The right accountant can be the difference between an efficient accounting process and a total mess. That’s why it’s so important to know what to look for in a nonprofit accountant.

So what happens after you’ve found a few firms that offer the services you need? The next step is to ask your potential nonprofit accountant a few questions to see if they’d be a good fit for your organization.

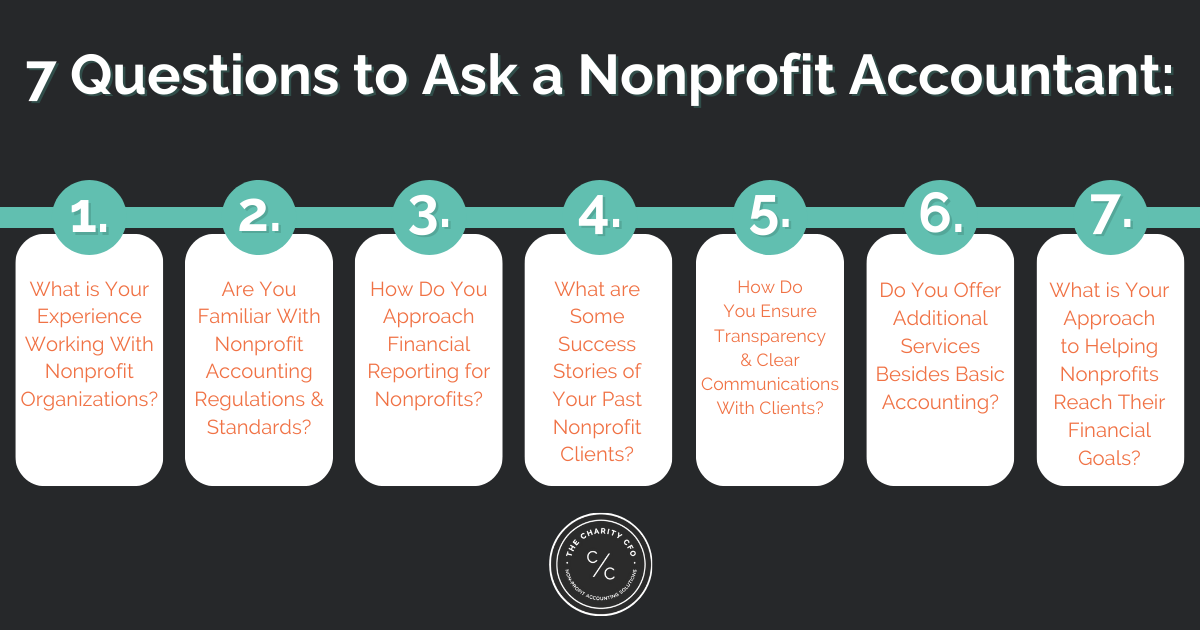

Here are seven questions to ask a nonprofit accountant before working with them.

1. What is Your Experience Working With Nonprofit Organizations?

As a nonprofit leader, you know nonprofit accounting isn’t the same as for-profit business accounting. Yet, it’s all too common for nonprofits to hire an accounting team with little to no experience in nonprofit accounting.

One of the first things to ask a nonprofit accountant is their experience with nonprofits. Working with someone who understands the unique financial challenges of nonprofits will make your partnership more seamless.

An accountant without nonprofit experience may need weeks or months to learn the ins and outs of nonprofit accounting before they can start helping your organization. Accountants with nonprofit experience, on the other hand, can hit the ground running to analyze your books and make insightful recommendations for your organization.

2. Are You Familiar With Nonprofit Accounting Regulations and Standards?

Tax filing or reporting mistakes could cost your organization its tax-exempt status. Your nonprofit accountant should have a good understanding of the current nonprofit tax laws and regulations related to your organization.

In addition, your accountant should be able to help you navigate unique nonprofit tax situations. For example, your nonprofit owns a for-profit business, which could lead to complicated tax requirements or even loss of exempt status. You want to know your accountant can help you figure out what needs to be done to stay in compliance as a nonprofit.

3. How Do You Approach Financial Reporting for Nonprofits?

Accurate financial reporting is essential to a nonprofit’s success. Having accurate reports helps promote transparency, showing your commitment to ethical conduct and integrity. This transparency also helps build trust with a variety of stakeholders, including:

- Employees

- Volunteers

- Board of Directors

- Donors

- Beneficiaries

However, not all financial reports are the same, especially if you need to present different data to various stakeholders. You can ask your accounting team how they handle financial reports to learn if their system will work for your organization. For example, your accountant might suggest using an accounting system like Quickbooks to streamline financial organization and easily generate reports.

4. What are Some Success Stories of Your Past Nonprofit Clients?

This is a great question to ask a nonprofit accountant. You might think of asking for client success stories or case studies as asking for an accountant’s portfolio. This is a chance for them to show you how they’ve helped other nonprofits like yours.

You can dive in further and ask the accountant a few follow-up questions as well, such as:

- What are some cost-saving strategies you’ve used with other clients?

- How did using accounting software improve efficiency for other nonprofits?

- How did your financial strategies help the financial health of an organization?

- What’s your process for evaluating an organization’s financial needs?

5. How Do You Ensure Transparency and Clear Communications With Clients?

Clear and open communication channels help everyone stay on the same page when it comes to an organization’s financials. You need your accountant to be accessible to answer questions and provide advice in a timely manner.

Asking a nonprofit accountant how they handle client communications–and if they’re willing to use your systems–can give you a better idea if you’ll work well together. For example, you might prefer phone calls over emails. You’ll likely want to work with an accountant who will accommodate your preferences.

6. Do You Offer Additional Services Besides Basic Accounting?

Bookkeeping and standard accounting services are major parts of nonprofit accounting, but what if you want an accountant who can be your go-to for financial advice? Asking about additional services lets you see what an accounting firm has to offer.

You might be surprised by the additional nonprofit accounting services a firm offers, such as:

- Fractional CFO services

- Advising on growth strategies

- Accounting system design

- Paying vendors

- Grant management

- Preparing and filing IRS forms

7. What is Your Approach to Helping Nonprofits Reach Their Financial Goals?

Your mission is the main reason for your nonprofit. That’s why it’s important to work with an accountant who understands how to create a financial plan that aligns with your mission and objective. This ensures each step of your financial plan helps you reach your goals and expand your impact.

Finding the Right Nonprofit Accountant to Reach Your Goals

Searching for a qualified nonprofit accountant can feel like a journey, but finding the right one is worth the time! Asking these seven questions can help you get a better idea of what nonprofit accounting services a firm offers, as well as their experience with nonprofit organizations.

At The Charity CFO, we’re happy to answer any questions you might have about our full-service nonprofit accounting and bookkeeping services. Our team specializes in nonprofit accounting, so you can be sure we understand the unique challenges and regulations that come with nonprofit finances.

Get in touch with us today to learn more about our services!

Do You Struggle to Make Sense of Your Financial Statements?

Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization's finances.

Get the free guide!

0 Comments