Banking Transformation: The Journey from Embedded to Contextual Banking

Dive into the evolution of finance with our article on Embedded Finance. Explore its historical roots, understand its modern applications, and grasp its transformative impact on the banking landscape. From early merchant practices to the rise of contextual banking, discover how embedded finance is reshaping the way we experience financial services. Join us in unraveling this financial revolution and learn why traditional banks need to adapt now to seize the opportunities presented by this dynamic shift.

The History of Embedded Finance

Embedded finance refers to integrating financial services into everyday products and services. Businesses can create a competitive edge and drive customer loyalty by offering their customers convenient, accessible, and affordable financial solutions.

Embedded finance is a relatively new concept, having only gained widespread attention in the past decade. Yet, the origins of embedded finance can be traced back to the early days of commerce.

You can find one of the earliest examples of embedded finance in the practice of merchants giving credit to customers. This was a way of financing trade and was particularly common in the medieval period. Merchants would extend credit to customers who could not afford to pay upfront for goods. The customers would then repay the debt over time, usually with interest.

One can continue to trace the history of embedded finance back to the early days of banking and insurance. Financial services were first offered as an adjunct to other businesses. For example, banks would provide loans to farmers to buy seeds and equipment. Insurance companies would then sell policies to cover the risk of crop failure.

This practice of extending credit continued into the modern era. Banks and other financial institutions further developed it but embedded finance came into its own with the advent of new technologies.

Embedded Finance in the Modern Age

Most recently, the internet and mobile phones have been instrumental in the growth of embedded finance as these technologies have made it easier for people to access financial services. They have also allowed for the development of new and innovative services.

In the early days of embedded finance, the most common use case was for payments. This made sense because one of the critical advantages of embedding finance into apps is the ability to facilitate payments without having to leave the app.

Today, embedded finance is present in many products and services. Embedded finance is becoming commonplace, from mobile apps that allow you to manage your finances on the go, to in-app payments and even insurance products.

What this means, however, is that embedded finance largely requires the use of financial APIs. These APIs make it possible to move data connections between various financial accounts in both fintech companies and non-financial companies. Before these APIs, non-financial institutes, like e-commerce stores, had to invest resources and lots of time to offer their financial services.

We have now reduced those barriers meaning smaller companies and businesses can easily integrate their services with financial providers at a much lower cost and faster rate.

The Difference Between Embedded Finance and Banking as a Service (BaaS)

To understand the differences between embedded finance and Banking as a Service (BaaS), we need to understand what BaaS is. BaaS is a model that allows non-banks the opportunity to offer traditional and standard banking solutions to their customers. Non-banks do this by connecting to a banking system, usually through webhooks and APIs.

This makes it easier for a host of companies to offer their own financial services through licensed access, rather than having to develop their own banking institutions. There are a lot of similarities between BaaS and embedded finance as both provide financial opportunities apart from standard bank systems.

An easier way to look at the relationship between embedded finance and BaaS is through the chicken and the egg idiom. In this case, BaaS is the chicken and embedded finance is the egg.

Without BaaS, embedded finance cannot exist, though they are inherently two individual systems. However, there are a few other key distinctions:

- Embedded finance is front end

- BaaS is back end

- BaaS supports ongoing transactions

- Embedded finance supports conversions

Embedded finance takes the basic end-to-end package of BaaS and reshapes it as an integrated financing option, rather than as a full banking service. While BaaS supports embedded finance, they are two different things. BaaS is the foundation, while embedded finance grows from it, leading to new possibilities itself, like contextual banking.

Contextual Banking and Embedded Finance

Contextual banking is a new wave of banking. Here, financial institutions use data, technology, automation, personalization and analytics. This contrasts with the traditional approach of providing generic products and services to all customers.

The rise of contextual banking refers to banks offering more personalized services and products relevant to their customers' needs. This trend is driven by the increasing use of mobile devices and the need for banks to provide a better customer experience to both retail and commercial customers.

In the past decade, there has been a rise in the popularity of contextual banking. Banks are turning to contextual banking to stay relevant in a world where consumers turn to digital channels for their financial needs. By offering a more personalized service, banks can better meet the needs of their customers and keep them happy.

The Rise of Contextual Banking

Banks that adopt contextual banking will be well-positioned to win over customers in the years to come. Contextual banking is a revolutionary way to interact with customers and its rise is still likely to continue in coming years. For example, an institution leveraging contextual banking would consider a customer’s location, time of day, and past transactions when providing services.

Contextual banking is made possible by using data and analytics to better understand customer behavior and needs. This allows banks to offer products and services more relevant to their customers. The trend towards contextual banking is also driven by the need for banks to stand out in a competitive market. It's a way for banks to provide a better customer experience and differentiate themselves from their competitors.

“As contextual banking evolves, the most relevant new businesses won’t be the platforms that simply amass the most data — but will be the ones that facilitate a trusted exchange of data in useful new ways.” - FISPAN Founder and CEO Lisa Shields

How Does It Apply to Embedded Finance?

When you combine contextual banking with embedded finance, you have a win-win situation. You are providing a service that considers your customer's spending habits and location, while also giving them personalized options that are specifically tailored to them, none of which we can achieve without embedded finance.

This looks great for a business, as it shows a higher level of care. When a customer feels like their needs are being met, or at the very least that they are being seen, they are more likely to turn into loyal and long-standing clients.

How Embedded Finance Is Changing the Banking Landscape

In the past, banking was a one-size-fits-all industry. Your bank was the one place you went to for all your financial needs, whether for a checking account, a loan, or investments. But that’s no longer the case. Today, embedded finance is changing the banking landscape, impacting factors such as customer demand, and heightening the acquisition of banking-as-a-service offerings from financial institutions. With embedded finance, financial services are integrated into other products and platforms that you may use every day.

For example, you might use a financial app that helps you manage your money and make payments. Or, you might use a point-of-sale system that allows you to pay for your sale with a credit or debit card. You’re using financial services in both cases, but they are services a traditional bank does not provide. Banks are no longer the only financial services providers, and risk losing their grip on the market because of it.

What's Driving the Trend?

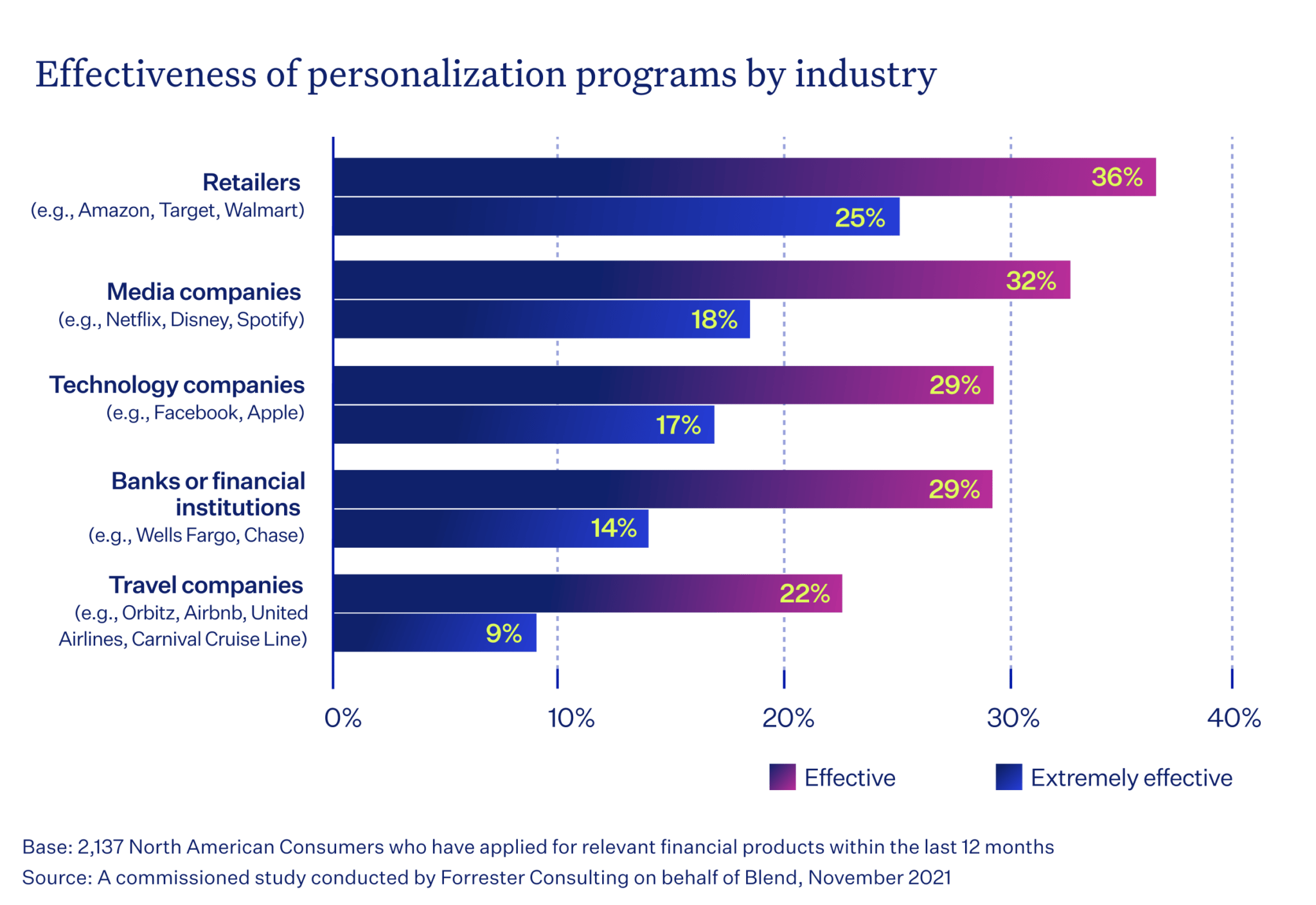

The trend towards contextual banking is being driven by customers who want more choice and convenience in their bank. As well, the trend is being enabled by technology that makes it easier to integrate financial services into other products. Highly personalized banking experiences are shaping the future of banking, with 72% of customers rating personalization as “highly important” in the financial services landscape.

Embedded finance is convenient for customers since they can access financial services without going through a bank. It is also suitable for non-bank businesses offering financial services as an added revenue stream.

Banks are trying to fight back by offering their own embedded finance products but they are at a disadvantage – they are not as agile as startups, and they have to deal with regulatory hurdles that startups don’t.

Unless banks adapt quickly and take action now, they risk losing more market share to embedded finance providers as incumbents continue to encroach on their traditional market.

Carpe Diem, what’s next for banks?

Traditional banks need to start offering their customers embedded finance products and services to stay ahead of the curve. This will allow them to tap into an additional revenue stream and provide their customers with the convenience and flexibility they demand.

By offering products and services bundled with other products and services, banks can provide a more seamless user experience and capture a larger share of customer spending. Also, by partnering with fintechs, banks can gain access to new technologies and tap into new markets.

Now is the time to capitalize on this opportunity.

If you are interested in learning how to enter the world of embedded finance: schedule your personalized demo with us today to see if we’re a fit for you.