My Two-for-Tuesday morning train reads:

• How four different types of stock market participants are thinking about 2024: Financial pros are bullish, but consumers not so much. (TKer) see also When Bond Yields Dropped, the Everything Rally Kicked Off: Stocks, bonds, crypto and gold are surging, sparking worries of a fleeting sugar high (Wall Street Journal)

• ESG Critics Ultimately May Help Improve the Strategies: Subjective and arbitrary decisions do affect ESG rankings — but ongoing challenges may lead to more accurate assessments. (Institutional Investor)

• Retail Group Retracts Startling Claim About ‘Organized’ Shoplifting: The National Retail Federation had said that nearly half of the industry’s $94.5 billion in missing merchandise in 2021 was the result of organized theft. It was likely closer to 5 percent. (New York Times) see also Retailers Lobby: “We Lied About Organized Theft” The claim that organized retail crime accounted for “nearly half” of inventory losses was false, but it’s also an indictment of modern media. All too often, the truth matters much less than meme production and clickbait. Who has time to actually fact-check news when something this juicy comes along? That it was obviously false and based on old lobbyists’ reports never seemed to raise any red flags. (The Big Picture)

• The war on ‘junk fees’ is gaining ground, but the fight is not yet won: If you’ve rented a car, bought an airline ticket, booked a hotel room or paid a cable bill, you probably know what the White House is talking about: hidden, surprise charges for services you may not even have used, transaction charges for buying online or downloading a concert ticket instead of picking it up at the box office, etc., etc. (Los Angeles Times)

• What if Tesla Is…Just a Car Company? Tesla’s aura as an elite tech disrupter dims as EV competitors multiply and improve their offerings. (Wall Street Journal) see also Why Repairing Your EV Is So Expensive: Battery-powered vehicles face longer wait times and bigger repair bills than gasoline-engine vehicles. (Wall Street Journal)

• Coffee Lovers, It’s Time to Stop Using K-Cups This week, we talk with our resident kitchen expert about coffee: the best ways to make it, what gear to buy, and what to avoid. (Wired)

• Greedflation: corporate profiteering ‘significantly’ boosted global prices, study shows. Multinationals in particular hiked prices far above rise in costs to deliver an outsize impact on cost of living crisis, report concludes (The Guardian) see also Corporate America Is Testing the Limits of Its Pricing Power: Firms may struggle to keep profits up if demand slows, but so far they are finding ways to keep margins wide. (New York Times)

• Guide to holiday season tipping: Who to tip and how much to give It’s time to start making your list and checking it twice. (The Week)

• Google launches Gemini, the AI model it hopes will take down GPT-4: Google has been an ‘AI-first company’ for nearly a decade. Now, a year into the AI era brought on by ChatGPT, it’s finally making a big move. (The Verge) But see Generative AI’s iPhone Moment: Google’s long-awaited Gemini model shows that the technology is losing its magic. (The Atlantic)

• Angelina Jolie Is Rebuilding Her Life: After years of healing, the actress is starting a new fashion venture and paring back her Hollywood presence: ‘I wouldn’t be an actress today.’ (Wall Street Journal)

Be sure to check out our Masters in Business with Joel Tillinghast of Fidelity, where since 1989, he has managed the Fidelity Low-Priced Stock Fund (and others). Over his 32-year tenure, the fund has beaten 100% of peers, and outperformed the Russell 2000 benchmark by 3.49% annually, and has more than doubled the performance of the S&P 500.

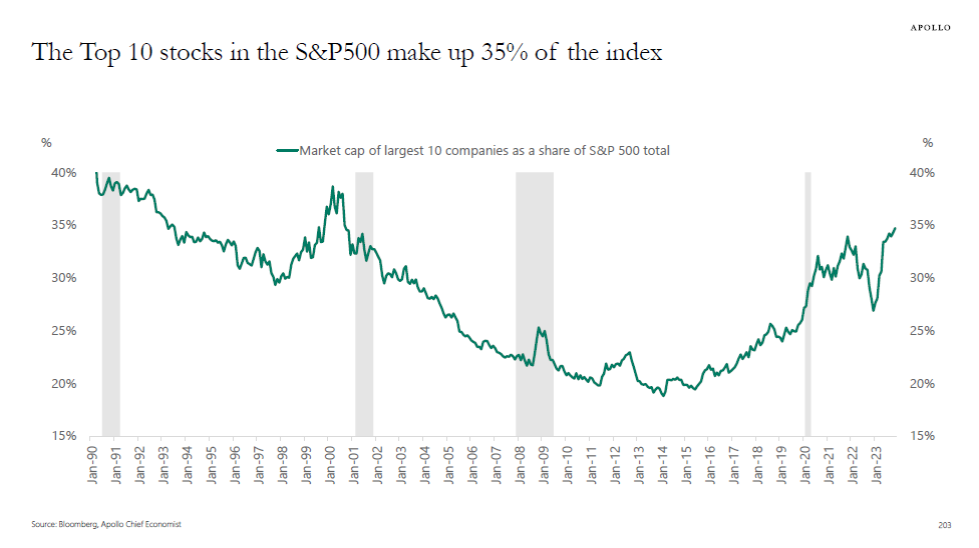

The concentration in the S&P500 continues to increase, and the ten largest stocks now make up 35% of the index

Source: Torsten Slok, Apollo Global