Revenue recognition for nonprofits may seem fairly straightforward, but has unique complexities with important compliance consequences.

Nonprofits rely on a mix of sources for their income, from fundraising, grants, and investments to earned income and individual contributions. All these sources must be carefully managed to ensure compliance with Generally Accepted Accounting Principles (GAAP) and guidelines.

Understanding how and when to recognize different revenue is perhaps one of the most important but difficult aspects of managing a nonprofit’s finances.

Revenue recognition is an accounting process of properly identifying when income has been earned. This accounting principle outlines specific criteria that must be met before revenue can be recorded in financial statements. Failing to recognize revenue properly may lead to inaccurate financial reporting, which could result in penalties, restrictions, and audits.

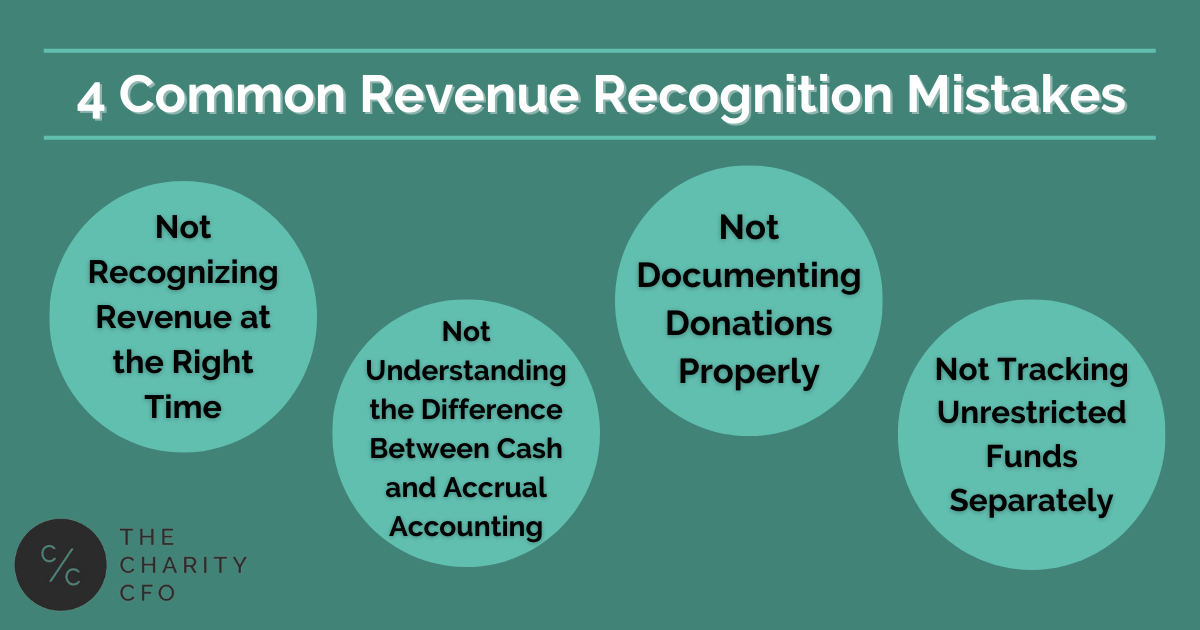

Here are four common mistakes to avoid with revenue recognition for nonprofits:

4 Revenue Recognition for Nonprofits Mistakes

Not Recognizing Revenue at the Right Time

When it comes to nonprofit revenue recognition, timing is everything. It’s important to recognize revenue when it’s earned and not before or after. If you recognize revenue too early, you could be in violation of Generally Accepted Accounting Principles (GAAP).

Your organization’s accounting method really impacts the timing of recognizing transactions. For example, if your organization uses the accrual method of accounting, you must recognize revenue when it is earned, and the obligation has been fulfilled.

When using the cash basis method, revenue is only recognized when cash or its equivalent is received.

This means that if you receive a pledge from an individual or organization but haven’t received the money yet, you won’t be able to recognize revenue until the cash is received. This makes it easy to handle multi-year pledges, where you can recognize the revenue for each year as cash is collected.

Not Understanding the Difference Between Cash and Accrual Accounting

Cash accounting is a method of recording income and expenses when they are actually received or paid out, while accrual accounting records income and expenses when they are earned or incurred. Nonprofits must understand the difference between these two methods in order to record their revenue properly.

When using the cash method of accounting, financial information is presented solely based on the cash received. As a result, it is important to accurately track all sources of income and not assume that just because an individual or organization has promised to donate, the money has been received.

This is a more straightforward option since it only follows money actually going in and out of your accounts. It is mostly recommended for small organizations with simple transactions that don’t require a detailed understanding of revenue recognition.

The cash method of accounting is generally preferred for:

- Small nonprofits with under $100,000 in revenue

- Nonprofits that do not have set programs

- Nonprofits that do not have paid staff

- Nonprofits that don’t have accounting professionals

Conversely, the accrual accounting method records transactions when they are incurred, not just when cash is received. This method allows you to recognize revenue that has been pledged or earned but not yet collected. You also recognize expenses when they’re incurred, not just when the money is paid. This method of accounting provides a more complete picture of your finances and is required by most states for organizations over certain income thresholds.

Accrual accounting allows you to match your expenses to the revenue they generate, so you can make more informed decisions and better projections. This explains why it is the most recommended option required by Generally Accepted Accounting Principles (GAAP) for nonprofits.

This method is an excellent option for nonprofits that:

- Have significant amounts of funding and funding sources

- Receive grants

- Employ paid staff

- Undergo annual financial audits

- Want to ensure accuracy and full transparency

Not Documenting Donations Properly

Donations are a major source of revenue for nonprofits. This is why it’s important to understand how to properly record each donation to remain in compliance with GAAP. You must include the donor’s name, date of the donation, donation amounts, and any restrictions on how the money can be used.

In particular, restrictions by a donor can affect the timing of your revenue recognition. For example, if a donor restricts their donation to be used for a specific purpose and the money has not been spent yet, the revenue cannot yet be recognized.

It is important to document these restrictions and create a plan for how the money will be used in order to properly recognize the revenue. You should also keep records of all donor acknowledgments and correspondence as required by the IRS for tax purposes.

Ideally, have a dedicated person or team to manage donation tracking, acknowledgments, and compliance. This will help ensure that your revenue recognition is accurate and you remain compliant with the IRS. A donation management system can make this process a lot easier and can help you keep track of donations more efficiently.

Not Tracking Unrestricted Funds Separately

Unrestricted funds are those that can be used for any purpose by the nonprofit organization, while restricted funds must be used for specific purposes as designated by the donor.

Unrestricted funds can be used for overhead costs like expanding staff, training and professional development, equipment, emergency expenses, technology acquisition, etc.

It’s important to track unrestricted funds separately from restricted funds so that you don’t accidentally use them for something other than what was intended by the donor.

But how do you track these funds? The best way is to use an accounting system that segregates your accounts and allows you to easily categorize donations as either unrestricted or restricted. This will help you keep track of donations and ensure that revenue is allocated correctly.

Trust The Charity CFO Revenue Recognition for Nonprofits

Revenue recognition can be tricky, which is why it’s important to have an experienced finance professional handle the accounting for your nonprofit.

The Charity CFO offers a team of experienced CFOs and accountants who specialize in helping nonprofits manage their finances. Our experts have extensive knowledge of GAAP and can help you ensure that your revenue recognition is accurate and compliant.

We understand the complexities of revenue recognition for nonprofits and can help you manage your finances more efficiently. Contact us today to learn how our services can help your nonprofit organization.

Do You Struggle to Make Sense of Your Financial Statements?

Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization's finances.

Get the free guide!

0 Comments