I’ve calculated a lot of SaaS metrics for a lot of SaaS companies. To make SaaS metrics repeatable and accurate, we must follow a sequential process. This is especially relevant for sales and marketing efficiency metrics.

CAC, or customer acquisition cost, is by itself not a stand-alone metric. But it feeds all sales and marketing efficiency metrics in Pillar 5 of my SaaS Metrics Framework.

Get your CAC wrong and all of your efficiency metrics will be wrong. In this post, I’ll lay the foundation for a correct and repeatable calculation of CAC.

What is Customer Acquisition Cost (CAC)?

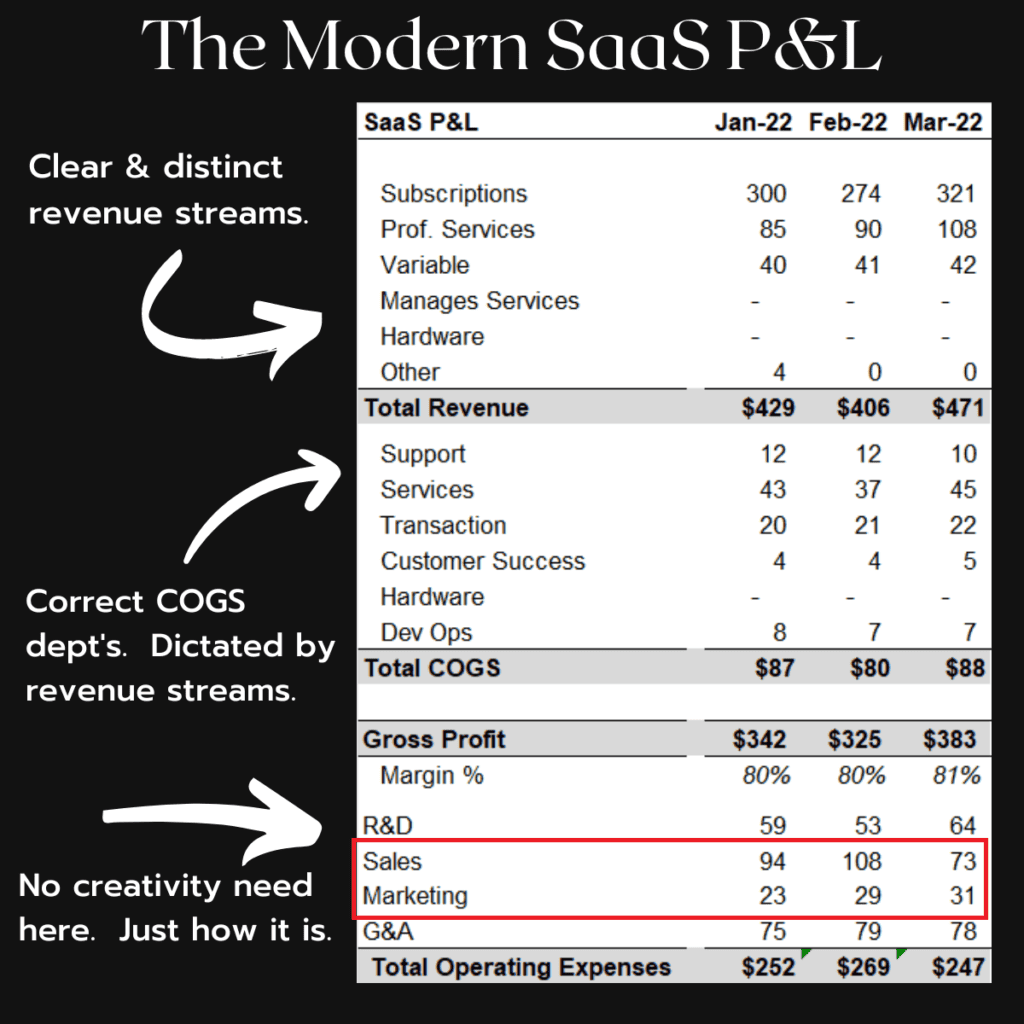

CAC is the upfront sales and marketing expense to acquire one new customer or user. CAC is commonly defined on a unit cost basis (i.e. cost to acquire one new customer). However, at its core, it’s the gross expenses from the Sales and Marketing departments sitting on our SaaS P&L.

These S&M expenses feed the unit cost CAC number that everyone talks about. We must source the sales and marketing expenses correctly, so that we can calculate accurate and meaningful S&M efficiency metrics.

CAC stops at the time of sale. Once you close the deal or sign up the new user, it’s now a COGS (cost of goods sold) function. Meaning, we need to deliver the revenue and fulfill the contract with our customer.

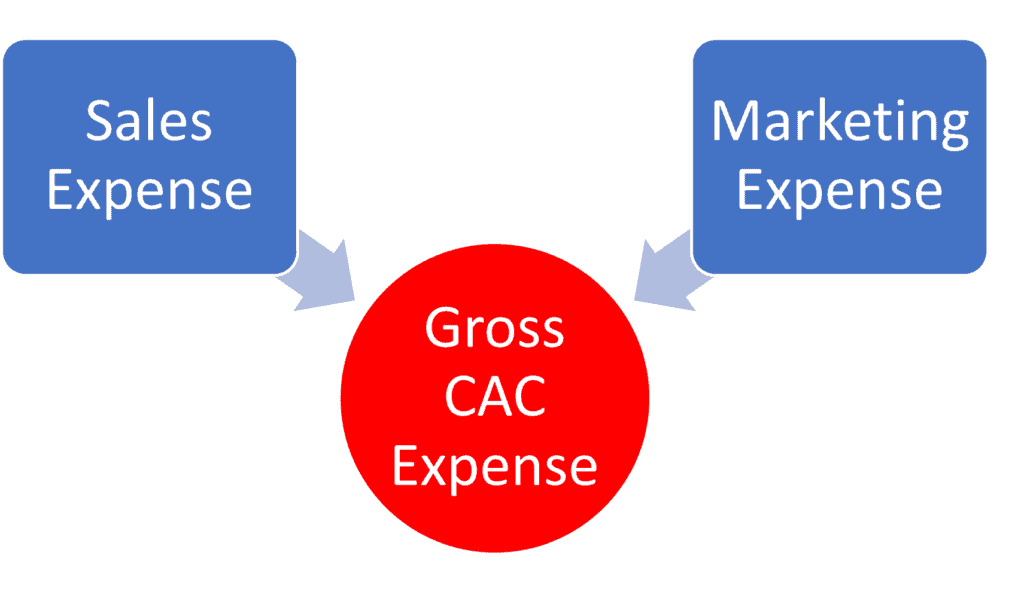

Gross CAC Expense

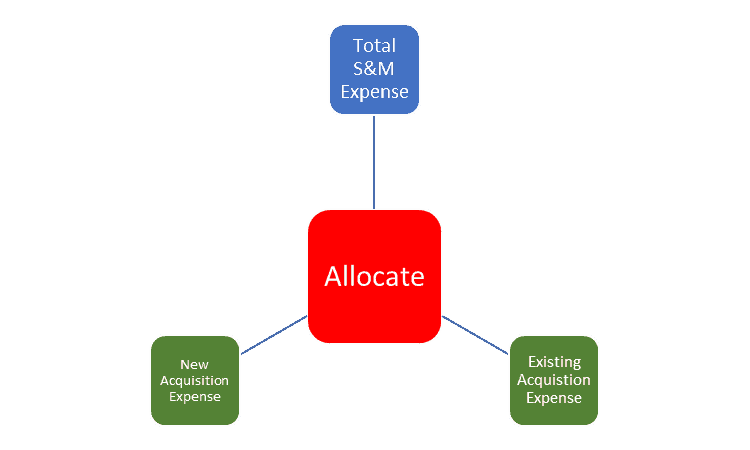

Our gross CAC expense equals our total sales and marketing expense sitting our SaaS P&L. Of course, we know CAC is often referred to as new customer acquisition.

The expense sitting in S&M is usually focused on acquiring new ARR and existing ARR. If we are early-stage SaaS and have one product line with no expansion potential, then 100% of S&M is focused on new customer acquisition. No allocation needed.

But as we scale and develop more products and features, we can cross-sell and/or upsell our existing customers. Part of your sales and marketing budget will be dedicated to expansion business. We then need to allocate S&M expenses.

Below, I’ll discuss the importance of allocating your S&M expense between new and existing business. This is a HUGE assumption that not many people talk about.

Common sales expenses:

- Wages, taxes, benefits

- Bonus, commissions (careful with capitalization)

- Travel, training, internal use software, consultants, contractors

Common marketing expenses:

- Wages, taxes, benefits, bonus

- Internal use software

- Contractors

- Travel, tradeshows, conferences, user groups, paid ads, SEO (a lot in the non-wage bucket)

Unit-based CAC

Unit-based CAC is the cost to acquire one new customer or user. We feed our CAC calculation with sales and marketing expenses and the number of new units acquired.

You can already see why process is so important with SaaS metrics. There is no unit-based CAC without gross sales and marketing expense. And we must allocate between new and existing to calculate CAC.

Unit-cost CAC is simply the portion of sales and marketing expense dedicated to acquiring new business divided by the number of new users or customers acquired. Of course, there are a lot of nuances that must be considered when calculating CAC.

Where Do We Source CAC Data?

CAC data is sourced from our SaaS P&L. A properly formatted SaaS P&L goes a long way in helping our metrics process.

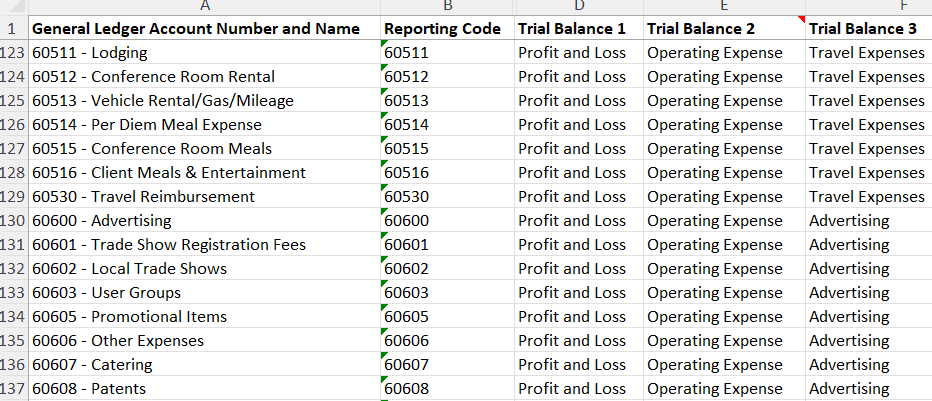

But we have to go deeper than our SaaS P&L. We must have S&M expenses coded to the proper general ledger (GL) accounts and to the sales and marketing departments.

Department coding of your expenses is critical to financial analysis and metrics. Really, the entire FP&A process. You don’t want sales commissions, for example, coded to G&A. Every single expense on our SaaS P&L must be coded to a department.

Once we have identified the correct department, we must code the expense to the correct GL account. For example, staff wages are coded to the Wages account. And contractors are coded to the contractors account and NOT lumped into Wages. The review of your COA and P&L set up is one of my top requested SaaS coaching calls.

The majority of sales expenses are wages, payroll taxes, benefits, commissions, travel, and internal use software. Departments must be fully-burdened. Meaning, all expenses attributable to a department get coded back to the department. Don’t hide expenses in G&A. We’ll catch that.

Where Do We Source New Customer Counts?

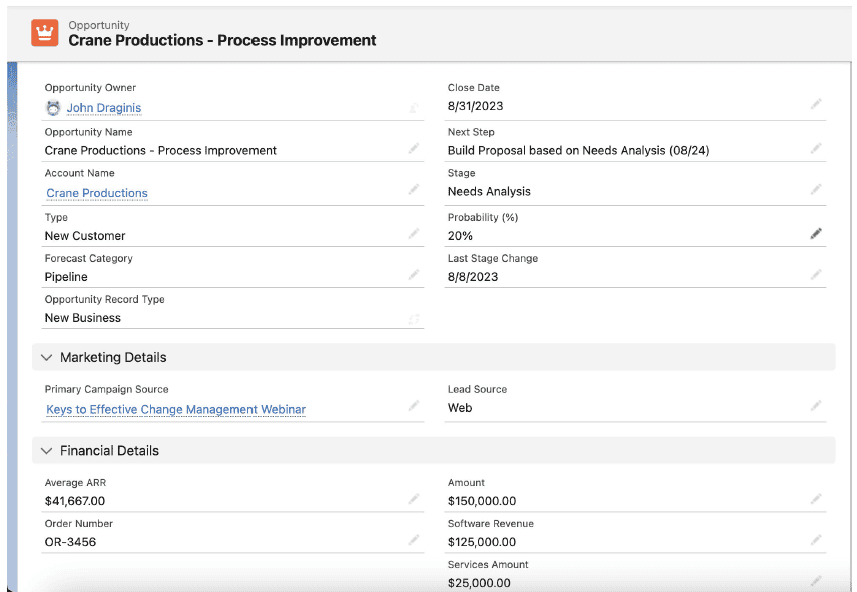

We source new customer or user counts from our CRM system or our MRR schedules. In our CRM, this will come from bookings data via Opportunity records.

Ben, wait! I don’t speak the bookings language or use a CRM. Then we’ll source your unit counts from your MRR schedule. This is very applicable to the low price point, high customer volume businesses. We’ll feed your MRR data into my retention schedule to track new customer or user wins.

It also depends on your sales motion and where you track the data. If you do use Opportunities in your CRM, the data tracked in Opps must be accurate and defined. It’s one of the biggest SaaS data mistakes that I see when helping SaaS companies.

Or we might source data from your CRM and retention schedules if you have SMB and enterprise customers or an SLG and PLG motion. Segmentation is important.

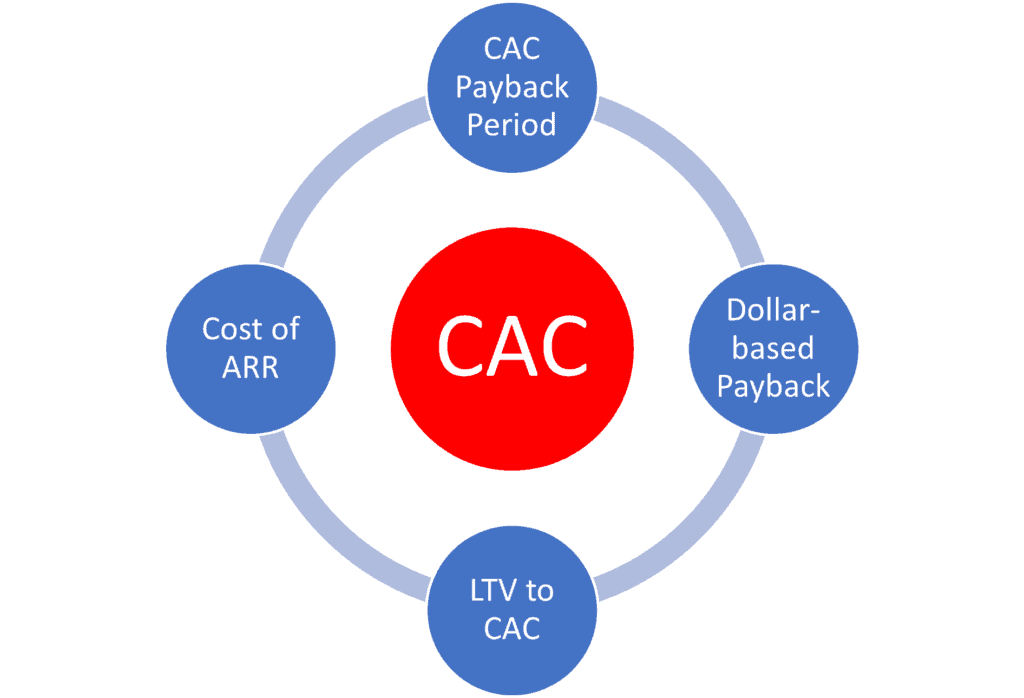

What SaaS Metrics Use CAC?

Okay, we’ve sourced our gross sales and marketing expenses and customer wins. This data feeds unit cost CAC which feeds a whole lot of important S&M efficiency metrics.

Once we have CAC (unit and gross) calculated, we are set up to calculate CAC Payback Period, Cost of ARR (blended, new, expansion), Dollar-based CAC Payback Period, and LTV to CAC. That’s why the foundation of CAC is so important.

New vs. Existing Expense Allocation

This is a big assumption. If we have a sales and marketing team that is focused on new and expansion business, we must allocate S&M expenses between the two. We’ll overburden CAC if allocate 100% of S&M to new CAC expense.

I like to allocate sales expense based on headcount. Take new business reps and existing business reps and calculate the split. Then apply this to the total sales expense each month. I update this allocation every month.

If our reps handle both new and existing business, we need another way to allocate the expenses. Don’t take the spilt in your Opportunity pipeline. That can lead to biased results. Take your lead flow and determine the split between new business leads and existing business leads. This is a better measure of sales “business” or activity.

Marketing is harder to allocate. This will require a conversation with your marketing head to see where their team spends their time and where the budget is focused.

Generally, I see 60-80% of sales and marketing expenses allocated to new business acquisition.

What’s Your Prize

Who are you really after? Users? Accounts? Brands? I like to use the Starbucks example.

Great! We landed Starbucks as a new account, but it’s the 38,000+ stores that we really landed. Should we feed 1 (Starbucks) or 38,000 stores into our unit CAC calculation?

The sales cycles and effort are much different if you land Starbucks versus your local coffee shop with three locations.

Coordinate with your Sales and Finance teams on how and where you are tracking new customer units. And what units. This also affects how I set up the revenue forecast. It’ll be more accurate at the store level vs one giant brand flowing through your revenue forecasting logic.

PLG and SLG Impact on CAC

It’s hard to keep track of all the different “X”LG motions today. You could have sales, product led, community led, and on and on.

New CAC stops at the time of sale. However, this is getting murky under today’s new pricing and GTM models. Expansion CAC costs are definitely an area of focus if you have different GTM methods.

If you have a PLG motion, you may expect “organic” expansion post new user onboarding. Should this be attributed to new CAC or expansion CAC? It’s important to understand the forces exerted on new and expansion acquisition. Who is taking credit for this on your team? This will help direct expenses into the correct efficiency formulas.

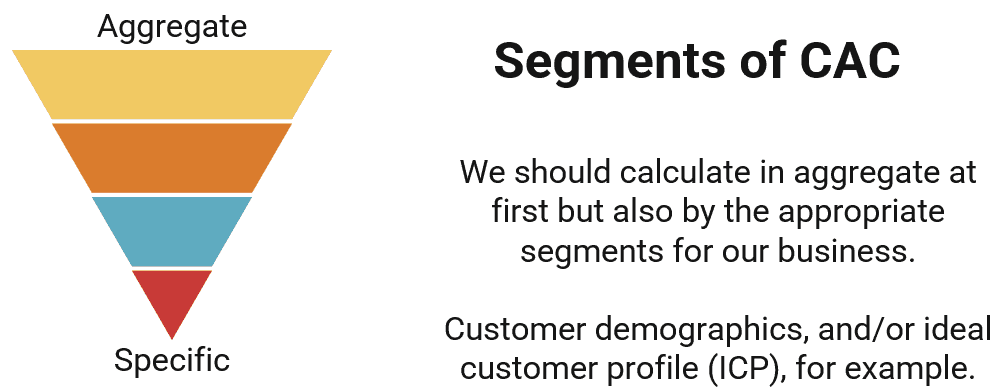

CAC Segmentation

Aggregate metrics can be dangerous to your SaaS health. If you sell a $100 price point product to SMB and a $100,000 price point product to enterprises, you should not calculate one unit cost CAC. It will be worthless.

You must segment your S&M expenses between SMB and enterprise. This is easier said than done. If you are big enough, you might have roles dedicated to SMB and enterprise. Perfect. Track these expenses distinctly in your chart of accounts so that you don’t have to allocate.

However, if your teams are not focused by ideal customer profile (ICP) or customer type or pricing plan, you’ll have to allocate expenses between SMB and enterprise in this example. This requires a solid chart of accounts, headcount coding, and department coding.

Takeaways

It’s easy to take for granted the metrics calculations in your SaaS business. Accurate CAC requires the following:

- Department coding

- “SaaSified” chart of accounts

- Accurate HRIS/payroll coding

- Fully-burdened cost centers

- Allocation methodology

You must follow a sequential process to get this right. If you have any fundraising or exit events on the horizon, I suggest you budget at least six months to get your metrics in place. There is nothing like due diligence to make your CFO sweat when hundreds of finance folks are pouring through your numbers.

You can get a huge kick in your SaaS metrics process with my SaaS Metrics Foundation course. Or check out the free resources on this blog or at my academy.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 8+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.