By David Enna, Tipswatch.com

Blame it on the Fed.

Early this week, it looked likely that today’s reopening auction of a 10-year TIPS — CUSIP 91282CJY8 — would generate a real yield to maturity of 2.0% or higher. But the Federal Reserve’s mixed messages Wednesday sent both real and nominal Treasury yields tumbling.

The result: The auction got a real yield of 1.932%, which actually was better than expected, based on a when-issued prediction of 1.91% and a market real yield of about 1.90% just before the auction’s close. (This TIPS trades on the secondary market.) The bid-to-cover ratio was 2.35, indicating that lukewarm demand resulted in a bump higher in yield.

In reality, 1.932% was an improvement over the Jan. 18 originating auction for this TIPS, which resulted in a real yield of 1.810% and set its coupon rate at 1.750%.

The Federal Reserve sent the bond market spinning yesterday by simultaneously holding to its plans for three interest rate cuts in 2024, while also forecasting higher-than-expected inflation and economic growth. A Bloomberg commentator had this reaction: “It seems the Fed is accepting higher inflation, for longer.”

But can I explain why that message sent real yields tumbling 10 basis points or more? No I can’t. Yes, cuts in interest rates appear to be coming, but if inflation remains elevated the process will be slow. It’s reassuring that today’s big-money investors saw that reality and demanded a slightly higher-than-market real yield.

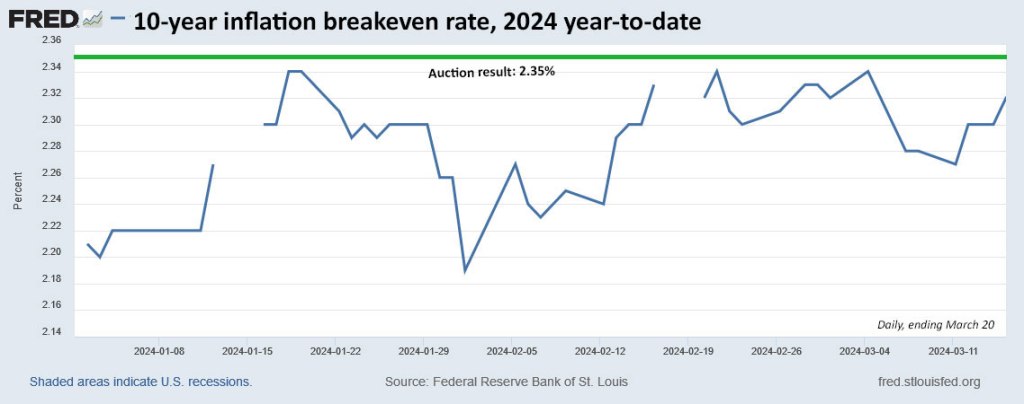

Here is the trend in the 10-year real yield through the year 2024:

Pricing

Because the auctioned real yield of 1.932% was higher than the coupon rate of 1.75%, investors at today’s auction got CUSIP 91282CJY8 at a discounted price. This TIPS will have an inflation index of 1.00234 on the settlement date of March 28.

Here is how the pricing worked for a purchase of $10,000 par at today’s auction:

- Par value: $10,000.

- Principal purchased: $10,000 x 1.00264 = $10,026.40

- Investment cost: $10,026.40 x 0.98380142 unadjusted price = $9,863.99

- + Accrued interest = $35.19

So, in summary, an investor buying $10,000 in par value at today’s auction will have paid $9,863.99 for $10,026.40 in principal on March 28. From then on, the principal will grow with future inflation and result in coupon payments of 1.75% a year.

Inflation breakeven rate

At the auction’s close at 1 p.m. EDT, the nominal 10-year Treasury note was yielding 4.28%, creating a 10-year inflation breakeven rate of 2.35% for this TIPS, in line with the originating auction’s 2.34%, but also creating a new high for the year. Here is the year-to-date trend:

This chart does appear to show that the Fed’s commentary on Wednesday caused inflation expectations to surge slightly higher.

Auction reaction

Although I wasn’t a buyer at this auction, I had been carefully tracking CUSIP 91282CJY8 on the secondary market this morning, where it was trading early on with a real yield of 1.88%. The auction result was 5 basis points higher, apparently caused by lukewarm demand.

For investors, a real yield of 2.0% or higher would have crossed a nice milestone, but this auction result looks quite acceptable for a long-term, inflation-protected investment. As I have have noted in the past, I bought this same TIPS at the originating auction (real yield of 1.81%) and then later on the secondary market (1.89%). Everyone who bought today has done better.

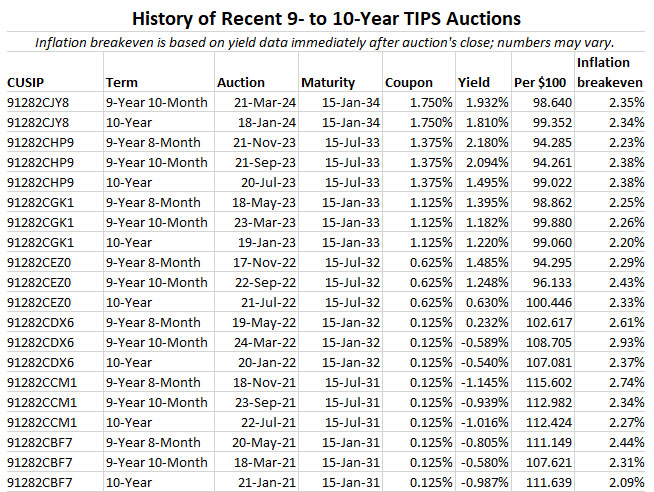

Here is a history of recent auctions of this term:

• Now is an ideal time to build a TIPS ladder

• Confused by TIPS? Read my Q&A on TIPS

• TIPS in depth: Understand the language

• TIPS on the secondary market: Things to consider

• Upcoming schedule of TIPS auctions

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing

Good Friday is the last day of March this year. Will that be a day I Bonds are issued, or will the last issue day be Thursday?

Great question and I don’t know the answer. I believe the U.S. stock market is closed on Good Friday, but it isn’t a federal holiday. If you are scheduling an I Bond purchase in TreasuryDirect, you should probably target Tuesday March 26 or Wednesday March 27.

This auction was a great reminder of how dynamic the market is and how mostly useless the Treasury Direct auctions are, especially for a reopening. Rather than take a gamble on what the auction closes at, you can lock in a guaranteed rate on the secondary market using one of many brokers. With coupons rising, it can make sense to go into the 10-year auction and risk that the actual yield could be +/- 0.05% of what it was a couple days ago. But for a 9-year 10-mo (or 9y 8m) reopening, I prefer the known yield of the secondary market over rolling the dice on how many bidders get into the auction.

I agree

Over time, I have grown to appreciate buying on the secondary market. People often complain about bid-ask spreads, or low-amount penalties, but those are generally costing you less than 10 basis points. Knowing the exact real yield you are purchasing is reassuring. Auction purchases work well for new issues (especially for the years 2035-2039 when no TIPS exist) and for very small investments. At TreasuryDirect, you can buy TIPS at auction with a minimum of just $100, and you are guaranteed to get the auction’s high yield.

On a different topic, but related to us income seekers, I came across this, as an example, 4 year GSE maturing 3/20/28 :

FEDERAL FARM CR BKS 5.62% 03/20/2028 Callable

3133EP5R2

This morning its YTM is 5.613% while it was 5.75% yesterday. Yes, it is from the secondary market and is callable after one year. I did not buy it because buying GSEs will be new for me and wanted to do some more due diligence. I have completed reading and learning about GSEs from usual places.

Buying GSEs, as you know, will be a taking one notch extra risk beyond US Treasuries. I am also aware of what GSEs went through during the 2008 financial crises. However, I see them providing extra yield if I am prepared to go beyond 2-3 years of maturity. So, with the above backdrop, any words of wisdom and experience will be most appreciated….thanks!!! chander

I purchased 3 callable FFCB bonds last year, so far one has been called. (The duration was 10 years.) I won’t be surprised if the other 2 are called, but in the meantime I’m enjoying the 6%+ yield. Right now I have some regret that I didn’t invest more.

Great move!

I just had CUSIP 3134GYYG1 called on 2-16-24 that had a coupon of 6% and maturity date of 8-16-27. It was a Fed Home Loan Mtg Corp bond that I purchased on Fidelity. I calculated that my earnings were about 5.34% annualized, and even though it was called early, it basically equaled current short-term interest rates that you’d get on T-Bills, so no skin off my back. I want to learn more about GSE’s & MBS and how to find the ones in that sweet spot that are least likely to be called, but I’m not sure what spread to Treasurys is optimal for those purchases. In my brief research though, I’ve learned that you should expect to earn about .25 points more than Treasurys in the long-run for holding Agencies and MBS bonds.

“But can I explain why that message sent real yields tumbling 10 basis points or more? No I can’t.”

I think it has to do with lemmings. :-)

Thanks for “tipping” me off to this bond, as I bought it earlier in the week on open market and received more than 2.0% real yield. You provide such a valuable service.

Brent

Chandler, AZ