By David Enna, Tipswatch.com

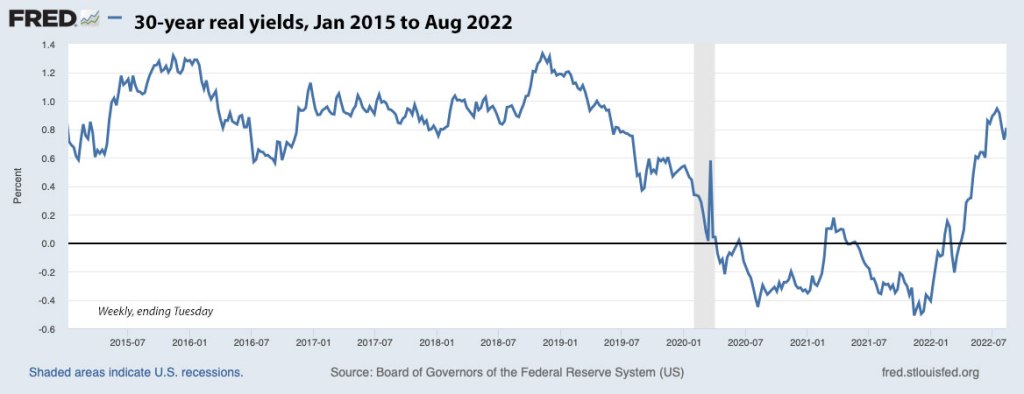

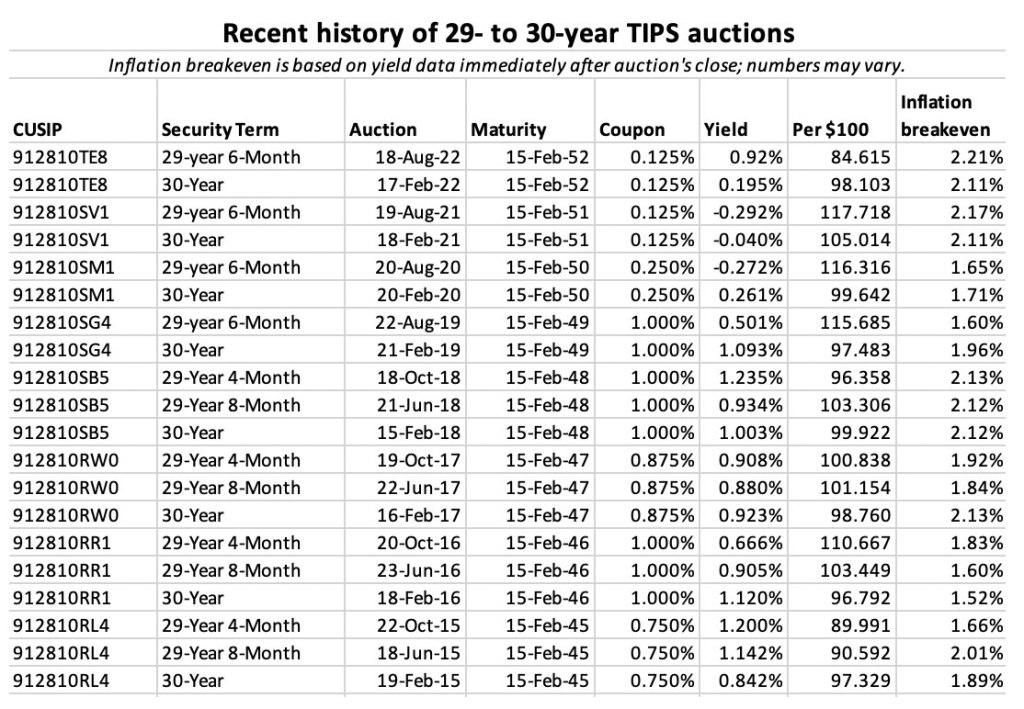

The U.S. Treasury’s reopening auction today of CUSIP 912810TE8 — creating a 29-year, 6-month Treasury Inflation-Protected Security — got a real yield to maturity of 0.92%. This was the highest yield for any auction of this term in more than 2 years.

It looks like the auction was met with strong demand, with the real yield coming in a few basis points lower than where this TIPS was trading right before the auction’s close. The bid-to-cover ratio was 2.69, also an indication of good demand.

This TIPS had an originating auction in February, where it got a real yield of 0.195% and a coupon rate of 0.125%. Thursday’s auction demonstrates how much real yields have surged higher in 2022. Investors paid an adjusted price of about $84.61 for about $106.40 of principal, after accrued inflation is added in. This TIPS will have an inflation ratio of 1.06397 on the settlement date of Aug. 31.

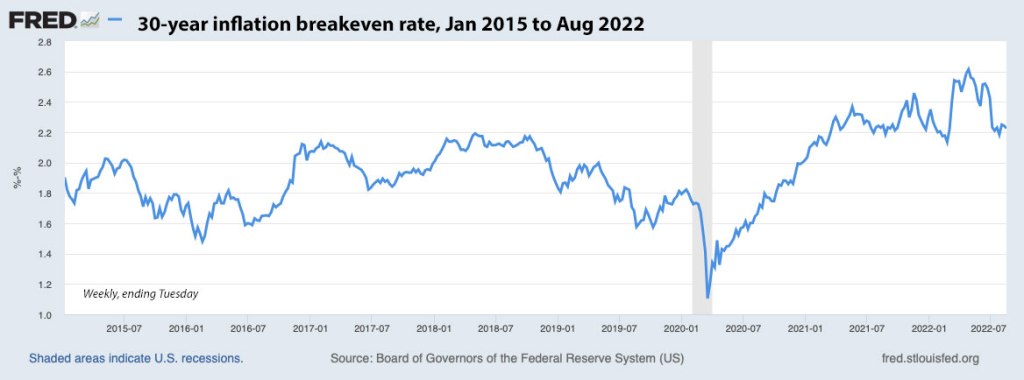

The inflation breakeven rate, by my estimate, was 2.21%.

I am traveling this week and I am about to go on a trek into Alaska’s Denali National Park, so I will just close with the usual graphs … Real yields, inflation breakeven rate, and auction history.

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. The investments he discusses can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

The breakeven rate was 2.21%?

That means the “all knowing” bond market expects 30 years of 2% inflation?

For perspective, inflation over the last 30 years of “very low” inflation averaged 2.5%. No 30-year period starting with 1971 has averaged less than 2.3% (periods ending in July) http://eyebonds.info/tips/cpi/cpibig_07.html

The Jan 2023 TIPS are selling with a real yield of over 1%. The April 2023 TIPS are yielding around 0.55%. I don’t know if that is common, for near-term maturities to match yields with the longest term maturities.

I bought a few, in part because the July inflation adjustment is till accruing, and it seems inflation might surprise on the upside. If the near-term stays high, I might roll over maturity, instead of buying say 5 year TIPS.

I’d like to state for the record that I have no clue what is going on with these short-term TIPS. Shortly before 4pm today the Jan 2023s were going for a real yield of just a few ticks shy of 4% on Schwab. That seems stupid. Are we expecting deflation to set in the next 4-1/2 months?

The real yields of very short term TIPS get extremely exaggerated. The market knows that the September inflation accrual will be negative, and the October accrual looks iffy. It might be a fine investment, but it’s likely close to the current market.