My back-to-work morning reads:

• How to Tweak Your Investments for a More Normal Market: Convert a traditional IRA to a Roth IRA; Higher interest rates means cash gets a respectable yield; Revisit concentrated positions; consider adding international stocks; buy longer-dated Treasuries. (Barron’s)

• Economists May Have Been Flying Blind All Along: Declining response rates to official surveys raise the possibility that government and central bank officials have been making decisions based on flawed data. (Bloomberg)

• It’s the Most Wonderful Time of the Year (for the Economy): For many Americans, the end of the year is a time for parties, family gatherings, festive meals and, of course, shopping. And all that holiday celebrating makes the fourth quarter the most important time of the year for the U.S. economy. (New York Times)

• The Unexpected Winner in the Craziest Week in AI: Microsoft Chief Executive Satya Nadella made a huge bet on the world’s hottest AI company. After it nearly blew up on him, he now emerges with closer ties to its leader, Sam Altman. (WSJ)

• No, Really. Building More Housing Can Combat Rising Rents: To many people, new home construction is synonymous with gentrification. But a new analysis reinforces how more supply drives down housing costs. (CityLab)

• Dubai’s Costly Water World: The city has spent billions of dollars to provide fresh water to its residents and tourist attractions, but experts say the efforts are straining the Persian Gulf’s natural resources. (New York Times)

• Why Randomness Doesn’t Feel Random: Randomness can leave our human brains poorly placed to make sensible deductions, and, unfortunately for us, it is a part, to a greater or lesser degree, of many everyday situations we are faced with, from the arrival time of the next bus to the next song that is dealt to us by our music players when set to shuffle. (Behavioral Scientist)

• How Elon Musk Spent Three Years Falling Down a Red-Pilled Rabbit Hole: His tweet endorsing an antisemitic theory that sent advertisers fleeing comes after years of increasing interaction with extremist content. (Businessweek)

• The asbestos times: Asbestos was a miracle material, virtually impervious to fire. But as we fixed city fires in other ways, we came to learn about its horrific downsides. (Works in Progress)

• The long goodbye: Working through the queue. My relationship with Netflix, like any long-term relationship, has had its ups and downs. I dipped my toe in with a one-DVD-at-a-time plan, but I soon upgraded that to two. (The Smart Set)

Be sure to check out our Masters in Business interview this weekend with Peter Atwater, who teaches confidence-driven decision-making as an adjunct professor at William & Mary and the University of Delaware. He coined the phrase “K-Shaped Recovery” to describe the confidence divide between the top and bottom of the economy post-pandemic. His new book is The Confidence Map: Charting a Path from Chaos to Clarity.

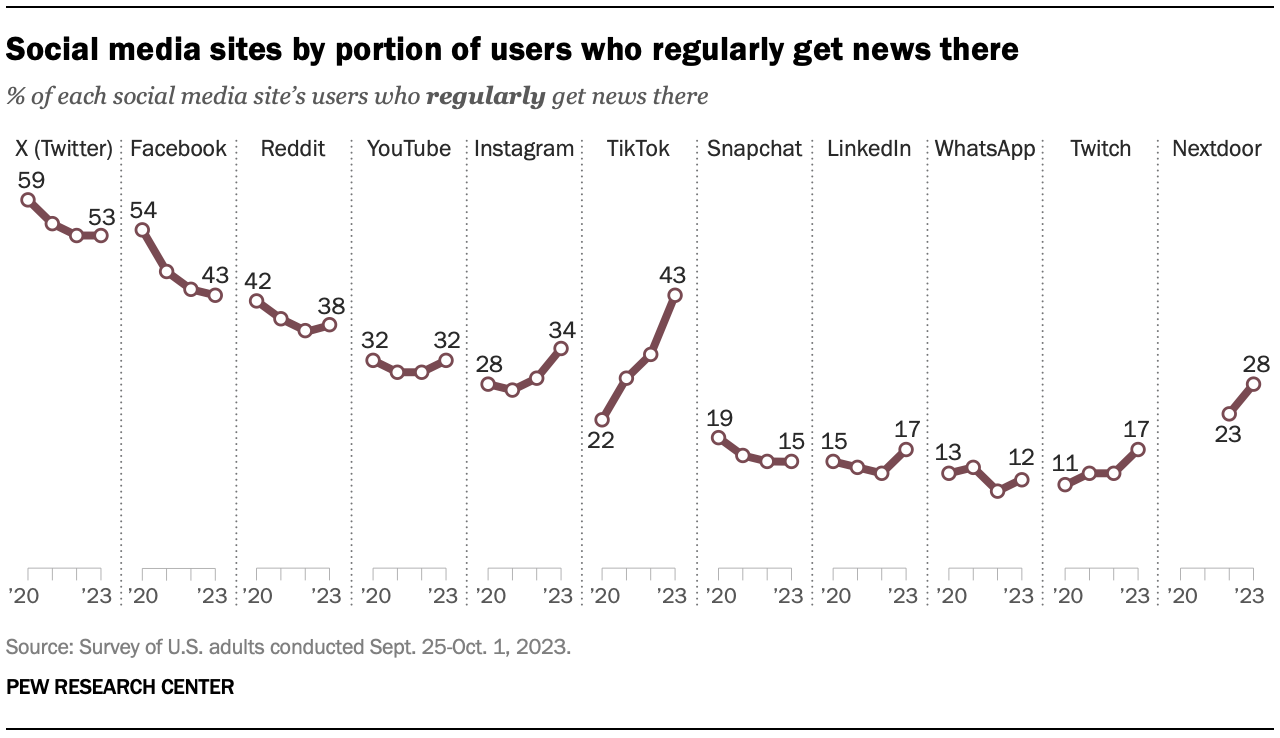

News consumption on social media

Source: Pew Research

Sign up for our reads-only mailing list here.