Central bank digital currencies may disrupt financial systems

Future CFO

JUNE 13, 2021

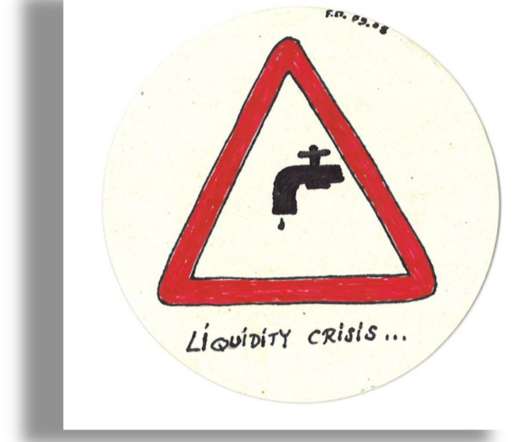

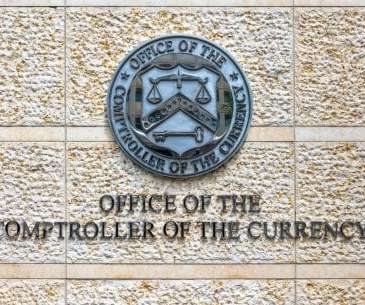

The broader adoption of general-purpose central bank digital currencies (CBDCs) will present authorities with trade-offs between the associated risks and benefits. The post Central bank digital currencies may disrupt financial systems appeared first on FutureCFO.

Let's personalize your content