Grants are the lifeblood of nonprofits, giving them the much-needed cash injection to market the organization, fund a project, or get an initiative off the ground. Having a full grant pipeline increases your nonprofit’s chances of success and improves your visibility and credibility. But in order to get the most out of these grants, you need to understand how to properly manage and account for them.

The IRS has strict regulations on how to handle grants and charitable contributions, so it is essential that you understand the best practices when accounting for them.

Why?

Because accurate nonprofit accounting can help with reporting and auditing requirements, and ensure that the funds are being used in accordance with the grantor’s wishes. Besides, proper accounting gives you a clear picture of your organization’s fiscal health and helps you to make informed decisions on how to allocate resources.

Nonprofit leaders can use the for-profit world’s valuable practice of engaging in succinct and clear grant reporting. You really don’t want to be red-flagged by the government because of incomplete, unorganized, or inaccurately recorded grant information.

What is a Grant?

A nonprofit grant is a type of financial assistance that your organization receives from government agencies, foundations, corporations, businesses, individuals, or educational institutes for a nominated project, program, or initiative. It is usually given in exchange for specific deliverables and outcomes.

It encourages collaboration between your nonprofit and the funder, and gives the funder some control over how the funds are utilized and sets the ground for future funding. Responsible stewardship of grant funds will usually lead to raising more grant money from the same or other funders.

Grants may include:

- Investments relation to programs

- Prizes

- Awards

- Scholarships

- Fellowships

- Research

- Training

- Mentoring programs

- Outreach initiatives

- Loans for charitable purposes

A grant will not include donations or contributions for unrestricted use or general operating support as these are not exchanged for any specific deliverables. Since they are project specific, they cannot be used to pay employees, compensate your board, or cover your organization’s operating costs.

According to the Financial Accounting Standards Board (FASB) guidelines, a grant should be recognized as revenue when all eligibility requirements have been met by the recipient and there is reasonable assurance that the revenue will be collected.

Major Types Of Grants

The three major types of grants are unconditional grants, conditional grants, and reimbursable grants.

- Unconditional grants are those which do not require the recipient to provide a specific deliverable or outcome in exchange for the funds. The recipient is under no obligation to fulfill any conditions or submit any reports.

- Conditional grants have designated deliverables or outcomes that must be met in order to receive the funds. Recipients are usually required to submit periodic reports on their progress and results.

- Reimbursable grants are those which require the recipient to provide evidence that it has already incurred costs before receiving reimbursement. Reimbursement is usually provided after the recipient has provided evidence that it has met all conditions, or completed the deliverable.

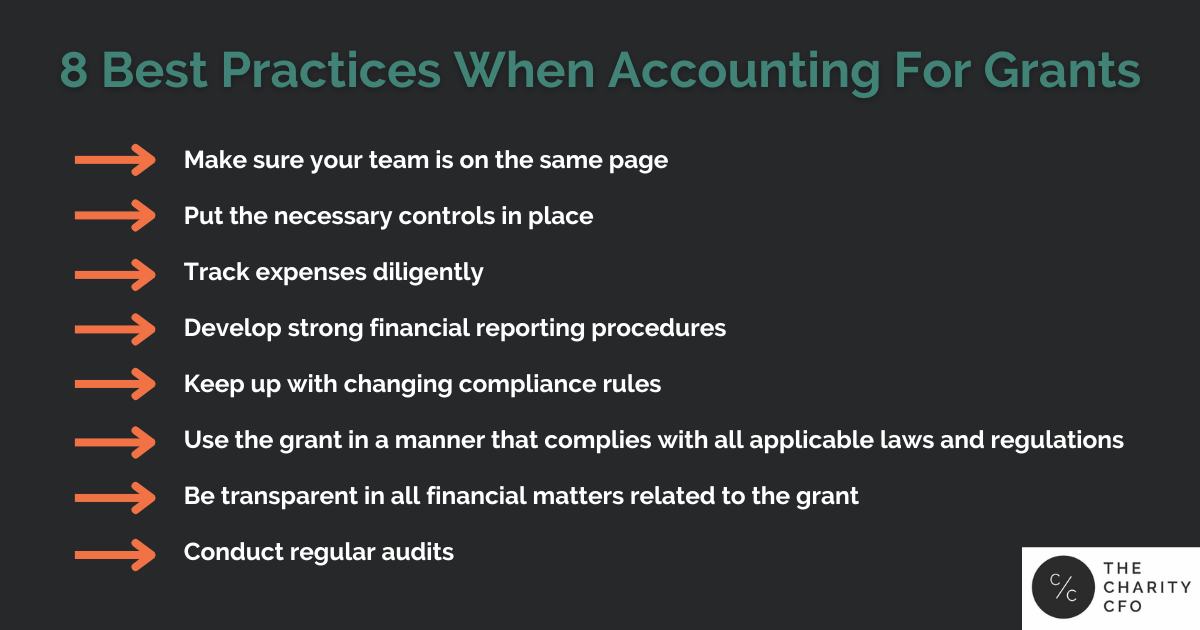

8 Best Practices When Accounting For Grants

The following are some best practices that all nonprofit leaders should follow when accounting for grant funds:

1. Make sure your team is on the same page

Set clear and consistent expectations with your team when it comes to accounting for grant funds. This means that everyone should understand the procedures, deadlines, and any other expectations related to accounting for grants. Establishing clear roles and communication protocols can help ensure that all team members are in alignment when it comes to grant accounting.

2. Put the necessary controls in place

Accounting for grants should be approached with an abundance of caution. Establishing sound internal controls is essential for ensuring the financial security, accuracy, and completeness of your records related to grants. This includes having a separate bank account for grant funds, segregating duties among different team members, and having adequate documentation of all grant-related transactions.

3. Track expenses diligently

When accounting for grants, it is important to track expenses diligently. This means having effective systems and processes in place for tracking grant expenditures, documenting grant-related activities, and making sure all expenses are properly classified. Doing this ensures that you can demonstrate compliance with grant requirements and provides a clear audit trail for any future reviews.

4. Develop strong financial reporting procedures

An efficient tracking and reporting system is a must-have in order to ensure accuracy and compliance when accounting for grants. Think routine summary reports, budget vs. actual reports, and variance analysis—all of these can help your team identify any discrepancies or issues related to grant accounting.

5. Keep up with changing compliance rules

Grant accounting can be complicated, and regulations are always changing. It is important to stay on top of any new compliance regulations by regularly reviewing the grant agreement, monitoring any developments in the industry, and proactively addressing potential issues. If you don’t have sufficient internal capacity and resources, you may want to consider hiring a nonprofit accounting professional to help manage your grant accounting.

6. Use the grant in a manner that complies with all applicable laws and regulations

It is important to keep in mind that grant funds must be used for their intended purpose and in accordance with all applicable laws and regulations. Grants should not be used in any way that could be perceived as fraudulent or unethical. As the grant recipient, you are responsible for understanding and following all applicable laws and regulations.

7. Be transparent in all financial matters related to the grant

Transparency is key when it comes to grant accounting. Make sure that your team is open and responsive to questions related to the grant account. Provide regular updates to the grantor, and be sure to document all decisions related to the use of grant funds.

8. Conduct regular audits

Regular financial audits can help ensure the accuracy of your financials, determine your fiscal health and compliance, and identify any potential issues. Having an independent audit team review your records related to the grant can help protect your organization from any unforeseen problems. These audits can also help identify opportunities, such as potential areas of cost savings.

What Are The Main Challenges Of Grant Accounting?

Grant accounting can be challenging, especially for smaller organizations with limited resources. Some of the main challenges that organizations may face include:

- Keeping up with changing grant regulations and compliance requirements

- Staying organized when dealing with multiple grants from different sources

- Meeting reporting deadlines and ensuring the accuracy of reports

- Differentiating between grants and other sources of income

- Tracking expenditures against budgeted amounts

- Understanding accounting rules, such as those related to matching funds, split funding, and indirect costs

- Knowing which expenses are allowable under the grant

- Managing cash flow during long grant cycles

These challenges can be daunting, but proper grant accounting practices can help organizations overcome them and ensure successful grant management. With the right processes in place, your organization can benefit from increased accountability and transparency, improved grant performance, and more efficient use of funds.

Feeling Stuck? Outsource Your Grant Accounting Needs To A Professional

Rolling all the responsibilities to an inexperienced person not only jeopardizes the organization’s fiduciary responsibility but also the sustainability of the organization.

If your team lacks the resources to effectively manage grant accounting, you may want to consider outsourcing these responsibilities. Experienced nonprofit accounting experts can help you develop and manage an effective grant accounting system and processes and provide guidance on best practices to ensure compliance and properly handle grant accounting responsibilities.

At The Charity CFO, we understand the complexities of grant accounting and bring our expertise to help your organization manage its grants in a way that complies with all regulations and provides maximum benefit for the organization.

By partnering with us, your organization can be assured that its grant accounting and financial management are in safe hands. We provide timely, accurate, and reliable services with high fidelity to your organization’s mission and values. Our team is dedicated to helping you achieve greater fiscal health, greater transparency, and improved service delivery for your organization.

Contact us today to learn more about how we can help with your grant accounting needs so you can focus on driving your mission and making an impact!

Do You Struggle to Make Sense of Your Financial Statements?

Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization's finances.

Get the free guide!

0 Comments