Answer: Very well.

By David Enna, Tipswatch.com

I got a reader question this week about CUSIP 9128286N5, a 5-year Treasury Inflation-Protected Security that will mature on April 15, 2024. The question reminded me that this TIPS has completed its cycle, with its final inflation index set by the February inflation report.

As a reminder, each month’s daily inflation indexes for TIPS are set by the inflation report two months earlier. So February’s non-seasonally adjusted inflation of 0.62% set the April 15 inflation index for this TIPS: 1.22640.

That is all we need to know to judge how CUSIP 9128286N5 did as an investment, at least versus the matching nominal Treasury in April 2019. And the answer is: It did extremely well.

On April 15, an investor who purchased $10,000 par value at the originating auction will get $12,264 in principal and a final coupon payment of $30.66.

In my preview article for the April 18, 2019, auction, I surmised that this offering was “relatively” attractive but that 5-year CDs yielding above 3% were a compelling alternative. See? I can be wrong. Way off, in this case, but there was no way to know that U.S. inflation was going to surge to a 40-year high three years later.

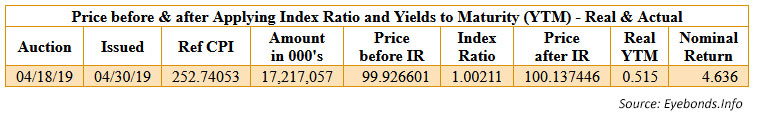

CUSIP 9128286N5 auctioned with a real yield to maturity of 0.515%, versus the 5-year nominal Treasury note yielding 2.37% on that day. That created an inflation breakeven rate of 1.85%, meaning this TIPS would out-perform the Treasury if inflation averaged 1.85% over the next 5 years.

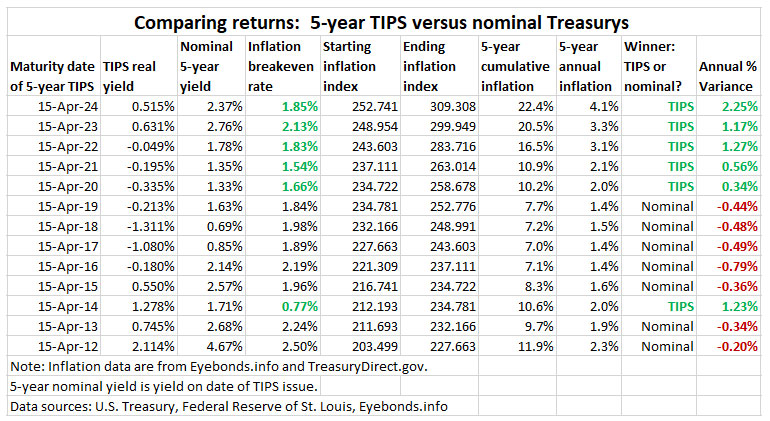

The result: Inflation averaged 4.1%, giving this TIPS a 2.25% advantage over the comparable 5-year Treasury note. That is by far the highest positive variance for any 5- or 10-year TIPS over the last dozen years.

CUSIP 9128286N5 generated an annualized nominal return of 4.6%, which I’d call spectacular versus the meager yields available in April 2019. Here are data for all 5-year TIPS that have matured since April 2012. Note the early trend of under-performance has dramatically shifted because of the ultra-high inflation of recent years.

To view this chart at a glance, the annual variance number in the last column shows how the inflation breakeven rate compared to actual 5-year annual inflation. When the numbers are green, a TIPS was the superior investment. When they are red, the nominal Treasury was the better investment.

The next decade could be entirely different. Never predict the future decade based on the performance of the past decade.

This TIPS versus an I Bond

This comparison is especially interesting, because the U.S. Series I Savings Bond was being offered with a 0.5% fixed rate in April 2109, so the performance should be very close to the TIPS. Let’s look at a $10,000 investment:

- I Bond: As of April 1, the I Bond’s value was $12,396 and can now be redeemed without penalty.

- TIPS: As of April 15, the TIPS investor will receive $12,264 in principal and a final coupon payment of $30.66. But keep in mind that the TIPS has been paying an annual coupon payment of 0.5% along the way. Eyebonds.info says the total interest paid will be $275.88 over the five years on a $10,000 investment.

The result is that the TIPS had a slight edge in performance.

Notes and qualifications

My TIPS vs. Nominals chart is an estimate of performance.

Keep in mind that interest on a nominal Treasury and the TIPS coupon rate is paid out as current-year income and not reinvested. So in the case of a nominal Treasury, the interest earned could be reinvested elsewhere, which would potentially boost the gain. For certain, we don’t know what the investor could have earned precisely on an investment after re-investments.

In the case of a TIPS, the inflation adjustment compounds over time, and that will give TIPS a slight boost in return that isn’t reflected in the “average inflation” numbers presented in the chart.

• Confused by TIPS? Read my Q&A on TIPS

• TIPS in depth: Understand the language

• TIPS on the secondary market: Things to consider

• Upcoming schedule of TIPS auctions

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

Please help. I’m confused.

I purchased this TIPS 5-years ago at auction ($10,000 at Schwab). It was my first TIPS auction.

Today the TIPS matured and I only received $10,000 cash. Not $12,264. What’s going on? Thank you.

Something weird here. Is it possible Schwab will post the inflation accrual separately? If not, you need to call Schwab for an explanation.

Thanks for the reply David.

I called Schwab. Their response was bizarre- they blamed it on an “accounting error” and said I will receive $12,264, but they couldn’t provide an ETA. Additionally, they took back the $10,000. End result- the TIPS matured yesterday, and I have received exactly $0. And waiting.

I did receive the final coupon payment.

Thanks. I love TipsWatch.

This is NOT GOOD.

That’s very disturbing! I find that Schwab often posts interest and redemptions so late in the day that it costs an extra day to reinvest the funds. Have a bunch of TIPS in my account, but I am switching to Fidelity for future purchases.

Another question: What’s the after tax real return. For most of us this would have been negative, because the real yield on these bonds was so low and inflation was high.

You can calculate after tax real yield as r-t*(r+i) where r is the real yield, t the tax rate and i the inflation rate.

So with 0.5% real yield and an average 4.5% inflation rate, and assuming a 35% tax rate, you would get = 0.005 – 0.35 (0.005+ 0.045), which is a -1.2% after tax real return. You would have needed a tax rate of 10% or less to break even.

Things have become much better now with 2% real yields, but inflation in the 4s and above would still be a problem for the higher tax brackets.

In most cases, a real yield of 0.50% will cover the effect of taxes when inflation is in the 2% to 2.5% range. But it was higher over the last five years, so the nominal return of the TIPS was 4.6%, before taxes. Inflation was 4.1%, and the spread of course was 0.5% and probably not enough to give a positive “after-tax real return,” as was true with all safe fixed-income investments in 2019. Many people hold TIPS in tax-deferred and/or tax-free accounts, where this is not an issue.

Not directly related to this subject, but if one decided to redeem a TIPS held in Treasury Direct before maturity, is there an optimum time to do it? E.g. will interest be paid to the day of redemption, unlike I bonds? Only thinking of doing this to avoid having to deal with the TD 1099 form year after next and beyond. Thinking of ditching my crypto fund, too, to avoid the K-1 form mess down the road.

You cannot sell a TIPS held at TreasuryDirect. You have to transfer it to a brokerage, where it can then be sold. And this isn’t easy. https://www.treasurydirect.gov/marketable-securities/transferring-between-systems/#id-from-treasurydirect-to-the-commercial-book-entry-system-298392 If you really want to get this done in 2024, you should not wait long.

Thanks, David! If I transfer to broker I won’t need to sell it 🙂

Mailed form today. Getting the signature guarantee was an adventure. Will report back on time to completion…

My credit union (Truliant in North Carolina) will do the medallion signature guarantees, but they want a lot of documentation. An officer has told me they face a liability risk in doing these, and that is why most banks won’t do it.

I’m a little confused by the term “deflation” as it pertains to TIPS. When you say “deflation” do you actually mean deflation or “less inflation”? In other words if I buy new issue TIPS at auction when inflation is at 3% and later inflation is reduced to 2%, is that the “deflation” that would reduce the value of my TIPS?

Deflation indicates a negative inflation rate. If inflation falls from 3% to 2%, that is disinflation, but prices are still going up. The accrued principal of a TIPS rises when inflation goes up, by any amount. If inflation becomes negative, then the accrued principal of a TIPS will decline.

Hi David

I’ve enjoyed reading your updates the past year and finally bought 5 year TIPS in a Treasury Direct account last October and December. Can you tell me when interest from these TIPS is paid? Thanks

I am assuming this is the same TIPS, so interest should be paid Oct 15 and April 15.

David, Outstanding work in setting the record straight regarding the performance of SCHP.

I called Schwab last year about the absence of distributions. I spoke with a person in a position of authority who made clear the following:

SCHP Schwab’s TIPS fund reserves the right to withhold distributing the interest received as a dividend, and instead reinvest TIPS interest payments, however, and whenever, they see fit, and make distributions of dividends only when they see fit. They also reserve the right to sell all TIPS they hold whenever they choose – especially if interest rates are going up and “mark-to-market” is making their performance look bad – and to instead reinvest in T-Bills.

Michael J. Daillak, CPA-Retired

How about comparing to to a TIPS ETF?

Between 4/30/19 and 3/26/24, SCHP returned 11.97% and VTIP 16.95%.

Thoughts?

The 5-year annualized total return for SCHP was 2.39% and for VTIP, 3.15%. So this TIPS easily out-performed them both.

David for all your wonderful work, you make TIPS too complicated and too confusing. I’m a retired CPA who has been recommending TIPS for 30+ years. I simply told my clients: You only buy through your broker (US Treasury accounts are too complicated) individual TIPS bonds WHICH YOU MUST HOLD TO MATURITY IN ORDER TO REALIZE THE INFLATION PROTECTION BENEFITS. I told them simply look at the Yield To Maturity (YTM) and add 2% to it. I explained that the inflation protection, when there isn’t any abnormal inflation, will cost them a lesser YTM of about one-half-of-1% (when compared to any other US Treasury bond, except an I-Bond, which also aren’t worth the trouble). Over the years, especially recently(!!), I’ve received a lot of “thank you” notes for this advice – and never a complaint! I also explained that their monthly brokerage statements would never reflect the correct value of their TIPS bond holdings, and at no charge, they could provide me a copy of any statement and I would provide the correct value to them – as well as explain how I calculated it.

I agree with everything you said. People freak out when the see TIPS values bouncing around in their brokerage accounts, but the best advice is to do what you say: Just watch accrued principal and hold to maturity.

David,

After retirement, I discovered only approximately 2% of individuals with brokerage accounts are self-directed investors, AND MOST OF THE OTHER 98% CAN’T EVEN UNDERSTAND THEIR MONTHLY BROKERAGE STATEMENTS (and I mean there was nothing on them that they understood!; and they had never actually made a buy or sell transaction!!) – this is something I’ve never seen discussed, in the advisory related sites I monitor.

This discovery helped me finally understand why my CPA clients would suddenly seem to disengage (and their eyes seem to “glass-over”) when I would bring up the subject of their investment’s portfolio.

I made this discovery after I initiated my website. I live in a 2,200-acre, gated retirement community of 18,000 people (13,000 homes). There are 250+ “clubs”. I thought I’d give a presentation of my site to the investments club – I found out there wasn’t one, but I could form one. So, in Jan 2017 I formed one – for educational purposes only. Three-plus years later I had a mailing list of almost 500. And I’d made 38 monthly 1+ hour presentations – and related “summary handouts” – which were emailed to all, whether or not they attended. Monthly attendance was around 50. 90 % of the presentations included one of the 30 minute “The Great Courses” investments videos.

After each presentation I’d be available for questions. Usually, my response would be “bring a copy of your statement next month, so I can be sure to give you a correct, and complete answer”. The cumulative results of those who showed up the next month with a statement, resulted in my great discovery set forth in the first sentence of this email – almost all attendees were there so that “they could sleep better knowing that they had looked into the subject of investing” presented by an “unbiased expert” (i.e., someone not their broker).

I believe all investors and their portfolios would be better off if the SEC did a study to confirm my opinion, and then appropriately re-directed the SEC’s efforts.

If you found the time to read the above, I hope you found it of interest.

Thanks so much for confirming your agreement with my earlier “Comment”!

Mike

Michael J. Daillak, CPA-Retired

Very interesting, Michael, kudos! In that vein, i always advocate that brokerage account holders exercise their reverse FINRA Rule 2090 ‘Know Your Customers’ by going to Brokercheck online and searching their broker AND their brokerage firm so that they Know Your Broker/Brokerage Firm and who they are entrusting their monies to. Look at the disclosures, complaints, arbitrations, and arbitration awards.

If you take a look at the secondary market for this TIPS today, you will see that it is trading for small lots with a real yield to maturity of -3.615%, which *looks* shocking but is meaningless. Buying $10,000 par at that bid/ask spread would cost you $12,272 and at maturity in less than a month you would get about $12,294, a gain of about 0.18%. Not really worth the bother.

For comparison with stocks: $10k in VTI (total U.S. market) April 2019 would be worth $18.8k vs $13.1k for total international vs $12.5 for the 5 year tips. Interesting that the safety of a treasury bond had almost the same return as international stocks.

You are comparing apples and oranges here.

It is apples and oranges, but still a valid comparison. Another way to look at it is annualized total return. For VTI the 5-year total return is 14.16%. For VXUS it is 6.18%, versus 4.64% for this TIPS. The TIPS did well for a near-zero-risk investment. But it is smart to have a diversified portfolio.