My Two-for-Tuesday morning train WFH reads:

• The U.S. Consumer Is Starting to Freak Out: The flush savings accounts and cheap credit that helped keep Americans spending at high rates since 2020 are disappearing. (Wall Street Journal) see also The Decline of the Nice-to-Have Economy: Consumers are reining in their spending on pandemic-era luxuries and conveniences, just as investors are doing the same—putting startups in a double bind (Wall Street Journal)

• After 30 Years, the King of ETFs Faces a Fight for Its Crown: State Street’s SPDR S&P 500 fund changed investing forever, ushering in the era of indexing and instant access to funds. (Businessweek)

• The Secret to EV Success Is the Software: Following Tesla’s lead, Volkswagen is building out expertise in-house to avoid the fate of the original cellphone makers. (Businessweek) see also Consumer Reports calls Ford’s automated driving tech much better than Tesla’s: Autopilot was once groundbreaking technology. Today, more than half of new vehicles are available with advanced driver assistance systems which are superior to Tesla’s. Tesla ranked 7th in autonymous driving tech… (CNN Business)

• What businesses do > what businesses say: “Business leaders broadly report deteriorating business conditions, but the breadth of decline reported for actual production, shipments, and employment is more modest — albeit still more negative than during most of the previous economic expansion.“ (TKer)

• This group is sharpening the GOP attack on ‘woke’ Wall Street: Consumers’ Research, bolstered by millions in undisclosed donations, targets investment firms and their evaluation of climate risks. (Washington Post) see also Politicians Want to Keep Money Out of E.S.G. Funds. Could It Backfire? States are supposed to act in the best interests of citizens and retirees. Divesting from E.S.G. funds and companies like BlackRock that run them may create legal jeopardy. (New York Times)

• Streaming Wars: Who’s Winning? For a few years, it was all pretty simple: Netflix ran the show, Hulu had sneaky value, and Prime Video had Fleabag. But when the calendar changed from October to November in 2019, so too did the entire streaming industry. (Streaming Guide)

• The computer errors from outer space: The Earth is subjected to a hail of subatomic particles from the Sun and beyond our solar system which could be the cause of glitches that afflict our phones and computers. And the risk is growing as microchip technology shrinks. (BBC) see also There are more ways to arrange a deck of cards than there are atoms on Earth: Consider how many card games must have taken place across the world since the beginning of humankind. No one has, and will likely never, hold the exact same arrangement of those 52 cards you did during that game. Just think about that…Crazy, no? (McGill)

• Mindblown: Why More Physicists Are Starting to Think Space and Time Are Illusions: A concept called “quantum entanglement” suggests the fabric of the universe is more interconnected than we think. And it also suggests we have the wrong idea about reality. (Daily Beast)

• “OMG Stop Freaking Out!!!” is a Bad Response to Right-Wing Freak-Outs If you can’t say something principled, don’t say anything at all. (I Might Be Wrong) see also If I Can’t F&*k the M&M Spokescandies, What Do I Have to Live For? Instead of just replenishing the M&M’s with their inherent erotic essence, Mars Wrigley has brought in Maya Rudolph to “fix” this castrated mess. (Jezebel)

• David Crosby on love, music and rancour: ‘Neil Young is probably the most selfish person I know’ (2021): At 80, the superstar musician has survived heroin addiction, illness and tragedy to hit an unprecedented run of musical form. He discusses the joy of fatherhood, the pain of falling out with bandmates – and why Joni Mitchell is still the greatest. (The Guardian)

Be sure to check out our Masters in Business next week with Neil Dutta, head of economic research at Renaissance Macro Research. He joined RenMac after spending seven years at Bank of America-Merrill Lynch, where he was a Sr. economist covering US + Canada. Prior to that, he was a research analyst at Barron’s.

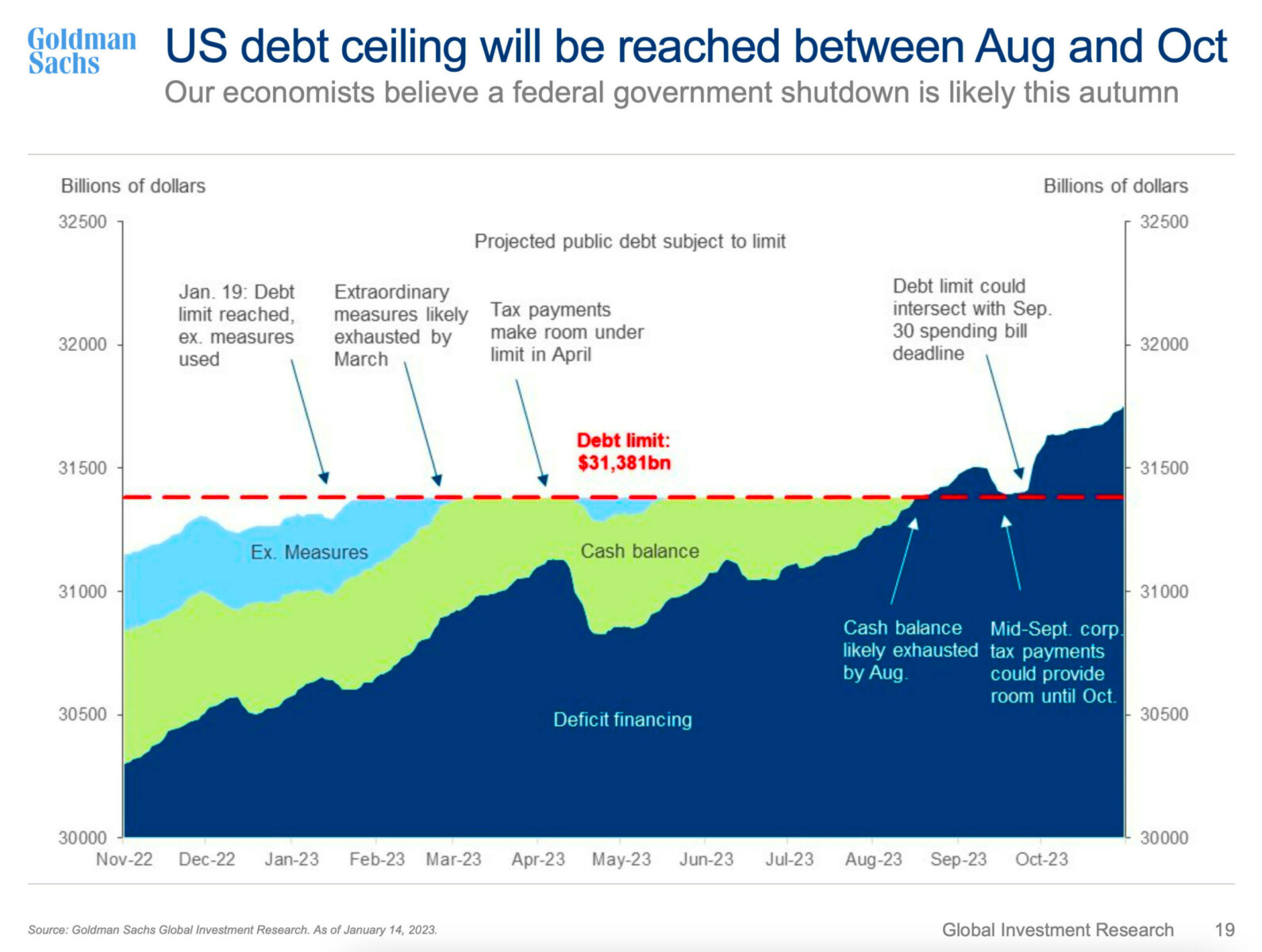

Debt ceiling will not be reached until much later this year

Source: Goldman Sachs via Jonathan Miller