By David Enna, Tipswatch.com

The U.S. Treasury on Thursday will offer $16 billion in a reopening auction of CUSIP 91282CJY8, creating a 9-year, 10-month Treasury Inflation-Protected Security.

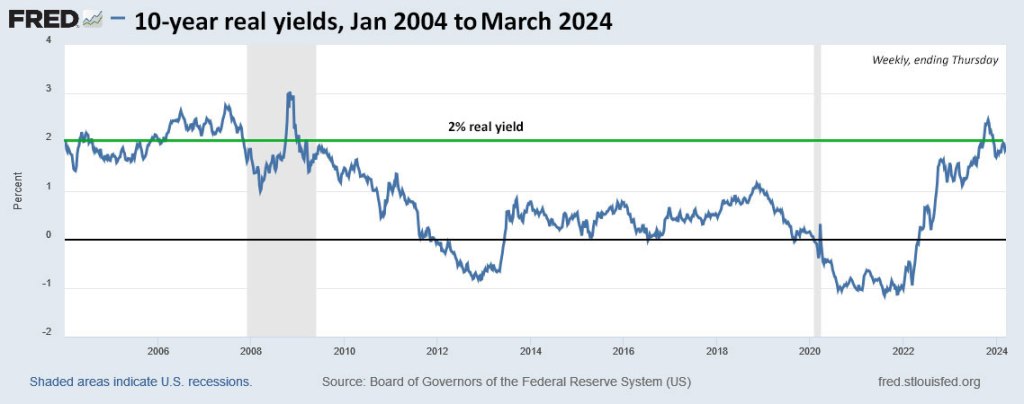

Real yields have been trending higher over the last few weeks, with the 10-year up about 12 basis points since March 1. And so it looks possible that this reopening will generate a real yield to maturity of 2.0%+ for only the third time since January 2009, a total of 87 auctions of this 9- to 10-year term.

I consider the 10-year to be the most desirable of TIPS offerings because of its medium term and generally higher yield versus the 5-year. Plus, a real yield of 2.0% over 10 years is an excellent investment target.

CUSIP 91282CJY8 is the only TIPS maturing in 2034, although another new 10-year will be auctioned in July. The offering size of $16 billion is the largest ever in history for a 10-year TIPS reopening auction. Three years ago, the March 2021 reopening size was $13 billion.

Definition: A TIPS is an investment that pays a coupon rate well below that of other Treasury investments of the same term. But with a TIPS, the principal balance adjusts each month (usually up, but sometimes down) to match the current U.S. inflation rate. So, the “real yield to maturity” of a TIPS indicates how much an investor will earn above inflation each year until maturity.

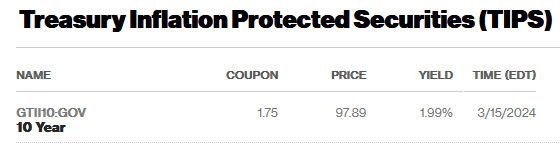

CUSIP 91282CJY8 has a coupon rate of 1.75%, which was set at the originating auction on Jan. 18. It trades on the secondary market, and you can check its yield and price in real time on Bloomberg’s Current Yields page:

At Friday’s close, CUSIP 91282CJY8 was trading with a real yield of 1.99% and a discounted price of 97.89, which reflects the below-market coupon rate of 1.75%. Because real yields have been climbing recently, it’s possible we could see 2.0% at Thursday’s auction. However, as one of my readers noted this week, 1.98% is close enough if you are purchasing on the secondary market.

Here is a look at the 10-year real yield over the last 20 years, providing perspective on the rarity of a 2.0% real yield over the last two decades, an era of aggressive Federal Reserve manipulation of the Treasury market:

Real yields could go higher, definitely, but are attractive in this current range.

Pricing

Let’s look at a hypothetical purchase of $10,000 par of this TIPS at Thursday’s auction, assuming a real yield to maturity of 1.99% and a price of 97.89. (Things will change, but this will give us an idea.) CUSIP 91282CJY8 will have an inflation index of 1.00264 on the settlement date of March 28.

- Par value: $10,000

- Principal purchased: $10,000 x 1.00264 = $10,026.40

- Cost of investment: $10,026.40 x 0.9789 = $9,814.84

- + Accrued interest = About $35.

In summary, an investor would be paying $9,814.84 for $10,026.40 of principal and then would collect inflation accruals for the next 9 years, 10 months, plus an annual coupon rate of 1.75%.

Inflation breakeven rate

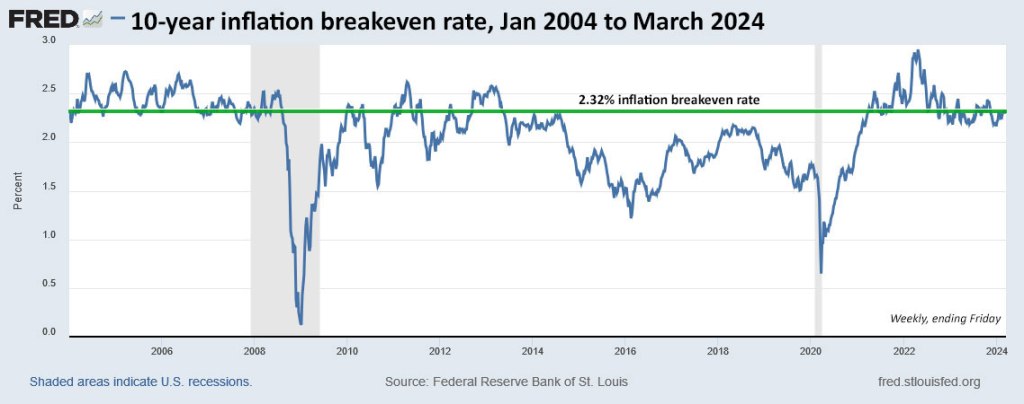

The 10-year nominal Treasury note closed Friday with a yield of 4.31%, which creates an inflation breakeven rate of 2.32% for CUSIP 91282CJY8, as of Friday’s close. That is slightly below the 2.34% generated by the originating auction in January. Over the last 10 years, ending in February, inflation has averaged 2.8%.

At this stage in the U.S. economy, with inflation reviving over the last two years, 2.32% seems like a reasonable breakeven rate. Here is the trend in the 10-year breakeven over the last 20 years, showing that 2.32% is a bit high historically, but within typical ranges in times of Federal Reserve inaction.

Final thoughts

CUSIP 91282CJY8 looks attractive right now, and there is no particular reason to wait until Thursday’s auction to purchase it. Investors comfortable with buying on the secondary market could pull the trigger at any time, before or after the auction, and know exactly what the real yield will be. Investors buying at the auction on Thursday won’t know the real yield until the auction closes at 1 p.m. EDT. It could be higher or lower than expected.

Either way, if you are intent on building a TIPS ladder out to 2034 and beyond, CUSIP 91282CJY8 would make an attractive addition. Again, I emphasize that real yields could continue rising, or begin falling later this year. We don’t know.

I won’t be a buyer because I already purchased CUSIP 91282CJY8 at the originating auction (real yield of 1.81%) and then later on the secondary market (1.89%). So my 2034 needs are met at this point.

This TIPS auction closes Thursday at 1 p.m. EDT. Non-competitive bids at TreasuryDirect must be placed by noon Thursday. If you are putting an order in through a brokerage, make sure to place your order Wednesday or very early Thursday, because brokers cut off auction orders before the noon deadline.

You can track yields in real time on Bloomberg’s Current Yields page. This provides a fairly accurate estimate for the auction result, but the results often skew a bit higher or lower. I hope to post the results soon after the auction closes on Thursday.

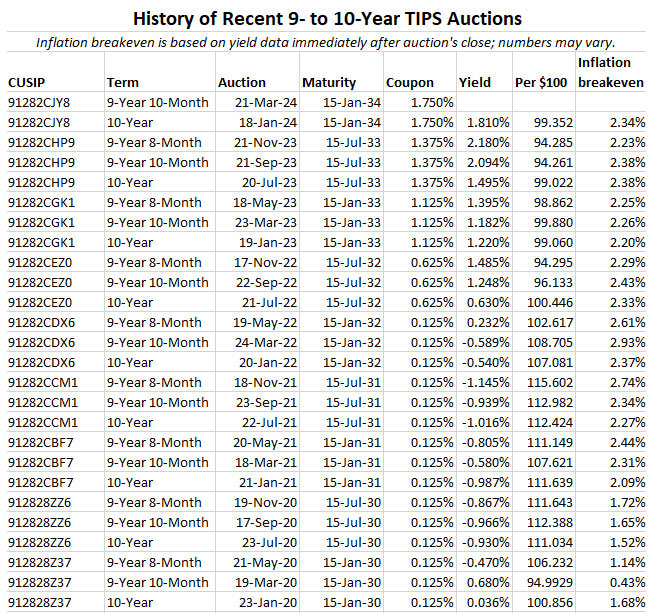

Here’s a history of 9- to 10-year TIPS auctions over recent years. I like to point out that just two years ago, this same March reopening auction generated a real yield of -0.589%. That was a lousy time to buy a TIPS. Things have improved.

• Now is an ideal time to build a TIPS ladder

• Confused by TIPS? Read my Q&A on TIPS

• TIPS in depth: Understand the language

• TIPS on the secondary market: Things to consider

• Upcoming schedule of TIPS auctions

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

Dale’s Lot Detail on Schwab today

Lot Details: 9128286N5 – UST INFL IDX 0.5%04/24INFL INDEX DUE 04/15/24Cost Basis CalculatorHelpExportPrintLot DetailsOpen DateQuantityPriceCost/ShareMarket ValueCost BasisGain/Loss $Gain/Loss %Holding Period

06/20/201950000$100.01562$123.78$61,078.04$61,889.02-$810.98-1.31%Long TermTotal50,000$61,078.04$61,889.02-$810.98-1.31%

I bought 50,000 principal of the 9128286N5 0.5% 4/15/24 /TIPS in the secondary market on 06/28/2019 at a price of $101.6629. This will be the first TIPS on my 10 year ladder to reach maturity. My Schwab statements have been clear about the current market prices and the inflation accrued principal, but have always been confusing reguarding my basis and Gain/Loss (maybe keeps adjusting for inflation accruals?).

In Janruary you posted a chart of 10yr TIPS vs. Nominal Treasury return from auction to maturity. Would please post simular Chart of 5 yr TIPS vs. Nominal chart; and would you also please run through how to calculate my 5 year return on ths 9128286N5 issue purchased in secondary market.

I always appreciate and look forward to your posts and your always clear expanations on purchase calculations; but I have not seen you walk through a post facto assessment of secondary market purchases that each magurity.

Hopefully, ths is not too great an ask. If so, I’ll happly await you addessing this in a future post.

Thank you, Dale

I do track the performance of both 5- and 10-year matured TIPS on this page: https://tipswatch.com/tips-vs-nominal-treasurys/

That particular TIPS, 9128286N5, will have an index ratio of 1.22640 on its maturity date of April 15. If you track back to the originating auction, which was April 18, 2019, that TIPS will have had a nominal return of 4.636%. compared to the nominal return of 2.38% for a 5-year Treasury note purchased on that date. (This info comes from Eyebonds.info): http://eyebonds.info/tips/hist/tips73hista.html

Eyebonds.info says a purchase at the reopening auction on June 20, 2019, generated a nominal return of 4.18%, still very good.

Right around April 15, I will post a recap article on this issue.

Did not expect such a prompt reply, Thank you David

Update, 6 pm Wednesday: Interesting day with the Federal Reserve sending mixed messages about future inflation and interest rates. CUSIP 91282CJY8 closed with a real yield of 1.93%, down from 2.00% on Tuesday. In my opinion, nothing Jay Powell said should have caused real yields to decline.

Agreed! I’ve been tracking TBill yields on an excel spreadsheet for the past year plus and found that, by and large, their yields decline in the days and sometimes week before the Fed Meetings and or Powells comments.

It’s still at 1.93% at 7:16pm. I wonder if the market had priced in 2 cuts and not 3 cuts as the Fed SEP suggest. His comment to slow the pace of reducing their balance sheet could be another factor. I think the market is happy about loosening of financial conditions because of these two primary reasons, so the market hit new records. Powell accepting getting to 2% inflation target in 2026 may also have helped.

Seems to be a pattern of rate plunging at auction time. Still a buyer?

As I see it at 6:45am, the 10-year TIPS real rate is down to 1.89%, well below 2%. Where the auction rate lands is anybody’s guess. David, what’s your view on buying today’s 10 year TIPS?…..thanks!!

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Yes, I am seeing 1.88% at 8:04 am. This was triggered by the Fed’s decision to continue forecasting three interest rates cuts (maybe) in 2024, while also forecasting a bit higher inflation that it previously forecast. Mixed message. “Higher inflation for longer” is what Bloomberg was saying. The breakeven rate is holding at about 2.34%, no huge move there.

As I noted, I was not going to be a buyer at this auction, but the current yield is close to where I previously purchased this same TIPS earlier this year. If I was a buyer, I would be disappointed by the 24-hour move based on the Fed’s mixed messages. But in reality, 1.88% is almost exactly where the 10-year TIPS started March. Where are real yields heading? Who knows?

Hi, Dave.

You stated that your “2034 needs are met at this point.”.

Have you overweighted 2034 and 2040 to cover the gap years?

And if not, why not?

Thanks.

I overweighted 2032 and 2033 and also 2040, but not by as much. I have another strategy of having shorter-term nominal investments maturing in 2025 and 2026, which will allow me to buy the 10-year TIPS maturing in 2035 and 2036. After that, I will be taking RMDs but I will still be looking for ways to buy 2037 to 2039. The only risk there is that real yields plummet in the meantime.

I’m going to be a heavy buyer at the auction. I’ve been doing this since the early days when one I bought had a real yield of 4.25% I believe. People then weren’t familiar with this new investment. When this TIP matures I’ll be 92 or my heirs can sort it out. I have room in my IRA. A safe investment at a real yield around 2% is too good for me to pass up.

This isn’t directly related to this TIPS, but I see that despite TIPS yields being up a bit overall, the TIPS that mature on 4/15/24 and 7/15/24 are trading for a negative yield in the secondary market. Why does that happen?

When the maturity date is very near, the TIPS real yield gets skewed — sometimes up or down. In this case, the April 15 2024 TIPS has its final maturity value already set from the February inflation number. Its final index will be 1.22640 on April 15. Its current index is 1.21987. So it is going to get a guaranteed nominal gain of 0.535% in less than a month. So what appears to be a negative real yield is actually just a math calculation. It is going to get a nominal yield of 0.535%, plus a final coupon payment of 0.250%, which is pretty good in one month.

Hi David, I may be asking you the obvious. If the final inflation index for a TIPS is say 1.2264. Is it right to assume that the total return on that TIPS, kept from its auction to maturity, was 22.64% plus all the coupons collected during its lifetime? thanks!!!

It would be if you bought it exactly at par, which never happens exactly. And keep in mind that that coupon interest was growing with inflation through the entire holding period.

The moment I posted my question, I did think about the both, unlike WhatsApp, I can’t edit once posted….of course David will never miss it…. 🙂 …. thanks!!!!

I just bought the TIPS on the open market at 97.7378, with a real yield 2.06%, I believe. Hope it was a good purchase. Thanks, David, you usually are right on the money.

Brent, Arizona

Hi David,

As always, thanks for your guiding light! A question I have that I haven’t been able to find a great answer to is how much of my asset allocation should go to TIPS? I’m thinking that in this time of uncertainty, that they are great investment. I’m not out to make a killing, and a real return on investment after inflation of 2% sounds attractive to me. I’ve got a conservative asset allocation similar to yours. I currently have 25% of my assets in TIPS, but I’ve been thinking about taking it up to 50%.

Take care

Good-Humored Public Service Announcement:

A little while ago I went ahead and made a secondary market purchase of this 10-year TIPS at 1.991%.

Since experience hath shown that I am sometimes (though, of course, not always) a one-man Contrarian Indicator, the rest of you folks might want to wait until Treasury’s own reopening a few days from now. 🙂

IMHO, it’s all going to come down to Fed Chair comments and their outlook. Right now, there are plenty of conflicting signals on both sides. The Fed has gained more credibility with being right on 3 cuts instead of Market’s wishful thinking of 6 or 7 cuts this year. So what they say now, it will have a bit more weight. I am going to buy the reopened 10 Year TIPS at the auction because I am not a fan of giving bid ask spread, even on one side of the trade. My wishful thinking: It’s a big auction, 2% real rate is my guess. By the way, I have been more wrong than right when making such guesses, no matter how convinced I have been with my narrative. However, I may be right one day…:)

David, thanks for the update. I picked up some of the 10-yr in January at auction. Is the recent YTM gain in the upcoming TD reopening only with regard to the purchase price? If I compare your $10K purchase example on your 10-yr auction update with today’s update, the difference is about $100. If I buy some more at the TD reopening, say in the same amt as at auction, will my 6-month interest payments from the reopening purchase be exactly the same as the amounts I’ll receive from the purchases at auction? Trying to understand if YTM gain on a reopening only refers to purchase price savings and not to better 6-mo payouts when compared to 6-mo payouts from auction purchase. Thanks for any clarification.

The price you pay is based on real yield trends, plus accrued principal. But the TIPS is still CUSIP 91282CJY8 and the coupon payments would be the same, as a percentage. Yes, the real yield to maturity is based on the premium or discount you pay at purchase. Each six-month coupon payment will always be one half of 1.75% of accrued principal.

Planning to buy more I-bonds soon, since I expect to be long gone before they cause another tax time bomb for me, and in the meantime I don’t have to worry about deflation or taxes. Will hang on to the moderate amount of TIPS I have acquired as a result of reading this blog (thank you, David!). Three years ago I was 1/3 in cash, now it’s less than 10%.

Well, with the 5-year TIP YTM at 1.92% and the 30-year TIP YTM at 2.15%, that 1.30% base rate on the I Bond sure looks good to me. Unlike the TIP, the I Bond gives full income tax deferral and no decline in value if interest rates increase. Of course, that 1.30% is a lot less than the April, 2001 base rate of 3.40% but that was then and this is now.

I prefer I Bonds to TIPs; I Bonds do not go down in value if interest rates increase and I Bonds give full income tax deferral. When the current I Bond base rate of 1.3% was set, the YTM of the 5-year TIP was 2.46%. Now it is 1.92%. I plan to buy I Bonds later this week.

No, not this week. I Bonds earn interest from the first of the month. I plan to buy next week.

I’ll be a buyer at this auction; I was out of the country at the time of the original auction.

I built out my entire ladder last year with purchases on the secondary market. Now I just need to trade out some of my 2033’s and 2040’s for new issues in the gap years. This week’s auction is an opportunity to avoid paying the spread on one side of this trade.

The attractive current pricing of this 10-year 2034 TIPS on the secondary market leads to the typical question: “Pounce” now or wait until the Treasury’s own official reopening this week and hope to do a bit better–but accompanied by the possibility of doing a bit worse? One of the many ways in which financial markets–whether for TIPS, stock mutual funds, whatever–play games with my mind. The answer to whether it would have been better to do Y instead of X only becomes known with benefit of hindsight, not foresight.

I sometimes think this issue is eliminated by buying I Bonds instead of TIPS–no market price to fluctuate daily or hourly, pay exactly $X, get an I Bond worth exactly $X in principal. But, of course, we’re now approaching the semiannual season for decisions about “Better to buy before–or after–May 1? Better to buy before–or after–November 1?” And the answer only becomes known after May 1 or November 1 has already passed.