No time to read this article now? Download it for later.

Does your nonprofit have ownership of a for-profit entity? Whether your organization owns a for-profit company outright or has limited ownership, a for-profit subsidiary can have serious tax implications for your nonprofit.

Let’s work through some of the most pressing tax implications you might face as a nonprofit with ownership in a for-profit company.

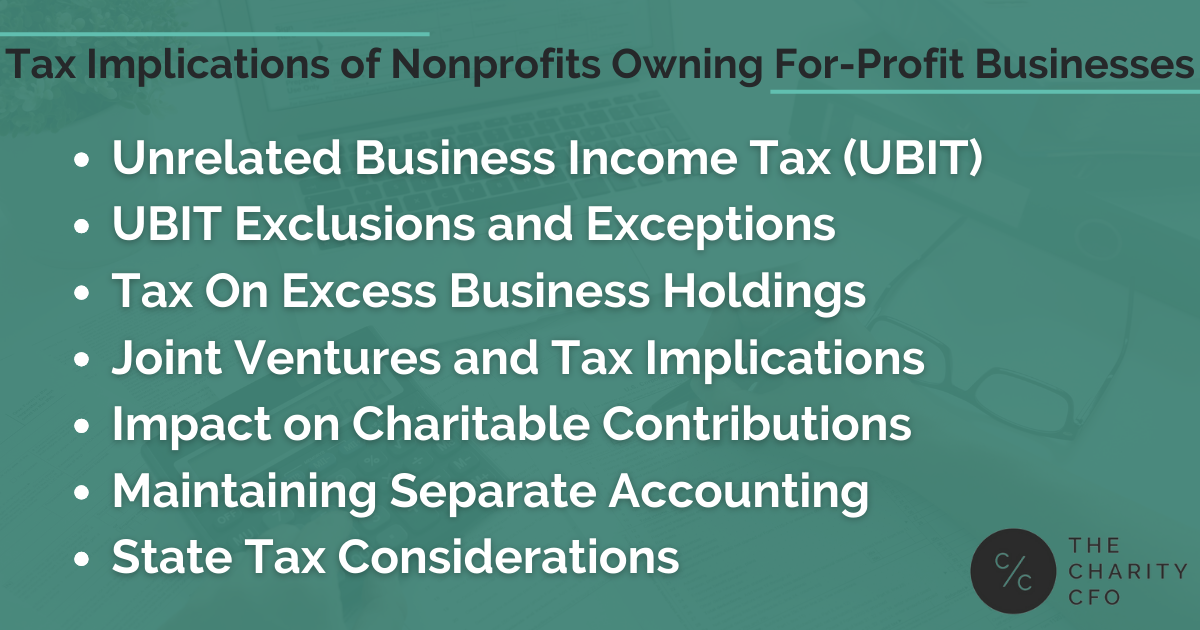

Tax Implications of Nonprofits Owning For-Profit Businesses

Unrelated Business Income Tax (UBIT)

Recognized nonprofits generally receive tax-exempt status from the federal government. Tax-exempt status makes it easier for your organization to retain nonprofit revenue and meet the goals of your mission.

However, your nonprofit may engage in revenue-generating activities that don’t relate to the purpose of your organization. The money that comes from these activities is known as unrelated business income because it’s earned from activities that are unrelated to your exempt mission.

The IRS can potentially charge your organization federal income taxes on your unrelated earnings. Known as unrelated business income tax (UBIT), you may face this tax liability if your nonprofit regularly carries on a trade or business that doesn’t substantially relate to your exempt mission or purpose.

UBIT Exclusions and Exceptions

Not all unrelated business income is subject to federal income tax. The IRS provides UBIT exceptions and exclusions to account for situations where a nonprofit uses for-profit activities to advance its exempt purpose.

Common nonprofit income that could be excluded from UBIT includes:

- Dividends and Other Investment Income

- Interest Earnings

- Royalties

- Certain Rental Income

- Gains or Losses from the Disposition of Property

Additionally, income generated using a majority volunteer labor force may qualify for an exception. For example, hosting a fundraising auction operated by volunteers may not require UBIT payment.

Tax On Excess Business Holdings

The IRS uses taxes on excess business holdings to limit how much ownership a nonprofit can have in a for-profit company without paying federal taxes. Taxing excess business holdings helps reduce conflicts of interest and limits the power a tax-exempt entity has over a business.

Excess business holdings are shares or interests a nonprofit holds in a for-profit company that exceeds the IRS’s limits. Generally, any ownership share over 20% of voting stock in a company is considered an excess business holding. Nonprofits with excess holdings may face an excise tax on the value of shares over the limit.

Joint Ventures and Tax Implications

Many nonprofits partner with for-profit entities to help advance their mission with the financial backing of their partner. For example, a mental health organization might create a joint venture with a for-profit healthcare system to establish mental health facilities in underserved areas.

Depending on the nature of the joint venture, nonprofits could jeopardize their tax-exempt status if they don’t follow certain limitations, including:

- The joint venture must seek to further the nonprofit’s charitable purpose.

- Any benefits to the for-profit entity must be insubstantial compared to the public benefit of the partnership.

- The nonprofit must have control over the charitable activities of the venture.

You may want to work with a nonprofit financial advisor or accountant to set up a joint venture with a for-profit entity. Your advisor can help you avoid pitfalls that could affect your tax-exempt status.

Impact on Charitable Contributions

Donors to nonprofits often receive tax benefits for their charitable giving. In most cases, a donor may be able to deduct certain charitable donations from their taxes. Many donors use nonprofit donations to lower their taxable income for the year.

Giving money to a nonprofit with for-profit business ownership could limit the donor’s ability to deduct donations, however. If your nonprofit engages in for-profit activities, you’ll need to communicate with donors to let them know. Proper communication helps donors understand the tax implications of their gifts and improves your organization’s transparency.

Maintaining Separate Accounting

Any nonprofit with for-profit ownership needs to maintain separate accounting for each area of business. This includes keeping separate financial statements, revenue records, and bank accounts.

Separating business activity is essential for maintaining accurate records of income, expenses, and activities associated with each business. Properly-recorded books can help reduce your chance of noncompliance in a nonprofit audit.

State Tax Considerations

The tax implications we’ve already covered mostly relate to federal tax-exempt status.

However, state tax agencies may also have rules for nonprofits that operate for-profit businesses. You’ll need to check your state’s tax laws and regulations to see how they might affect your organization.

Seek Professional Guidance for More on the Tax Implications of Nonprofits Owning For-Profit Businesses

Few parts of nonprofit accounting are as complicated as a nonprofit owning a for-profit business. Your organization may be liable for certain taxes on excess business holdings or income from unrelated business activities. In some cases, operating a for-profit entity could put your nonprofit at risk of losing its tax-exempt status.

Nonprofit leaders like you don’t have to navigate tricky tax implications on your own. Working with a trusted nonprofit tax advisor, like The Charity CFO, gives you the resources to avoid unwanted tax implications.

Our team of dedicated nonprofit accountants and financial advisors is ready to put our specialized knowledge to work for your organization. Reach out to us today to get started!

Do You Struggle to Make Sense of Your Financial Statements?

Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization's finances.

Get the free guide!

0 Comments