- Policy

- 2 min read

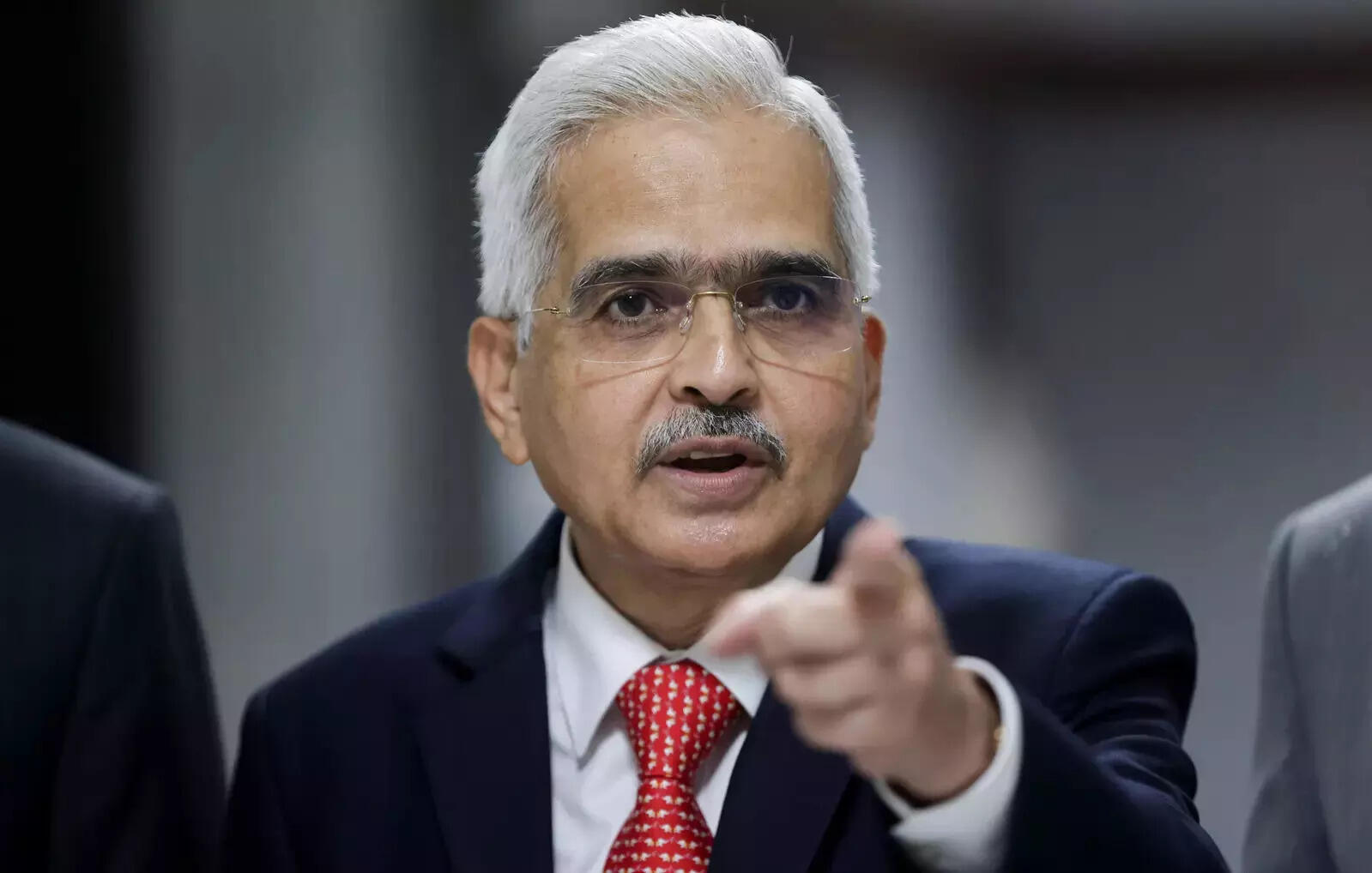

RBI Governor emphasizes criticality of internal, statutory audits for financial institutions

RBI Governor Shaktikanta Das on Thursday emphasized that a robust assurance mechanism by way of internal audit is essential to provide independent evaluation, while statutory auditors are critical towards maintaining market confidence. As regards to statutory branch audit of private banks, RBI is reassessing the quality and coverage, he added.

While addressing the ‘Global Conference on Financial Resilience’ on Thursday, the Reserve Bank of India (RBI) governor Shaktikanta Das stressed upon the criticality of effective internal and external audits for financial institutions.

It is no secret that stability and growth of an acre of an economy and financial markets are dependent upon trust among the stakeholders to be future ready, he said while adding that with greater openness of the economy and faster transmission of information and capital flows on account of advent of technology, it has become even more necessary to ensure credibility and confidence in the system.

For the aforementioned reasons, the Reserve Bank as the supervisor of banks has taken key keen interest in the functioning of statutory auditors of the regulated entities, wherever and whenever necessary.

Das highlighted that the RBI engages with external statutory auditors on issues of critical nature on individual banks and financial entities and have recently revised the guidelines for statutory branch audits of public sector banks, according to which a minimum of 70% of credit exposure of a bank is required to be covered for a branch audit.

Also Read: India not adversely affected from financial instability in AEs: RBI Guv Shaktikanta Das

From financial year' 23-24 onwards, the board of directors of public sector banks will decide on the coverage of branch audit and selection of branches which untill now was being done by the central bank .

As per the precribed norms, while deciding on these matters, the boards are required to keep in mind the specific characteristics of individual banks like the bank's business and risk profile, geographical spread, degree of centralization of processes and similar other factors. The boards of banks are expected to exercise the highest level of diligence while deciding on these issues, he said.

"As regards to statutory branch audit of private sector banks, we are doing a fresh assessment of the quality and coverage of such audits. In the Reserve Bank. As I have mentioned earlier, we attach a lot of importance to skill building and capacity development of our employees. We have been strengthening the Department of supervision, both in number and quality," he added..

The comments are significant against the backdrop of rising instances of accounting irregularities reported in some of the large banks over the last few years.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions