How Business Owners Can Create Good Banking Relationships

Author: Larry Chester, President

Businesses depend on banks for more than just loaning money. Owners rely on banks to deposit cash, transfer funds, and process checks sent out to suppliers. Banks provide services that are essential to business owners, which is why it is important for business owners to maintain a good relationship with their bank.

Well, what happens if your relationship goes sour? Most business owners pay very close attention to their relationship with their bank, especially when it gets close to the time for the renewal of their line of credit.

Watch Larry Chester, President of CFO Simplified and financial savant explain how to build back a good relationship with your bank so you can be bankable again in the video below.

How To Fix A Bad Relationship with a Bank (and Be Bankable Again)

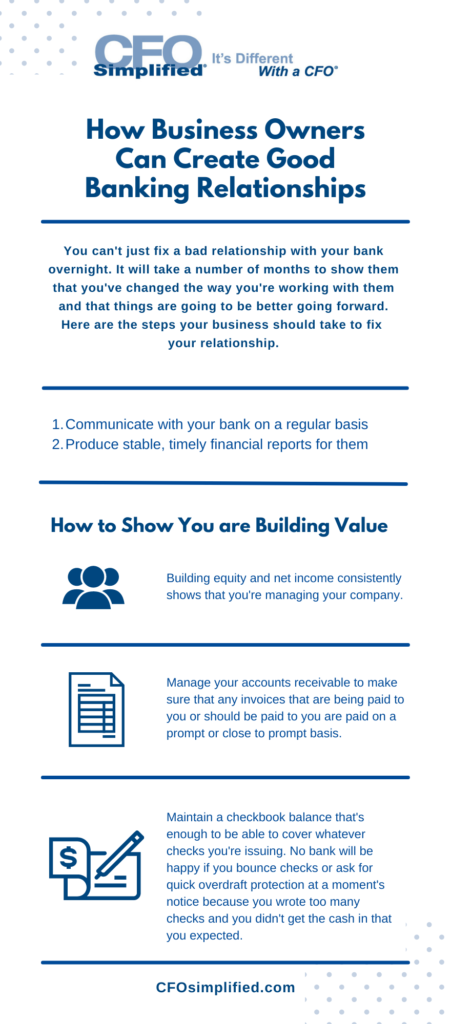

You can’t just fix a bad relationship with your bank overnight. It will take a number of months to show them that you’ve changed the way you’re working with them and that things are going to be better going forward.

Here are the steps your business should take to fix your relationship.

- Communicate with your bank on a regular basis. Tell them your story. Explain to them what had been happening that had caused you to do things that didn’t make them happy and how you’re going to do things better in the future.

- Produce stable, timely financial reports. You should be getting financial reports within 10 days of the close of the month for yourself to look at anyway. So if you are producing financials and you’re getting to the bank on the 15th of the month, that’s more than enough time for them to be happy with what you’re doing. Even if you produce them and get them to them by the 20th of the month, that’s still well in line with proper performance.

The Importance of Stable Financials

When rebuilding your relationship with your bank, it’s important that your financials are stable. You don’t want to be showing a large profit one month and a large loss the next month—even if over a period of time that balances itself out.

A rapid change in profitability or loss on a monthly basis looks bad because it shows that you’re not properly managing your financial reporting.

When looking at your financials, there are two main things banks are keeping an eye on:

- Profitability or net income on a regular basis

- Positive cash flow

Read this article to learn how to calculate profitability.

Remember that the bank is a business as well, and the one thing that they’re very interested in is making sure that whatever loan they’ve given you will be paid back.

For them, receiving financial reports that are stable and timely tells the bank what they need to know to be comfortable that they will indeed be paid back.

How To Show You are Building Value

When you are trying to show your bank that your business is in fact, bankable, it’s important to show your value as a business. But how do you go about doing that? By building value in your company over time. The steps below help show your bank that you are building value and that your business has value.

- Building equity and net income consistently show that you’re managing your company. Through building equity and net income on a regular basis you prove that your business is growing profitably and can take care of any future liabilities you might have. Learn how to read your income statement here.

- Manage your accounts receivable to make sure any invoices that are being paid to you or should be paid to you are paid on a prompt or close to prompt basis. The bank will consider anything over 90 days as uncollectible (even if you get paid after the 90-day period, the bank will not be happy with the late payment). Furthermore, you need to make sure that you collect your money within 60 days of when it’s due – and certainly no longer than 90 days. Make sure that you pay your bills on time so that the amount that you owe to your suppliers is paid on a current/ prompt basis.

- Maintain a checkbook balance that’s enough to be able to cover whatever checks you’re issuing. No bank will be happy if you bounce checks or ask for quick overdraft protection at a moment’s notice because you wrote too many checks and you didn’t get the cash that you expected.

Ensure your balance sheet accounts are in line. Stay organized by:

- Having proper levels of inventory

- Ensuring that your accruals and prepaids are properly posted

- Ensuring that your assets and liabilities don’t have any negatives in your reports. Negatives show that items on your balance sheet are being improperly recorded.

Keep Your Bank’s Reporting Requirements in Mind

Realize that your bank has given you certain requirements for reporting on a regular basis. Covenants allow them to take a quick look at what you are doing and make sure that you’re able to cover your loan obligations with them.

There are two numbers that are very important here.

- Tangible net worth: This is the total amount of assets you have, less your liabilities and that has to be a positive number. The bank will tell you what the limit is and what they’re able to accept.

- The debt service coverage ratio: This shows the bank that you have enough of the following to pay the debt that you owe the bank:

- Net income

- Profit

- Cash flow

Whether that be just interest payments or interest and principal payments, either one or both is important that you have enough money to be able to function. These are all important things to do when you’re getting ready to renew your loan with the bank.

Most importantly, do these things on a regular basis. As your business rebuilds a relationship with your bank, it’s crucial to be able to show either three months or six months of steady operation with each of the measures indicated above.

Overall, it will certainly show them that you have control over your company and you’re actively managing it correctly.

Continue reading to learn more about why financial reporting drives good decisions.

Related Posts

Cash Flow Solutions –

Twelve Things To Do If You’re Cash Short

Every business ends up short of cash from time to time. But there’s short of cash, and then there’s SHORT

Roadmap to Starting a Business

If you’re going to embark on a new project, it’s a good idea to figure out all of the steps

Get Clarity On Your

Company’s Performance

Our people are unique CFOs. They are all operationally

based financial executives.