How can nonprofit accounting software help your organization with efficiency?

We’re in the age of technology, and it seems that for every process or transaction, there is a corresponding technological solution designed to make our lives easier and our work more efficient.

In today’s digital age, technology has revolutionized almost every aspect of business operations, including accounting and finance. For-profit companies have long used accounting software to track their financial transactions and monitor their bottom lines. However, nonprofit organizations face unique accounting challenges and not all commercial accounting software may be equipped to handle.

Where to start with nonprofit accounting software

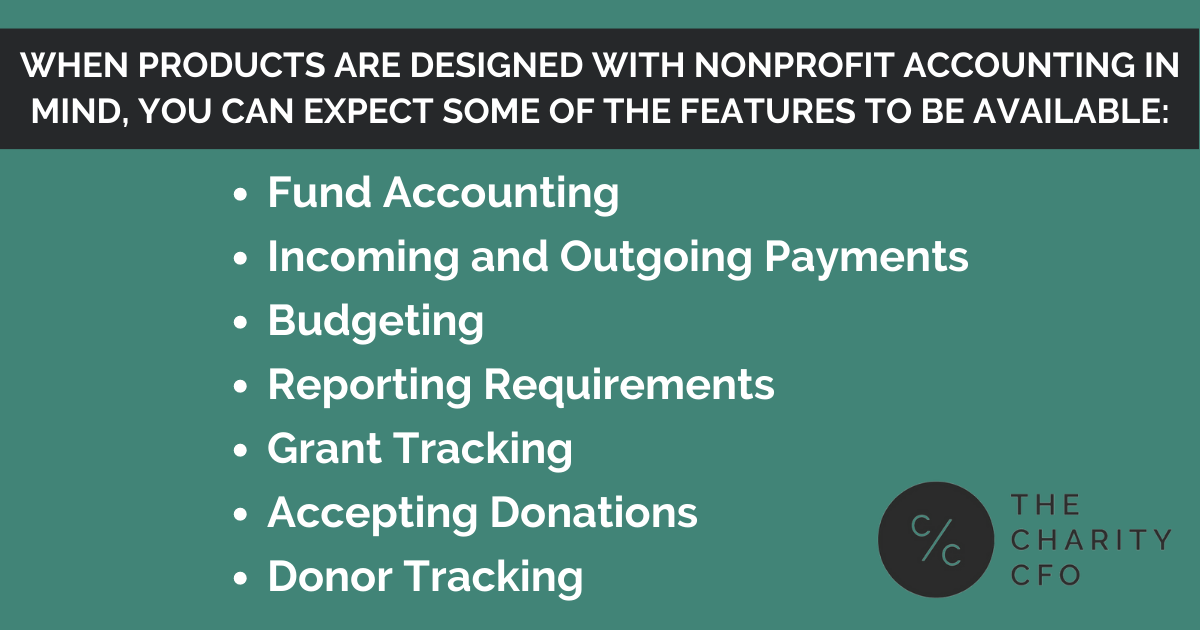

Nonprofits have to comply with strict financial accounting standards. Meeting these requirements is crucial to the organization’s survival and to maintain donors’ trust. To help meet these requirements, many nonprofits are turning to accounting software that is specifically designed for their needs. When products are designed with nonprofit accounting in mind, you can expect some of the features to be available:

-

- Fund accounting: Easy management and tracking of funds, tracking revenues sources and expenses for restricted and unrestricted funds separately. The software should also be able to generate reports that show the balances and activity for each fund.

- Incoming and outgoing payments: Record incoming payments, such as donations and grants, and outgoing payments, such as expenses and salaries. Might also include the ability to track pledges, payments received, and pledge balances.

- Budgeting: Tools for creating and managing multiple budgets for different funds or projects and budget to actual reporting. Some tools may also provide forecasting based on historical data.

- Reporting requirements: General financial statements and other reports that are compliant with nonprofit accounting standards as well as reports that are required by grantors, donors and other regulatory bodies.

- Grant tracking: From application to closeout, including the ability to create budgets for each grant, track grant expenditures, and generate reports that show the status of each grant. Some tools will also include reminders for reporting deadlines and other grant-related tasks.

- Accepting donations: Tools typically include online donation forms and the ability to accept recurring donations.

- Donor Tracking: Allows organizations to track contact information, giving history, and communication preferences. Some tools may also allow you to segment donors into different groups based on criteria such as giving level or engagement level and ability to generate trend reports over time.

How to evaluate nonprofit accounting software

One of the benefits of nonprofit accounting software is its ability to help organizations manage many elements of their finances in one place. It even helps automate some recurring tasks, reducing the chance of errors and duplication, and saving valuable hours each week. However, no one solution will be able to handle the vast needs of nonprofit accounting. Some good questions to keep in mind when evaluating a tool to support your accounting needs:

- Is the system easy to learn? Is there support available?

- How quickly do you need the software to be set up?

- What specialized features will you need? These features might include a platform to file your Form 990-N or the ability to create custom reports.

- Do you need integration with other systems?

- How secure is the system?

“Talk to a customer service representative from each software provider you’re considering to get answers to these questions,” says Katie Gray, the Content Manager for the all-in-one nonprofit software provider Springly. “They can clarify these points so that you don’t have to go searching on their website.”

Software won’t do it all

It is important to note that while nonprofit accounting software is powerful, it is not a cure-all. Technological tools have their limitations and many of them are additions to tools made for for profit businesses. This introduces an element of uncertainty as to whether they will be kept up to date on all things nonprofit or are accurately configured for the standards that nonprofits must adhere to. It is not a substitute for the expertise of a professional accountant or bookkeeper.

These professionals can help ensure that the organization is meeting all the legal and regulatory requirements, and make sure that the software is being used effectively. Nonprofit organizations can benefit greatly from engaging an accountant with specific industry experience for several reasons:

- An understanding of nonprofit accounting standards. They should be knowledgeable about these standards and can ensure that the organization’s financial statements are prepared in accordance with them.

- Experience with grant and donor reporting,including compliance with federal and state regulations and reporting to grantors and donors.

- Knowledgeable about compliance with tax exemption requirements to ensure that the organization remains in compliance with them.

- Assistance with fundraising, budgeting, forecasting cash flows, and providing financial insights that can help the organization make informed decisions about fundraising and donor management.

- Understanding of nonprofit financial statements and the unique financial reporting requirements of nonprofit organizations, including the Statement of Financial Position, Statement of Activities, and Statement of Cash Flows.

At the end of the day, all of these technologies are great and can truly make your operations run more smoothly, provide more insights in a quicker manner, and streamline your processes. However, there will always be the need for the human element. While technologies are getting much much better at reading data, the humans that are closely tied to your organization can make the minute and fine decisions that a technology doesn’t have the capability to understand. Having someone to talk to through issues, discuss problems and solutions, and analyze and decide what is ultimately best for your organization can not be replaced.

Engaging an accountant with specific nonprofit industry experience combined with the power of technological tools is a powerful duo to set an organization up for success and ensure efficient and effective management of your finances.

Do You Struggle to Make Sense of Your Financial Statements?

Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization's finances.

Get the free guide!

0 Comments