Aug. 6, 2023, update: The I Bond exit ramp is now open; proceed with caution

By David Enna, Tipswatch.com

For years, my constant advice about redeeming I Bonds has been this: “Don’t do it until you really need the money.” I advocate investing in I Bonds every year, no matter the fixed and/or variable rates, and holding that investment for the long term.

Because of the purchase limit of $10,000 per person per year, buying every year and holding is the only way to build a large stockpile of super-safe, tax-deferred, inflation-protected cash. After five years, you can begin withdrawing with no penalty. It’s reassuring to have an inflation-protected, tax-deferred savings account. And this can be very useful in retirement years when you begin to need the money.

But … investors who jumped aboard I Bonds in the last couple years had a different priority: To maximize interest earned at a time when other safe investments were paying near 0.0%. Inflation protection wasn’t the goal. It was a logical and perfectly sensible investment: Nab 3.54% for six months, then 7.12%, then 9.62%. Wonderful.

No I Bonds have ever reached their 30-year maturity, so that means every I Bond in existence will be paying at least 6.48% annualized for six months after the 9.62% rate runs its course. And after that …. probably a lot less. The I Bond’s variable rate is likely to fall to about 3.2% to 3.5% at the May 1 reset. That is lower than the current nominal yield on the entire spectrum of Treasury bills, notes and bonds.

After May 1, people investing in I Bonds for the short term will be looking to exit this investment and move into a higher nominal interest rate. But this is a tricky transaction, because of the three-month interest penalty on I Bonds held less than 5 years. Get this wrong and you could lose 3 months of 6.48% interest, or more.

Here’s a walkthrough on ideal redemption months for I Bond investments in April, May, October and November for 2020 through 2022. These are high-volume months for I Bond purchases because they bracket the rate resets on May 1 and November 1.

All the data in this presentation is drawn from EyeBonds.info, a helpful and reliable site that presents detailed information on I Bonds. Click on any image to see a larger version.

If you bought in April 2020

These I Bonds have a fixed rate of 0.2%. Don’t redeem them if you have others with a fixed rate of 0.0%. Always hold your I Bonds with higher fixed rates until you really need the money.

A $10,000 investment in April 2020 is still be earning a composite rate of 9.83% through the end of this month, and then on April 1 will transition to a composite rate of 6.69% for six months. It will be worth $11,760 on October 1, 2023.

Ideally, the earliest time to redeem will be Jan. 1, 2024. (But don’t redeem these if you have other options with a 0.0% fixed rate.)

If you bought in May 2020

These I Bonds have a fixed rate of 0.0%, so they are a potential target for redemption. They are currently earning a composite rate of 6.48% through the end of April. On May 1 a $10,000 investment will be worth $11,560.

Ideally, the earliest time to redeem will be Aug. 1, 2023.

If you bought in October 2020

These I Bonds have a fixed rate of 0.0%, but are still earning a composite rate of 9.62% through the end of March. Then they will earn 6.48% annualized through the end of September. On Oct. 1, a $10,000 investment will be worth $11,560.

Ideally, the earliest time to redeem will be Jan. 1, 2024.

If you bought in November 2020

These I Bonds have a fixed rate of 0.0% and will continue earning an annualized interest rate of 6.48% through the end of April. On May 1, a $10,000 investment will be worth $11,500.

Ideally, the earliest time to redeem will be Aug. 1, 2023.

If you bought in April 2021

These I Bonds have a fixed rate of 0.0%, so they could be a target for redemption. But through the end of March 2023, they are still earning an annualized yield of 9.62%, then will transition to 6.48% for six months. On Oct. 1, 2023, a $10,000 investment will be worth $10,500.

Ideally, the earliest time to redeem will be Jan. 1, 2024.

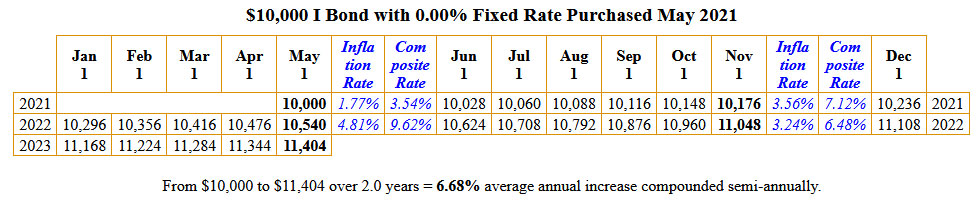

If you bought in May 2021

These I Bonds have a fixed rate of 0.0% and will continue earning an annualized yield of 6.48% through the end of April. On May 1, a $10,000 investment will be worth $11,404.

Ideally, the earliest time to redeem will be Aug. 1, 2023.

If you bought in October 2021

These I Bonds have a fixed rate of 0.0% and are currently earning an annualized rate of 9.62% through the end of March. They will then transition to six months of 6.48%. On Oct. 1, a $10,000 investment will be worth $11,404.

Ideally, the earliest time to redeem will be Jan 1, 2024.

If you bought in November 2021

By November 2021, investor passion for I Bonds was starting to ignite. These I Bonds started with an annualized rate of 7.12% for six months and then 9.62% for six months. Now they are earning 6.48% through the end of April.

Ideally, the earliest time to redeem will be Aug. 1, 2023.

If you bought in April 2022

These I Bonds can’t be redeemed until April 1, when the one-year holding period ends. They have a fixed rate of 0.0% but are still earning 9.62% annualized through the end of March and then will transition to 6.48% for six months. A $10,000 investment will be worth $11,208 at the end of October.

Ideally, the earliest time to redeem will be Jan. 1, 2024.

If you bought in May 2022

These I Bonds cannot be redeemed until May 1, when the one-year holding period ends. They have a fixed rate of 0.0% and are currently earning 6.48% through the end of April. A $10,000 investment will be worth $10,820 at the end of April.

Ideally, the earliest time to redeem will be Aug. 1, 2023.

If you bought in October 2022

By October 2022, interest in I Bonds had escalated to the point of crashing the TreasuryDirect website, because of the extremely attractive annualized rate of 9.62%. These I Bonds cannot be redeemed until Oct. 1, 2023, when the one-year holding period ends. They have a fixed rate of 0.0% and are currently earning 6.48% through the end of September.

Ideally, the earliest time to redeem will by Jan. 1. 2024.

If you bought in November 2022

Because these I Bonds have a fixed rate of 0.4%, they should not be your first option for redemption. If you need the money, look at redeeming I Bonds with a 0.0% fixed rate first. These I Bonds are earning a composite rate of 6.89% through the end of April, and then will transition to six months of a new, unknown composite rate based on the fixed rate of 0.4% plus a new variable rate to be set on May 1.

The earliest time to redeem will be Nov. 1, 2023, but as I noted, the fixed rate of 0.4% makes these a poor choice for redeeming if you have other options.

If you bought in other months

The pattern is consistent for all I Bonds, no matter the year they were purchased. If you bought an I Bond any time in recent years, here are the ideal times to consider redemptions to minimize the three-month interest penalty:

- January: After Oct. 1, 2023.

- February: After Nov 1, 2023

- March: After Dec. 1, 2023

- April: After Jan. 1, 2024

- May: After Aug. 1, 2023

- June: After Sept. 1, 2023

- July: After Oct. 1, 2023

- August: After Nov. 1, 2023

- September: After Dec. 1, 2023

- October: After Jan. 1, 2024.

- November: After Aug. 1, 2023

- December: After Sept. 1 2023.

Does this really matter?

A Twitter follower pointed out today that the cost of the three-month interest penalty on $10,000 earning 6.48% annualized “is only $162, so who cares?” It’s a good point, but I know many of my penny-pinching readers really do care. That’s why I love you guys.

So it becomes a math question. Anytime you redeem I Bonds before five years, figure out the amount of the three-month penalty and ask yourself: Will my alternative investment earn enough to make up the difference?

Final thoughts

A few readers have chided me for helping people manage short-term investments in I Bonds. “These are supposed to be long-term investments!” But the reality of near-zero interest rates sent people flooding into I Bonds in the last two years, and the new reality of 4%+ interest rates on safe Treasurys will cause some investors to shift to something new. It’s all good. I like the idea of mixing inflation protection (I Bonds and TIPS) with nominal investments (Treasury bills and notes), which provide deflation protection.

But every investor, I think, should devote some asset allocation to inflation protection. We definitely aren’t out of the haunted forest yet, for now or the future.

• Let’s handicap the I Bond’s May fixed-rate reset

• I Bonds: A not-so-simple buying guide for 2023

• Confused by I Bonds? Read my Q&A on I Bonds

• Let’s ‘try’ to clarify how an I Bond’s interest is calculated

• Inflation and I Bonds: Track the variable rate changes

• I Bonds: Here’s a simple way to track current value

• I Bond Manifesto: How this investment can work as an emergency fund

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

I bought my two I bonds in July of 2021 and January of 2022. Should I redeem them in October 2023 or wait til January 2024? Or should I wait til the new rate is announced in Nov?

I’m not in a rush to redeem, just wanting to maximize my interest earned. Planning on turning around and putting them in CDs.

For the July 2021 issue, wait until Oct. 1, 2023. For the January 2022 issue, the date is also Oct. 1, 2023. At that time, both will have completed three months at 3.38%. Both of these have fixed rates of 0.0%, so they could be targets for redemption.

Wouldn’t it make more sense to wait until mid-October before making that decision? I’m in the same situation and that’s what I’m going to do, so I can compare the 3.38% penalty with the new inflation rate (which we will know by then) to see which is more beneficial.

Marc, the I Bond will earn zero interest for the month you sell it, so selling early in the month is optimal. But mid-October could be a very interesting time for I Bond investors, because the new variable rate could be fairly low but the potential fixed rate could be higher. Time will tell.

What I’m saying is it may be worth waiting from October 1 to October 12, so 11 days, until the final CPI numbers are released which determine the next variable I Bond rate to make that decision.

If that rate is substantially lower than the current rate, you might hold the I Bond longer and then sell three months into that lower rate to reduce the penalty. This would also put you into 2024 which would push your owed tax off until April 15, 2025

If the new variable rate is higher, you could sell on November 1 with the current rate as the penalty and not forfeit that next interest payment. You’d just be holding the I bond one extra month at the current rate.

I did something a little different. In April 2023 I redeemed 2,500 of I bonds that were older than 5 years, had 0% fixed rate, and were purchased in May or Nov. Then turned around and purchased 2,500 in I bonds. End result, the 2,500 in I Bonds will get the 6.48% for 5 months, then 6.89% for 6 months and will have the 0.40% fixed rate instead of 0.00% fixed rate. What do you think???

You will not see a combined rate of 6.48% at the start. If you purchased an I Bond in April 2023, it will get a combined rate of 6.89% for the first 6 months, which includes the 0.4% fixed. That is the current rate for I bonds issued November 1, 2022 to April 30, 2023. Beginning in October, it will receive the inflation rate that will be announced May 2023, combined with the 0.4% fixed rate you locked in for the life of the I Bond purchased during that period. Of course, all of that will be delayed for 3 months from showing in Treasury Direct due to the 3 month deferral in force until April 2028.

http://eyebonds.info/ibonds/25/ib_2023_04.html

Rereading, I think you are saying that you have collected 5 months of 6.48% on the old I bonds you redeemed. That may be true, depending on the month in which you originally purchased that old bond. It’s always 6 month increments based on your purchase month. Don’t forget that you will also owe federal tax on the gains for the I bonds you redeemed. Rolling over isn’t really an accurate description. You sold, you owe, you bought new.

I agree with other commenters that there is no way you had one set of I Bonds that earned 6.48% for 5 months and then 6.89% for six months. So you are talking about two different I Bonds. What you never said was “which month did you purchase the I Bonds you sold?” But, I think what you did was fine. … Turning over I Bonds more than 5 years old for a higher composite rate does make sense, as long as you are OK with the taxes due.

sold 2,500 of Ibond greater than 5 years, 0% fixed, and purchased in May or Nov, so those bonds got the 6.48% for 5 months. After sale, purchased same amount of new bonds that will be the 6.89% for 6 months. Tax rates are only going higher, don’t mind paying some tax now. Love you sight.

Depending on the amount of accrued, untaxed interest due (and other considerations), delaying redemption from November or December to January 1 of the next year may be advantageous as it would provide an additional 15 months of tax deferral because the tax would not be due until April in the following year (also assumes that the interest paid in January does not increase required estimated taxes)

Question for those of us who have i bonds with a 0% fixed rate.

You advocate not redeeming your i bonds if possible. However, what are the pros and cons of redeeming i bonds with a 0% fixed rate and using the proceeds to repurchase i bonds with the .4% fixed rate, especially if you are looking to hold long term (and if at the moment you don’t have other funds you can use to invest in i bonds)? If the rate increases or decreases on May 1, does this change the calculus?

Thank you.

I think rolling over 0.0% fixed I Bonds for a higher fixed rate is a good strategy, especially if you can’t raise new money for an I Bond purchase. I’ve done it in the past, but rarely. As you get older it makes sense, especially if you are satisfied with your total I Bond holdings.

Just a note from Captain Obvious: If you redeem 0% I-Bonds to buy new ones, you are going to have an excess, the accrued earnings, left over in the old bonds, either to leave in your account or to cash out. I.e., I bought $10K of the Nov. 2016 0% I-bonds, now worth $12,400 and change. But I can only buy $10,000 this year, so I can either leave $2,400 of the 11/16’s in my account, or redeem the whole lot and take $2,400 in cash. My choice, if I were to do this, would be to let the excess ride.

Many thanks for this great post, (I’ve learned so much from your website about this topic).

This may be a case of nitpicking, but I believe in the tables you posted above regarding issue date, there’s an error in the April 22 issue date table. I bought $65K in April 2022 issue I-bonds, (via forced tax refund + $40K in giftbox for the wife and I). I believe that for someone who intended this as a short-term play, April 2022 was the “sweet-spot” of 6 months @ 7.12% APY, followed by 6 months @ 9.62% APY, followed by 6 months @ 6.48% APY? The table you posted completely skips the 6 months of 9.62% APY.

My question is this, I’m leaning towards buying another $20K this year, (obviously late April). I’m thinking I should simply buy 2 more $10K gifts, (and use 2023’s $10K/year allowance to deliver two $10K gifts from our respective giftboxes). In other words, push the earliest possible redemption dates for this year’s $20K purchase off to Jan 1, 2025, (since these I-Bonds would carry a .40% coupon rate)?

No, if you take a careful look at the April 2022 table, it shows the 9.62% rate beginning in October 2022 and ending in March 2023. The 6.48% rate took effect in April 2023 and will continue through September. If you buy in April 2023, the earliest possible redemption date would be April 1, 2024, if you don’t care about the three-month interest penalty. But all of that depends on when you deliver the I Bonds from the gift boxes — you’d be limited to $10,000 (minus interest earned) per person per year.

Thank you, Sir. I now see my critique was an error of reading comprehension by me, (I didn’t look to the right for numbers in blue on the table).

IMHO, April 2023 issue is more desirable to push backwards in terms of earliest redemption date to January 2025 because of the .40% coupon rate.

Clint,

You’ve described what I think is the best strategy for this year. My wife and I already delivered $10K Gift I Bonds to each other from our respective Gift Boxes. We plan to purchase new $10K Gift I Bonds for each other after the April 12th CPI Report and before May 1. As discussed earlier, the new combined Composite Rate could be around 5.2% for the next 12 month period ( (6.89% Composite Rate now + 3.50% Inflation Rate next /2) ) which works short-term or long-term with the 0.4% Fixed Rate component.

The beauty of the Gifting Strategy is that purchases aren’t limited to $10K per year, only deliveries. Therefore, if the May 1 Fixed Rate Component is so attractive that it warrants purchasing long-term, we can always buy another pair of $10K gifts after the October 12 CPI Report depending on where inflation is at that time.

If inflation continues it’s downward trajectory, I might sell some of my 0% Fixed Rate I Bonds three months after the new May 1 rate takes effect, and others three months after the November 1 rate takes effect which will be in 2024 thereby spanning the interest rate hit for tax purposes between 2023 and 2024 and lowering the penalty.

Marc,

We are of the same mind. The only difference is that I haven’t delivered any of the I-bonds I bought in my wife’s and my gift-boxes back in April 2022, (I plan to “Kick-that-can” down the road until the September 2023 CPI print in October of this year).

Only then will I decide how to use the $10K/per year allowance to “Acquire” I-Bonds.

David, is the I Bond early withdrawal penalty tax deductible, similar to the CD penalty deduction? Thanks.

I am sure the penalty itself is not taxable, but I can’t say how TreasuryDirect reports income from an I Bond that is redeemed early. (I’ve never done it.) Does TreasuryDirect simply report the interest actually paid on the 1099-INT? Maybe other readers have experience with this.

Thanks all.

Although I don’t have any direct experience with it, I suspect it isn’t reported as a penalty. Rather, the way it is handled appears to be more of a 3 month “lag” in the interest credited to the total and then a catch-up burst at the 5 year mark. From a more practical standpoint, the handling of early withdrawal penalties I’ve had on CDs has been virtually identical to not receiving the interest in the first place other than how you put the numbers into your income tax preparation. The result is the same either way. So, yes, I think tax deductible in the sense that it isn’t credited in the first place and so doesn’t exist until you get it.

Put another way, the 1099-INT that I did receive from Treasury Direct last year did not have a box 2 for Early Withdrawal Penalty at all. The 1099-B they issued had lots of empty boxes. So I think if they intended any interest you don’t receive on an I-Bond to be considered a penalty, the box would exist whether or not there was a value to put in it.

That’s correct, everyone gets a boost in interest of three months worth when the I Bond hits its five year anniversary. That’s how it’s treated, rather than continuously accruing. I have redeemed EE Bonds early and no penalty is charged, you just get the 0.1% interest for nine months.

If the penalty were tax deductible, rather than simply not earned, that would be a problem for taxpayers who do not itemize due to the doubled size of the standard deduction under the recent tax law. Non-itemizers would end up paying tax on the earned-but-taken-back interest for the last 3 months.

Great point

That is incorrect, if you have a penalty on early withdrawal, it is deductible on Form 1040 Schedule 1 Line 18. Does not matter if you itemize or not.

I’m no tax expert but it looks like the IRS applies the CD penalty as an “adjustment to income” instead of a deduction, and so it probably come off the interest total even if you are taking the standard deduction. https://www.irs.gov/pub/irs-pdf/f1040s1.pdf

Yes, I incorrectly used the word deduction. It appears penalty adjustment not applicable for IBonds but they are for CDs.

To Henry Fung’s point about the three month “boost” in the accrual when you hit 5 years for an I Bond: The interest is always being counted and accrued, through the entire 5 years. So it isn’t really boosted at 5 years, it simply is what it has always been. Before 5 years, the last 3 months of interest are subtracted.

Thank you for the info on recently purchased I-Bonds. Like many others, I bought some chasing yield and don’t plan to hold long-term. I also purchased I-Bonds in 2001 which I still hold given the 3% fixed rate on top of CPI. Unfortunately, these will mature in 7-8 years at which time all interest will be taxable even if they are not cashed. I want to hold these as long as possible, but don’t want a huge tax hit at the end of the 30th year when all taxes on interest come due whether cashed or not (and they also stop earning any interest). I’m thinking of cashing one per year with the final one cashed in January 2032. Just wondering if you have any thoughts on what all to consider in this situation? Thanks in advance.

My way of dealing with this, since I am retired: I set a total income goal for the year and then I include any potential maturities into that equation. Plus, I pay estimated taxes each quarter. Obviously, no I Bonds have yet matured, but when they do I will just plan on that amount of taxable income being part of my overall income goal.

This topic is very interest-ing to me. 😉

There are a couple of great articles for your blog in these two comments… 1) your income strategy in retirement overall and in particular to i-bonds, and what I am interested in just as much… 2) is it worth keeping i-bonds to maturity and what are the criteria for cashing out under different scenarios.

I am still an i-bond noob, but have been maxing out buying them for 2 years, plan on buying more, would like to hold long term, but not sure if it is worth it with respect to better yielding investments. A big part of why I buy them is for portfolio diversification.

I still don’t quite understand how the changing interest rate affects the yield in the long term. I am probably overthinking it.

Thanks for your very helpful site!

The I Bond variable rate changes every six months to match six months of inflation. So an I Bond will at least match official U.S. inflation, or do better if there is a positive fixed rate, like today’s 0.4%. I’m not sure I will hold all my I Bonds to maturity. Now that I am retired, I could see cashing in some of the 0.0% fixed rate I Bonds to supply need cash. That’s the whole idea, to move inflation-protected money into the future.

Excellent. Great way to look at it that makes sense. Move inflation protected money into the future!

Thanks!!

I am about 4 to 10 years from retirement, so will hold some to maturity and cash out some before maturity.

I purchase a small I-bond for my now 5 y.o. child monthly for the past three years (and will continue). I plan to redeem, combine, and repurchase the November – January 2021 bonds, which were higher at the time because monthly child tax credit that some people hated. I believe the November bond will lose three months of 6.48%, but gain 6 months of 6.89% and get a higher fixed rate until she choses to redeem after she’s 18. Since I cannot get close to $10k/yr on my SSN, let alone $10k each for my spouse and child, I don’t lose anything here except for a tiny amount of taxes.

David, You haven’t written much about EE Bonds lately. I guess they are fairly unpopular right now although I don’t consider 2.1% to be completely unattractive. I like the convenience of savings bonds and I don’t care for CDs. But I have some EE bonds though that are paying almost 0% and will have to decide whether to continue to hold those or cash them in. I guess it would come down to making a prediction of whether or not inflation will stabilize to make 3.527% interest at maturity a good enough deal over 20 years.

Also, I am wondering what the recommended highest age would be for someone to buy an EE bond? I guess that might come down whether the 3.527% rate appears desirable, plus an estimate on one’s longevity. I don’t think the question the need for the money at that future age is a major factor, because as long as someone is alive, they will need money.

Yes, EE Bonds are less appealing now, with the 20-year Treasury bond now yielding 3.88%. But that’s still close. For your older EE Bonds, if you have several years built up, it’s probably worth holding to the 20-year mark. I’ve always thought buying EE Bonds at age 40+ each year made sense, to build up a yearly supply of doubled cash during the retirement years of 60+.

I started on EE’s in 2020 with the low rates but when rates went up I bailed on them once the one year lock up was over. Still one EE purchased in mid 2022 which was right before the big inflation spike. You would have to calculate what the rate to maturity is of holding them vs. dumping them, but I think culling them and switching to equivalent Treasuries makes a lot of sense.

Another very helpful article! I’m eagerly standing by for your April 12 report (as discussed here in the section titled “Key date: April, 12, 2023”

https://tipswatch.com/2023/01/03/i-bonds-a-not-so-simple-buying-guide-for-2023/).

I do plan on looking at my over five year old bonds, the ones purchased where the fixed rate was 0%, and dumping them once the 6.48% rolls off.

Good strategy. As I get older I have been realizing, “Hey, eventually I will need to start spending this I Bond money.” I also would target I Bonds with a 0.0% fixed rate, held more than 5 years, after the 6.48% interest period is completed.

Do you think it might make sense to hold on to the bonds for a while and buy additional bonds, in case there is another bout of high inflation in 2023-24? I think that is at least a medium possibility.

Yes, this is what inflation protection is all about, protecting against unexpectedly high inflation, just as we have had the last two years. In addition, at times of Fed stimulus, I Bonds often have inflation-adjusted yields higher than the TIPS market or short-term Treasurys.

This is another fantastic resource–thank you for putting this together! (Are you sure you were on vacation? This must have taken some time to pull together.)

David,

Thanks for this very useful guide to redemption.

What is your opinion about when to buy in 2023? I have been waiting for the March inflation numbers to come out and thought I would buy in April . However, what are your thoughts on what the variable and fixed rates will be come May?

I am also waiting for the March inflation report, which comes out April 12. I think the new variable rate will be in the range of 3.2% to 3.5% and it’s possible the fixed rate could rise to 0.6%, or maybe higher. After April 12, you have a couple of weeks to decide to buy in April or May and I will be writing about that at the time.

I am part of the short-term I-Bond holders and plan to redeem per your suggested schedule. I also trekked into TIPS as the yields became positive again. Now that the Federal Reserve has raised rates significantly causing banks who invested in long term fixed income to weaken I am going back into the Bank Preferreds of the largest banks that now yield 6.5%+. The risk is greater than I-Bonds and TIPS but the yield is significant.

Another helpful article. Two quibbles and a comment:

1) I think it’s worth mentioning that buying every year is not the only way to stockpile I Bonds. The alternative approach is for two partner to use the Gifting Strategy to by in bulk, deliver annually, and accomplish the same basic result.

2) Although a 3.5% annualized inflation rate for the next six months would be lower than a 26-Week T-Bill that is currently yielding 4.841%, you aren’t making that exchange right now because of the penalty. This introduces an unknown — what T-Bill interest rates will be at the time you cash out of the I Bond. While it’s likely to remain higher than the 3.5% given where we are now, we just don’t know. It’s not guaranteed. The 3.5% I Bond rate would be.

3) If the May 1 inflation rate is 3.5%, the annualized rate combing that with the current 6.89% works out to be 5.195%. So buying a I Bond in April beats the most recent 52-Week T-Bill which yielded 4.617%.

I haven’t used the Gift Box strategy, but if the fixed rate rises to something like 0.8% in May (iffy) I probably would use it to lock in that rate on one extra set of I Bonds. On your point no. 3 … if you apply the three-month interest penalty after one year, your annual interest rate falls to 4.4% in your scenario. Pretty close to the 52-week T-bill, which closed at 4.59% yesterday. So I Bonds are still in the picture for short-timers.

At the end of this year, I will redeem the I-bond I bought May 2022. Not planning to buy anything new.

It is becoming too difficult to track 5 different investment/retirement accounts. I’m going to consolidate to three.

Is there a typo here for April 2022 – indicated by **. Shouldn’t the date be same as that for May 2022?

If you bought in April 2022

** Ideally, the earliest time to redeem will be Jan. 1, 2024.

If you bought in May 2022

–> Ideally, the earliest time to redeem will be Aug. 1, 2023.

For the April 2022 I Bond, the 6.48% rate begins on May 1, 2023, and ends after September, so you want the three-month penalty to apply to Oct, Nov. Dec, pushing the optimal redemption to Jan 2024.

For May 2022 I Bond, the 6.48% rate begins on Dec. 1, 2022, and ends after April 2023, so the three-month penalty can be May, June and July, setting the ideal redemption date at Aug. 1, 2023.

Ah! Sorry about that. So just to confirm that I got this correctly. If I bought I-Bonds in Jan 2022 then the earliest time to redeem will be November 2023.

Did I get that correctly? Sorry for the multiple questions.

If you bought in Jan 2022, then you earned 7.12% through the end of June, then 9.62% through the end of December, and now are earning 6.48% through the end of June. Your optimal redemption date is Oct. 1, 2023, which would apply the penalty to July, August and September.

Thank you! Really appreciate you being patient with me on this.

David,

What is your opinion regarding just how well I Bonds keep up with real inflation?

(For example, I’ve read that the inflation measure that is used to adjust Social Security benefits (the CPI-W) is not adequate. As a result, if one started receiving their benefits in 2000, they would have lost have of their value by now–even after the inflation adjustments. The Treasury uses an even worse inflation measure, the CPI-U, to add inflation adjustments to I bonds. The CPI-U is said to understate inflation even more so that the CPI-W. )

Thanks in advance.

Greg

In the case of I Bonds and TIPS, inflation is defined as CPI-U. It’s what you are signing up for. Your personal inflation won’t match CPI-U, certainly. It might be lower or higher. In many years, CPI-W lags CPI-U but in the last couple years it has been a bit higher. More on this: https://tipswatch.com/2017/11/08/does-the-social-security-cola-shortchange-seniors/

I have such a negative feeling about the antiquated TD system,

just cannot bring myself to buy anymore. 😫

Same story here. Instead of buying more I-bonds, I will fund my IRA and buy TIPS.

Excellent thanks!

Can you double check your section on “If you bought in November 2021”? I think you just missed an edit.

I really appreciate this post. breaks it down very nicely. I think our plan is for my wife to buy $10k in April with available cash. I’ll have to cash out some 0% fixed rate I bonds to buy $10k before November if the fixed rate is still above 0%. Thoughts on taking the 3 month penalty in order to get a greater than 0 fixed rate moving forward?

Thanks for that catch! I could see taking the penalty if the fixed rate rises in May.

Some time ago there was a post comparing nominal notes versus TIPS and frequently the nominal security turned out to have been the superior investment. So I have tended to mix nominal and inflation protected. The I bonds have some advantages over the TIPS, tax deferral being one, and can fit in the combination.

I track TIPS vs nominals here: https://tipswatch.com/tips-vs-nominal-treasurys/

Thanks Dave!

Probably wouldn’t have found it on my own.

Cheers

Thanks for your useful insights into TIPs and I Bonds. One question. I seem to recall that savings bonds (both I & EE) earn interest from the beginning of the month of purchase and to the end of the month of redemption regardless of the date purchased or redeemed. Am I remembering that correctly? Thanks.

You get full interest for the month you invest, but no interest for the month you redeem. Interest is earned on the first day of the next month. So, buy late in a month, redeem early in a month.

Thank you!

Just to make sure I understand the mechanics: I think interest earned each month is paid on the 1st of the following month. So if you redeem on September 1, you lose the interest that was posted on 7/1, 8/1 and 9/1 (which was earned in June, July and August). You don’t earn any interest for September (which wouldn’t have been posted until 10/1, anyway).

I purchased one of my bonds in June 2021. My last interest at 6.48% will be earned in May 2023 and posted on 6/1/2023. So I want to lose the next three months which will be posted on 7/1, 8/1 and 9/1, I think. So the plan would be to redeem on 9/1.

Do I have the mechanics correct? Thanks, David!

Kevin, this looks exactly right.