In the day-to-day hustle of running a business, bookkeeping often lands in the “necessary but not thrilling” category for most CEOs and business owners. While not the most glamorous aspect of business financial management, accurate bookkeeping is crucial for maintaining financial health and compliance. However, the real challenge isn’t just about keeping the books in order; it’s about choosing a reliable and efficient team that isn’t a distracting headache for you.

Should you hire a bookkeeper or contract professional bookkeeping services? The right choice will help you focus on important tasks and boost the bottom line.

This article is a practical guide to the trade-offs between outsourced and in-house bookkeeping to help you determine which option best fits your business needs.

What Is The Meaning Of In-house Bookkeeping?

A business that has W2 bookkeeper employees is said to have in-house bookkeeping. The opposite – when a business contracts an agency or independent contractor to keep the books – is called outsourced bookkeeping.

Small business bookkeeping, HR, and IT are commonly outsourced functions due to their technical nature and less-than-full-time requirements. Outsourcing helps avoid the hidden costs of in-house bookkeeping.

The Pros of In-House Bookkeeping

In-house bookkeeping brings a couple significant advantages.

Control

In-house bookkeepers have one major advantage: direct control. Having bookkeepers as part of your staff allows for greater oversight and influence over their work. This arrangement can lead to more tailored financial management practices, closely aligned with the company’s specific needs and culture.

The benefit of direct control cannot be overstated. Independent contractors often work for several firms competing for their attention. Agencies maintain their own policies and procedures which may restrict how you can use their staff.

Cost Benefits for Larger Teams

For businesses with large accounting teams (more than 3 FTE), in-house bookkeepers can be more cost-effective. Outsourced agencies markup wages 20–100% to cover supervision, administration, and overhead. By the time your accounting team needs 3 FTE, that markup represents a major expense which could be saved by bringing the work in-house.

The Pros of Outsourced Bookkeeping

Simplicity

Small businesses who outsource bookkeeping do not need to develop complex accounting procedures, supervise staff meticulously, develop fraud prevention and detection methods, recruit, hire, and train new employees. Outsource bookkeeping agencies have out-of-the-box solutions ready to deploy best practices.

Fast Onboarding.

Outsourcing bookkeeping functions can significantly reduce the time and effort involved in recruiting and hiring qualified staff. Agencies specializing in bookkeeping services offer the advantage of quickly integrating experienced bookkeepers into your operations, ensuring a seamless transition and immediate productivity.

Professionalism

Bookkeepers provided by reputable agencies are not only skilled but also benefit from ongoing oversight and professional development within their firms. This layer of supervision ensures that the bookkeeping practices adhered to are up-to-date and of high quality.

Assurance of Best Practices

Reputable outsourcing firms specialize in bookkeeping and are thus at the forefront of implementing industry best practices such as OCR and AI automation. This expertise ensures that your financial operations are handled with the utmost professionalism and efficiency.

Reduced Turnover Risk

The responsibility of managing bookkeeping staff, including the risks associated with turnover, shifts to the outsourcing agency. This arrangement can provide a more stable and reliable bookkeeping function.

Cost Efficiency

Professional bookkeeping agencies are often less expensive due to their efficient use of technology and adherence to best practices. Inefficient bookkeepers often have to re-do work to fix mistakes, opaquely inflating their accounting expenses.

In addition, many outsourcing agencies employ competitive near-shore labor markets, making service quality higher and costs lower.

Deciding What’s Best for Your Business

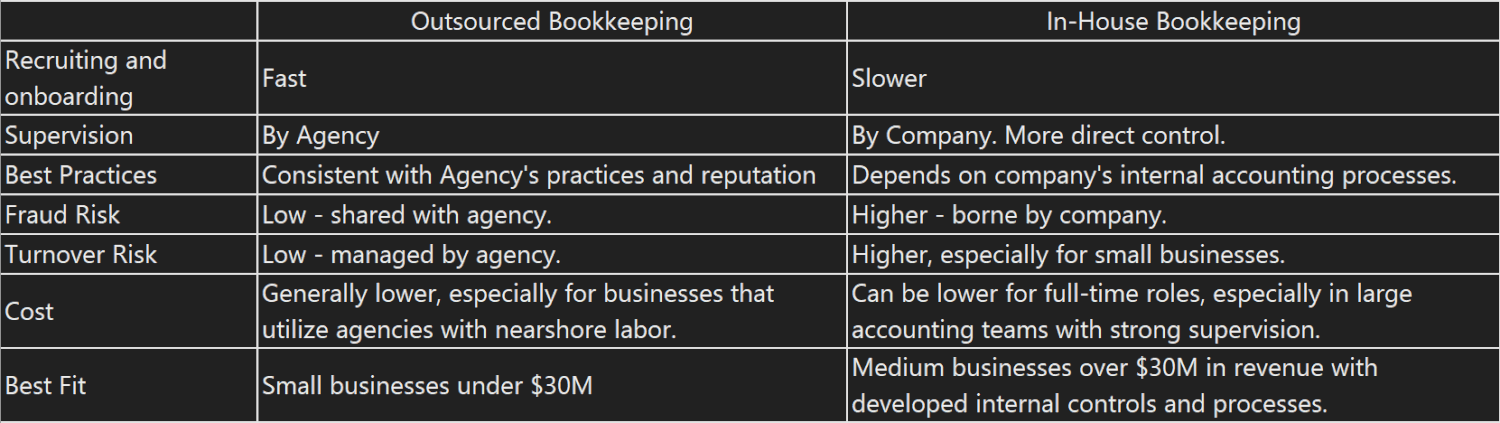

The decision between outsourced bookkeeping and in-house bookkeeping largely depends on the business’s size, complexity, and existing internal structures.

Small businesses or those requiring only one or two bookkeepers may find greater value in outsourcing, benefiting from the reduced overhead, expertise, and flexibility it offers. This option is particularly appealing for businesses lacking in-depth process structures or dedicated supervision for bookkeeping tasks.

Conversely, larger businesses (e.g. revenues exceeding $30 million) often have developed internal controls and processes. These organizations may benefit more from building a team of in-house bookkeepers supervised by an accounting manager. This structure ensures direct control over bookkeeping tasks and can be more cost-effective due to its scale and existing internal support.

In navigating the choice between in-house and outsourced bookkeeping, businesses must weigh their operational needs, financial strategies, and the scale of their operations. If you are interested in learning more about how outsourcing may fit with your business, contact us now for a free consultation.

This article was written by a CFOshare employee with assistance from generative AI for rhetoric, grammar, and editing. The ideas presented are a combination of the author’s expertise, original ideas, and industry best practices.