Have you ever been in an organization where bills are everywhere, vendors are irritated by late payments, the staff is drowning in paperwork, and you have a sinking feeling in your gut that the company is somehow being ripped off? This situation is common among small businesses. The biggest challenges facing accounts payable are chaos, maintenance cost, and fraud.

Small businesses can conquer these AP problems by implementing a digital transformation, managing labor costs, and implementing fraud controls. You may have heard of AP automation but are still determining how much it would benefit your business. Learn how your organization can use AP automation trends and productivity changes to take you from chaos to order, expensive to productive, and risky to controlled.

Bring order to Accounts Payable.

AP is susceptible to chaos due the several common business situations:

- Low-skill employees in AP processing roles

- Poor supervision of AP staff

- Focus on sales and operations rather than back-office functions

- Legacy of old systems such as paper bills and checks

These companies manage AP by putting out fires rather than continuous improvement. Running this type of AP risks upsetting suppliers, over-paying bills, and feeling out of control.

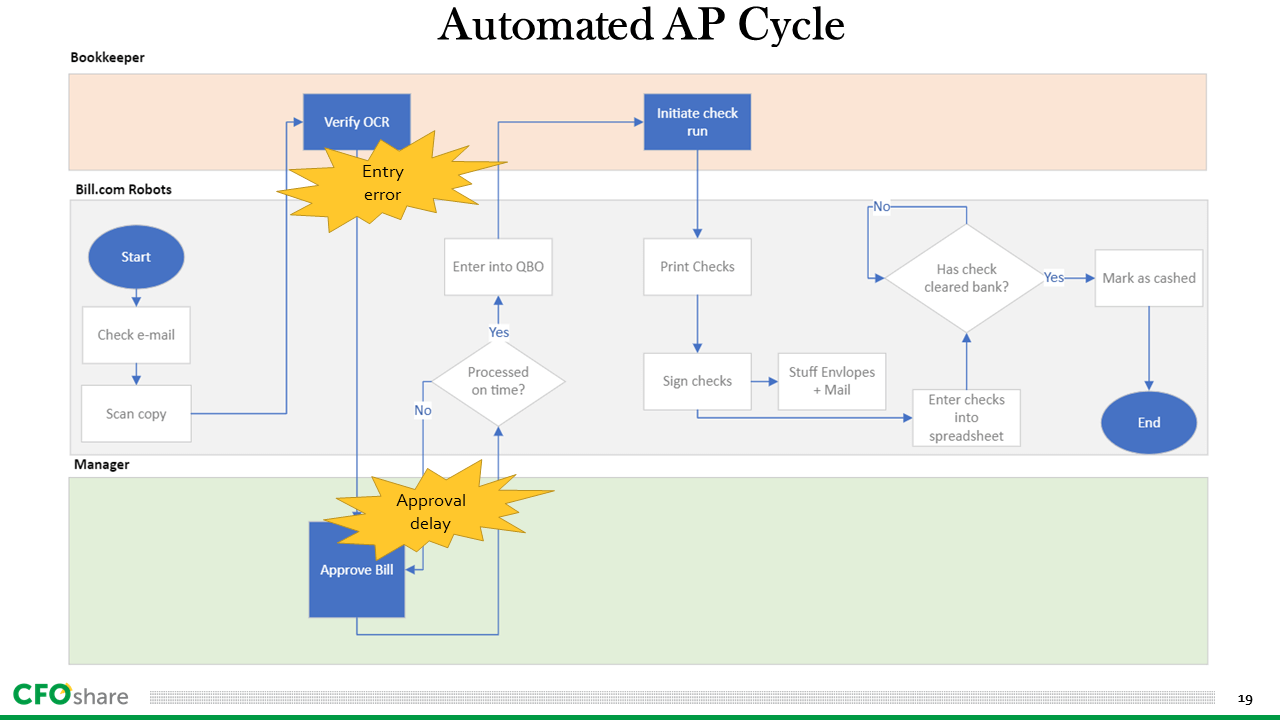

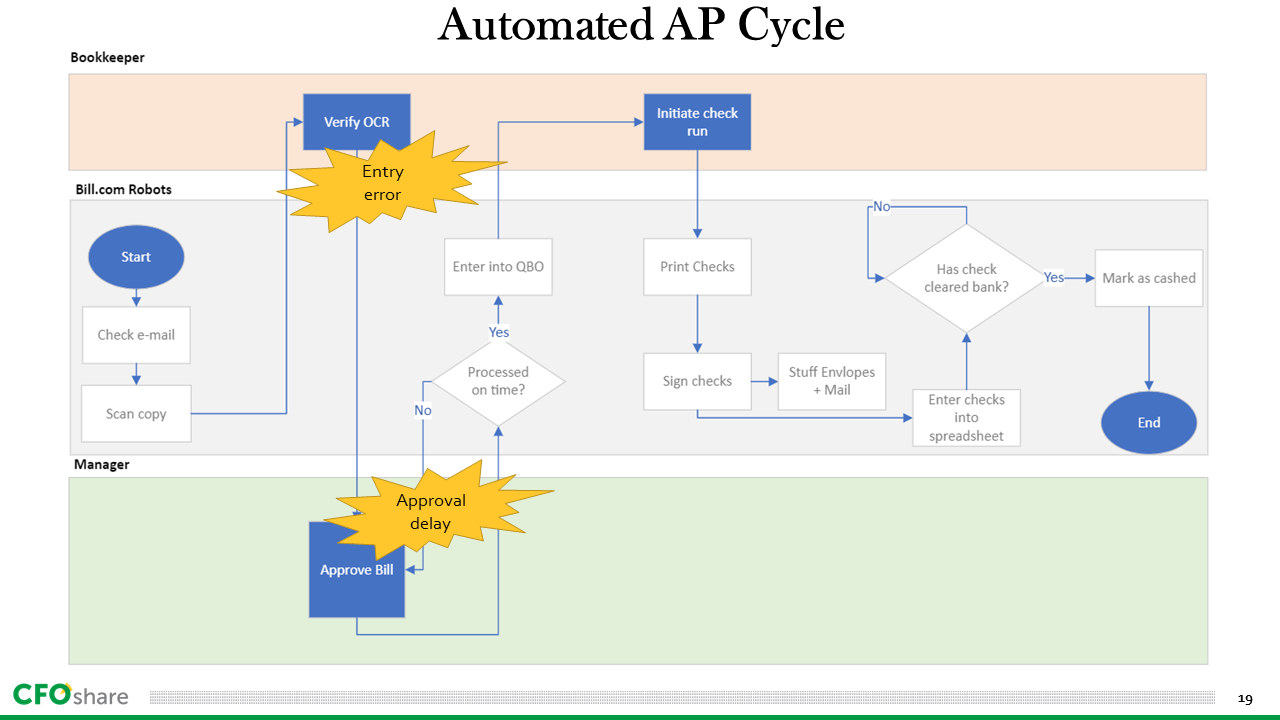

Professionalism and the adoption of AP automation are crucial to improving the AP process. An AP digital transformation centralizes all bill receipts into one inbox, eliminates paper and associated data “blackholes,” and maintains clear audit records of all activity.

Eliminating paper workflow fixes many AP problems like lost bills, duplicate bills, and slow approval routing. Productivity changes when there are fewer errors bogging down your team.

Companies that embrace modern AP automation trends generally have higher quality data, fewer errors, and clearer views on cash flow management.

Increasingly more small businesses are hiring professional AP outsourcing companies to take over the process. This experienced team brings organized AP systems to your company, eliminating AP chaos.

AP automation trends help reduce labor costs.

Accounts payable is a non-revenue-generating expense which best in class businesses minimize. However, assigning low-wage and low-skill labor often creates expensive errors and huge messes that take time to clean up.

Productivity improves with embracing AP automation trends through software like bill.com. Optical character recognition (OCR) eliminates data entry labor, and digital workflows increase throughput, reducing labor hours up to 10x.

Nearshore labor also provides favorable long-term cost changes. At CFOshare, we use English-speaking Mexican bookkeepers for AP processing roles who are:

- lower cost than American employees

- more trustworthy than other Latin-American nationals, and

- conveniently operating in the same time zone as the USA.

Indian and Filipino offshoring options are common amongst our competitors but do not offer that same combination of benefits.

Minimize fraud risk

Accounts payable is the number one source of fraud in small businesses. AP risks are extensive, including vendor fraud, invoice fraud, bank account change fraud, and many more schemes.

The biggest AP risk is your staff, whom fraudsters target with scams. Educate your staff on common fraud schemes to reduce the chance they fall for one. At CFOshare, we require mandatory fraud training for every new hire and repeat this training annually.

Your staff themselves may try to embezzle money through AP. Separation of duties is the primary means to discourage embezzlement and is easily implemented using digital AP software into three distinct AP processing roles:

- Bill entry

- Bill approver

- Payment processor

By separating these responsibilities, no one actor is capable of defrauding the company. This significantly reduces the likelihood of embezzlement through the AP system.

Leave AP to professionals.

Outsourced AP is less expensive, less risky, and less chaotic than managing bill payments in-house. Book your appointment today to learn how CFOshare AP services can help your business streamline vendor payments.