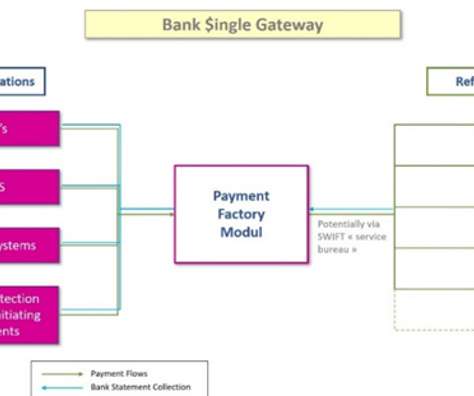

Bank Single Gateway for efficient connectivity

Simply Treasury

AUGUST 3, 2022

Automated bank connectivity through a single secure channel has become essential to reduce costs, facilitate on-boarding by banks, secure transactions, speed up and automate reconciliations and reduce staff workload. It's the key to finally having better cash management, as multinational companies do. Increasing risks of frauds.

Let's personalize your content