What are the Bull and Bear cases for 2024?

I don’t do annual forecasts1 because the short-term is way too random. Instead, I prefer to consider market history and recent data, and ask “What are the possible and probable outcomes for this year?”

I find it very useful as an investor to be able to see both sides of the bull-bear debate. Toward that end, here are a dozen bullish and bearish factors I suspect are most likely to influence how the markets will progress this year.

Let’s jump right in:

~~~

Reasons to be Bullish

1. Momentum: The S&P 500 rose 24.2% last year after falling 19.4% during 2022. Since 1928, years with gains of over 20% were followed by an average gain of 5.9%; My colleague Ben Carlson points out that good years have a tendency to cluster together. “Many times good returns are followed by good returns (but sometimes good returns are followed by losses.)”

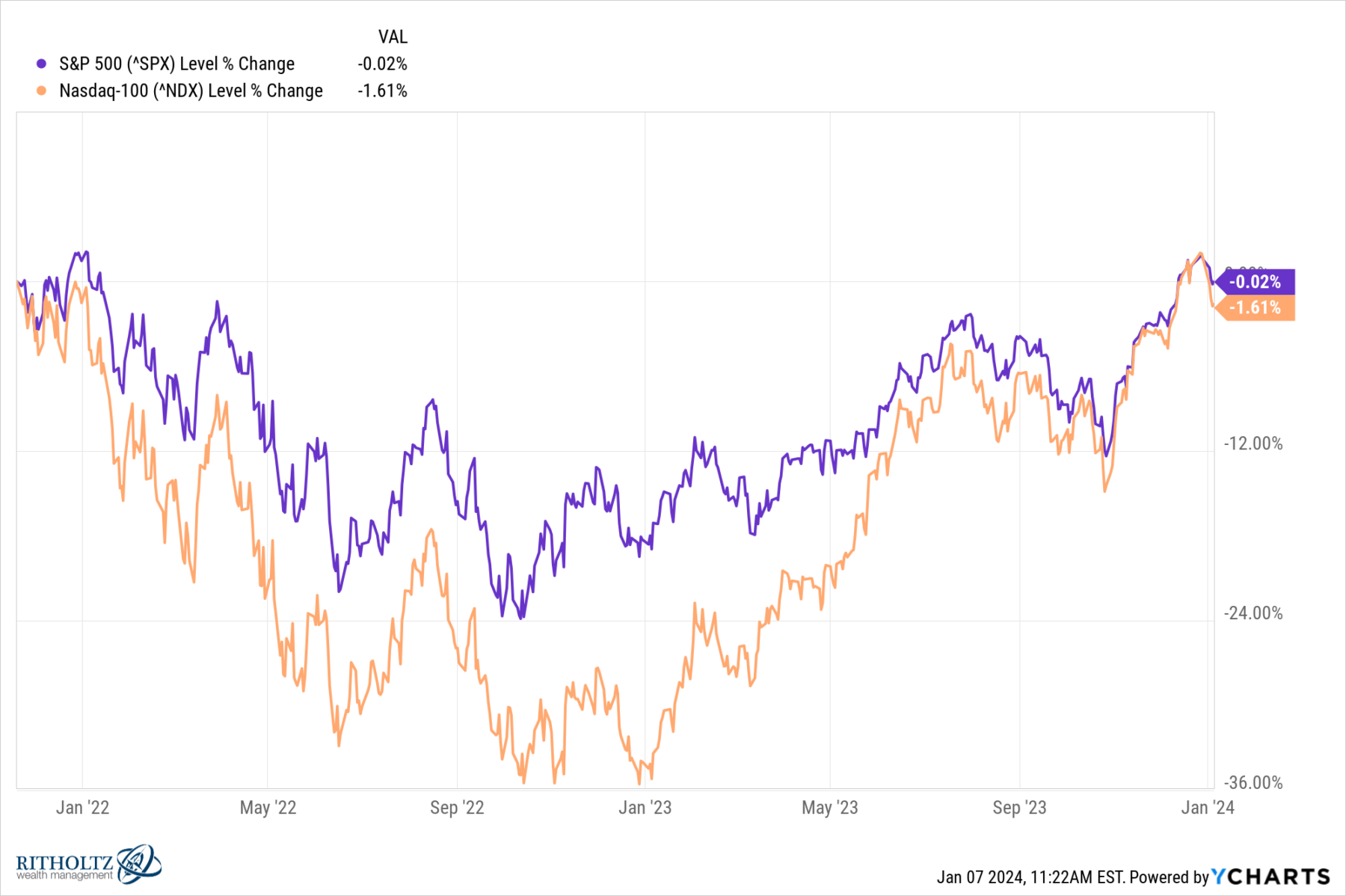

2. Flat over 2 years: The S&P 500 gained >12.1% in Q4 2023 – up ~36% since the October 2022 lows, and up 24.2% for the full year. It finished 2023 with 9 consecutive weeks of gains. While some folks are suggesting that this is “Too far too fast,” I suggest putting it into context: As the chart above shows, the S&P 500 has been ~flat since its November 2021 peak, and essentially flat over 2022-23 calendar years.

Same for the Nasdaq 100: It gained 14.3% in Q4, and a whopping 53.8% in 2023, its best performance since 2009. But for context, the Nasdaq 100 is also flat since its November 2021 peak, and up a mere 3.1% over 2022-23.

3. No Recession: Excluding recession years, after a big up year, the 2nd-year saw gains that averaged 9.7%. During recession years losses averaged 10.1%. Down years are far more likely than up years to be associated with recessions. Since 1928, markets have fallen in non-recessionary years only 16 times, and 2022 was one of those exceptions (down 19.4%). Besides 2022, recent examples include 2018, 2000, and 2002 (the recession was in 2001).

4. Inflation: I have repeatedly been pounding the table that inflation peaked in June 2022; that was a lonely position for a while, with a handful of people – Ed Yardeni, Paul Krugman, and Claudia Sahm come to mind – who also saw this happening in real-time.

As Ed Yardeni observed: “Inflation tends to be a symmetrical phenomenon. It tends to come down as quickly or as slowly as it went up when measured on a y/y basis. We can see this consistent pattern in the CPI inflation rate for the US since 1921.”

It is now obvious that inflation fell much faster than was widely expected. But for a long time, many refused to believe it, and they acted on their beliefs by selling equities.

Regardless, most measures of inflation had already peaked by June 2022. PCE at 7.1% in June 2022; Core inflation at 5.6% in February 2022, then falling to 3.2% during November 2023. Durable goods inflation also peaked in February 2022 at 10.7%, and fell to -2.1% by November of 2023. Non-durable goods inflation rate also peaked in June 2022 at 13.1% before falling to 0.7% in November 2023. (Data via Yardeni Research).

5. Federal Reserve: While a recession is possible in 2024, it mostly depends upon how long the FOMC keeps rates tighter (higher) than is appropriate for the economy. I explained this in an open letter/BusinessWeek article in August, to Jay Powell:

“Mazel tov! You beat inflation and avoided a recession. Revel in the sweet taste of victory as you fly-fish with other central bankers at the annual symposium in Jackson Hole, Wyoming. With inflation at 3.2%, unemployment at 3.5% and gross domestic product expected to top 3% in the third quarter, you’ve earned a vacation. Hell, take the rest of the year off!”

That turned out to be exactly correct.

Note: I have the Fed in both bullish and bearish sides of the arguments because depending upon what they end up doing in 2024 will be significant in each direction.

6. Misreading Housing: I keep pointing out we are measuring the Housing component of the PCE services inflation rate incorrectly. It has fallen slowly, from 8.3% y/y in April 2023 to 6.7% in November – but as I have been warning since 2007, we measure this incorrectly using a poor model of housing prices called “Owners Equivalent Rent.”

OER is the wrong way to model residential inflation. We can see this in actual real-time measures (as opposed to OER’s modeled lagged extrapolations) such as this. Zillow Research and Apartment List Rent Indexes. They showed 3.0% and -1.2% in November housing cost inflation measures respectively. It is very likely the Fed’s OER inflation rate will drop in coming months from 6.9%

~~~

Reasons to be Bearish

1. Long and Variable Lags: The recessionistas who are convinced a recession scenario is likely for 2024 are basing their forecasts a simple fact: Monetary policy impacts the economy on a delay (aka “long and variable lags”). This has been showing up in data such as the State Coincident Indicators, which are softening.

550bps increases in the Federal Funds rate from March 2022 through July 2023 – and its long and variable lags – continues to exert a drag on the economy, which could lead to further economic contraction. All of that tightening is why we cannot rule out a recession in 2024.

2. CRE/WFH: The post-pandemic environment continues to be difficult for commercial office real estate. The banking sector has funded all of the construction and purchases over the past decade. Banks hold over $3 trillion in CRE; Unrealized losses on Treasuries and mortgages are about $684bn (Source: Torsten Slok, Apollo).

Weaker demand to more people working from home, and of course higher interest rates are a drag on this sector. The worst buildings in the least desirable regions could be looking at a 40% decline in the price per square foot for office space.

3. Market Concentration: What happens when the Magnificent 7 is no longer so magnificent?

Perhaps the market broadens out to include more large, mid, and small-cap stocks catching a bid. But just as likely is that equity markets see their biggest growth engine sputter, dragging the major indices back to much smaller gains — or worse.

4. Yield Curve Inversion: The yield curve has been inverted since the summer of 2022. Inverted yield curves correctly anticipated the past eight recessions. Campbell Harvey of Duke, who created this indicator, points out they tend to disinvert at the start of the recessions. We are starting to see signs of that dis-inversion…

Related issue: Single-family housing has signaling recession since 2022, when mortgage rates spiked.2 Mortgage rates have fallen since peaking in late October, and if that continues, it’s a huge positive (hence why it does not get its own bullet)

5. Global Slowdown or Recession: In the US, there are signs that consumers are running out of excess savings and taking on more debt. Europe has been in a mild slowdown, with what some call rolling recessions throughout the continent (the slowdown there and in China probably explains lower oil prices). China seems to be in or close to recession; its real estate market is a perennial potential property crisis.3

6. War: Conflict in the Middle East risks disrupting oil production and sending crude prices higher. A spillover could drag other nations (Iran, USA) into the conflict. The Russian invasion of Ukraine is the same; China & Taiwan is a perpetual worry.

~~~

As Elroy Dimson observed, “Risk means more things can happen than will happen.” The dozen variables above are the risks that I see as likely to determine how 2024 unfolds. This is before we consider the “unknown unknowns” that await us. Hence, why forecasting is so fraught with error.

The world is simply way too random a place to make reliable forecasts a year into the future. That is not enough time for the longer-term secular trends to play out, but it is a long enough period for millions of random events to temporarily derail the dominant trends in place and derail our expectations.

Previously:

Forecasting & Prediction Discussions

Can Economists Predict Recessions? (September 29, 2023)

Round Trip: Lessons From the 2022 Bear Market (August 1, 2023)

How Bullish Were You in 2011? (November 29, 2023)

__________

1. Normally around now, the most forecasty time of the year, I write a column excoriating all of those people who blew their 2023 calls. Why? It’s not that your forecast was wrong, it’s that you are forecasting in the first place. More on this at a later date.

2. ~40% of all homeowners are mortgage-free. Most of the rest refinanced at record-low mortgage rates.

3. Seriously, who the hell knows what is gonna happen here…