- Economy

- 4 min read

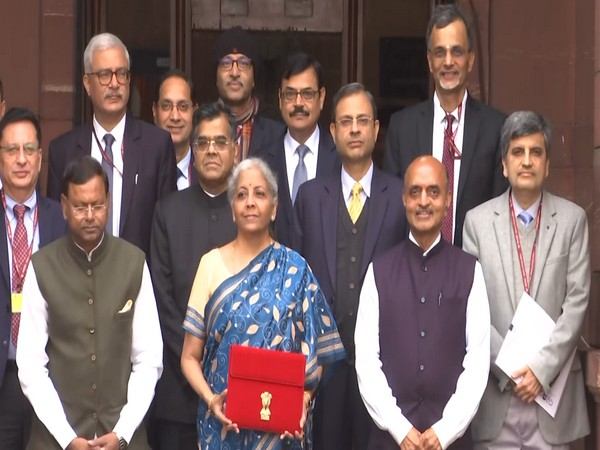

Union Budget 2024: FM Nirmala Sitharaman Budget Highlights that matters for India Inc

Here are the major developments from Union Budget 2024 that matter the most for India Inc and the CFO community. Finance Minister Nirmala Sitharaman, presents her sixth union budget, rather than a full Budget ahead of the General Election in 2024.

She also said that the country has evolved in the last 10 years under PM Modi with "Sabka Sath, Sabka Vikas" Mantra.

Key Highlights from FM Nirmala Sitharaman Speech:

- FM: Development that is all round, all pervasive and all inclusive

- Indian economy has witnessed profound transformation in the last 10 years, says Nirmala Sitharaman

- Direct benefit transfer of Rs 34 lakh crore from the govt using PM Jan Dhan accounts has led to savings of Rs 2.7 lakh crore and has been realised through avoidance through leakages prevalent earlier.

- Poor, women, youth and farmers are four castes for our government

- Focus is on outcomes and not outlays to achieve social economic transformation

- The Skill India Mission has trained 1.4 crore youth, upskilled and re-skilled 54 lakh youth, and established 3000 new ITIs. A large number of institutional higher learning, namely 7 IITs, 16 IIITs, 7 IIMs, 15 AIIMS and 390 Universities have been set up

- GST has enabled one nation, one market, one tax, says FM

- DPI is instrumental in formalisation of the economy. GIFT IFSC and IFSCA are creating a robust gateway for global capital and financial services for the economy.

- Average real income of people increased by 50 per cent

- The economy is doing well. Inflation is moderate

- Our government will adopt economic policies that foster and sustain growth, said FM Sitharaman. It will be guided by principles of Reform, Perform and Transform.The government focused on more comprehensive governance, development, performance of GDP.

- Despite the challenges due to Covid, implementation of PM Awas Yojana Rural continued and we are close to achieving the target of 3 crore houses. 2 crore more houses will be taken up in the next 5 years to meet the requirement arising from increase in the number of families.

- Fishery: Seafood exports from 2013-14 has doubled.

- Recently announced India Middle East Europe Economic Corridor will be game changer for India

- FM says the government will push for bilateral treaties with foreign partners in the spirit of 'First Develop India'

- Govt to increase defence outlay by 11.1% to Rs 11,11,111 crore, 3.4 per cent of GDP

- 40,000 rail bogies to be converted to Vande Bharat standards. Airports to be doubled to 149. Indian carriers have placed orders for 1,000 new aircraft

- A corpus of Rs 1 lakh crore will be established with 50 year interest-free loan for tech-savvy youth. Corpus will provide long term financing, or refinancing with long tenors with low or nil interest rates. This will encourage private sectors to scale up research and innovation significantly in sunrise domains.

- Rs 34 cr Mudra Yojana loans been given to women entrepreneurs

- Revised estimate of 2023-2024 of total receipts (except for borrowing) is Rs 27.56 lakh crores of which tax receipts are Rs 23.24 lakh crore.

- The capital expenditure target for FY25 is set at Rs 11.1 lakh crore, up by 11.1 per cent.

- The revised estimate of fiscal deficit is 5.8 per cent of GDP.

- FY24 total expenditure revised to Rs 44.90 lakh crore

- Revenue receipts at Rs 30.03 lakh crore are expected to be higher than budget estimate reflecting strong growth momentum and formalisation in economy.

- We continue on path of fiscal consolidation to reduce fiscal deficit to 4.5% in 2025-26

- FY 25 fiscal deficit pegged at 5.1 per cent; aim to reduce fiscal deficit below 4.5 per cent by FY26

- FY 25 gross market borrowing pegged at Rs 14.13 lakh crore

- Every challenge of pre 2014 era overcome through economic management and governance. These placed the country in resilient and high growth path through right policy, true intension, and decision making. In the full budget the govt will provide the detail roadmap for our pursuit of developed India

- Tax benefits for startups, investments made by sovereign wealth, pension funds to be extended to March 2025

- The tax rates for direct and indirect tax remains unchanged, as no proposals was made

Sitharaman pegged the FY 25 GDP growth at around seven per cent. The Reserve Bank of India (RBI) has pegged third quarter real GDP growth in this financial year at 6.5 per cent, which may moderate further to six per cent in the January to March 2024 quarter.

The total expenditure in Budget 2023-24 was allocated at Rs 10 lakh crore. Railways was allocated highest-ever capital outlay of Rs 2.40 lakh crore.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions