Episode 189

2022 Outlook Series: Global Technology & Operations

Host:

Craig Jeffery, Strategic Treasurer

Speaker:

Christina Easton, Microsoft

Episode Transcription - Episode 189: 2022 Outlook Series Global Technology and Operations

INTRO 0:08

Welcome to The Treasury Update Podcast presented by Strategic Treasurer, your source for interesting treasury news, analysis, and insights in your car, at the gym, or wherever you decide to tune in. On this episode of the 2022 Outlook series, host Craig Jeffrey joins Christina Easton, Director of Treasury Operations at Microsoft to explore the global outlook on technology and operations. This dynamic discussion covers a wide range of topics, including achieving leadership with global cash management, trade finance activities, the modernization of technology, and more. Listen in to this lively conversation about their expectations and insights for the year ahead.

Craig Jeffery 1:08

Welcome to The Treasury Update Podcast, Christina.

Christina Easton 1:10

Thank you, I’m happy to be here.

Craig Jeffery 1:12

I am glad we’re continuing the series that we have and having you on from Microsoft to talk about the 2022 Outlook, covering a bunch of different areas. But before we get into the topics that we’re looking at for 2022, maybe give me a little bit about your background, maybe a little bit about your career. What are you responsible for at Microsoft?

Christina Easton 1:36

Sure, happy to. So, my career really started out in banking and a variety of sales roles at Bank of America in the US and in the UK. From there, I’ve transitioned to the corporate side and really started out in treasury for Cisco Systems back in the day and then also for Microsoft in treasury. So, that awesome experience going to two amazing companies from the get-go was super helpful. I took a break and also led my own consulting company and that to me, was exciting because it gave me a variety, variety across transformational projects in treasury, e commerce, but also platform integrations. And after doing that, for about nine years, I decided to go back and retool with the RPA in mind, and so I joined a company called Avalara, which is in tax compliance to SaaS company here in Seattle. And it was an interesting opportunity to lead payment automation governance and strategy. And now I find myself back at Microsoft, and it’s super exciting to be back. My role here now is to manage a team of 20 folks across cash and investment operations, bank infrastructure and alternative payment infrastructure, in addition to cash management globally, and in that also lies trade finance. So, it’s a very broad breadth across the team within Microsoft.

Craig Jeffery 2:59

So it’s excellent to get bored with one area, you can just focus on another group. You know, Christina, you know, as we look at, we’ll start with cash investment ops, I know we want to cover banking, you mentioned trade finance, we’ll cover that. We’ll look at modernization of tech and people to some extent, but on the cash and investment operations side, the amount of operational treasury varies in complexity from one organization to the other. How big is it? How many countries are you in? How many are the banks you have to relate to and work with? I’d like to hear what you’re doing here and the cash investment ops area as you look at to the rest of 2022 and maybe beyond, particularly in a way that there would be applicability to other organizations. Now, Microsoft is a huge company, there’s some things that are very unique, but there’s a lot of things that are really useful for others to hear about.

Christina Easton 3:53

Yeah, definitely. You know, three areas come to mind in this space, and they are compliance, risk mitigation, and optimization/innovation. And starting with the compliance piece, you know, we’re really looking…we’re a compliance first organization. So, for us it’s very important. And we’re looking across the company around data security requirements for payments. So, in other words, do we know where data is downloaded across finance teams? Is it protected? Do we make sure we’re ingesting and storing it appropriately and that we are compliant with NACHA and similar regulations around the globe? Similar to this, we trade screening is top of mind, you know, we that’s another area of commitment and compliance, and one that we’ve worked closely with in terms of ensuring our wire request capabilities, have the train screening component embedded. The second area was risk mitigation. And there we’re really looking at reducing fraud and mitigating risks across the company, kind of eliminating the use of checks comes to my mind. There’s an internal project called Check free, where we work collaboratively across the company to identify ways of being a little bit more proactive around the support of reducing the number of checks that are issued as well as received. And finally, the optimization innovation piece is important because we’re constantly looking at ways that we can improve what we do. We’re looking at ways of having an opinion on near time payments, instant payments and where across the business it will impact treasury and liquidity. And then we’re also keeping in mind, you know where the company needs to invest and where we need to be in the next five years.

Craig Jeffery 5:45

I tell you broke that into three areas. This compliance first, now you use the term trade screening, is that like OFAC compliance, is that the broader category? All those things? Okay?

Christina Easton 5:55

Correct.

Craig Jeffery 5:56

That makes sense. I just haven’t heard that term, but it fits the category well, while his hate on checks. Sounds like you’re you want to get rid of checks.

Christina Easton 6:05

There’s a lot of human capital in checks. I mean, if you look across the various services at the bank needs to provide, right, and the human cost on their side as well as our side as well as you know, the companies involved in the whole supply chain. It is very labor intensive.

Craig Jeffery 6:21

You know, and paper cuts. Someone somewhere gets paper cuts. Now, you were talked briefly to near time and instant payments, what are the…. maybe you can explain what are some of the implications there like why, why is it important for instant or near instant payments? What are some of the use cases that you see?

Christina Easton 6:44

Well, it really depends on what part of the business you are referring to. There are a lot of use cases it could be for accounts payable, it could be for payroll, it could be for certain countries, you can look at instant payments and real-time payments around refunds. The question really is the ability to claw it back if it was done incorrectly, that still needs to be available. The ability to have real-time reporting with real-time payments, that’s going to be critical, and how does that integrate back into the ERP system for reconciliation and further data insight. So, there are a lot of components that that come with these buzzwords, and these new payment options of being instant in real-time. But you really need to look at the full infrastructure to see where is it going to be impacting the correct processes that you have and where does it make sense? It may not make sense across the board for every single area where you initiate payments.

Craig Jeffery 7:48

Bridging a bit roughly back to your comments about data security, on payments and NACHA, so the you know you’re talking about NACHA this the compliance with the tokenization or ensuring everything’s encrypted at rest and in transit or is or other things that are going on there? How do you think about them?

Christina Easton 8:08

Yeah, I was specifically referring to the data at rest. You know, the new requirement that’s 2022 requirements. That piece is very important, and I think companies have until June to get that right.

Craig Jeffery 8:22

Excellent. Let’s shift over to banking. You know, there’s companies that have accounts, you know, 100 accounts at one bank. There are others that have 1000s of accounts at hundreds of banks, you know, managing signatories, the different services that exist, and there’s more than just traditional DDA accounts that have to be managed. Those all fit under this category of banking, so merchant IP, regular bank accounts, custody accounts. You know, one thing Christina, when we surveyed banks and corporations, you know, their biggest compliance issue is? It’s KYC. KYC is like the top for bankers and it’s the top for corporations, from a compliance perspective. You’ve heard this a long time that there’s this great promise for KYC processes are going to get better at some point in time. Probably after there’s no checks. But what’s your outlook for KYC? You know, we are on this broader front of compliance with banks and signatories? What’s happening? What do you what are you doing?

Christina Easton 9:28

Yeah, that’s a great point. You know, we’re in the process of piloting a KYC process at the moment and I do want to highlight that it really requires a collaboration among all banks, you know, starting with the global banks, yes, but also including large companies as well. It’s similar to like a consortium of years past where we’ve had you know, other initiatives that come to fruition because of consortiums, but it really needs to be a collaboration between companies and banks. You know, the term of instant payments, real-time payments is great. I’d love to see that in KYC. You know, is anyone really looking at how real-time we can get with KYC? Because as you said, there’s a lot of paperwork. It takes a very long time to get things provided from a corporate perspective, but also for the bank to review it and I’m sure they have everything, and it gets more complicated depending on which countries you go into. So, I think there’s a real opportunity, you know, we’re piloting I think that’s great. We also need to kind of create a forum where we can push the envelope even further to really say what is it as an industry that we really need to get to? What is our North Star? What are we aiming towards? What is feasible and realistic, given the regulatory framework that we are working in? But where do we need to be? This isn’t us versus them. This is where do we need to be together?

Craig Jeffery 11:01

There’s a lot of good with KYC but there’s the way that it’s managed. The overhead that both sides have to go through always seems to be very onerous. So, I like to describe that as collaboration. How can how can this be done efficiently? How can we have really good Know Your Customer activities without 5 million manual steps, deliveries of passports, electric bills, all those challenges?

Christina Easton 11:29

And internally, to add to that, we’re also looking at standardizing processes, still for bank account administration, for custody accounts, for merchant IDs, alternative payments. You know, having a standard process, regardless of really what type of account are some internal initiatives that we’re working on to just kind of help and support the workflow to the point where we get to that KYC process, but also to include it. KYC is probably going to extend across other payment methods as when they get adopted. So, this is going to be an evolving KYC world.

Craig Jeffery 12:07

You know, Christina, besides KYC there’s this whole area of the online banking services has to be managed as well from new users being added, permissions being turned up and down or on and off, groups. What are you wanting to do there?

Christina Easton 12:25

Yeah, the managing services and access is quite cumbersome, especially when you have as many bank accounts as we have and the complexities you know, there are two we’ve developed a custom workflow process to track and document all requests. That’s been tremendously helpful over the years. You know, I look across the organization to identify you know, there are more synergies and opportunities where we can fully automate the integration and having an internal workflow is great, but I’d love to be able to find some kind of API process for us to then integrate with our banks to make it a little bit easier to provide access when access is required through a portal.

Craig Jeffery 13:09

Now I want to shift I know we got a lot on this next topic, but just thinking about global cash management, so we want to be at least have the minimum standards but I know Microsoft likes to achieve leadership. The global cash management requires global visibility to the banks to your operating areas. Anyway, think about connecting, connectivity, real-time. What are you expecting to happen over time? What’s your outlook in the space?

Christina Easton 13:35

Well, we’re super fortunate to have near 90% visibility of our cash so the visibility piece is important, and I think we’ve been able to crack that nut and have that information readily available to us. However, where I see the opportunity is really more on the integration with our partners on outbound messaging, outbound communications, and where we kind of reach into the services offered by banks. A lot of banks have services through their banking portals, and that for us can be contingency plan as well as sometimes the primary method of communicating and sending instructions. But I do feel in the horizon that we’d like to leverage more of the API connectivity, fully leverage our SWIFT messaging capability, and really just be more reflective of where we need to be in the next five years. And how we can help propel and adopt that desire to be more integrated and not use bespoke portals.

Craig Jeffery 14:37

Just a quick question on SWIFT so the legacy maybe it’s not legacy, it’s still fairly common method for SWIFT is, you know, some of these various message types and connecting by sending messages back and forth and SWIFT’s new approach is this platform environment do you see connecting to the platform in the future via API, the SWIFT platform, is a way to continue to leverage their reach of banks, or is it do you think it’s going to become more…it’ll be easier to go to banks directly with their own library of API’s?

Christina Easton 15:13

LSS a really good question. I think I think the answer is, you know, when I look at Microsoft, we really need to look at security kind of everything in the cloud is this direction we’re trying to go, and I find it to be not a one size fits all answer. We prefer to have as much as possible in the cloud, which provides agility and security. But I think for some other companies and businesses, it might make more sense to have an API directly with their bank versus going through SWIFT. They’re just different models. We’re quite complex and we have a lot of messaging types that we communicate through to other partners. So, for us, SWIFT makes a lot of sense at the moment. But that is not to say something’s going to pop out in the next five years where we’re going to have perhaps a number of integrations with key players.

Craig Jeffery 16:11

I really like SWIFT’s model of making so that you, you can connect to the 1000s of banks, and you can leverage newer methods of connecting like there’s a lot of good promise there. Christina, you had mentioned you You’re responsible for trade finance, could you talk me through what you’re doing here? And you’d mentioned you’re working on a pilot. Can you explain what’s your thinking here?

Christina Easton 16:35

Yeah, so we here have also automated the workflow process within a custom tool, which we developed and it’s leveraging power platform as your SQL and storage. We’re now piloting the process beyond the workflow, namely sending the instruction to the bank via SWIFT messaging. We have about a handful of banks that we want to have integrated by the end of the year. That might sound aggressive, but I think it’s certainly doable and we plan to roll that out to further banks if we keep you know continue adding different partners in the trade finance space.

Craig Jeffery 17:12

The automation of this the process, that workflow is really about error reduction? Human capital? What’s driving this one?

Christina Easton 17:21

Yeah, well it is really around kind of efficiency with the resources that you have, documenting, and being able to track the flow of requests that we have sufficient information on the intake of new requests, and that we can have an approval workflow that identifies all the controls have been met before we then submit that through to the bank for issuance. The workflow processes that we’ve designed, hits on, you know, the efficiencies of the resourcing available to us internally, but also hits on the controls being documented and auditable and ensuring that our banks are communicating efficiently in return.

Craig Jeffery 18:03

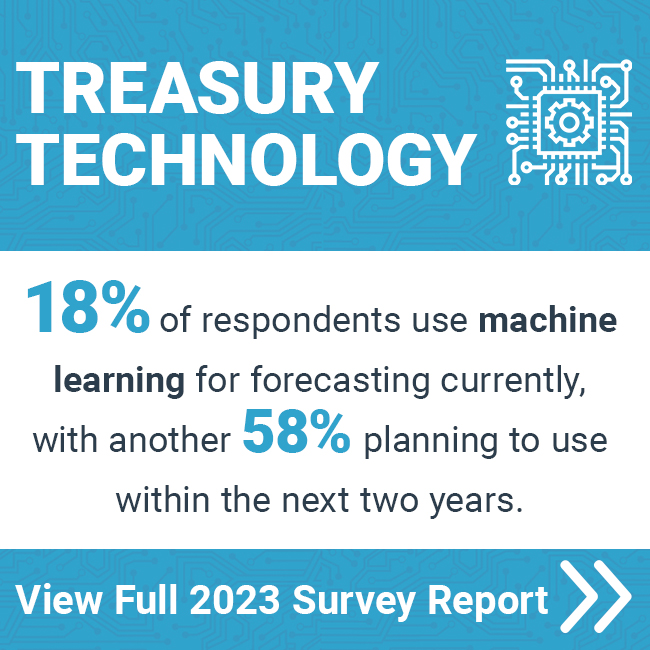

Banks are given the trade finance overview with your pilot. Hopefully we can check in again, sometime, maybe towards the end of the year, to see how it’s going. I want to shift to modernization of tech and people that most of the things we talked about our about technology and upgrading tech is one thing that has to be done but making sure our team stays current has a lot of treasury leaders, finance leaders, business leaders concerned. Here’s a few stats just to put some of this in context. Just over one in four companies are working on upskilling their staff and finance in treasury and yet an even larger percentage 40% are concerned their staff is not upskilling properly. I’d love to hear your thoughts about the you know how the industry as a whole can best upgrade their tech and keep your staff current from these changing technologies that are existing. I mean, you’re a tech firm. Maybe you have some advice.

Christina Easton 19:03

Sure, ell, we’re migrating to SWIFT on Azure and now more than ever, Microsoft Azure is vital to our company strategy, and key delivering success. In this new area of intelligent cloud and intelligent edge we have a tremendous opportunity with Azure to advance the treasury vision. So, Microsoft treasury, again we reference SWIFT, and we are communicating over the cloud. But we’re also looking at processes workflows, systems. What got is where we are today may not be the same recipe we need for where we need to be in five years. And that kind of plays to new technologies and opportunities to innovate. But also, how we prioritize and how we’re agile to pivot as needed. And I think that is super important as we look at leveraging technology and what we do. We should really avoid trendy and flavor of the month product offerings and invest in the right projects that drive the roadmap that meet the company’s goals and missions and vision. And at the same time, work with our banking partners to communicate and be very transparent where we’re going and where we need them to be.

Craig Jeffery 20:19

I have a question on part of what you’re saying, you said, you know, what got us here is different. So, history, there is an approach used historically that needs to adapt for the future. It’s different. You follow that up by talking about agile and pivot as needed. Are there any examples of this or how would you explain that further what’s the mindset is just being faster have shorter cycles that were but you’re getting others or other nuances to?

Christina Easton 20:50

Well, I think you know, organizations are also very…need to be very fluid and flexible. The organizational structure needs to mold and shape to the business environment. And my understanding of specifically where we are today, even in treasury or in the broader global treasury, financial services organization that I live in, is that looking for synergies across the team, how we can leverage the strengths of the individuals and how we can leverage the tools, not just in your silo of “Oh, I work in this function”, but how does the tool relate with other groups within finance as an example or within legal or within tax. And kind of taking a step back to identify, reflecting on the processes, end-to-end and not just, oh, well, this is my piece. So almost putting the walls and the silos aside to say we’re here, we’re working together. This is a collaborative environment and I’m going to leverage the work that you’ve done already, versus coming up with my new way of doing it.

Craig Jeffery 22:00

Yeah, so your end-to-end is… you already described some end-to-end which is the process that’s outside the walls with the structure of Microsoft that you talked about, what’s your banking partners, collaboratively for things like KYC, working with SWIFT, a consortium owned by the banks. Yeah, so it’s really end to end. Well, I usually just call it end-to-end to end-to-end so inside your organization to the other parties as well. So very, very mature look. Okay. Okay, great. Thanks. Thanks for let me take you down that path side trail, just wanted to understand that some of their levels of faster end-to-end look is awesome, I think cut you off when you’re talking about people and how that end-to-end goes.

Christina Easton 22:52

Sure, sure. On the people front, you know, the…having a diverse team with strengths that range from executing, influencing, relationship building, and strategy. Plus, tech savvy is really critical. Utilizing strengths in people versus focusing on areas of weakness or opportunity, I think engages the team a lot better and that kind of goes back to where we were, or what we did in the past may not get us to where we want to be in the future. In the past, people may have focused on Oh, I’m not really good at this particular tool, I’m going to go learn it, or this is my kind of job function. And that’s kind of my focus. We really embrace the growth mindset. We embrace learners. We embrace people that aspire to learning and understanding and participating and collaborating with each other. And not so much as this is my role here and I’m going to stay in my particular function or in my particular job requirements. So, the diversity is therefore really important as long as diversity and experience coming from different industries or coming from different, even functions within finance or across the business, gives such a different perspective. So, I really value diversity. I evaluate inclusion even the quietest voice has a voice. And we as leaders need to ensure we pull that out from individuals that may not be readily communicating their great ideas I also feel that communication skills are important. Communicating and being able to adapt your communication style to your audience is important. Regardless of what generation you’re from, I think it’s important to appreciate what makes certain individuals tick and how you need to communicate in order to get adoption, or get buy in, or get participation. I did talk about technology briefly and again, people that can embrace technology, understand it, and don’t necessarily say well, IT will do that, or engineering will do that. We all need to know enough. And we all need to be able to roll up our sleeves and be able to fix a Power BI or be able to fix a table and really appreciate where the source is coming from and where the problem may have come up. So, I really want to emphasize the technology piece, and the ability to problem solve growth mindset and problem-solving mindset.

Craig Jeffery 25:36

Yeah, nice. You know, I had to follow up on a couple things that you said you talked about pulling those ideas out of people is that extrovert introvert people that process verbally, usually speak up, others may have great ideas, but they’re quiet and this is just making sure you’re getting everybody to weigh in.

Christina Easton 25:56

Yeah. And really giving people the confidence. I mean, everyone is a leader. Everyone is responsible for acting as a leader in certain times. And so, I feel it’s important to be uncomfortable sometimes. And if that is not speaking up and speaking up and you’re not usually an extrovert and we don’t usually speak up, it’s finding ways to get your message across. It could be in a chat; it could be in an email. It could be in a brainstorming session with less people in it. There are ways and I think as a leader, you need to identify how your team…what motivates your team, how they want to be engaged, how they like recognition. Those are all the things that a coach and a leader need to understand.

Craig Jeffery 26:41

When you were talking about there’s some that are good at influencing, some that are good at strategy, there’s those that are tech savvy. And you talked about when people historically feels that oh, I’m not good at this. Let me spend a lot of time I want I’m not good at instead of focusing on the strengths. That resonated a lot, you’re probably with a quote from, I think it was Albert Einstein, write something about the to try to get a fish to climb a tree the fish thinking it’s, it’s stupid, right? Because that’s not built for that and it’s, it’s like, now there’s always something you have to do that you’ve got to have some proficiency. You know, I don’t know how to use how to forward on the phone, well sit down and learn it. You should be focused on things that you’re really good at because there’ll be a much greater, greater yield to that side, I liked how you were you’re sharing it. This has been a really good conversation, Christina. I wanted to give you a chance at the end, you know, as you may have predictions for what’s going to go on in 2022 or 23, or key developments you expect in treasury in the next couple of years. I’ll let you finish up with your predictions or development expectations.

Christina Easton 27:53

Certainly, it’ll be interesting to see where things land with central bank digital currencies and the impact on financial sector markets, but it’ll also be interesting to see where things land on future NFT’s, use of smart contracts, and invoicing, and payments. I’ll keep an eye on a regulatory framework around cryptocurrencies, stable coins, and an eye on blockchain use cases distributed ledger for corporates. My personal interest is around payments. I’m very passionate in that space. But I also want to look at finding ways to continue automating certain types of payments where we haven’t been able to necessarily do so in the past.

Craig Jeffery 28:35

Christina, thank you so much for your thoughts and your comments. We’ve got to do this again.

Christina Easton 28:40

I’d love to, anytime. Thanks, Craig.

OUTRO 28:49

You’ve reached the end of another episode of The Treasury Update podcast. Be sure to follow Strategic Treasurer on LinkedIn, just search for Strategic Treasurer. This podcast is provided for informational purposes only, and statements made by Strategic Treasurer LLC on this podcast, are not intended as legal, business, consulting, or tax advice. For more information, visit and bookmark strategictreasurer.com

Related Resources

Check out our YouTube playlist covering many frequently asked questions in treasury!