My Two-for-Tuesday morning train reads:

• In the Stock Market, Don’t Buy and Sell. Just Hold. There’s new evidence that market timing doesn’t work. Your odds of success are better if you just hang on and aim for average returns, our columnist says. (New York Times) see also The “Art” of Market Timing: Market timing is extremely difficult, very few people (if any) do it consistently well. This is before we get to the issue of capital gains tax’ hurdle of 20% on those pesky profits. (The Big Picture)

• Most Americans are better off financially now than before the pandemic: Jobs, paychecks, spending, wealth, and financial security have made big gains, which offset the burden of higher inflation. That’s true for most families. The good news stretches far beyond the rich. (Stay at Home Macro)

• The Great Disconnect: Why Voters Feel One Way About the Economy but Act Differently: Americans are angry and anxious, and not just about prices, which may be driving economic sentiment more than their financial situations, economists said. (New York Times) see also Wages are rising. Jobs are plentiful. Nobody’s happy. It’s a good time to be a worker and a bad time to be a consumer — the problem is most people are both. (Vox)

• Investors Are Hungry for Risk—and Holding Record Cash Sums: Some analysts see the investor balances in money-market funds as a bullish sign for stocks and bonds. (Wall Street Journal)

• The Future of the Office Is Cozy: In the latest high-end office design trend, employers are trying to lure people back to work by giving them the comforts of home — and a room of their own. (CityLab) see also The Envy Office: Can Instagrammable Design Lure Young Workers Back? If your feed makes the corporate life look stylish, it’s just another evolution in the long history of the American workplace. (New York Times)

• The Biggest Delivery Business in the U.S. Is No Longer UPS or FedEx: Amazon is eclipsing both carriers, and the gap is growing. (Wall Street Journal)

• How Elon Musk, for Many, Went Too Far: A misleading tweet, a vexed billionaire and a new firestorm over antisemitism. (Wall Street Journal) see also Elon Musk Can’t Help Himself: He wants to own a social network where he can spout antisemitism—even if that means owning a bad business. (Slate)

• The majority of US gun deaths are suicides. Here’s how to prevent them: Lois Beckett Experts like Paul Nestadt of Johns Hopkins University say stigma and misinformation get in the way – but don’t have to. (The Guardian)

• Are Americans Falling Out of Love With EVs? Manufacturers need to cut costs as electric-vehicle inventories pile up, but this is easier said than done. (Wall Street Journal) see also EV or Hybrid? What the Next Decade Holds: The transition from ICE to EV won’t be complete until charging infrastructure and range issues improve. (The Big Picture)

• Secret History of Alan Alda’s M*A*S*H Dog Tags: At auction, it was revealed they were from WWII vets: a Black man from the South and a Jew from Brooklyn. I found their families. (The Ankler)

Be sure to check out our Masters in Business interview this weekend with Peter Atwater, who teaches confidence-driven decision-making as an adjunct professor at William & Mary and the University of Delaware. He coined the phrase “K-Shaped Recovery” to describe the confidence divide between the top and bottom of the economy post-pandemic. His new book is The Confidence Map: Charting a Path from Chaos to Clarity.

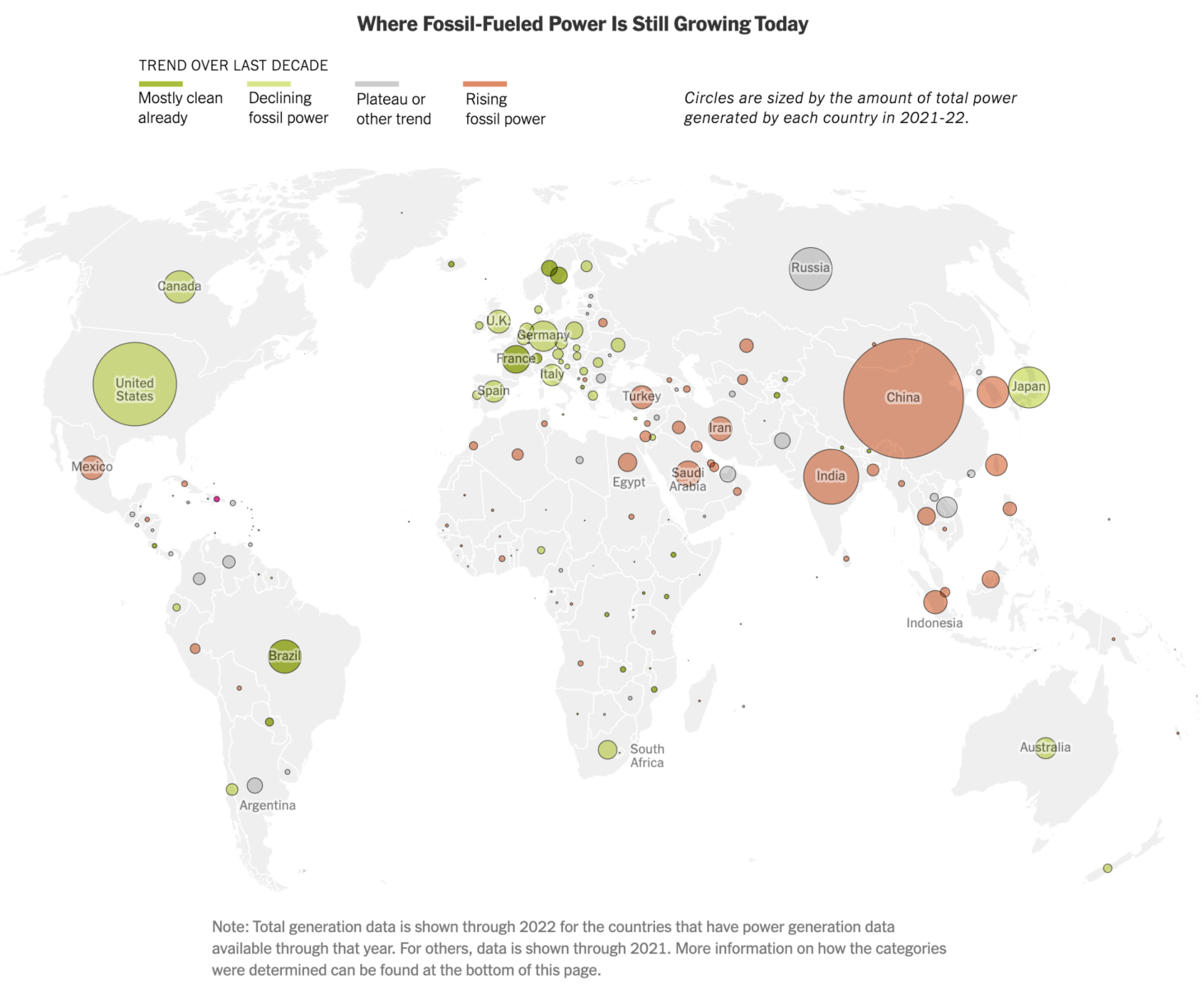

How Electricity Is Changing Around the World

Source: New York Times