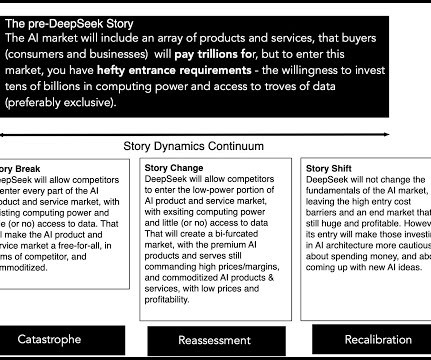

DeepSeek crashes the AI Party: Story Break, Change or Shift?

Musings on Markets

JANUARY 31, 2025

The investments in that AI architecture were being made, with the expectation that companies that invested in the architecture would be able to eventually profit from developing and selling AI products and services. This story leaves me with a judgment call to make about the relative sizes of the markets for the two pathways.

Let's personalize your content