Functional expense reporting confuses many first-time nonprofit bookkeepers and executives. But it’s not because it’s complicated.

It’s a straightforward concept. But, because most for-profit companies don’t track functional expenses, they’re just not familiar with it.

But it is need-to-know-information in the nonprofit world. Because you’re required to report functional expenses to complete your IRS 990 and maintain nonprofit status.

In this article, we’ll break it all down to show you what functional expenses are, why they matter, and how to track them in your organization.

What are Functional Expenses?

Functional expense reporting is the process of tracking the money you spend according to what the money was used for– like fundraising, administration, or programs.

“Functional expenses” aren’t a specific type of expense. Rather, it’s a way of looking at how you spent your money, according to the function that money accomplished.

For example, “salary” is a straightforward line-item on a for-profit financial report.

But a nonprofit must track what “function” that salary was used to support. But what is a function, anyway?

There are 3 core functional expense categories:.

To complete your IRS 990, you’ll need to report your expenses based on how they fall within 3 categories, they are:

- Program Services – This includes any costs associated with executing programs and services to fulfill your officially declared mission. This may include materials, advertising, salary of program administrators, a portion of your rent, and more.

- Management and General Administration – This category includes most of what you’d call “overhead costs.” Here you’ll put operational expenses that aren’t involved in executing your mission or fundraising. For example, office rent, executive salaries, utilities, and office supplies will probably fit into this category.

- Fundraising – Here, you’ll put costs directly tied to raising money. That may include special event costs, advertising, staff salaries, and more.

These 3 expense categories are mandatory for the IRS, but you may choose to track others internally.

Many of your expenses (like salary, rent, and utilities) contribute directly to the execution of multiple functions. So for those categories, you’ll need to allocate your expenses according to how much they contribute to each function, which we’ll discuss a little further down the page.

Functional expenses versus natural expenses

We’re here to talk about functional expenses, but the Statement of Functional Expenses actually shows 2 types of expenses– functional and natural. So, what’s the difference?.

First of all, to be clear, your organization only has ONE set of expenses.

Functional and natural expenses are the same expenses; they’re just 2 different ways of looking at how you spent your money:

- Functional expenses: Categorizes your business expenses by the “function” those funds were used for, like programming, administration, or fundraising.

- Natural expenses: Categorizes your business expenses based on the “nature” of those expenses– like salary, rent, utilities, maintenance, supplies, and so on.

Many people are comfortable with natural expenses because most for-profit businesses classify their expenses ONLY by nature.

But non-profits need to classify their expenses according to both nature and function.

A simple example of functional expense allocation:

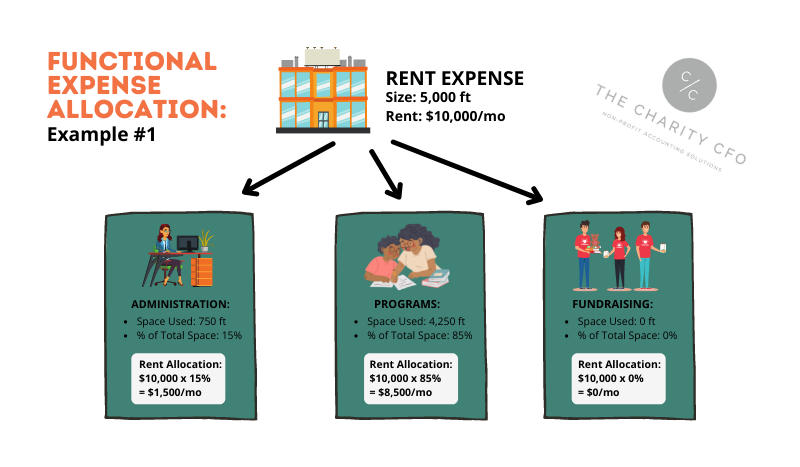

Let’s say you rent a 20,000 square foot building for your nonprofit, which runs after-school programs in a disadvantaged neighborhood.

Approximately 3,000 square feet of space is used for administration. And the balance (17,000 sqft) is used as classroom space to execute your programs. of rent to the administration function.

15% of your space (3,000/20,000) is used for admin, so you’d allocate 15% of your rent to general administration expenses. And the other 85% of your rent would be allocated to program expenses, as in the example above.

Why do you need to track functional expenses?

So why do nonprofits track functional expenses? There are 3 simple reasons:

- It’s the law. You need to include a functional expense report with your IRS 990. And if you don’t file a 990 for 3 consecutive years then you automatically lose your tax-exempt status. So you really don’t have a choice, but if you want more reasons…

- To pass an independent audit. Reporting functional expenses has been required by Generally Accepted Accounting Principles (GAAP) since 2017, as detailed in ASU 2016-14. That means you’ll need to present a Functional Expense Report to pass an audit.

- To build public trust. Funders, donors, charity watchdog organizations, and others want to see how you’re spending your money. Being clear, consistent, and accountable in your reporting of expenses is a big step toward earning their trust.

How should you allocate functional expenses?

The Financial Accounting Standards Board (FASB) established specific requirements for how nonprofits identify and disclose the types of expenses allocated and the methodology used in ASU 2016-14.

The most important thing is establishing a clear process and methodology for allocating your expenses. And then track everything and apply your process consistently.

Allocating expenses is dividing overhead costs between all of the functions that are indirectly related to that cost. The square footage allocation example we used above is one common example of functional expense allocation.

Because nonprofit team members often wear many hats, personnel costs are another expense that nonprofits need to allocate across multiple functions…

Another example of functional expense allocation:

Suppose you have a full-time employee that spends 2 days per week working in the office and 3 days per week running after-school classes.

In that case, you should allocate 40% of their salary (⅖) to admin expenses. And the remaining 60% would go to program expenses.

Tracking and allocating functional expenses is a major bookkeeping challenge for small nonprofits. However, nonprofit-friendly accounting software can help you make creating your Statement of Functional Expenses fairly easy.

Or you can hire a nonprofit-specialized bookkeeping service and let them do the hard work for you!

What is included in a Statement of Functional Expenses?

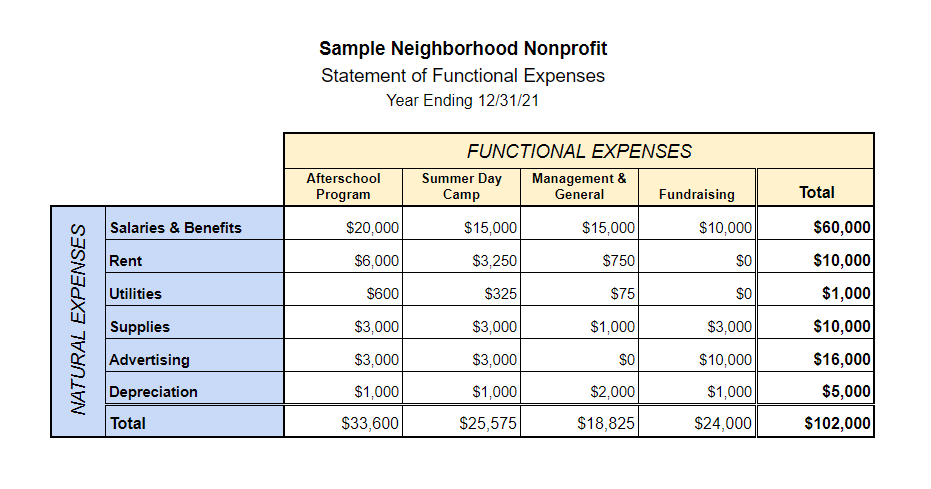

A Statement of Functional Expenses is a matrix-style report that shows the breakdown of functional and natural expenses in an easy-to-read table.

It is a very common report in the financial world and you may want to add it to your in-house reporting schedule. Your auditor will expect to see an explanation of your functional expenses (although the required format may vary).

Here’s an example of a functional expense report for the fictional after-school organization we created above:

Create your own with our Statement of Functional Expenses Template

Creating a Statement of Functional Expenses may be as easy as clicking a few buttons if you’re using the right accounting software (assuming your books are updated and transactions are classified correctly).

But if you need to make one manually, it’s pretty easy to do in any spreadsheet software. If you’d like to take a shot at it, click here get our FREE STATEMENT OF FUNCTIONAL EXPENSES TEMPLATE.

To create your report with the template, list all your natural expense categories in the first column.

Then add all your functional expense categories in the first row.

Next, enter your total expenses for each category of natural expenses in the “Total” column.

Then allocate those total expenses to each of your functional expense categories using the process you’ve defined for your organization.

Still have questions about functional expenses?

The key to tracking functional expenses is setting up processes and being disciplined with your bookkeeping.

Yet many nonprofits struggle to keep their books updated or create the financial statements they need on time. And that leads to sloppy accounting, playing catch-up, and wasting a lot of time and money.

If you want to report your functional expenses properly AND always have audit-ready financial reports at your disposal, an experienced nonprofit accountant can help.

At The Charity CFO, we work exclusively with nonprofit organizations to give them accurate books, timely reports, and expert advice on their nonprofit finances.

Because nonprofit accounting is all that we do, we have established policies for handling nonprofit-specific tasks– like functional expense reporting, fund accounting, grant tracking and more.

So if you’re ready to modernize your finances and finally find the time to focus on your mission, click the button below to find out how we can help you.

Schedule a Free Consultation!

Do You Struggle to Make Sense of Your Financial Statements?

Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization's finances.

Get the free guide!

0 Comments