By David Enna, Tipswatch.com

Back in early November I worked with financial adviser (and overall economic guru) Allan Roth on an article he was writing for AARP. The topic: How surging real yields of Treasury Inflation-Protected Securities now made these investments more attractive than Series I Savings Bonds.

A month later, on Nov. 28, the article went live on the AAAP site, with the headline: “Today’s Best Inflation Buster: Treasury Inflation-Protected Securities“. Here is Roth’s main conclusion:

While the I Bond bought today gives you a 0.4 percent rate above inflation, that five-year TIPS mentioned earlier yields inflation plus 1.625 percent. That’s 1.23 percentage points in yield more than an I Bond. I … think TIPS are generally superior to I Bonds right now, since they provide a greater yield. But that could change at some point.

As Roth noted, “That could change.” And yes, things have changed in the short time since that article was published. The 5-year TIPS yield dropped as low as 1.16% on Dec. 2, a substantial decline from the 1.63% just a few days earlier in November. In recent days, the 5-year real yield has rebounded, closing Friday at 1.45%, based on Treasury estimates.

Yeah, we all had dreams of TIPS yielding 2.0%+ above inflation, but that doesn’t look likely anytime soon. (It still could happen, based on recent market volatility. One bad inflation report and … watch out.)

I believe TIPS yields remain attractive, while not spectacular, at these current levels. And there is no way to know how long this phase of high real yields will continue. If the U.S. economy goes sour, and inflation begins to wane, the Federal Reserve could again move to stimulate the economy. The result could be deeply lower yields.

Back on Nov. 20 when I wrote my article on I Bonds vs. TIPS I noted a “sense of urgency” in TIPS investing. Grab the good yields while they last. And I am still a buyer of TIPS at these yields.

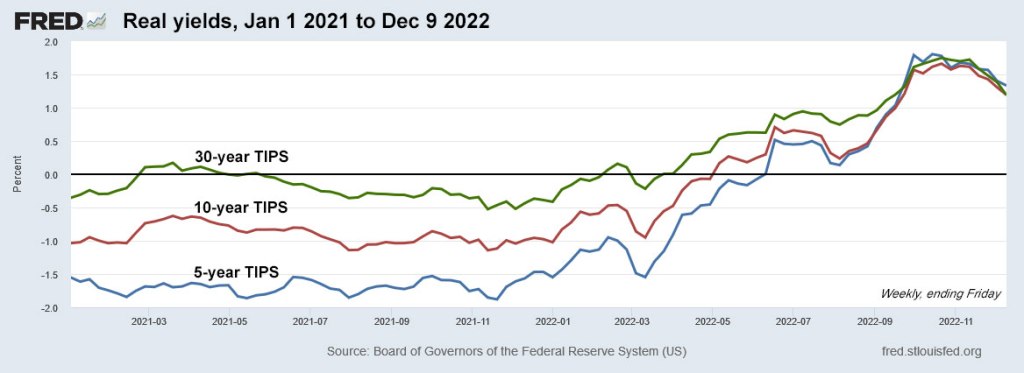

Here is a chart of 5-, 10- and 30-year real yields over the last two years. Notice how yields began flattening when the Treasury began tightening in mid-2022. This is a typical reaction to tightening, as the market begins anticipating a slower economy, or possible recession. And even though real yields have declined a bit in the last month, they remain substantially higher than the market over the last decade.

January 2021 through March 2022 was an awful time to invest in TIPS, with yields substantially negative to inflation. December 2022 looks much more attractive in comparison.

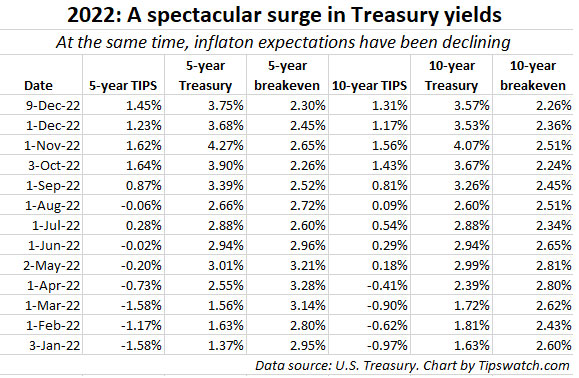

It’s almost shocking to look at how TIPS yields have surged higher in just four months. Here is a chart showing TIPS and Treasury yields for 5- and 10-year terms, and the resulting inflation breakeven rates. As TIPS yields have been moving higher since August, the inflation breakeven rate has been declining. In other words, TIPS are now “on sale” versus similar nominal Treasurys. That’s a positive factor for TIPS investors. Here’s the chart:

In conclusion

Real yields have softened a bit from their highs in early November, triggered primarily by two “milder than expected” inflation reports, combined with vague pivot language from the Federal Reserve. But we can be certain that the Fed will raise short-term interest rates by 50 basis points at its meeting Dec. 13-14. A week later, on Dec. 22, the Treasury will auction a reopened 5-year TIPS.

If real yields hold at the current level of about 1.45%, I’d be a buyer of that 5-year TIPS, even though I’m loaded with 2027 maturities. I’d also be very likely to buy the new 10-year TIPS to be auctioned in January, filling a 2033 spot on my TIPS ladder.

That’s my plan. I’d love even higher yields, but I’ll take what I can get at this point in the tightening cycle. Remember, do your own research before investing.

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. The investments he discusses can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

Mr. Enna, thank you for your devoted time providing such data for us rare birds who are TIPs devotees.

My problem is that I have been waiting until spring and the end of rate increases to make huge purchases of 30 year (and some shorter term) TIPs to ride out the rest of our days as a couple, holding them to maturity or near maturity in a laddered fashion, but it appears to me our biggest nemesis now as long term TIPs investor is this infernal, extreme long term maturity yield inversion in Treasuries and their TIPs counterparts, to a level that seems unprecedented, which is hard to overcome by Fed rate increases and the Fed divesting of holdings, and even the lowering Treasury-TIPs breakeven rates. My research has shown that normally the longest an inversion exists is around 10 months (in the 70s extreme case was longer), but the 30 year bond has inverted with different maturity bonds at different times over 2022, and now is even inverted to the overnight Fed rate and 3 month, so setting a starting marker is difficult.

Do you have any insight or opinion on how long it will take the 30 year TIP yields to catch up to the shorter maturity counterparts, or even exceed them like normal?

This is a tough call because when the inversion breaks, it could be because the Fed launches quantitative easing and real yields across the board could decline. The Treasury started issuing 30-year TIPS again in 2010, and since then there as been no inversion as pronounced as the one we are seeing today. Right now the TIPS yield curve is extremely flat, with the 5-year closing yesterday at 1.35% and the 30-year at 1.30%.

Thank you so much for the prompt reply! I would expect the easing not to occur for roughly a year, but things are so volatile these days anything could happen. Interestingly, during most of 2022 the highest long term yield has peaked around the 23-year maturity point pretty consistently, as far as long term existing TIPs yields.

Here’s my understanding……With respect to buying TIPS on the secondary market and assuming you did not pay a premium…… on the day the bond matures if the CPI has increased or at a minimum remained constant compared to the CPI the day you bought the bond, then at maturity you will get back as much or more than you paid for the bond. If the CPI decreases, then at maturity you will receive less than you paid. If you paid par or less at purchase, you will receive par at maturity. It seems pretty unlikely to me that CPI would decrease over an extend time but it is possible. Please correct me if I am wrong.

I agree with this.

The decline in break-even rates for 5- and 10-years is indeed pretty striking. Am I correct in inferring that the markets feel that over the next several years (a) inflation will be tamed, and/or (b) there is a possibility of a recession, and/or (c) yields will start to drop (following “a” and/or “b”)? Who would have thought Fixed Income could be so exciting!

Thanks for taking time to write a nice perspective article while traveling.

I think the highest factor right now is fear of a recession, which would force the Fed to ease. The scary possibility is that we could have a recession while inflation remains high. TIPS investments would do well in this scenario, since yields would go down (increasing the market value of the TIPS) while inflation accruals would remain high.

David,

I was told by someone at Schwab that if buying a secondary market TIPS, I could lose value if inflation slowed (not went negative) based not the accumulated principal in that bond. Is that accurate?

Thanks

No, that is not accurate. If inflation continues rising, at any level, your principal balance will continue to grow.

When you say:” If inflation continues rising, at any level,” do you mean it has to be higher than it was a (day/month/year?) before? Or just positive, ie. Not 0, negative ie. Less than 0.?

I’m not getting this…

Thank you for your patience and insight.

TIPS inflation accruals are based on monthly non-seasonally adjusted inflation, so if inflation goes up by any amount, even 0.01% then the inflation accrual will increase by 0.01% two months later. For example, October’s non-seasonally adjusted inflation was 0.41%, so in December the inflation accruals are increasing by 0.41%. This is divided into daily amounts, so an person can sell a TIPS on any day and get the full inflation accrual. Here are the December indexes: https://www.treasurydirect.gov/instit/annceresult/tipscpi/2022/CPI_20221110.pdf (Of course, if the monthly inflation number is negative, as was the case (very slightly) in July and August, then the inflation accruals go down by that amount two months later.

Thanks!

Corey, I thought about this later and I think what the Schwab adviser was referring to was a TIPS purchase on the secondary market that has a high premium cost above par, because of a high coupon rate. In that scenario, if inflation was very low, you could end up losing money, because the premium above par is not guaranteed to be returned at maturity. The inflation accruals would continue to grow, but not enough to cover the premium above par you might pay.

So as long as the purchase price is below par (no matter the amount of accrued/added principal because of inflation over the life of the TIPS thus far), there couldn’t be a loss of principal unless inflation went negative after purchase – correct?

I think if the *adjusted* purchase price is at or below par, then you will get back at least the par value of your bonds, IF they are held to maturity.

The adjusted price does include some prepaid interest (usually not much) that will be paid back to you at the next coupon payment. Buying a TIPS below, at, or slightly above par value creates very little risk, in my opinion.

Don’t forget about the high coupon payments you will be receiving, which are included in the yield calculation. If the real yield is positive X%, you will still receive a total payment that is X% above inflation relative to your initial purchase cost, if held to maturity.

Are you sure the Advisor wasn’t referring to the market price of the TIPS before maturity? If that’s the case, of course you could loose market value with slowing inflation or rates moving higher.

Well, it wasn’t until September 23rd that the 5 year TIPS’s yield went above 1.5%. It stayed over 1.5% until November 30th. That’s only a little over 2 months. Currently, the 4/15/27 maturity is going for a little over at 1.5%. And, the 10/15/27 maturity just a tad under 1.5%.

Over the last 6 months I’ve been able to load-up on TIPS. That was starting with the June auction at 0.362%. In late November I was able to purchase the same TIPS on the secondary market for 1.805%! The October auction yielded 1.732%. Overall the average is north of 1%. Good enough, I guess.

After the yield nosedive we had after the last CPI report, I’m getting a bit skittish. We’ll see what happens with the yields this week after the CPI report and the FED’s funds rate announcement. But if the 4/15/27 yields remain over 1.5%, I think I’ll pop for another 10K tomorrow. Nibble, nibble.

Typo: You say “I’d also be very likely to buy the new 10-year TIPS to be auctioned in January, filling a 2023 spot on my TIPS ladder.” How would 10 year TIPS fill a 2023 spot? Don’t you mean 2033?

Yes, I did mean 2033, and this is fixed. Thanks for the alert.

Isn’t nice to know that some of us read your every word?

My readers correct me all the time. I count on it.

If inflation persists at a higher level than the Fed believes, which is likely, and is higher that is generally believed, also likely, then TIPS will outperform nominal Treasuries into the foreseeable future. The only nominal Treasuries worth buying at the moment are 13-week T-Bills, which now actually yield more than 10-year T-Bonds.

Sorry but I am not as savvy as you guys when it comes to Tips. My question is you can buy 5-10-even 15 year tips right? Is this better than an annuity that is paying me a guaranteed 5.7%? It is tax-deferred on my money for 7 years. With 100k I can bank 5,700 a year guaranteed from what I read if inflation goes down I lose my accrued funds. How is this beneficial again I am just trying to understand as see if this is right for me.

This question is impossible to answer, because terms of annuities vary wildly. Are there annual fees? Is there a stiff early withdrawal penalty? Do you lose your initial investment at death? I know very little about the wide scope of annuities, so I can’t answer.

Why is it impossible to answer. I said a term of 7 years that is paying a guaranteed 5.7%. Early withdrawal penalty is not in the mix. You lose nothing upon death your beneficiary gets it. If you know nothing about them why did you reply I am trying to get an answer to my question. Not more guestions without an answer.

Give it a rest. This blog is about TIPS and I-Bonds, not annuities. If you are looking for a definitive answer to your idiosyncratic question, then ask your financial advisor, which is what you pay him for.

No need to be angry at someone for helping even if you don’t like the answer Mike. Annuities are all different and contract terms very wildly … generally requiring multiple pages to make all the applicable points bearing on the matter.

You should exercise the Tipswatch policy of satisfaction guaranteed or double your money back!

lol exactly!!

If you are buying TIPS at par you would never lose your accrued funds. You would get the coupon payment, whatever that is, and the inflation adjustment is paid out at the end. The multi year guaranteed annuity would usually have stiff early withdrawal penalties (10% or more in the first few years is not uncommon) and is dependent on the paying power of the insurance company, and if that fails your state guarantor. In California, for instance, the state guarantor only promises 80% of the cash value.

Not to mention that the state guarantor is just a consortium of insurance companies, not the actual Socialist State of California.

It’s ironic that the supposedly most liberal state in the US has the absolutely worst annuity “insurance”. When I found-out about it, that 80% limit sure made me lose interest in annuities fast.

Mike, I think if an average inflation over the next 5 years is higher than 5.7-1.45=4.25% then a 5 year TIPS outperforms 5.7% annuity. Since the future inflation is unknown, I’m interested in both TIPS and annuities. Where did you find this annuity?

And btw, thank you so much for the site. I’ve been reading it for years. Armed with your alert about real yields, I picked up some 7 years at an attractive real yield.

To: Butopia1502 — I’ve used Vanguard and Interactive Brokers to buy TIPs in the aftermarket (VGD also allows you to buy them at auction through them — to my mind, much better than going through the clanky Treasury Direct — one day I fear that whole site is going to collapse and then good luck figuring out who owes what). Both VGD and IB are transparent in terms of the markup/down: they indicate face amount along with the bid/ask. If your purchase is less than the face amount, then they tell you the revised bid/ask. The inflation adjustment rolls up (or down — note that TIPS, unlike iBonds, can have a deflation adjustment where they lose value) throughout the life of the bond (I check mine at VGD, where it appears when you get a quote on the bond).

David…how is tax assessed on a newly acquired TIP purchased on the secondary market midyear? Will I be assessed for a full year of inflation growth on the accrued value of the bond or will my tax assessment be on the increase in accrued value from the day I purchase the bond?

David or others can correct me, if I am wrong. The tax you pay on OID will be from the settlement date of your purchase. It is one business day after the trade date.

I’ve never owned a TIPS in a taxable brokerage account, but I would assume that your tax liability would be limited to the time you actually owned the TIPS, not any earlier period. Also, you probably pre-paid for a certain amount of coupon interest at the purchase, so that amount should also not be taxable. The brokerage should handle that in the tax forms it sends you.

Thanks, as always David. I am armed and ready for the Dec 5yr TIPS with fresh powder in my IRA (again thanks for previously pointing out the tax benefit of having TIPS in an IRA rather than a taxable account). I recent retired at 83 and rolled over my 401k into a rollover IRA. Then I discovered that thanks to the new law, I could still contribute $7000 to the IRA this year as long as I had as much earned income this year even though I must still meet the RMD. So, I get multiple tax breaks: 1. Delay taxes on the $7000 until I fall into a lower bracket; 2. shelter the TIPS interest from taxes until after it matures/until I take the proceeds with a RMD.

TIPS are generally great- in a tax sheltered account. Otherwise I always consider the tax burden of TIPS versus deferring taxes with I Bonds. Sometimes the final accounting is a surprise.

can you buy these on the secondary market through a brokerage account? Do they trade just at a discount or with accrued interest? How do you get “paid” for the inflation part of the return?

Yes, you certainly can buy TIPS on the secondary market (or at an auction), through a brokerage account, generally with no commission. On the secondary market, you will probably pay a discount or premium to par value, something to watch for. You get paid based on two factors 1) the coupon rate of the TIPS (paid semi-annually), and 2) the inflation accruals, which you receive at maturity or when you sell the TIPS.