Swimming the sea of financial metrics can often feel like drowning in alphabet soup. What is the difference between ROI and ROIC? Your expertise lies in innovation, customer engagement, and driving growth in your business; not memorizing financial jargon. Yet, understanding the financial underpinnings of your decisions is crucial for sustained success. What sets ROI and ROIC apart, and which one should you, as a small business owner, focus on? Let’s demystify these concepts together.

Return on Investment Definition (ROI)

ROI measures the bang for your buck. It helps small businesses by answering a simple question: for every dollar you invest in your business, how much profit do you get back? ROI should be estimated before and calculated after every major investment you make, including:

- Buying new equipment and machinery

- Hiring a new role

- Developing a new product or service

- Marketing through a new channel or to a new segment

Calculating ROI is straightforward: divide your net profit from an investment by its cost, then multiply by 100 to get a percentage. This figure helps you compare the efficiency of different investments, whether it’s a new marketing campaign, purchasing new equipment, or opening a new location.

As an example, a small business is considering hiring a new sales rep. The rep will require $150k in training and administrative support before they are able to generate a return of $250k/yr for an estimated 3-year tenure. Therefore, the ROI would be

[(3 years x $150k/yr return) / ($150k training + support) ] *100%

= [450 / 150 ]*100%

= 300%

Remember that ROI is just one metric to evaluate when committing time or money to an initiative. Whenever possible, the wise business owner only invests in projects that:

- Align with the company’s mission and strategy,

- Generate a financial return (ROI), and

- Avoid catastrophic risks.

A law firm investing in bitcoin may generate an ROI, but likely does not align with the company’s mission or strategy.

Return on Invested Capital Definition (ROIC)

ROIC takes a broader view. It evaluates how well a company on the whole uses all its available capital (both debt and equity) to generate profits.

The formula involves dividing your net operating profit after taxes (NOPAT) by the total invested capital. ROIC is especially favored by external investors and asset managers to assess a company’s efficiency in allocating its capital resources.

Small business accounting rarely analyzes ROIC. Instead, ROIC is most useful when comparing different companies in the same industry. This provides insight as to which businesses are more efficient at generating returns. Businesses that generate strong, steady ROIC often drive higher valuations than those with volatile or low ROIC.

Is Return on Invested Capital the same as Return on Investment?

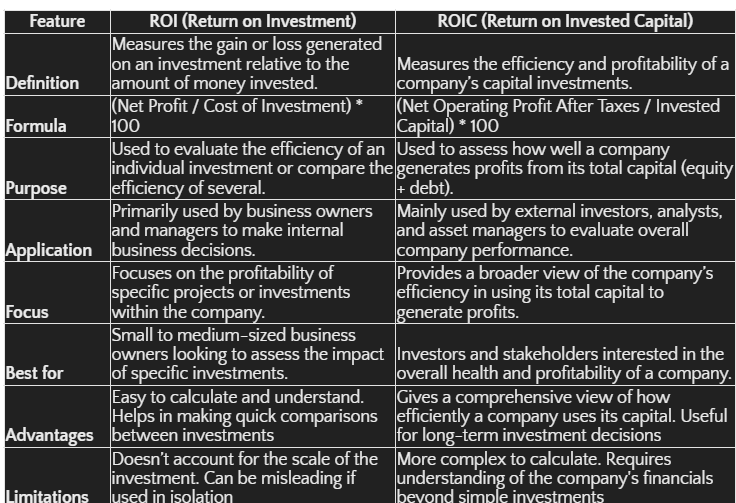

While both metrics offer insights into profitability and capital efficiency, their applications diverge significantly. ROI is best suited for internal analysis, helping managers quantify the return of projects, investments, or initiatives. ROIC provides a corporate macro view, often used by external stakeholders to gauge overall company performance.

ROI is More Relevant for Small Business Owners

For entrepreneurs, ROI is the go-to metric. It’s practical, directly actionable, and intimately tied to the day-to-day decisions that affect your business’s bottom line. ROI enables you to:

- Avoid wasting capital on poor investments

- Compare several different initiatives and prioritize the best one

- Measure success of specific projects versus expectations

- Plan cash flow more effectively.

Consider a local bakery investing in a digital marketing campaign. By calculating the ROI of this campaign, the owner can directly see the increase in customers and sales attributed to their online advertising efforts, making ROI a tangible measure of success. If the ROI is too low, the owner may end the campaign early and save precious cash.

ROIC, on the other hand, does not provide much small business help. It’s used primarily by asset managers to invest in companies, not projects.

Keep in mind neither metric should be used alone in isolation. You can asses your financial health by understanding the four key components of small business accounting.

The journey through financial metrics doesn’t have to be daunting. For small business help on ROI and ROIC, consider partnering with an outsourced finance professional. Remember, in the vast ocean of metrics, choosing the right one for your business context is key. For small business owners, ROI offers a practical, straightforward path to measuring and maximizing the value of your investments.

This article was written by a CFOshare employee with assistance from generative AI for rhetoric, grammar, and editing. The ideas presented are a combination of the author’s expertise, original ideas, and industry best practices.