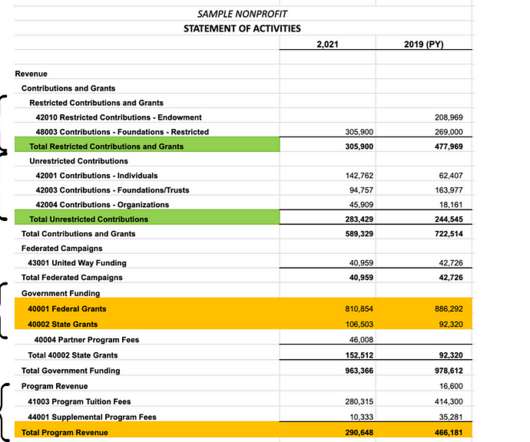

Statement of Activities: Reading a Nonprofit Income Statement

The Charity CFO

JANUARY 31, 2022

You may also know it as a profit and loss statement or income and expense report. In the for-profit world, they call the difference between revenues and expenses net income. Or profit. . But, since auditable nonprofit financial statements, we’ll talk about accrual accounting practices in this article.

Let's personalize your content