- News

- 2 min read

JSW Steel's export push can sustain rebound

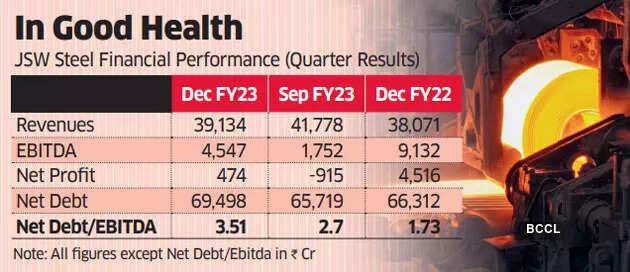

For the December quarter, the company's Ebitda rose by 160% sequentially to ₹4,547 crore, although down sharply over last year's corresponding quarter. Lower raw material costs helped. But several cost-saving investments which it commissioned also have started showing. Revenues stood at ₹39,134 crore, down 6% QoQ and net profit at ₹474 crore vs loss of ₹915 crore.

After a tough first half of FY23, India's leading steel producer JSW Steel showed some recovery in the December quarter. The momentum could continue in near term, with the company looking to increase its export after the recent removal of export duties and uptick in global demand after Chinese economy showed signs of opening up. But upside may be capped due to expected slowdown in 2023.

For the December quarter, the company's Ebitda rose by 160% sequentially to ₹4,547 crore, although down sharply over last year's corresponding quarter. Lower raw material costs helped. But several cost-saving investments which it commissioned also have started showing. Revenues stood at ₹39,134 crore, down 6% QoQ and net profit at ₹474 crore vs loss of ₹915 crore.

Chinese steel prices have risen to $640 a tonne from $530 in November 2022. Will price sustain? Prices may sustain but unlikely to see previous high, said Rao, citing expected slowdown and unlikelihood of investment-related growth in China.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions