- Strategy & Operations

- 4 min read

iPhone may click with Titan, Murugappa

Apple explores partnerships with Murugappa Group & Titan Company for local assembly of camera module sub-components in India, aiming to shift operations from China and strengthen the Indian supplier ecosystem.

If talks fructify, the Indian supplier ecosystem will deepen for the Cupertino company as it shifts more of its operations away from China.

At present, Apple does not have Indian suppliers for the camera module embedded in its iconic phones, several models of which are now assembled in India. “Partnering either with Titan or Murugappa Group could address this issue,” said one of the people cited above.

“In a timeframe of five to six months, they (Apple) will have finalised which is the (partner) to bet on,” said a person in the know.

Camera assembly initially

The camera module is a critical component that is currently one of the “biggest challenges for Apple in India,” another person said.

Titan specialises in precision components manufacturing for its watches and jewellery.

Chennai-headquartered Murugappa Group is an over 100-year-old industrial house with sprawling interests across engineering, financial services and chemicals.

ET reported on April 11 that Apple is looking to move at least half of its supply chain to India, as well as increase local value addition from suppliers by almost 50% over the next three years.

Emails sent to Apple, Murugappa Group and Titan did not elicit any response till press time on Monday.

Industry experts are of the view that Apple is likely to start by assembling the camera module in India.

“Starting with module assembly is a good foundation to attract different sub-assembly manufacturers and build the complete local value chain — from image sensor to lenses and the entire camera module,” said one person with knowledge of the matter, adding that the US major is increasingly tapping local sources for products it finds difficult to source from its existing suppliers.

Talks with Titan and Murugappa are one example of the company looking to strengthen its base in India. Both groups have deep expertise in high-precision manufacturing.

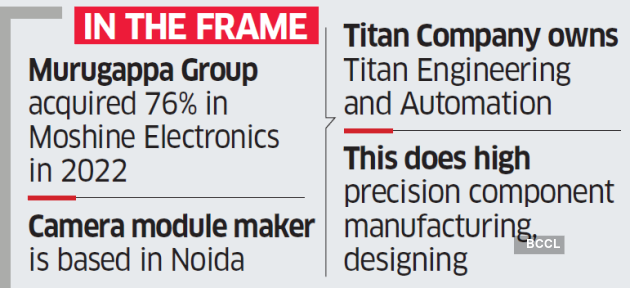

In 2022, Murugappa Group acquired 76% stake in Noida-based camera module maker Moshine Electronics to diversify its business in the electronics and components space.

Bengaluru-headquartered Titan Company owns Titan Engineering and Automation, which began as an inhouse engineering department for high-precision component manufacturing and design. It has significantly expanded and now caters to global customers across industries such as defence and aerospace.

“Murugappa Group, in particular, with its acquisition of Moshine Electronics, has an advantage. In future, with a potential fab, it could manufacture the image sensor,” said the person quoted above who reckons the group “could be an end-to-end player or partner in Apple’s India value chain."

Similarly, Tata group (of which Titan is a group company) could also go from assembly for camera module and sub-components to eventual manufacturing in the fab, he added.

Separately, Tata as well as Murugappa Group have applied and qualified for government incentives to set up a semiconductor chip assembly unit in India. Tata group is also building a $11-billion chip fab in Dholera, Gujarat.

Diversifying supply

Typically, image sensor chips within a camera module form the largest and most costly component of a smartphone as well as of its display.

Martin Yang of Oppenheimer & Co earlier told ET that these are the components for which Apple will either depend on imports or set up a local manufacturing unit in India. “For image sensors, Apple depends largely on Sony in Japan, Samsung in Korea and Omnivision in China. These image sensors are specialised semiconductors, and it is very costly for new players to enter this market,” Yang had said.

Sourcing locally can also provide significant cost benefits for Apple, in addition to reducing its dependence on Chinese suppliers.

Backed by the production-linked incentive (PLI) scheme, Apple has become very aggressive in its push to manufacture in India. Some of its largest electronics manufacturing services partners — Foxconn, Pegatron and Wistron (now taken over by Tata Electronics) — have significant presence in India.

ET reported in December last year that Apple was in talks with component makers such as India’s Aequs Group and Taiwanese camera and lens maker Rayprus Technologies, and in preliminary discussions with Indian contract manufacturer Dixon Technologies.

Rayprus is among the leading companies globally which make multi-camera modules for smartphones and is one of the few suppliers of the technology not based in China, according to experts.

A January report by ET showed Apple was targeting production of nearly Rs 1 lakh crore worth of iPhones in India by March end or the first quarter of FY25, having increased capacity at its manufacturing partners. Around 70% of iPhones produced in India are exported, which is only set to increase.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions