By David Enna, Tipswatch.com

A 30-year Treasury Inflation-Protected Security is a potentially volatile investment. probably most appropriate for big-money investors like insurance companies, hedge funds and central banks. The term of 30 years makes it a tough purchase as part of a hold-to-maturity bond ladder, and the volatility creates uncertainty most small-scale investors don’t need.

The Treasury on Thursday will auction $8 billion in a reopening of CUSIP 912810TE8, creating a 29-year, 6-month TIPS. To give you an idea of this term’s volatility, consider this:

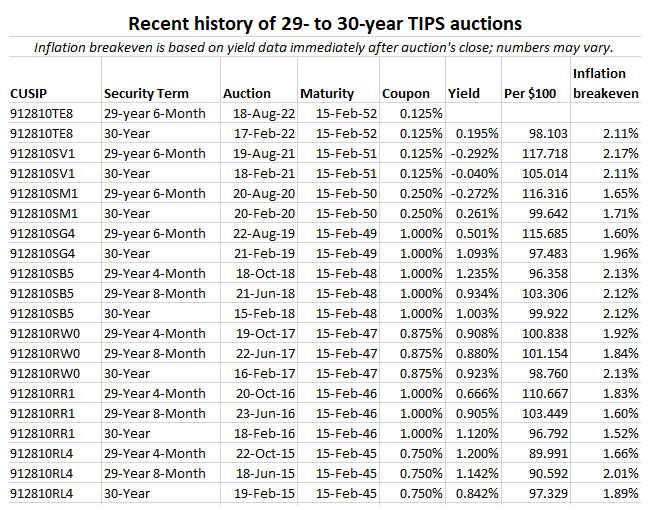

- CUSIP 912810TE8 was created at an originating auction on Feb. 17, 2022, with a real yield to maturity of 0.195%, which set its coupon rate at 0.125%. The unadjusted price was about $97.96 for $100 of par value. It sold at a discount because the auctioned real yield was higher than the coupon rate.

- This TIPS is now trading on the secondary market and closed Friday with a real yield of 0.90% and a price of about $80 for $100 of par value.

- So do the math: In just six months, this TIPS has declined in value by 18%.

However … today’s real yield of about 0.90% is a heck of a lot more appealing than February’s 0.195%. Is it enough to make this offering attractive? Not for me, but it could be for anyone who speculates that real yields will be heading deeply lower in future months.

Definition: The “real yield” of a TIPS is its yield above or below official future U.S. inflation, over the term of the TIPS. So a real yield of 0.90% means an investment in this TIPS will exceed U.S. inflation by 0.90% for 29 years, 6 months.

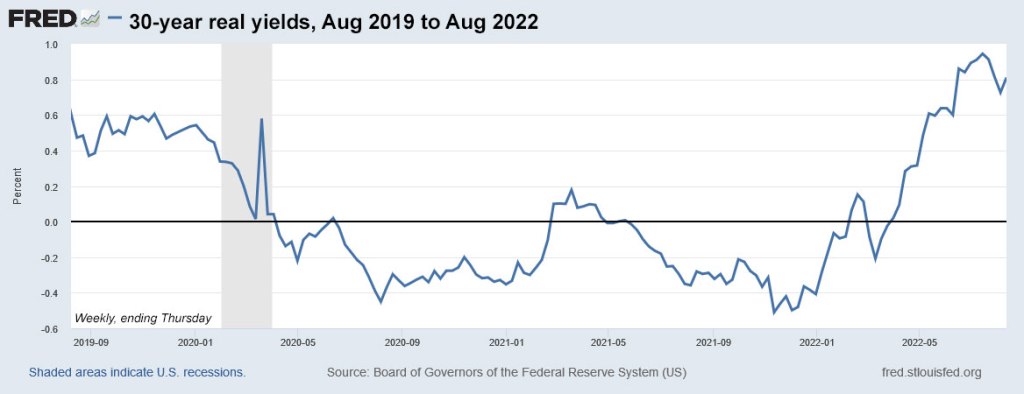

Here is the trend in the 30-year real yield over the last three years, showing the strong rise from the never-seen-before 30-year negative real yields triggered by the Fed’s aggressive market intervention after the Covid outbreak in March 2020:

So, yes, a real yield of 0.90% looks pretty attractive. But you don’t have to go back far into TIPS history to find higher 30-year real yields. As recently as February 2019, a 30-year TIPS originating auction got a real yield of 1.093% and a much more attractive coupon rate of 1.0%. But 0.9% isn’t bad by recent standards. You have to go all the way back to February 2011 to find a 30-year TIPS auction with a real yield higher than 2%.

Because CUSIP 912810TE8 has a coupon rate of 0.125%, it is an extremely inappropriate investment to hold in a taxable account (like any purchase at TreasuryDirect). If you bought $10,000 of this TIPS, you would earn $12.50 in the first year from the coupon rate, while potentially owing current-year taxes on an inflation accrual that could top $600 or more in year one. If you are in the 24% tax bracket, this TIPS would potentially be cash-flow negative by $150 or more every year for as long as you held it. Do not buy this TIPS in a taxable account.

Another thing to consider is that this TIPS will carry an inflation index of 1.06387 on the settlement date of Aug. 31. That will ramp up your cost, but also increase your accrued inflation. The adjusted price could end up around $85.12 for $106.40 of accrued value. That is a rough estimate and things could change this week. (Plus there will be a very small amount of accrued interest, about 57 cents on a $10,000 investment).

That means a $10,000 par investment at Thursday’s auction will cost about $8,512 for about $10,640 of accrued principal. For people who worry about severe deflation in coming years, that $640 is not guaranteed to be returned at maturity. However, the chance of that happening is essentially zero.

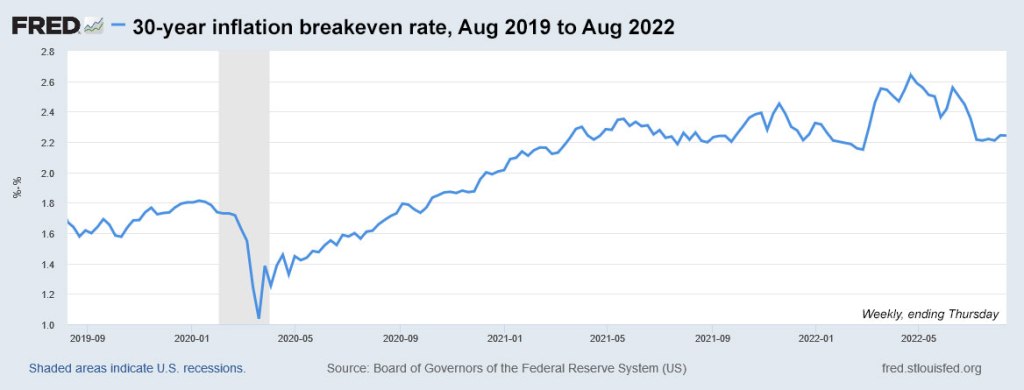

Inflation breakeven rate

With a 30-year Treasury bond closing Friday with a nominal yield of 3.11%, this TIPS currently has an inflation breakeven rate of 2.21%, which seems in line with historical standards. The market is not forecasting steeply higher inflation over the next three decades. I think that reasonable rate makes this TIPS more appealing than a 30-year nominal Treasury.

Here is the trend in the 30-year inflation breakeven rate over the last three years, showing that inflation expectations have settled down in recent months as the Federal Reserve began raising interest rates and lowering its balance sheet of Treasury holdings:

Thoughts on this auction

If you are reading this article, thank you. Not many people are interested in a 30-year TIPS. The term is too long and the investment is too volatile for small-scale investors. I’ve purchased two TIPS of this term in my investing history, both in a taxable TreasuryDirect account:

- CUSIP 912810FH6 back in April 1999, with coupon rate of 3.875% and a real yield to maturity of 3.899%. Yes, I still hold it and this TIPS will have earned about 12.4% over the year ending in September. Its current inflation index will be 1.80245 on September 1.

- CUSIP 912810QP6 in February 2011, just a month before I launched this Tipswatch site. It carries a coupon rate of 2.125% and so it will have earned about 10.6% for the year ending in September.

When CUSIP 912810QP6 matures, I will be 87 years old. I might make it! But any 30-year TIPS I buy today won’t mature until 2052. Prediction: I won’t make it. So the 30-year term falls out of my investing scope. If you are younger, and you want to put a small amount of CUSIP 912810TE8 on the top rung of your TIPS ladder, I can endorse the strategy. Just don’t do it in a taxable account.

You can check the Treasury’s real yield estimates for a full-term 30-year TIPS on its Real Yield Curve page and also see how CUSIP 912810TE8 is trading in real time on Bloomberg’s Current Yields page. This auction closes at noon Thursday for non-competitive bids, like those made at TreasuryDirect. If you are putting an order in through a brokerage, make sure to place your order Wednesday or very early Thursday, because brokers cut off auction orders before the noon deadline.

I’m traveling again

By the time this TIPS auction closes at 1 p.m. EDT Thursday, I will be traveling somewhere in south-central Alaska. I will attempt to post the auction results, but that will depend on if I have internet access and free time. I will also to try check in to answer questions, if you have any.

In the meantime, here is a history of every 9- to 10-year TIPS auction going back to 2015:

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. The investments he discusses can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

early August 2023 been bottom picking (hopefully) buying this bond at the following:

Quote Details Bid Ask

Price 60.355 60.594

Current Yield 0.207% 0.206%

Yield To Maturity 1.942% 1.927%

FYI, this TIPS closed Wednesday with a real yield of 0.94% and a price of about $78.95 for $100 of par value. Reminder that I am traveling and may only be able to post a short story on Thursday’s auction result.

David:

Thanks for your continuing postings. I did not think that my contempt for the Federal government could be any greater until I reviewed a recent Notice from the IRS. I make a practice of overpaying estimated taxes in order to be able to purchase $5,000 in paper I Bonds with my refund. I did this for 2021, with my overpayment being in excess of $20,000. The IRS claims that my refund should be a few hundred dollars less than I calculated, but still in excess of $20,000. However, they have refused to “honor” my request to purchase an I Bond with my refund “because the refund amount you calculated on your return doesn’t match our calculations”. This is ridiculous and outrageous, and I thought that you and your readers would be interested. (Just to be clear, the IRS completely and totally refused to honor any part of my request to buy $5,000 in I Bonds when the refund owed was more than $20,000 and the supposed “error” in my calculation of the refund was only a few hundred dollars.)

Regards.

GVE

I agree that seems wrong.

GVE, this site has a great post on your topic:

https://thefinancebuff.com/overpay-taxes-buy-i-bonds-better-than-tips.html

Alas all too believable. But, since we can’t take out business elsewhere…

Off topic, but can’t resist:

https://www.morningstar.com/articles/1108848/i-bonds-forever

Off topic perhaps, but a great article nonetheless.

On another unrelated topic.

5 year TIPS yields are “up” to +0.32%.

If that holds, the October auction may be bearable.

But that’s a long way off.

Right now, the secondary market has an inflation adjusted price over $103.

With some minor deflation already in the cards, that’s too rich for me.

I held back some cash from the June auction that had a yield of +0.36%.

In retrospect, not too great a move!

I will be a fan of 5-year TIPS this year, and next probably, but also keep an eye on adding to 10-year holdings.

Quite frankly I don’t buy 30 year anything. You can call this a simple and naive view, but I base my action on the firm knowledge that humans as individuals can barely plan more than a few months in advance, and as groups barely more than a few years.

Do I trust any government or corporation out there for 30 years? Nope, not a chance. 5 years maybe, 10 years is pushing it.

Thanks for your wonderful, detailed, knowledgeable updates. Please enlighten me/us on how “future inflation”, especially the 30-year variety is arrived at. Seems like 30 year “real yields” are so dependent on that presumptive crystal ball number to be of any real value. Even 5-year numbers for that matter.

It’s just non-seasonally adjusted inflation, with each month’s accrual set by inflation two months earlier. In effect, you only know one month into the future. Basically you are protecting yourself from unexpectedly high inflation.

I didn’t phrase my question properly. Happily, your July 24th post explains everything about calculating TIPS real yield. Makes sense. Thanks.