How to put finance business partnering puzzle together?

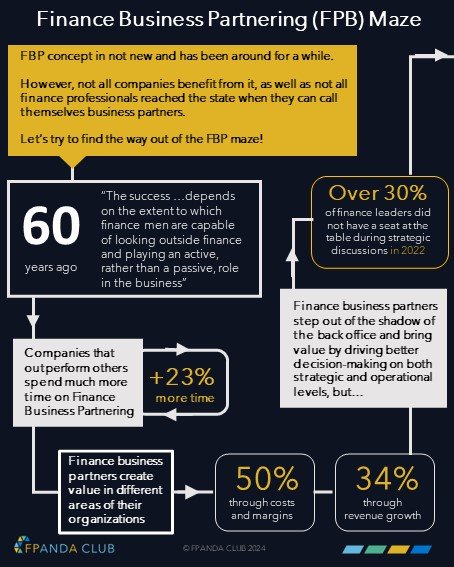

Finance business partnering is not a new concept and has been around for a while. Well, not just for a while, for more than 60 years.

“The success …depends on the extent to which finance men are capable of looking outside finance and playing an active, rather than a passive, role in the business.”

Since then, finance community could not come up with one single definition and understanding of finance business partnering to be used by everyone. It’s still unclear whether it’s a job title, or a role, or the way of working, etc.

Indeed, the concept is not the easiest one to define, but its benefits for the companies are intuitively obvious and well known. With a focus on driving better strategic and operational decisions, finance business partners create value through cost and margins, revenue growth and risk management.

Sounds great, right?

However, 22% of business managers don’t consider any other financial implications but revenue when making operational decisions.

Moreover, over 30% of finance leaders still do not have a seat at the table during strategic planning discussions.

Why not all companies are able to unlock the full potential of the FBP and can finance business partnering puzzle be eventually put together?

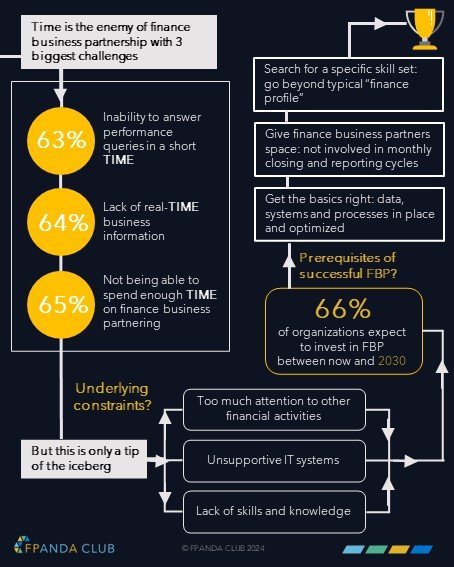

Time is usually mentioned as the worst enemy of finance business partners:

65% of finance organizations are not able to spend enough time on business partnering

64% of finance teams experience lack of real-time data

63% of finance organization can’t answer performance queries in a short time.

Time-related issues are only a tip of the iceberg or the consequences of a much broader range of underlying constraints to effective business partnering:

unsupportive IT systems and not optimized processes,

involvement of the finance business partners in other financial activities such as monthly closing and reporting,

lack of skills and knowledge.

Good news is that 66% of organizations are going to invest in finance business partnering between now and 2030.

But where to start?

Here are some prerequisites to get return on these investments and achieve successful implementation of finance business partnering.

Get the basics right

Advancements in automation, data practices, and innovative systems make it much easier to generate financial and non-financial insights. This is supposed to enable finance professionals to devote more time to interpreting and analyzing data, offering meaningful insights that contribute to better decision-making.

But it’s not that easy…

Unsupportive IT-systems are seen as one of the most constraining factors to finance business partnering. Various IT-related issues often stem right from the implementation phase when companies struggle to align their strategic objectives with IT solutions. This leads to further undesirable manual inputs or manipulations with data to meet quality standards and produce relevant information.

As result, only 20% of finance professionals consider themselves data masters having the tools and resources to provide effective insight. Among those who rest, 20% are data overloaded because of poor data governance and several conflicting data sources, 25% can’t get the data they need and over 30% don’t possess technology, tools, or resources to exploit the data they have.

The whole idea of finance business partnering is based on providing valuable insights derived from data analysis. Effective business partnering is dependent on accurate data, streamlined processes, and well-maintained IT-systems. These are the basic that should be in place and in good standing.

Without these foundational aspects, finance functions struggle to make meaningful contributions to financial or overall performance of the organization and the risk of losing credibility as a finance professional becomes too high and threatens the potential for true collaboration with other departments in the company.

Give finance business partners enough space

Time is the worst enemy of finance business partners. Yes, we hear that a lot. But what about space?

Don’t worry, I’m not going to talk physics here.

When asking finance professionals how much time they actually spend on finance business partnering, one of the common anwers is “we don’t have time on that” or something along these lines.

Interested by that phenomenon, I made a quick research on the job posts of finance business parners’ positions.

Monthly closing, reporting, compliance and support in audit are among the most frequent responsibilities mentioned in the descriptions. Literally almost everything but finance business partnering.

Time is probably not the initial problem here. Finance business partners need space to thrive.

Of course, all those operational tasks are essential and somebody have to execute them within a finance organization.

They should ideally bring business value, but let’s be honest, meeting regulatory requirements and reporting deadlines will always take precedence over business partnering responsibilities.

It’s not enough just to call somebody a “finance business partner”. A clear distinction between different roles in the finance department should be made to make the concept work.

It is extremely important to ensure this specific positioning of the finance business partners with their business focus and proactive approach in regards to other finance, accounting and controlling roles.

As for traditional financial roles, they have other priorities: correctness, completeness, timeliness of books and reports, etc. Not all finance employees can and should totally shift to business partnering, and there is nothing wrong with that.

However, finance business partners will perform the best when they are not bothered by time-consuming operational tasks and can focus on driving and supporting decision-making.

Otherwise, they will just add up to the budget of the finance function instead of adding value.

So, please give finance business partners space and they’ll have time to perform business partnering activities.

It’s not a space-time continuum model, it’s just that simple, right?

Search for a specific skillset

Employees’ competencies are crucial for successful business partnering. However, traditional finance background is not necessarily helpful in finance business partnering roles which require a different skillset.

Leaving aside analytical skills that are a “hard skill” must-have, soft skills are of particular value to finance business partners: communication and relationship skills, business understanding and advisory skills to name a few.

To recruit best candidates for finance business partnering roles, go beyond typical “finance profile” and look for the skills that are not naturally developed by finance professionals.

Another option is to grow your own business partners within the organization by offering finance professionals opportunities to gain experience with other departments or develop required skills through training programs.

One way or another, if you are really interested in successful finance business partnering, be ready to invest some money. To give you an idea, finance professionals that fit finance business partner profile with analytical, business acumen and effective communication skills cost around 25% more than those that do not possess these qualities.

Finance business partnering has been a hot topic for CFOs for many years. Being originally a department transforming data into information, finance organization is the best candidate for business partnering role.

However, finance organizations seem to struggle to position themselves as true business partners. Finance teams face various challenges related to IT-systems, transactional activities and upskilling. Once overcome, there will be no hurdles left for finance business partnering to finally become a reality.

References:

Future of Business Partnering Global Survey 2022. FSN The Modern Finance Forum, 2022.

Drive Financially Sound Operational Decisions. Gartner, 2018.

The State of Strategic Finance. Vena Industry Benchmark Report 2022.