.

Another viewpoint …

Here is a new video from Jim of the “I Was Retired” YouTube channel, addressing 5-year potential investments in Treasury notes, TIPS and/or I Bonds. The video is well organized and an accurate look at the three investments. (Another thing I really appreciate is that Jim has his liquor cabinet directly behind his filming stage. Yes, and I totally understand!):

• I Bond dilemma: Buy in April, in May, or not at all?

• Confused by I Bonds? Read my Q&A on I Bonds

• Let’s ‘try’ to clarify how an I Bond’s interest is calculated

• Inflation and I Bonds: Track the variable rate changes

• I Bonds: Here’s a simple way to track current value

• I Bond Manifesto: How this investment can work as an emergency fund

Ended up buying $30k using the trust option.

I bonds are not taxed by California state. For me that saves about 10%. Are t bills also exempt? if not, then having a 10% advantage would not make changing to t bills a good idea, plus I would be adding to my taxable gross income this year. Does this makes sense?.

All Treasury issues are not taxed at the state or local level.

regarding the tax implications of buying T Bills…can get a substantial tax deferral by purchasing a 52 week TBill now. for instance, the April 2024 52 week TBill doesn’t pay any interest until April 2025 and the tax bill for that interest won’t be due until 2026. that pales in comparison to the potential 30 year tax deferral of buying an IBond, but potentially useful for someone anticipating being in a lower tax bracket in 2025.

HI David,

For years, I have been a big fan of “The Intelligent Investor” WSJ Column by Jason Weig. As I was reading his latest column that he posted today, when it came to TIPS, he had this to say:

……You can build a TIPS ladder, either at TreasuryDirect or a broker. That can be tricky, though, because TIPS aren’t always readily available in the exact amounts and maturities you’ll need. For detailed guidance, see Tipswatch.com, eyebonds.info, tipsladder.com and Bogleheads.org (search: “TIPS ladder”)……

Congratulations for being referred first. You deserve every piece of recoginition for all the help you provide to your readers…best

Thanks for pointing this out. I had seen the article but had not read it yet. It’s nice to be noticed!

FWIW, funds for an I-bond purchase I scheduled for today were deducted from my Fidelity account before 6 am this morning. So, I’m not too worried about the purchase I scheduled for Monday.

Agree. The past two years I’ve scheduled I Bond purchases on April 26-27 and the funds were deducted at 5 am. I therefore decided to take the chance scheduling my purchase for Monday this year.

I’m surprised to see that Treasury Direct says the current I Bond rate “is available until 11:59 p.m. Eastern Time on Tuesday, April 30. The new rate becomes available at midnight.”

During the last three rate resets, the Treasury announced the purchase deadline as 11:59 pm on the second-to-last business day of the month (which in this case would be April 29). These were the deadlines for the last three composite rates:

9.62% ended Friday, October 28 (last business day Oct. 31)

6.89% ended Thursday, April 27 (last business day April 28)

4.30% ended Monday, October 30 (last business day Oct. 31)

Anyone who wants I bonds issued at the current rate should definitely purchase before this weekend to be safe. However, it appears the Treasury may be reverting back to its old standard of waiting until the 1st of the month to announce the new composite rate.

Great point. This only works if the Treasury guarantees the April rate will be applied for any order up to midnight.

This morning I, finally, made my yearly buy of I Bonds, for $10K each, for me and wife. I must say that this is the most I have waited this year. Every previous year, I get it done in early January. It has been a good learning experience. I also updated the registration with WITH, I had do it for each individual holding in our two accounts. Thanks to all for very instructive exchanges.on this topic.

I do have a new, unrelated to the above, question. I bought 4 week bills this morning and was debating if I should go for the 4 week or 8 week auction. I decided to buy the 4 week bills. Today’s 4 week auction closed at 5.370% while the 8 week, which I did not buy, closed at 5.393%. For today’s buy, it is less of a big deal for me. However, for the May 9th 4 week and 8 weeks auctions, my amount is substantially higher and I should care more in picking the one that may offer better interest. I know, no one knows this, it’s complex, depends on supply and demand, etc., etc. However, if there is some data, some link, some place, that you know, where I can build my own narrative to justify picking one vs. the other, will be highly appreciated. It will also teacn me how analyize the short-end of the yield curve with a smaller granularity…as always, thank!!!….you all are the best!!!

You can check this:

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_bill_rates&field_tdr_date_value_month=202404

Which I’m pretty sure I found out about from this site.

However, it’s not a guarantee of how the auction will turn out. Also, there is not likely to be much difference between buying two consecutive 4-week bills or one 8-week one.

Last year, I spent way too much time agonizing over whether to buy 13-week or 26-week bills. I divided up my pot of money and bought a new bill every week. For example, should I buy a $500 bill every week for 26 weeks or a $1000 one every week for 13 weeks, so I would roll the same money over each week all year. I bought 26-week bills, since they had a higher interest rate. However, the rates rose so fast, that I would have been better off always buying 13-week bills. (By week 14, the new 13-week bills were paying more than the 26-week bill I’d bought 13 weeks before.) As long as we can’t know the future, you just have to pick one.

Similarly, for today’s auction, buying a $500 8-week bill or a $1000 4-week bill costs exactly the same, to the penny. After my experience last year, I’m just going for 4-week bills now.

Thanks for taking the time to share your approach. So far, I have also preferred 4 week bills because every 4 weeks I can assess the rates/markets and get the good feel of managing actively with the latest data. However, my “feel good” strategy has, many times, fired back mercilessly in other investments…:)…David is right about the fact that 8 week term should have a slightly higher interest but we are talking about only 4 weeks and an inverted yield curve. So, I think, other factors play a bigger role. There got to be a class of buyers how have stronger need for one vs. the other. If I find out about what are those dominant factors, I will most certainly share. Thanks again for inculging in this with me….best

There have been times in the last year when the 4-week had a higher yield than the 8-week, but generally you would expect it to be slightly lower. Sometimes demand for the 4-week rises (and yields fall) when investors are expecting interest rate cuts more than 4 weeks out. I don’t think that was the case in these auctions. I personally roll over staggered 13-week and 26-week T-bills (with maturities every few weeks) and I hardly pay attention to the yield as long as long as it hasn’t started sharply downward.

That is interesting! One time I logged in a tried to buy an I Bond for that same day, but it gave me some kind of message and the earliest purchase date allowed was the next day. Luckily for me, I hadn’t waited until the last day of the month.

When I bought it today, I only got ths message:

A purchase has been scheduled in your TreasuryDirect account on 4/25/2024. For more details, go to the History tab and click Security History. If you have a question about this activity, please call (844) 284-2676.

Good to know! Thanks. They must have changed their requirements.

As I posted in the comments of another recent conversation on this website, TreasuryDirect says that the I Bonds will be issued effective as of the first day of the month in which Treasury receives the funds for the purchase, and that funds received after midnight will cause the bond to be issued in the following month. (See https://www.treasurydirect.gov/indiv/help/treasurydirect-help/faq/ >>>”Purchasing Savings Bonds” >>>”If I buy an EE or I Bond at the end of the month, what issue date appears on the bond?”)

It’s therefore possible that if TreasuryDirect receives the funds by 11:59 p.m. on April 30, an I Bond would still be considered issued as of April 1. But I think it would be foolhardy for anyone seeking April-issue I Bonds to wait until the last minute (in order, I assume, to “milk” every last penny of interest from wherever that cash was being held before the TreasuryDirect order was placed, in hope of earning interest on the same money in two different places for most of April).

My wife and I bought our I Bonds yesterday.

Like you, I do not trust the Fed to stay the course and not return to their quantitative easing. However, I also do not trust the BLS not to cook the inflation numbers. In the latest numbers they applied a “seasonal correction” to turn a 6% month over month increase in the cost of gasoline to a 3.6% drop. Their hedonic corrections to the price of goods are also notorious. On the other hand, T-bill interest rates cannot be cooked or faked. Of course, the government taxes inflation, but that applies to Tbills and ibonds. With T-bills you have more flexibility to react to changes in the market, so put me in the T-bill camp.

The gas index went up 1.7% in March after the seasonal adjustment. It was up 6.4% before the seasonal adjustment. Those figures are listed in the report: https://www.bls.gov/news.release/cpi.nr0.htm

BLS is open about their methodology. The seasonal inflation factors are linked in the report and are listed here: http://www.bls.gov/cpi/tables/seasonal-adjustment/seasonal-factors-2024.xlsx

The seasonal factor for gasoline in February was 94.624. It was 99.007 in March, so an increase of nearly 5% is expected from typical seasonal changes.

The effect goes the other way at the end of the year. Gas prices need to go down significantly into the winter to match the expected seasonal effects. If not, it would be treated as an increase for inflation purposes even if prices were flat.

The idea is to remove typical seasonal variations to get at the underlying economic conditions. The unadjusted numbers are what we all pay. The seasonally-adjusted numbers are what economists and policymakers need to consider to make decisions based on economic trends rather than seasonal trends.

Thanks for this. I read the earlier comment and knew it was wrong, but just went “sigh.” The BLS is not cooking the inflation numbers. But some people will never believe that.

Paul, before you and David throw your arms out of whack, patting yourself on the back here is my source. Changing numbers to achieve some poorly defined academic measure, instead of using the numbers that consumers pay, is commonly known as “cooking the books”

https://www.bls.gov/news.release/ppi.nr0.htm

Product detail: Leading the March decline in the index for final demand goods, prices for gasoline decreased 3.6 percent. The indexes for chicken eggs, carbon steel scrap, jet fuel, and fresh fruits and melons also fell. Conversely, prices for processed poultry jumped 10.7 percent. The indexes for fresh and dry vegetables, residential electric power, and motor vehicles also moved higher

This is the producer price index, not the consumer price index. The PPI has nothing to do with inflation adjustments for TIPS and I Bonds. It tracks wholesale prices and can be a predictor of future CPI.

As stated by Paul in his comment above, the CPI is also subject to these arbitrary seasonal corrections. I say “arbitrary” because they’re entirely at the discretion of the BLS. Who is to say that in some “emergency”, as defined by the BLS, they do not change the seasonal adjustment tables to make the inflation go away. As you stated in the original article, no one expected the fed to print tremendous amounts of money to hold interest rates to essentially zero for nearly a decade. I stand by my point that simple and transparent is better so I’m sticking to T-bills.

ZIRP is over, but implying the Fed caused the surge in inflation is a bit much. Correlation isn’t causation, and there are lots of contributing factors to the surge. There are also many factors involved in the level of QE/QT. But this isn’t a political or economics chat.

I use I Bonds instead of buying longer term (over 10 year) TIPS for a ladder. I hate buying long term debt because regimes are constantly changing, be they inflationary, economic and yes, political regimes and structures.

The flexible maturity of I bonds lets me have long term debt that can be put (sold) without a loss in value at any time of my choosing. The drawback is obvious – it takes a long time to fill the long end of the ladder, and the amounts are small. Frankly, I am not that concerned about the long end, though.

David, everyone’s circumstances and metrics are different. I think you did a good job of capturing this “debate” and the general silliness of it.

I buy 10k of I-Bonds every year because it is one of the few tax-deferred accounts that I can get my hands on besides an IRA or 401k. I-bonds are also a unique investment which cannot lose in periods of high inflation or deflation. They’re unique enough to justify an annual purchase.

I hope this isn’t too far off topic…I have a bunch of .9 inflation factors, and a bunch of 1.3’s. I wasn’t going to sell the .9 batch BUT … couldn’t I sell them, 50K worth, then my wife and I each buy each other 25K worth via giftbox strategy before May 1, thereby effectively “trading out” our 50K .9’ers for 1.3ers? I know I’ll have to “deliver” them over the course of 3 years but shoot, they’re locked in at 1.3 for 30 years.

Or I suppose I could just finally try the giftbox option. I’ve got 3 LLCs, then my wife and I, and adult daughter. That’s 6 accounts. 2 of the LLCs might be disbanded in 1-3 years, which will necessitate me moving those bonds from those accounts to a “still living” entity. So I have to be careful not to buy giftbox purchases TOO far in advance, otherwise i’ve got to keep the LLCs open just to keep from having to cash em’ in.

It’s a strategy, but two potential negatives 1) taxes will be due on the I Bonds you sell, and 2) you will be stacking up a lot of gift-box purchases, which can only be delivered $10,000 a year into the future. The danger is that the fixed rate continues to rise.

That does make sense. What I’ve done instead is leave the .9’s alone and just bought two more batches of 10K giftbox for and from my wife. Just 2025 will be taken up, but I have 4 accounts left for 2025 purchases if the unexpected happens. (I’m assuming it will be nothing but “down from here” but I suppose I shouldn’t assume that, and shouldn’t close off all my doors for 2025-26). Thanks for your perspective and clarity.

David, thanks for the mention of this week’s video. It is a longer one, and I usually post on Friday’s but this subject, the intricacy of TIPS took more time to unravel. In 5 years, it will be interesting to see how nominal Note really did compared to the TIPS. I also got April’s 5 yr. TIPS to add to my portfolio in Bucket One. And those few bottles behind me are just part of the “portfolio” for my DIY retirement. If you see some of my older videos I had a bunch of scotch on top of the china cabinet, but Marie made me put all those in the closet!

Cheers!

As a real life experiment, I’m buying equal amounts of TIPS, I-bond, and T-bill. In 5 years, if I’m still around and remember what I was doing, I will compare the results. As an aside, I realized that the “break even” for TIPS vs. treasuries would likely be slightly different for a small investor due to the spread on the secondary market for small purchases.

One thing to remember is that the inflation breakeven rate changes every day, even hour by hour. Once you make a purchase it is set in stone. So the secondary market has a constantly shifting breakeven rate, which you can estimate by looking at the yield of a similar nominal Treasury. Also … I have found that the spread isn’t onerous, often just 10 basis points.

I’m still buying I Bonds, but have a feeling the rest of the 2020s will be much different from the 2010s. We may be in a new era in which T-Bills modestly outperform I Bonds for a few years. I could see this happening if inflation gets stuck around 3% but the fed funds rate also stays above 4.5% (or even rises from current levels).

On the other hand, sticky inflation and rising real yields should keep I Bonds competitive with T-Bills if the fixed rate rises in tandem. A future fixed rate of 1.5% plus ~3% annual inflation would give I Bonds a respectable 4.5% return. T-Bill rates may stay higher for longer, but will eventually dip below 4.5%. In other words, I agree that I Bonds still make sense as a long-term investment.

Two big things will definitely contribute to how things go (along with other things of course). 1). Will the government keep printing money left and right which devalues the dollar? 2). When will the economy cool off? One kind of feeds the other.

Another thing that has me wondering about inflation increasing and not slowing down is retirement. A lot of Baby Boomers are starting to retire now. A lot of them will have pensions/Social Security and other assets that will allow them to spend regardless how the economy is doing. So the economy can go as bad as it wants (ie lost jobs etc), but there’s going to be a lot of people with money coming in that is independent of jobs numbers. There’s going to be less people working which will raise wages since businesses will be fighting to get the limited workers available. Supply-Demand.

As a long term investment – a better comparison would be 5 year CD or 5 Year treasury. I have found in my personal experience, I bonds outperform the higher of 5 year CD/treasury when the fixed rate is at least 1%. Through out the 2010s, I stayed out of 0% I bonds till 2021 and was keeping my emergency savings in 5 year CDs (occasionally 3 year CDs when the rates were significantly higher) and rolling them.

I also like that I bonds have lower penalty (3 months, useful if these are your emergency funds) than 5 year CDs – some of them like penfed claw back half of all your interest as I found out when I had to sell them.

I also like the current I Bonds and intend to maximize my contributions. Hope the novemeber reset is also over 1% so that I would be set for next year!

Hard not to seriously consider cashing in at least some I-bonds and switching to 5%+ you can get t-bills for 2 years now. Giving up tax deferred earning but just sick seeing that 2% you’re giving up. Originally thought this was a long-term hold to potentially draw on at $1000/month for 5 years to add to disposable income with a little inflation hedge. Now looking at under 3% just doesn’t seem to make sense. Plus if Trump tax cuts disappear at the end of 2025, definitely want to pay taxes on earnings before rates go up.

ibonds shelter income for 30 years, offer total safety, allow for flexible withdrawal if held long enough and definitely have a place in the portfolio but there is no one perfect answer and we all need to be prepared to zag when the world zigs. I will be turning in my older 1% fixed ibonds and will buy 10K in April, to 1.) lessen the pain when the older bonds mature and to lock in the higher fixed rate. Little tweaks but life seems to be made of 1000’s of little decisions. I can see why having a pension must make life so much easier.

It’s impossible to predict the future, so maybe the best choice is to bet on both. There is no rule that says you have to buy 10,000 I Bonds every year. Get 5,000 I bonds and 5,000 T-Bills to juice your returns.

I agree with Chris B. If you can — Diversify – invest in both short term T-Bills and I Bonds. Diversity is always the best strategy for long term investing.

The point David has made in the past is that the 10 K per year limit (20 K for a couple and then there is the gift box maneuver) can require a significant amount of time to build up a sizable holding of I bonds. Reducing the amount by half will double the time required. It all depends on how much inflation you believe is in our future.