How to Prepare for a Financial Audit

CFO Share

NOVEMBER 15, 2023

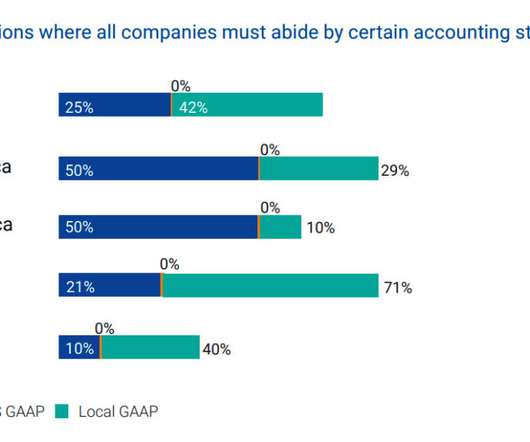

Embarking on your first financial audit can be nerve-wracking. This article includes small business accounting tips to prepare for an audit while minimizing its expenses and findings. An audit evaluates: Compliance with accounting standards (GAAP or IFRS.) Do not expect to walk away from an audit with zero findings.

Let's personalize your content