Christina Ross (CEO of Cube) teamed up with Chris Ortega (CEO of Fresh FP&A) for an info-packed webinar to discuss proven tactics for surviving budget season.

Check out highlights from the webinar below.

Product

Product

How Cube works

Sync data, gain insights, and analyze business performance right in Excel, Google Sheets, or the Cube platform.

Security

Built with world-class security and controls from day one.

Why Cube?

Cube meets you where you work—your spreadsheets. Get started quickly with a fast implementation and short time to value.

Developer Center

Cube's API empowers teams to connect and transform their data seamlessly.

Integrations

Connect and map data from your tech stack, including your ERP, CRM, HRIS, business intelligence, and more.

Get a demo

Break free from clunky financial analysis tools. Say hello to a flexible, scalable FP&A solution.

See Cube in action

Use Cases

Use Cases

Centralized Data Management

Centralized Data Management

Automatically structure your data so it aligns with how you do business and ensure it fits with your existing models.

Security Integrations Access controlReporting & Analytics

Reporting & Analytics

Easily collaborate with stakeholders, build reports and dashboards with greater flexibility, and keep everyone on the same page.

Three statement model Cash flow reporting Ad-hoc reporting Performance reporting Variance analysisPlanning & Modeling

.png)

Creating a high-impact finance function

Get secrets from 7 leading finance experts.

Download the ebook

Industries

Customers

Customers

Customer Stories

Discover how finance teams across all industries streamline their FP&A with Cube.

Featured Customers

BlueWind Medical reduced company spend by over $100k with Cube

Edge Fitness Clubs cuts reporting time by 50% & saves $300,000 annually

Join our exclusive, free Slack community for strategic finance professionals like you.

Join the community

Resources

Resources

Content Library

Discover books, articles, webinars, and more to grow your finance career and skills.

Templates

Find the Excel, Google Sheets, and Google Slide templates you need here.

Blog

Discover expert tips and best practices to up-level your FP&A and finance function.

Newsletter

Need your finance and FP&A fix? Sign up for our bi-weekly newsletter from former serial CFO turned CEO of Cube, Christina Ross.

Community

Join our exclusive, free Slack community for strategic finance professionals like you.

Help Center

Make the most of Cube or dig into the weeds on platform best practices.

Creating a High-impact Finance Function

Secrets from 7 leading finance experts.

Get the guide

Company

Company

About us

We're on a mission to help every company hit their numbers. Learn more about our values, culture, and the Cube team.

Careers

Grow your career at Cube. Check out open roles and be part of the team driving the future of FP&A.

Contact

Got questions or feedback for Cube? Reach out and let's chat.

In the news

Curious what we're up to? Check out the latest announcements, news, and stories here.

A newsletter for finance—by finance

Sign up for our bi-weekly newsletter from 3x serial CFO turned CEO of Cube, Christina Ross.

Subscribe now

Updated: September 22, 2023 |

By

Cube's founder and CEO, Christina Ross is a 3x CFO and former finance transformation leader. As a well-recognized expert in all things FP&A, she is passionately mission-driven to help finance leaders become the heroes of every org. She currently resides in NYC.

Christina Ross (CEO of Cube) teamed up with Chris Ortega (CEO of Fresh FP&A) for an info-packed webinar to discuss proven tactics for surviving budget season.

Check out highlights from the webinar below.

CEO & Co-Founder, Cube Software

Sign up for our bi-weekly newsletter from serial CFO and CEO of Cube, Christina Ross.

As a former 3x CFO, I've survived my fair share of budget seasons—and so has my colleague, Chris Ortega (fractional CFO and CEO of Fresh FP&A).

From budget season horror stories to tales of success, Chris and I discussed it all in our recent webinar, Surviving Budget Season: 4 Proven Tactics for Finance Leaders. We spilled our tricks of the trade and offered our best advice to ensure your upcoming budget season is productive, collaborative, and on target.

If you couldn't make it live, check out some of the highlights below for quick tips to help you prep for this crucial time of year.

Before you can work the plan, you've got to plan the work. In my experience, there's no better way to do this than by creating a comprehensive financial planning calendar.

To create an effective calendar, be sure to:

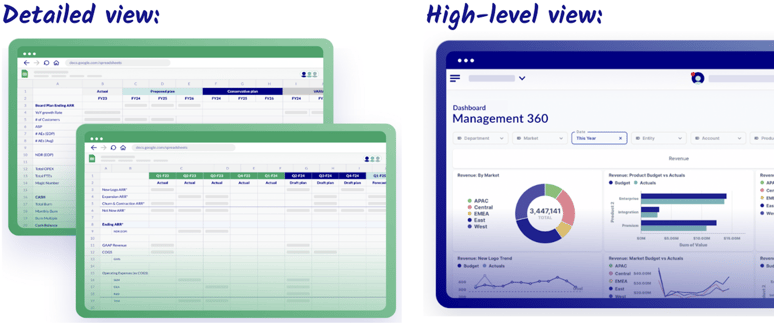

When presenting a financial plan, it's crucial to consider your audience. For top-level executives and the C-suite, they often prefer a high-level overview; they want the key takeaways without getting bogged down by details like accruals and variances.

On the other hand, for those delving deeper into finances, a more detailed framework can be helpful. This can involve breakdowns by department, key drivers, or different scenarios.

This is where technology can be a game-changer. With FP&A software, you can streamline communication and simplify the tracking and reporting processes during budgeting. With the right tech, both granular views (like the ones on the left) and comprehensive snapshots (like the one on the right) can be efficiently presented, catering to diverse audience needs.

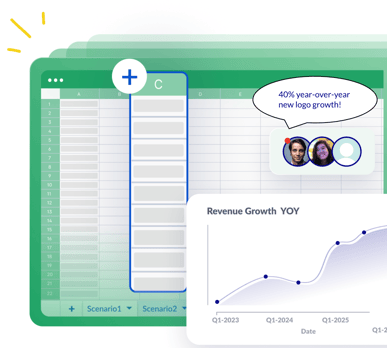

The right software can make the planning process faster and more efficient. The main thing? Focus on solving real pain points, like consolidating and unifying data. Many finance leaders say that's their biggest challenge. But it's not just about data; it's also about collaborating effectively and scaling up as the business grows.

Here's a glimpse into how software and consultation can truly accelerate (and improve) the planning process:

When rolling out a budget, you'll inevitably hit some bumps in the road. But there are four things you can consciously avoid doing to make the process smoother:

We've only scratched the surface with these tips. Want to learn more?

Click the image or button below to view and download the on-demand recording.

View the recording