Transforming accounts payable operations through AI

Future CFO

JANUARY 26, 2024

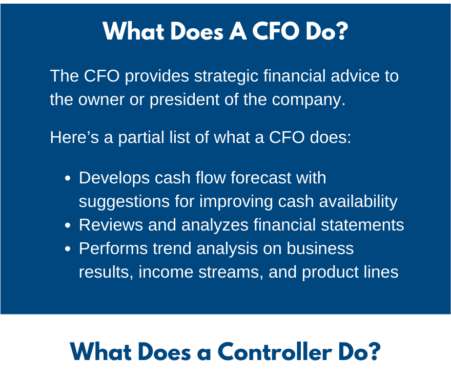

The outcome is boosted efficiency, increased accuracy, cost reduction, and stronger supplier relationships—a game-changer in Accounts Payable that allows finance leaders to navigate uncertain economic conditions and elections with confidence. The post Transforming accounts payable operations through AI appeared first on FutureCFO.

Let's personalize your content