By David Enna, Tipswatch.com

Here we go: A good news inflation report as we head toward a new year.

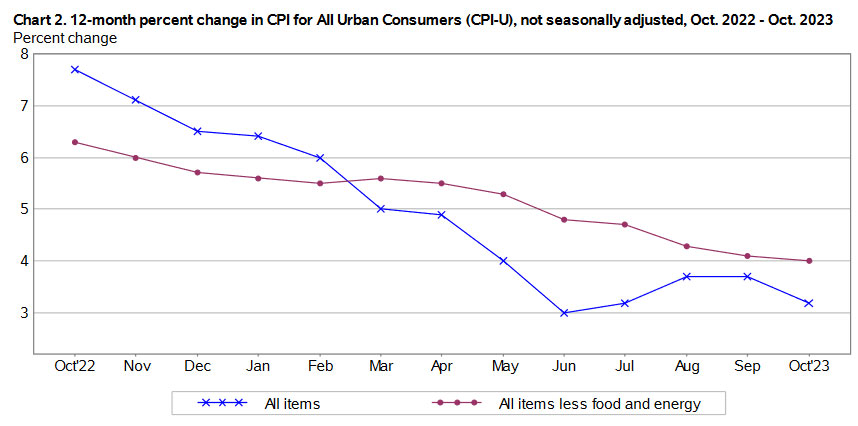

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in October on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. The rate of annual inflation dipped to 3.2%, down from September’s 3.7%.

Core inflation, which removes food and energy, is still running hotter: coming in at 0.2% for the month and 4.0% for the year. (That’s the lowest core number since September 2021.) In fact, all these inflation numbers came in lower than expected. We can expect both the Federal Reserve and the stock market to issue large sighs of relief.

Within an instant, Bloomberg posted this headline: “Cooling US Price Pressures Likely Take Fed Hike Off Table.”

Gasoline prices fell 5.0% for the month (which was expected — I paid $2.85 a gallon at Costco this week). But that decline was offset by rising shelter prices, up 0.3% for the month. More from the BLS report:

- Gasoline prices are now down 5.3% over the last year.

- Costs of shelter have increased 6.7% over that same time.

- The costs of food at home rose 0.3% in October, but are up only 2.1% over the last year.

- Food away from home prices rose 0.4% for the month, and 5.4% for the year. Why higher? Probably higher labor costs.

- The index for meats, poultry, fish, and eggs rose 0.7% in October.

- Prices for used cars and trucks fell 0.8% for the month and are down 7.1% for the year.

- New car costs also fell 0.1% and are up 1.9% for the year.

- Costs of motor vehicle insurance rose 1.9% for the month.

Here is the 12-month trend for all-items and core inflation, presenting a clear picture of gradually declining U.S. inflation:

What this means for TIPS and I Bonds

Investors in Treasury Inflation Protected Securities and U.S. Series I Savings Bonds are also interested in non-seasonally adjusted inflation, which is used to adjust principal balances on TIPS and set future interest rates for I Bonds. For October, the BLS set the inflation index at 307.671, a decrease of 0.04% compared with the September number.

For TIPS. The October inflation report means that principal balances for all TIPS will decline by 0.04% in December, after rising 0.25% in November. Here are the new December Inflation Indexes for all TIPS.

Essentially, TIPS balances will be flat in the month of December. For example, for CUSIP 912828B25, which will mature Jan. 15, 2024, the inflation index will begin December at 1.31911 and end the month at 1.31862.

For I Bonds. The October report is the first of a 6-month string that will determine the I Bond’s new variable interest rate, to be reset on May 1. So we start off with a factor of -0.04%.

It would not be surprising to see additional deflationary numbers for November and/or December, as is often the case because of the lack of seasonal adjustments. Last October, non-seasonal inflation rose 0.41% in October and then fell 0.10% in November and -0.31% in December.

Here are the numbers for the current cycle:

What this means for future interest rates

After September’s upside inflation surprise, the Federal Reserve needed some positive inflation news, and it got it with this report. Falling gasoline prices and moderating food prices kept inflation relatively under control.

Euphoria, anyone? Stock market futures (at 9:20 am ET) are predicting the potential of an early 1% gain. The 10-year Treasury note is trading at 4.46%, down about 17 basis points from yesterday’s close. The 10-year TIPS is trading at 2.17%, down about 15 basis points from yesterday.

From today’s Wall Street Journal coverage:

The fresh figures help reassure investors that the Fed is likely done raising interest rates. … “The sources of inflation are disappearing quickly,” said Luke Tilley, Wilmington Trust’s chief economist. “A whole bunch of categories are moving in the direction that we need them to.”

Michael Ashton, my inflation guru friend, posted this commentary:

The CPI was a happy surprise today, but not so much that I would throw a party. … We’re still just starting the difficult part, from the standpoint of monetary policy but also from the standpoint of figuring out how quickly inflation can get tamped back down to target. …

What I can say is that the market reaction to all of this is absurd. This just doesn’t move the needle on the Fed. There was no tightening and no easing in the pipeline before this number, and after this number that hasn’t changed an iota.

I have been thinking that the Federal Reserve knows it has reached its peak short-term rate, now set in the range of 5.25% to 5.50%. This has been aided by a recent rise in longer-term yields, which appears to be reversing a bit this morning. Fed officials will probably continue with “cautious” statements, but this cycle of rate hikes appears to be over.

Will rate cuts begin in 2024? That’s a complete mystery.

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear. Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

Does anyone know how home and auto insurance inflation is weighed into the monthly CPI? We all have policies due at different months, how is it accounted for in the CPI? Our home insurance went up 16% last year and 18% this year (been in same house for 10 years so acute adjustments); can consumer’s afford the insurance inflation?

Home insurance is weighted at about 1/3rd of one percent and was up 2.9% in October. Auto insurance is weighted at 2.7% and was up 1.9% in October and 1.3% in September. The BLS says auto insurance costs are up 19.2% over the last year. But I do not know how these are measured. (My home insurance also increased drastically this year.)

BLS determines the weight of home and auto insurance based on the Consumer Expenditure Survey and the cost of both insurances by collecting the premium amounts each month.

Does anyone know how home and auto insurance inflation is weighed into the monthly CPI? We all have policies due at different months, how is it accounted for in the CPI? Our home insurance went up 16% last year and 18% this year (been in same house for 10 years so acute adjustments); can consumer’s afford the insurance inflation?

It’s a few weeks off, but does anyone care to comment on expectations for the January new issue 10 year TIPS? How will that likely compare to the November 10 year TIPS re-open auction? And finally, will there really be any significant advantage to buying at auction in January?

Real yields have been volatile for several months, so there’s no way to say. I am holding out for that January auction because I want to add a 2034 rung to my TIPS ladder. It also will have a higher coupon rate and sell closer to par value. But the rule of 2023 has been: “When you see a really attractive yield, buy on the secondary market.”

I’d say the biggest “Savior” for inflation going flat/down has got to be gas prices. If it had stayed the same or only dropped a couple of points, then we’d be looking at an increase. A 5% plus drop is pretty big and affects all items. Rarely did I see gas under $3/gal over the year, but I’ve seen it $2.75-$2.85 as the new norm.

Keep in mind that gas prices rose 2.1% in September after rising 10.6% in August (seasonally adjusted). So we reversed some of that in October and we are likely to see more declines through the end of the year. Gasoline prices are volatile, so no assurances the trend will continue for long.

Do you have any comment on the 10 yr TIPS auction happening 11/16?

That auction is actually going to be Tuesday, Nov. 21. The announcement will be tomorrow. I will be posting a preview of the auction on Sunday morning.

Can you comment on the -34% for Healthcare in the CPI report which was a large enough decrease to affect the inflation number by itself? I think they forgot the decimal point. Thanks.

It looks like that decline was in health insurance costs, which have a relative importance of 1/2 of 1% of overall CPI. https://www.bls.gov/news.release/cpi.t02.htm What was happening? The BLS said this:

Changes to Health Insurance Methodology

Following recommendations from the National Academies of Science, Engineering, and Medicine’s Committee on National Statistics (CNSTAT), the BLS is improving the methodology used to calculate retained earnings in the CPI health insurance index. Under the pre-October 2023 method, retained earnings were updated annually without any smoothing of the data. Under the new method, the BLS will update retained earnings every 6 months using half-year data and will calculate a 2-year moving average to smooth the changes in retained earnings. Beginning with the publication of October 2023 data, there will be a 6-month transition using annual data that has been averaged (smoothed) over 2 years. In May 2024 (publication of April 2024 data), we will begin to incorporate half-year, rather than annual, retained earnings. After this date, the retained earnings will be updated every 6 months with April and October data which will be released in May and November, respectively. This change in methodology will reduce the time lag associated with the health insurance index by 6 months.

A more detailed explanation of these changes is available in Improvements to the CPI Health Insurance Index (www.bls.gov/cpi/additional-resources/improvements-cpi-health-insurance-index.htm)

Phew. Glad I bought my TIPS ladder a few weeks ago. Real rates have come down noticeably since then. Thanks for the great blog, it has been very helpful!

Thank you for posting the December Inflation Indexes. It simplifies the tax planning for the TIPS OID in my taxable account.

It’s obviously very early in the next I Bond cycle with only 1/6 of the data, but it’s never too early to speculate. 😏

If we are indeed entering a month to month deflationary period as year to year inflation tracks down below 3% in the coming months, the next decision to buy I Bonds in April will be a slam dunk for both short-term and long-term investors.

It will be an emphatic no for short-termers on buying and an emphatic yes on selling three months after the I Bond inflation rate drops. It will also be an emphatic yes for long-termers on buying to lock in a high point of the I Bomd fixed rate.

April is gearing up to be a very interesting dichotomy for I Bond investors.

I agree. But inflation is so unpredictable. I do think we will see nothing more than flat non-seasonal for November and December, but then what? Last year inflation surged in January (0.80%) and February (0.56%).

Do you really think this is the high for the fixed rate? It seems that it “lagged” on the way up so might “lag” on the way down and maybe even tick up to 1.5%??

It will be the high if real yields keep heading lower. If that trend turns around, then there’s a chance of a higher fixed rate.

for some odd reason, probably because the Fed purposefully obfuscates it at their press meetings, people continue to get the definition of inflation wrong.

inflation/deflation is simply the increase/decrease of the supply of currency and credit. it is not the CPI or any other price measurement. prices do, however, increase/decrease as a result of the supply of currency released into the economy (volatility).

in my opinion, the Fed continues to confuse everyone about this because if the real definition was disclosed then the people would come to understand that the real source of inflation is congressional legislation (spending) and the subsequent currency creation by the Fed to pay for it.

inflation is a creation of the government and the Fed and they alone can control it. they just don’t want you to know about it or the game would be up.

Of course, my articles are dealing with CPI-U, an index that tracks the effects of Congressional and Fed policy on the prices we pay. It is definitely a real thing.