One of the most complicated elements of managing a non-profit organization's finances is allocating administrative-related expenses. These are expenses that cannot be specifically assignable to the areas benefited – commonly referred to as Indirect Costs. The methodologies of allocating indirect costs are often complex and situational. Additionally, many funders of non-profits have their own rules, exceptions and limits, creating a spider web of regulations.

When a non-profit organization cannot effectively manage indirect costs, they may inaccurately quantify and report a business unit or award's (contract/grant) sustainability and profitability. The organization may also find itself out of compliance with a funding agreement or federal and state regulations. Lastly and most significantly, the non-profit may under-recover its administrative costs from particular funding sources and be forced to use unrestricted donations to cover any losses.

Why allocate costs?

There are two primary reasons an organization may be interested in allocating indirect costs to individual projects or activities.

- To determine the total costs and profitability of a business unit, department, location, activity, award, etc. Many non-profit organizations may not be required to allocate costs for compliance purposes but may still want to allocate indirect costs to assess performance.

- To comply with contract or grant requirements associated with a particular funding agreement. Most non-profit funders articulate the terms of applying indirect costs in the agreement, even if only to put a percentage cap. At the far end of compliance regulations tend to be government agencies – local, State & Federal.

What are direct and indirect costs?

Direct Costs:

Direct expenses are explicitly incurred to further the grant program objective. These include items specified in the approved grant budget line items.

- 2 Code of Federal Regulations (CFR) Section §200.413: "Direct costs are those costs that can be identified specifically with a particular final cost objective, such as a Federal award, or other internally or externally funded activity, or that can be directly assigned to such activities relatively easily with a high degree of accuracy."

Indirect Costs:

Indirect expenses incurred for common or shared objectives cannot be readily identified with a particular final cost objective. Example: Administrative and overhead are indirect costs.

- 2 CFR Section §200.56: "Indirect costs mean those costs incurred for a common or joint purpose benefitting more than one cost objective, and not readily assignable to the cost objectives specifically benefitted, without effort disproportionate to the results achieved."

- Indirect rates result from a ratio (whereby an indirect cost pool is divided by a direct cost base), which is then expressed as a percentage.

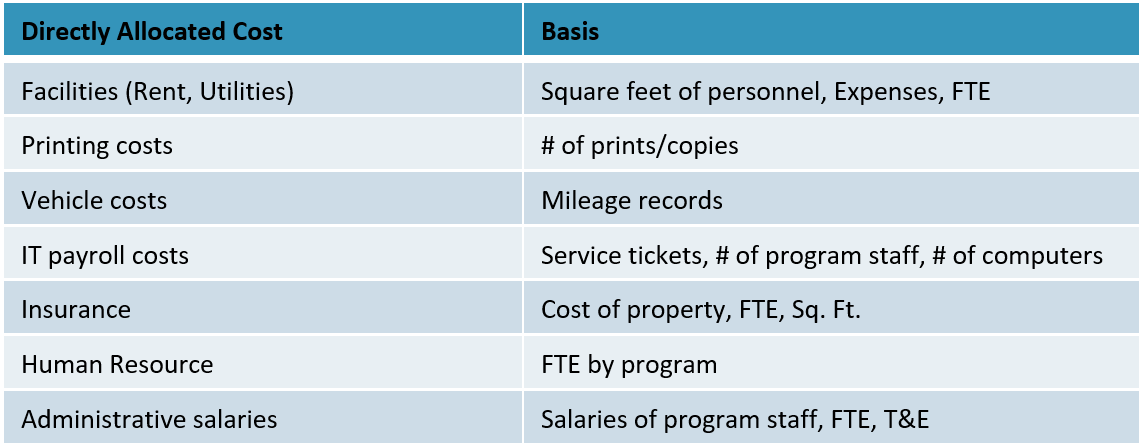

Example costs and cost drivers:

Recommended Best Practices

Keep it simple

Cost allocation methodologies can become extremely complicated to track, implement, account, and explain. And just because a policy is complex does not make it better. Federal guidelines within 2 CFR Part §200:403-405 state that costs must be allowable, reasonable, and allocable, but there is no universal rule for classifying costs as direct or indirect (§200.412).

When developing a cost allocation methodology, consider that costs should equal the benefits derived and consider whether you can defend an allocation using logic and reason.

Perfection isn't required – it must just be considered reasonable.

As a way of example, consider rent expense. A common methodology is to allocate rent expense as an indirect cost, using square feet as the basis. To implement this method, an organization would need to measure the square feet each employee, department, or program utilizes as a percentage of the total occupied space. This in itself is cumbersome. However, some may go so far as to attempt to update the square feet monthly to account for staffing changes.

Alternatively, it may be reasonable to update the square footage calculation annually instead of monthly for simplicity. Or rather, consider using FTE counts monthly or even annually instead of square feet. If total costs correspond to a reasonable proportion of rent expense, it might also be possible to use total direct expenses as the basis.

Evaluate the most advantageous methodology

Organizations need to evaluate several factors to determine the most advantageous methodology of cost allocation - as in - should an expense be charged as direct or indirect.

Compliance requirements:

When determining whether to charge an expense as direct vs. indirect, the organization's compliance requirement arrangements are first considered. For a grant or contact-dependent organization, funders may place artificial indirect rate caps or apply other prescriptive rules on what may or may not be considered direct. Sometimes funders refer to federal regulations like 2 CFR Part 200, and other times, funders create their own rules.

Financial advantages:

Next, organizations should consider the best financial outcome of charging an expense as direct vs. indirect. When funders place restrictive caps on the allowable percentage of indirect, it is often to the organization's benefit to allocate as many costs as possible directly to the funder, thereby reducing indirect costs and the indirect rate. This technique will often maximize the reimbursable costs of the organization and reduce grant, contract, or programmatic losses.

Cost-Benefit:

Lastly, organizations should determine whether analyzing, tracking, and allocating costs are worth the effort involved. It is possible to determine a direct application for many costs, but an organization must consider whether that's the right decision. For example, printing costs can often be directly charged to a particular award, department, or program by utilizing a key code for each print job. However, the benefit of charging printing directly may outweigh the staff time used to accomplish this.

Document policy & procedure

Documentation of a cost allocation methodology is a crucial best practice to ensure consistent application and explanation to auditors, funders, and management teams. Once developed, it will likely be one of your organization's most commonly referred policies.

Automate if possible

If cost allocations are an essential and ongoing process for your organization, consider utilizing an existing tool within the accounting system or developing a tool using Excel templates to effectively and consistently apply the policy.

Other points of emphasis:

- Costs must be expensed as direct or indirect and not applied situationally to both. Once classed as indirect, the same expense should generally not be charged as direct. For example, an Executive Director's wages should generally not be charged as direct on some awards or indirect on others. There may be minor exceptions, but they should be small and justifiable.

- All programs/awards should be allocated their fair share of direct and indirect costs, even if a funder won't pay for it or can not afford the allocation. This shortcut will distort the profitability of both the program/award not applied AND all remaining programs/awards that did receive an allocation. This practice is also not in compliance with federal regulations.

The potential impact of poor cost allocation

- Management may incorrectly assess profitability by business unit, department, location, activity, award, etc. This could result in expanding or closing a particular activity while using inaccurate data.

- Non-profit organizations have one or more grants or contracts that stipulate cost allocation requirements. Failure to follow these rules could result in a breach of contract, repayment to funders, and audit findings.

- Poor cost allocation methodology may result in unrecovered costs from funders, which forces an organization to use unrestricted funds to make up the shortfall or result in net losses to the organization.

Conclusion:

While developing and implementing a cost allocation methodology may seem daunting, it may be beneficial to break down each type of organizational expense individually and consider the best approach based on compliance, financial impact, and cost-benefit. A non-profit organization can build upon these principles to develop a comprehensive approach and policy with this backdrop.

CFO Selections has created strong connections with non-profit organizations throughout our regions and in Oregon through our partnership with the Nonprofit Association of Oregon (NAO).

If you are looking for assistance with non-profit cost allocation, please reach out to us! CFO Selections' mission is to provide non-profit organizations of any size with high-quality, customized strategic consulting services.

Contact us for additional information.

About the Author

Todd Kimball is a Partner with CFO Selections and leads the non-profit practice in Oregon and SW Washington. He is also the Accounting Solutions Partners practice leader in Oregon and SW Washington.

Todd Kimball is a Partner with CFO Selections and leads the non-profit practice in Oregon and SW Washington. He is also the Accounting Solutions Partners practice leader in Oregon and SW Washington.

Todd is a senior accounting professional with over 15 years of expertise in the non-profit and government sectors. He has a proven track record at tackling the most challenging not-for-profit accounting issues and finding solutions that work and move organizations forward. He excels at creating process efficiencies, motivating and utilizing staff to their full potential, implementing internal controls and providing sound technical expertise. Learn more about Todd here.