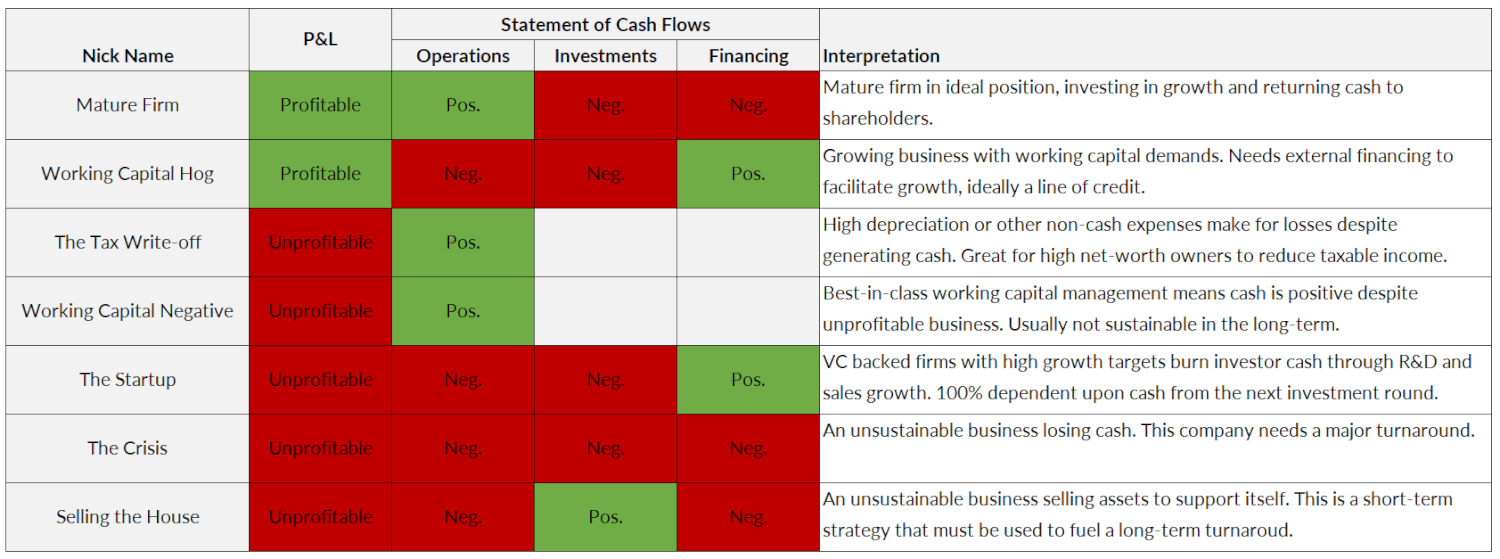

The cash flow statement and the income statement are closely intertwined but measure different aspects of a company’s financial performance. Understanding the complex relationship between the two yields powerful insight into the business health. Here’s how they can be correlated in different scenarios:

Mature Firm – Profitable P&L and positive cash flow

The most sustainable situation and generally a favorable one as the company is generating profits on the income statement and generating positive cash flow from its operations. This company’s core operations are healthy and able to generate cash to support its activities.

Working Capital Hog – Profitable P&L but negative cash flow

This situation can occur when the company may have high levels of accounts receivable or inventory, indicating that sales have been made, but the cash has not been collected or converted into cash yet. In this situation, the business needs cash from financing to support further growth, typically in the form of a business line of credit.

The Tax Write-off – Unprofitable P&L but positive cash from operations

This scenario suggests that the company is generating cash from its core operations, even though it is reporting a net loss on the income statement. This can occur when the company has non-cash expenses such as depreciation or inventory write-downs,

Working Capital Negative – Unprofitable P&L but positive cash from operations

Similar to the tax write-off firm, a company can experience losses on the income statement but positive cash flow when there are significant working capital improvements, such as a decrease in accounts receivable or inventory levels. This scenario can be good, as it may reflect efficient working capital management or non-cash accounting deductions. However, the long-term future of the business is not sustainable. Success hinges on the company’s trajectory towards future profitability, which will enable it to self-finance its operations.

The Startup – Unprofitable P&L but positive cash from financing

An unprofitable company that raises cash through debt or equity will see positive cash from financing and negative net income on the P&L. For example, a venture-backed company that just completed a series A round would likely show an unprofitable P&L but positive cash from financing. This combination indicates that the company is relying on external sources of funding to support its operations and cover its losses. Relying on external funding can be good for growth-stage companies but may become unsustainable in the long term. It’s considered good if aligned with a strategic growth plan, but it’s bad and unsustainable if there’s no clear path to profitability and the reliance on external funds continues indefinitely.

The Crisis – Unprofitable P&L and negative cash flow

This situation implies that the company is not generating sufficient cash from its operations to cover its expenses, resulting in a negative cash flow. This situation is unsustainable and may indicate a pending liquidity crisis. Such companies need additional financing, revenue growth, or cost-cutting measures to survive.

Selling the House – Unprofitable P&L and positive cash from investments

This is a crisis company in disguise – supporting itself by liquidating assets. Selling assets is a good short-term tactic to shore up cash, but the position is not sustainable. This company must complete its turnaround before running out of money.

Conclusion

A small business’ ability to analyze the P&L and statement of cash flows is critical to choosing the right financial strategy. Best in class businesses have a financial professional performing this analysis on a monthly basis, at minimum.

Outsourcing your CFO and finance department can help you interpret these financial statements correctly and help you make the best decisions for your business. Schedule a call with our team to learn more.

This article was written by a CFOshare employee with assistance from generative AI for rhetoric, grammar, and editing. The ideas presented are a combination of the author’s expertise, original ideas, and industry best practices.