- Corporate Finance

- 3 min read

CaratLane’s Mithun Sacheti, Binny Bansal back Xeed as Indian founders turn big local sponsors of funds

In India, founders like Sacheti and Bansal are funding domestic funds like Xeed Ventures. The Rs 600 crore fund, with Premji Invest's backing, invests in startups like Charcoal.inc and Kredit.pe, led by Sailesh Tulshan.

India’s startup and technology ecosystem is witnessing the emergence of a growing pool of influential founders turning into funders by backing multiple domestic funds. In the latest instance, CaratLane founder Mithun Sacheti and Flipkart cofounder Binny Bansal have become anchor LPs (limited partners) in Bengaluru-based Xeed Ventures, an early-stage fund run by Sailesh Tulshan, said multiple people in the know.

The Rs 600 crore fund, formerly known as 021 Capital, has also roped in Premji Invest as an LP, the people added. While Bansal is a sponsor in a dozen funds, Sacheti, who scored a big win by selling his 27% stake in online jewellery marketplace CaratLane to Tata group’s Titan for Rs 4,621 crore last year, has been actively deploying capital across different vehicles. He is a general partner and LP in Singularity Growth, a fund backed by ace capital markets investor Madhu Kela.

021 to Xeed Ventures

Xeed, a play on the word seed, will look to cut cheques below $1 million and make 20-25 investments from the fund. It will continue to focus on enterprise, B2B, and fintech deals. “As much as 70% of the capital for the fund is already pooled in and they’ve started making new investments. Besides Bansal and Sacheti, there are other founders who have also deployed cash,” said one of the persons cited above.

Xeed has closed a few investments like Charcoal.inc, a direct-to-consumer brand, and a financial services startup Kredit.pe.

Tulshan, Bansal, Sacheti and a spokesperson for Premji Invest did not respond to ET’s queries.

021 Capital was formally launched in 2019 by Tulshan, who managed the personal investments of Sachin Bansal, who is not related to Binny Bansal. This coincided with the sale of online retailer Flipkart to US retail behemoth Walmart in a $16 billion deal.

Premji Invest and Sacheti were backers of 021 Capital Fund-I as well. Along with its Rs 300 crore Opportunities Fund which was raised separately, in total the vehicle had garnered Rs 600 crore.

021’s name was inspired on PayPal cofounder Peter Thiel’s philosophy on innovation and entrepreneurship captured in his famous book– Zero to One. Some of 021’s bets include Brightchamps, Spotdraft, Increff, Superk, Nymble, Oro, Pandorum, Bharatagri, among others.

Founder LPs line up

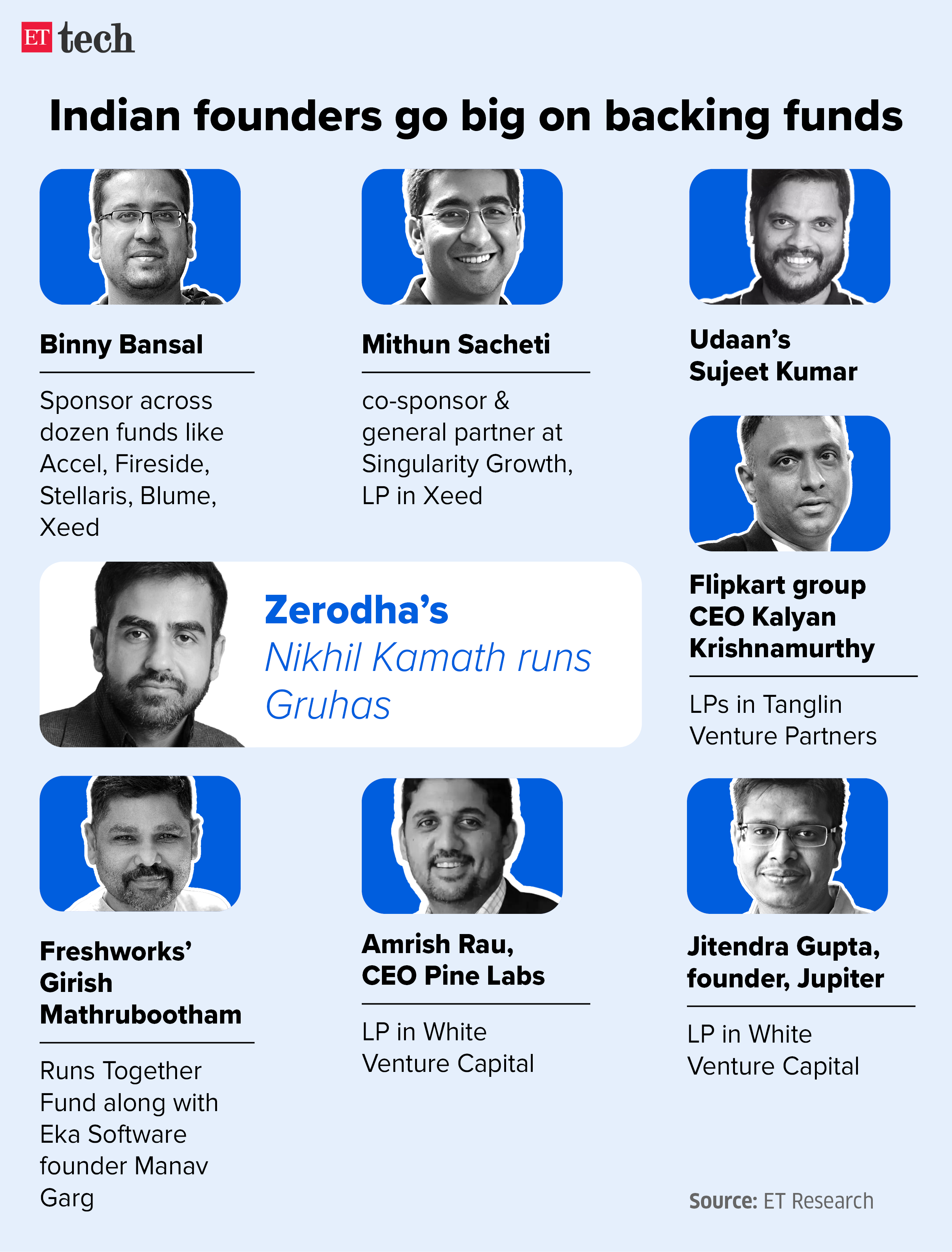

Some of the other influential founders and operators who have floated or backed funds include Zerodha’s Nikhil Kamath (Gruhas), Udaan’s Sujeet Kumar, Flipkart group CEO Kalyan Krishnamurthy (LPs in Tanglin Venture Partners), Freshworks’ Girish Mathrubootham who runs Together Fund along with Eka Software founder Manav Garg, Amrish Rau, CEO Pine Labs, Jitendra Gupta, founder, Jupiter (LPs in White Venture Capital), Myntra and Curefit founder Mukesh Bansal who operates Meraki Labs.

There is another set of entrepreneurs who have taken on the role of full-time investors like Snapdeal’s Kunal Bahl and Rohit Bansal who run Titan Capital.

Most of these founders began ploughing their personal capital about a decade ago via angel investments. Having found success, many have since formalised the structures through which they invest by either turning into LPs or launching their own funds.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions