My morning train WFH reads:

• What recession? This summer’s economy is defying the odds. Americans still have jobs and are continuing to spend — on plastic surgery, motorcycles and cruises — leading many to revise their doom-and-gloom forecasts. (Washington Post)

• The Anti-California: How Montana performed a housing miracle: Montana had a supply crisis. It needed a supply solution. How to get Montana more housing: Make it possible for folks to build housing units by right, rather than having every development go through a miserable, expensive process of negotiation. Encourage dense development in already dense areas. Cut red tape. (The Atlantic) see also A.I. Can’t Build a High-Rise, but It Can Speed Up the Job: Developers are embracing artificial intelligence tools like drones, cameras, apps and robots, which can reduce the timelines and waste that have made construction increasingly costly. (New York Times)

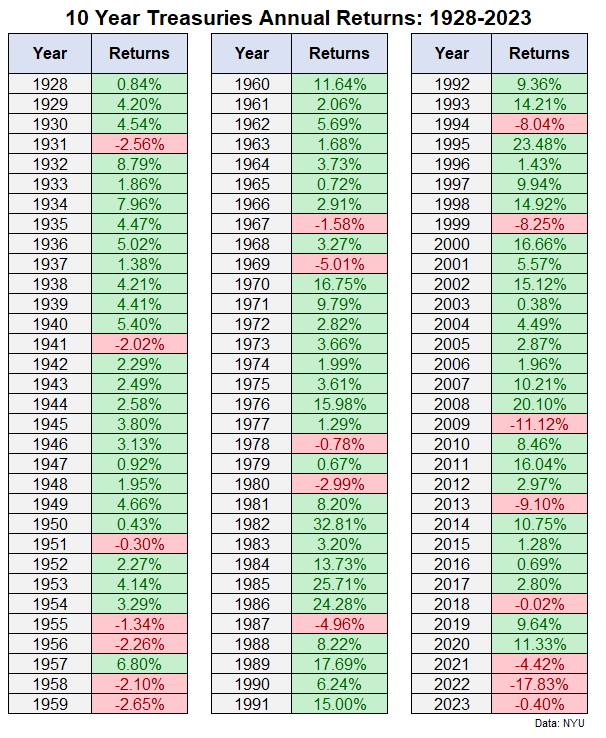

• Bond Yield Hits Highest Since 2008, Adding Pressure to Borrowing Costs: Bets that interest rates will fall have suppressed 10-year yields for most of 2023, but analysts warn that may be changing. (Wall Street Journal)

• Venture capital funds are mostly just wasting their time and your money: Morgan Stanley equity strategists Edward Stanley and Matias Øvrum have run the numbers for the past 20 years of crossover investing and found that the average VC fund doesn’t reliably outperform the average stock. (Financial Times Alphaville)

• How a Small Group of Firms Changed the Math for Insuring Against Natural Disasters: Climate change, inflation and global instability have thrust companies that sell insurance to insurers into the spotlight. (New York Times)

• Taxing the 1 per cent: Public Opinion vs Public Policy: Recent studies suggest that public policy in established democracies mainly caters to the interests of the rich and ignores the average citizen when their preferences diverge. I asked Norwegians to design their preferred tax rate structure and matched their answers with registry data on what people at different incomes actually pay in tax. I find that within the top 1%, tax rates are far below (by as much as 23 percentage points) where citizens want them to be. (Cambridge Core)

• See Inside a Ghost Town of Abandoned Mansions in China: Now, farmers are reportedly putting the land of the deserted development to use. (Architectural Digest)

• Google’s Search Box Changed the Meaning of Information: Web search promised to resolve questions. Instead, it brought on a soft apocalypse of truth. (Wired)

• The five conspiracies at the heart of the Georgia Trump indictment: What Trump, Giuliani, Meadows, Powell, and others were actually charged with. (Vox)

• The A’s Don’t Just Want to Leave Oakland. They Want to Leave Moneyball Behind, Too. In an interview, team president Dave Kaval says the team hopes revenue from a new stadium will help it pay more for players than its famous cost-conscious strategy. (Wall Street Journal)

Be sure to check out our Masters in Business next week with legal scholar Cass Sunstein, who founded and leads Harvard Law School’s program on behavioral economics and public policy. He authored several books, including the bestselling “Nudge: Improving Decisions About Health, Wealth, and Happiness.” (written with Nobel Laureate Richard Thaler) and the New York Times best-seller “The World According to Star Wars.” His new book is “Decisions about Decisions: Practical Reason in Ordinary Life.”

We could be looking at an unprecedented run of losses in the bond market

Source: A Wealth of Common Sense

Sign up for our reads-only mailing list here.