50 Shades of FP&A Maturity

Recent technological advancements and constant changes in the business environment enable the finance function in general and FP&A teams in particular to adopt new ways of work, new practices, new tools to meet the needs of their internal and external customers.

Unfortunately, 75% of time of FP&A teams is still allocated to data gathering and process administration. Trying to balance between doing donkey work, performing ad hoc requests and meeting strict deadlines, FP&A professionals have no time left to reconsider the state of the FP&A function. These outdated practices and old-fashioned FP&A organizations can no longer coexist with modern realities which require the FP&A function to be focused on value creation.

From a strategic standpoint, FP&A capabilities to provide business insights and drive informed decision making can become a source of competitive advantage for the company. That is the reason why many finance and FP&A leaders are taking the steps to transform their functions: restructure processes, upgrade systems and tools, develop teams. The starting point in this arduous journey is to understand the current state of the FP&A function and then determine which way to evolve based on the existing, emerging and likely to appear requirements and expectations of the stakeholders.

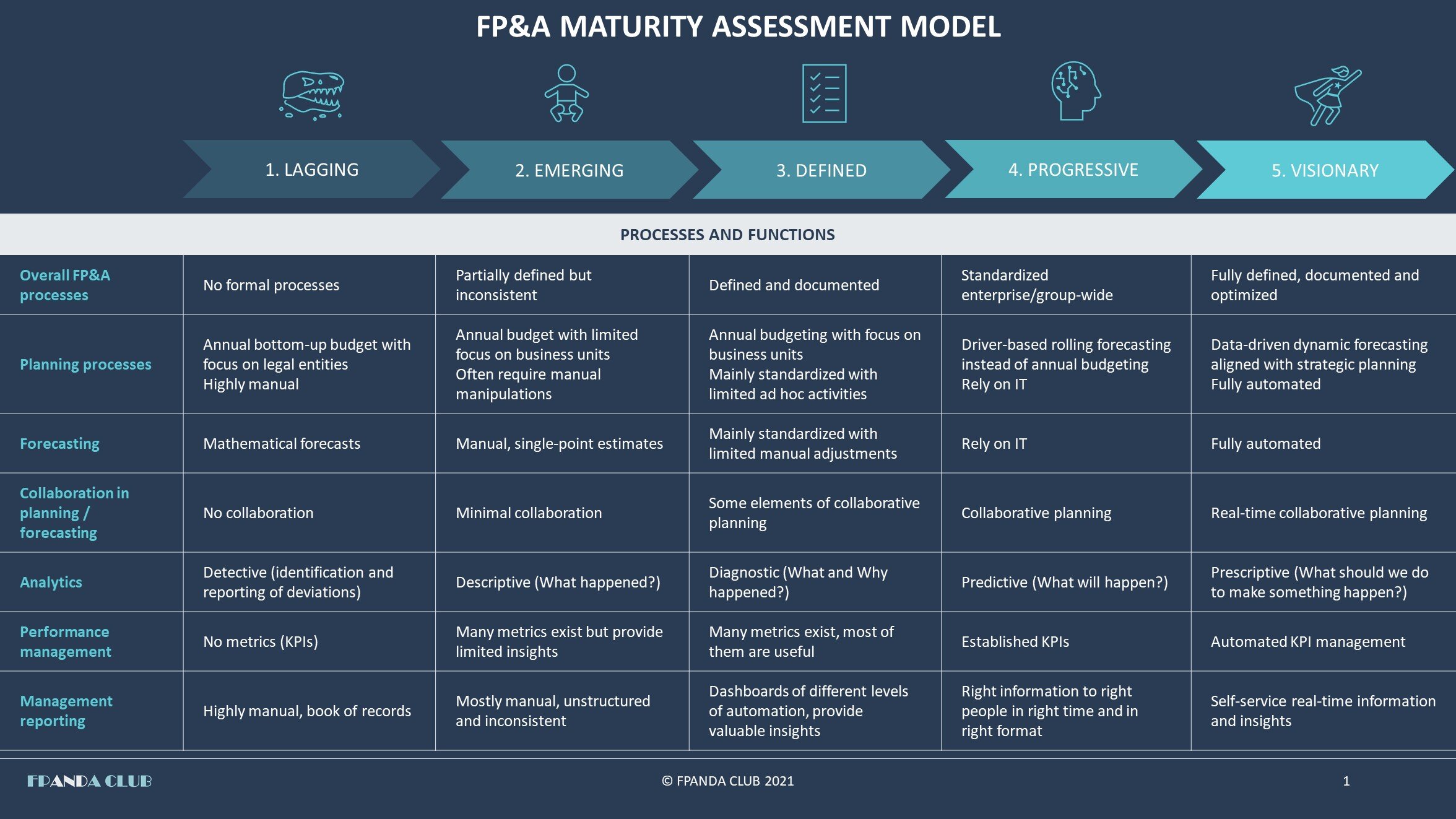

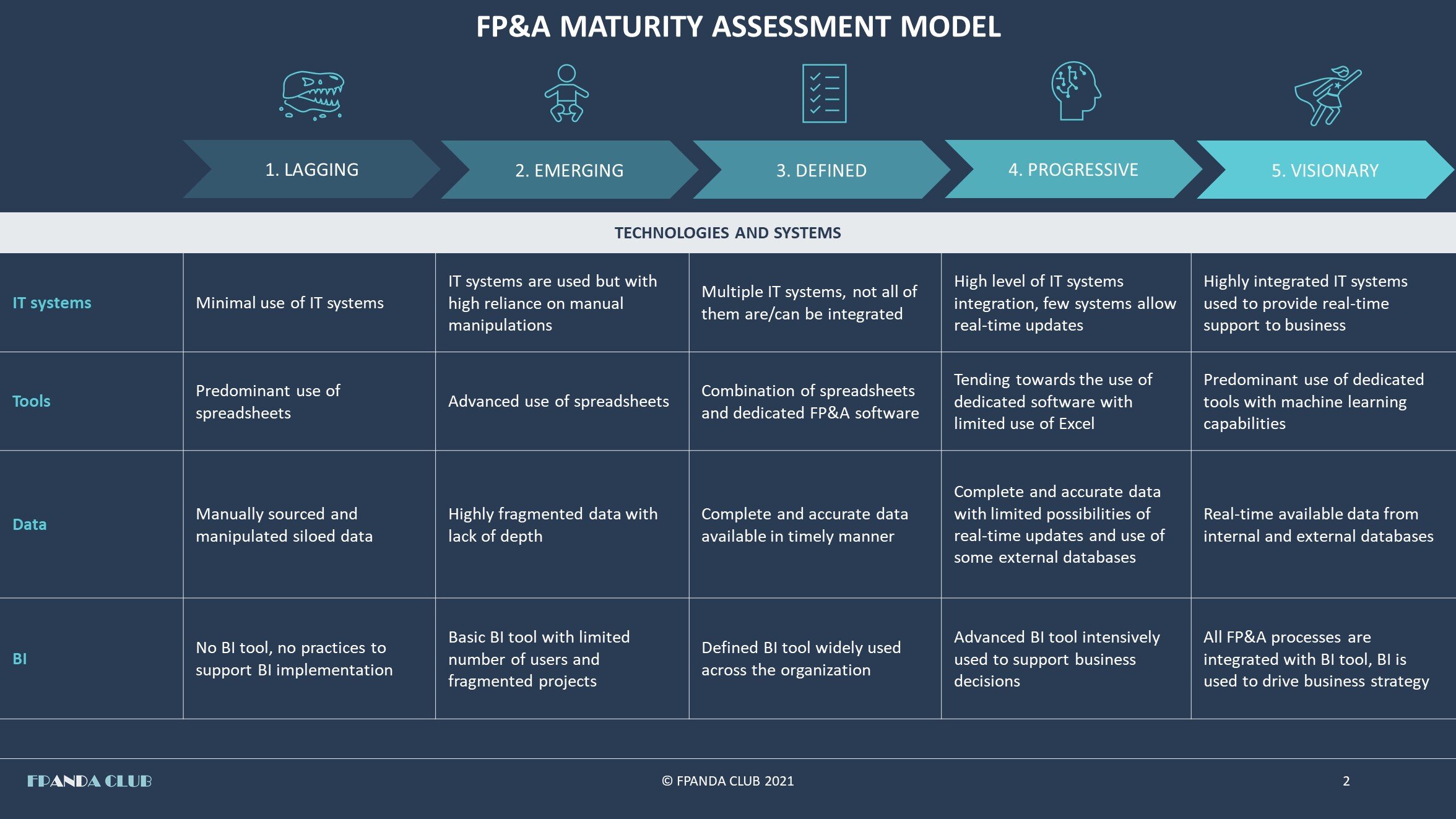

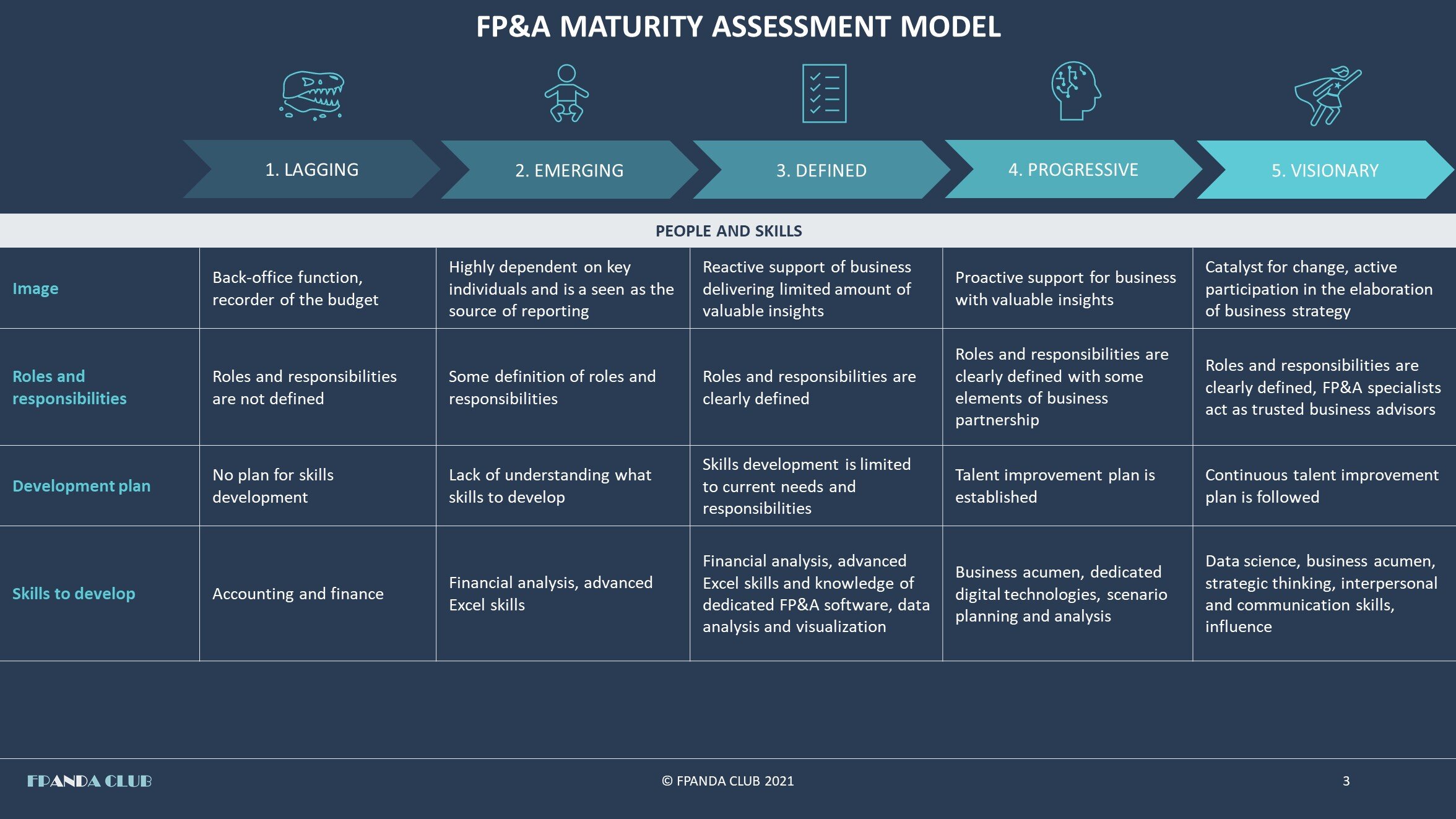

This article describes the FP&A maturity assessment model focused on major tasks of the function (strategic planning and budgeting, forecasting, analytics, management reporting, performance management and decision support) and built around 3 key areas – processes, tools/systems and people. To assess the level of maturity of your FP&A function a free high-level and easy to use tool is available for download (Excel file which contains no macros).

FP&A Maturity assessment model shown below comprises five stages representing evolution of FP&A: lagging, emerging, defined, progressive and visionary.

As FP&A organizations can vary from one to another and differ significantly in size, scope, structure and culture, we understand that it is rather challenging to create one model that fits all this diversity. Moreover, the FP&A function encompasses many processes and activities which even within the same company can be positioned differently in terms of their maturity. Thus, every FP&A organization can simultaneously demonstrate attributes of several stages depending on the criteria of assessment and the focus of the provided services. Therefore, the overall result of the assessment may fall somewhere in between the proposed stages of maturity. Keeping this in mind, the main goal of the model is to evaluate the capabilities and highlight the opportunities for improvement in various aspects of the FP&A function.

Lagging

At this stage of the maturity, the FP&A function or team is usually a part of other finance entities such as accounting, treasury or finance function in general, with roles and responsibilities that are not clearly defined and processes that lack formal description. Reporting, planning and forecasting exercises are highly manual, require significant efforts and are based on standard general ledger information. No or minimal IT systems are used with data stored and manipulated manually which results in errors, further corrections and outdated information.

Lagging stage can be common to some recently founded startups and is characterized by the lack of formal FP&A structure, processes and procedures. However, some elements of the lagging stage can exist in mature organizations focused on accounting and reporting functions rather than on analytics or simply in the companies that prefer not to invest in the evolution of their FP&A functions. The positive side of this stage is that there are plenty of opportunities for improvement, so if you are an enthusiastic leader and recognize your FP&A function in the description, it is time to roll up the sleeves and get to work.

Emerging

At this stage the FP&A function is hardly supposed to be distinguished from the rest of the finance function. However, some core processes, such as budgeting and forecasting, are partially defined. This definition can be rather inconsistent as well as the description of team’s roles and responsibilities mostly focused on generic finance activities. Annual budgeting is a bottom-up exercise and has some focus on business units in addition to legal entities. Reporting is mostly unstructured and inconsistent as data is highly fragmented. IT systems can be implemented, including a basic BI tool, but all processes mostly rely on the advanced use of spreadsheets.

Emerging stage is perhaps one of the most widespread or at least the one every FP&A organization passes at a certain period of development. Surveys show that 75% of organizations still rely on spreadsheets while preparing their budgets and plans, which results in various issues with functional constraints, data integrity, versioning, accessibility. The goal of the FP&A function at this stage of maturity is to proceed to the next stages as soon as possible to create and streamline core processes, enrich analytics and start to create value.

Defined

This stage is characterized by clearly defined and described roles, responsibilities and processes within the FP&A function which distinguish FP&A professionals from other members of the finance team. Planning, forecasting and reporting are focused on business units, are mainly standardized and partially automated based on the combination of spreadsheets and dedicated FP&A software solutions, including a widely used BI tool. Accurate and complete data contributes to generating valuable insights and providing strong analytics with an emphasis on what happened and why. Many metrics are included in the performance management system and the most of them are useful for the business.

Defined stage is the FP&A organization based on the established, proven standard practices that can support FP&A processes in their traditional forms. However, there is room for improvement in terms of talent development and the implementation of emerging best practices which will be more adjusted to modern needs, requirements and expectations.

Progressive

At this stage of maturity, the FP&A function adopts a range of advanced systems, techniques and tools to support its processes. Annual budgeting is replaced by a driver-based rolling forecast performed in a collaborative manner with a high reliance on integrated IT systems and a dedicated FP&A software. Getting rid of manual tasks, FP&A analysts have more time at their disposal to offer proactive support to business providing meaningful analysis and valuable insights. Analytics is focused on the future aiming to predict what will happen, model risks and opportunities. Reporting and established KPIs reach their users in the right time and right form to influence business decisions. A shift towards a business partnership model is supported by the talent improvement plan with an accent on the development of commercial awareness, business acumen, scenario planning as well as proficiency in digital technologies.

Progressive FP&A is characterized by using best practices in key processes of the function and tends to leverage technologies to bring value. In terms of automation of planning and forecasting processes, this stage of maturity is reached by less than 10% of FP&A organizations which confirms that most FP&A functions have a long way to go.

Visionary

At a supreme stage of the FP&A maturity, all processes are optimized, fully automated and integrated: self-service real-time planning and reporting aligned with business strategy, forward-looking prescriptive analytics based on the “what-if” scenario planning and machine learning capabilities. The FP&A function not only participates in the decision-making process but ensures strategic alignment and drives change. Continuous team development plan is followed and is focused on data science, business acumen, strategic thinking, interpersonal and communication skills to support the role of FP&A professionals as trusted business advisors.

The development of the FP&A function is, undoubtedly, a long and hard journey which takes many years and requires significant investments in IT systems, tools and talent acquisition. However, not taking the path of transformation will lead to the FP&A organization falling behind the current and emerging needs of its stakeholders, missing the opportunities to leverage technological advantages and contribute to the business development.