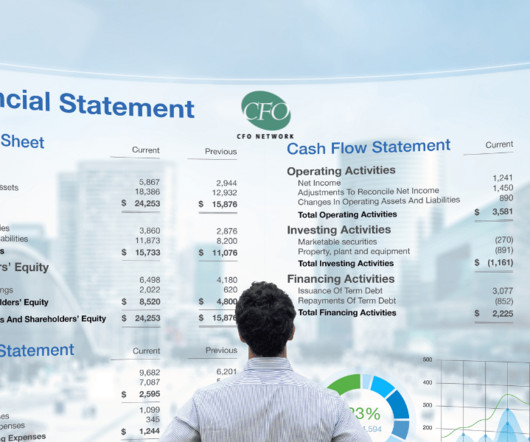

Mastering Cash Flow Management: Ensuring Liquidity for SMB Success

CFO Network

MARCH 11, 2024

Implementing automated invoicing systems can streamline this process, reducing the likelihood of delays and ensuring a steady flow of cash into the business. Accounts Payable Management: Ensuring Timely Payments Another critical aspect of cash flow management is managing accounts payable effectively.

Let's personalize your content