- Governance, Risk & Compliance

- 4 min read

HSBC Geneva leak: ITAT says data is old, bank balance can't be taxed

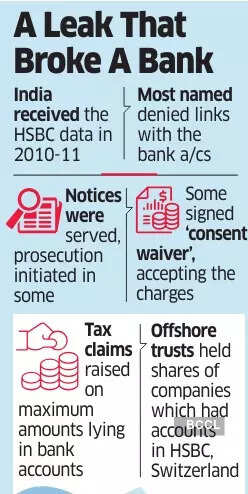

In a decision that could have a bearing on other `HSBC account’ cases, a tax tribunal last week has ruled that the I-T department cannot go back 16 years to reopen old matters to tax the ‘peak balance’ lying in such bank accounts. Why? Because, according to the Mumbai bench of the Income Tax Appellate Tribunal --- a quasi judicial authority --- a bank balance reflects 'assets' and not ‘income’, and, under the law, only income can be taxed.

Almost 14 years after the sensational data leak from HSBC Geneva, a tax order has questioned the very approach of the Income-Tax (I-T) department in going after individuals whose names figured in the infamous list of information that was stolen by an employee of the British bank's Swiss private banking arm.

In a decision that could have a bearing on other 'HSBC account' cases, a tribunal last week ruled that the I-T department cannot go back 16 years to reopen old matters to tax the 'peak balance' lying in such bank accounts. This is because, according to the Mumbai bench of the Income Tax Appellate Tribunal (ITAT), a bank balance reflects 'assets' and not 'income', and, under the law, only income can be taxed.

The HSBC cases were reopened under both the provisions (six years and 16 years) and both provisions (under the old law) allowed taxation of income (and not assets). Under the present law, the department can reopen an assessment up to 10 years if it suspects that the untaxed income is more than ?50 lakh.

The 16-year provision (applicable earlier only in terms of offshore incomes) no longer exists in the law and the taxman today primarily relies on the Black Money Act, which was passed in 2015, to catch unreported overseas wealth and income. However, once a matter is taken up under the old law, the department may find it difficult to invoke the Black Money Act.

The present case (falling between 6 and 16 years) pertains to assessment year 2006-07, with I-T department issuing the notice in March 2014.

QUESTION OVER 'BASE NOTE'

Interestingly, the ITAT - a quasi judicial authority - in its ruling also recorded the argument questioning the authenticity of the key document which I-T sleuths relied upon.

In the matter pertaining to the assessment year 2006-07, the I-T department had attached a 'base note' along with the notice that was served on the assessee.

During the hearing, the latter's counsel had pointed out that the amounts mentioned in the base note is stated in 'lakhs', and not in 'thousands' as is found in the statements of banks overseas. Moreover, the note does not bear the name of the stamp, bank name, as well as letterhead, and gives no reason as to why the amount in an offshore bank should be taxed in India.

Tribunal's interpretation

While these observations on the 'base note' may have a peripheral relevance to ongoing HSBC cases, assessees named in the latter may in future draw on the ITAT's recent interpretation of Section 149 of the I-T Act that allowed reopening within 16 years of the assessment.

Referring to the section, the ruling said: "...income from (the) bank account in Geneva has neither accrued nor arisen or deemed to have accrued or arisen in India. Further, no part of income from (the) alleged bank accounts has been received or deemed to be received in India."

Ashish Mehta, partner at the law firm Khaitan & Co. Mumbai, said, "The evidentiary value of 'base note' has been in question ever since 2011, when searches/reassessment cases have been initiated solely on such 'base note'. This is a positive ruling recording arguments around the admissibility of 'base note' and ultimately holding that the reassessment proceedings could not have been initiated in the hands of a non-resident of India. It has been held that the tax department was not able to prove that any 'income' from the bank account in HSBC Geneva has been received in India or accrued/arose or deemed to have accrued/arisen in India."

"Merely adding the peak balance [which is an 'asset' and not 'income'] does not provide jurisdiction to the tax authorities to invoke the reassessment proceedings," he added.

According to tax practitioners, in several cases, foreign accounts were structured in a way where an offshore trust (in which individuals were beneficiaries) held shares of companies (possibly in tax havens) which had accounts in HSBC, Switzerland. There is, however, no evidence such a structure was used by the assessee, who had categorically denied having any bank account with HSBC Geneva.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions