Finance and accounting are meticulous endeavors. Or at least they should be. They also happen to carry some pretty hefty weight on their broad shoulders – i.e. the viability of your entire organization – so precision and attention to detail are essential.

Therefore, it only makes sense to take a similarly meticulous, precise, and detailed approach when building out your oil and gas accounting function, a notion that’s especially true in the dynamic oil and gas industry.

Unfortunately, that build out isn’t always straightforward, particularly if you’re new at it or starting from scratch. But that’s why we’ve put together these insights and our accompanying infographic – to give you a reliable foundation to build from. So on that note, let’s jump right in.

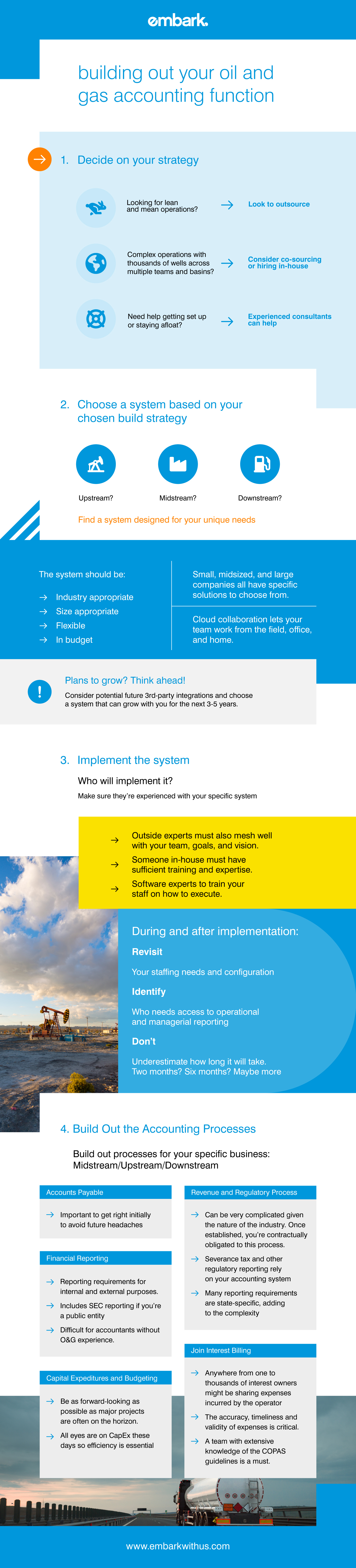

Pick Your Strategy

First and foremost, you'll need a plan of attack. And like most aspects of modern business, there is no absolute, clear-cut answer when choosing the best course of action for your specific needs. In general, though, you’re really choosing between three different solutions:

1. In-House

Most oil and natural gas companies eventually reach a point of critical mass where the business is so big and complex that bringing the accounting function completely in-house just makes the most sense. Granted, there’s no hard and fast threshold to where or when this occurs, but it’s typically on the more mature stages of the life cycle.

Likewise, the nature of your underlying assets might dictate the need for in-house accountants as well. If you’re working across multiple basins and operating teams with complex lease positions, then an in-house solution provides the time you need to address all of those complexities without trying to explain everything to an “outsider.”

None of this is to say, of course, that you must immediately flesh-out your entire accounting team right off the bat. Instead, start slow and fill the most critical seats first, then expand the team over time.

2. Outsourcing

Yes, we understand many organizations are still somewhat unfamiliar with outsourced accounting solutions, especially larger and more established companies that might still view them as glorified bookkeeping services. But we’re here to tell you those negative preconceived notions just don't hold water.

In many instances, outsourcing your accounting function is the obvious choice, and not just for those quick exits and smaller accounting issues where it doesn’t make sense to staff a team. In fact, we would argue that, given the current state of the energy sector, outsourcing is most relevant and impactful for streamlining ongoing operations and maximizing efficiencies.

Keeping your headcount in-check and avoiding investments into potentially costly systems are obviously attractive for companies – particularly startups – trying to stay lean and mean. Plus, there’s something to be said for the agility and convenience of outsourcing, where you can utilize talent that’s entirely on-par with in-house talent, just without the headaches involved with recruiting, interviewing, and hiring.

Sometimes the stage of your company’s life cycle will even dictate the choice, naturally leading you to fractional/hourly personnel. For example, many younger companies need to keep costs down yet still require significant expertise, perhaps in acquisition onboarding or accounting standards compliance. In this case, outsourcing to an experienced partner is the most logical solution.

And don’t forget outsourcing comes in all shapes and sizes. Sure, offshoring a mountain of redundant transactions makes it an obvious choice. However, there are outsourced solutions more akin to managed services, too. In these instances, you’re relying on outside expertise in some high-level capacity that’s adding value to your oil and gas operations.

3. Combination/Co-Sourcing

Whoever said it had to be one or the other between in-house and outsourcing? There are plenty of circumstances where a combination of in-house accounting and an outsourced solution work best for you and your objectives.

For example, everything in E&P accounting is cyclical in nature, where your revenue process might be heavy for a couple of weeks each month but then settles back down. Therefore, do you really need to hire three full-time revenue accountants for such lopsided workflows?

Co-sourcing can be beneficial in this type of situation, where you hire one full-time person and then bring in outside specialists for those times when things get more intense. This way, you still get the experience and expertise you need – assuming you choose the right outside group – but don’t unnecessarily inflate your labor costs.

No matter which route you choose, just be sure to look at the bigger picture when deciding on a solution. Costs, scalability, agility, and growth all play a major role in your decision, both today and tomorrow. One of the worst-case scenarios is finally realizing the growth you’ve been aiming for all along, only to have inefficiencies in your accounting function cut that growth down at the knees.

Choose a System

Much of your decision-making around an accounting system depends on if you're an in-house, outsourced, or co-sourced accounting function. Obviously, an entirely in-house team will require dedicated oil and gas accounting software whereas an outsourced function does not. While something like the cost of a system will occasionally impact internal vs. external staffing decisions, those cases are quite rare.

Further, there are several accounting systems to choose from, whether you're in the downstream, midstream, or upstream oil and gas sector. That said, it’s usually best to start with your industry segment, then determine the nature of your operations. In other words, are you small and simple? Quickly growing and complex? These categories will help you determine the most appropriate system, not to mention the bells and whistles that will suit your short, mid, and long-term goals.

Also, given the high-stakes involved, this isn’t the time to relegate yourself to the lowest cost or most popular provider. Instead, find a system that’s appropriate for your industry segment, the size of your organization – once again, both now and in the future – and hits all of the right notes. That means a system that fits your budget, is scalable, and includes cloud collaboration and third-party integrations if needed.

Implement the System

Once you have chosen a system that suits your needs and circumstances well, don't throw caution to the wind and trust anyone with your implementation. After all the time and effort you invested in finding the most appropriate system, either hire outside experts or use sufficiently trained, experienced in-house team members.

If you choose to use an outside expert, pick someone that’s experienced with your new system as well as your team, goals, and vision. Even if it’s only a light system and a two-month job, you still want someone that works well with your team, can train your staff on the system, and aligns with your culture. Otherwise, it’s going to be a long two-months.

If replacing systems, you also want to make sure you’re implementing the system to its full capabilities and not what you’re accustomed to from your old system. Remember, you’re replacing that old system for a reason – or several of them – so you’re not adding any value by simply replicating what already wasn’t working well for you.

Lastly, remember to be intentional with both choosing a system and implementing it, keeping an eye on your overarching goals and what you want from them. Is your focus strictly on FASB accounting compliance? Or generating financial statements? How you roll-out the system and who has access to operational and managerial reporting can have a drastic effect on your decision-making going forward.

Build Out the Accounting Processes

Once the system is implemented and fully configured, you need to build out your accounting/business processes so they correspond with your oil and gas segment, including:

Accounts Payable

Obviously, Accounts Payable is a basic process that every company requires. However, just because it's commonplace doesn't necessarily mean it's straightforward. Therefore, Accounts Payable should never be taken for granted and is of absolute importance to get right, even when it's extremely time-consuming and requires a fair amount of heavy lifting.

Joint Interest Billing

Ownership of operated, producing wells can range from one working interest owner up into the thousands. Expenses incurred by the operator during oil and gas production activities are shared with these working interest owners, so the accuracy, timeliness and validity of expenses is paramount. Having a team with extensive knowledge of the Council Of Petroleum Accountants Societies’ (COPAS) guidelines is a must.

Revenue and Regulatory

Given the nature of the oil & gas industry, the revenue process can be extremely complicated, so an experienced accounting perspective is usually very beneficial. The importance of understanding your contractual obligations and setting up the accounting system to appropriately calculate revenue and owner payments is essential.

Severance Tax and Other Regulatory Reporting

Likewise, severance tax and additional regulatory reporting can also be extremely complex since every state has its own requirements. This is another instance where you'll need a thorough understanding of your accounting system for reporting purposes. Processing months or years of corrections on every well you operate will undoubtedly require far more time and money than setting things up correctly from the get-go.

Capital Expenditures and Budgeting

Obviously, capital expenditures are now perpetually at the forefront of everyone’s mind in the industry, not to mention the federal government on a frequent occasion. Things have changed dramatically in the last few years, so CapEx isn’t what it used to be. And by ‘used to be,’ we mean just a few years ago.

Indeed, no matter the industry, businesses that don't have one eye on the future will likely hit some major potholes. For oil and gas in particular, though, it's always important to be as forward-looking as possible if major projects are on the horizon, including drilling wells, building a pipeline, or upgrading an existing refinery. Naturally, in an environment like today’s where maximum efficiency is a must, all of these notions suddenly become even more essential.

Financial Reporting

As is always the case, you'll need to meet financial reporting requirements for both internal and external purposes, including those for private equity or your good friends at the bank. Of course, external reporting would also include the stock market if you're a public entity.

With so many moving parts, all of these reporting requirements could prove to be difficult, perhaps even impossible, for an accountant without significant oil and gas experience. However, once you’ve managed to solidify and streamline your reporting requirements and you're ready to go, remember to always keep a pulse on what's working well and what's not so you can pivot as needed.